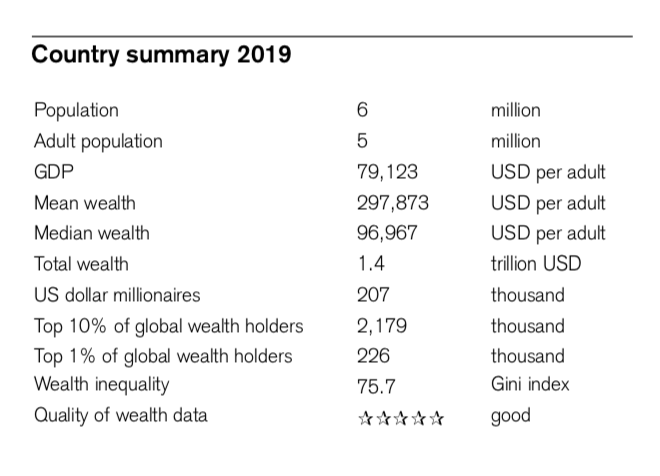

Singapore saw a rise in the number of millionaires in the country in 2019, with around 207,000 owning at least US$1 million (S$1.35 million) in wealth.

226,000 Singapore residents are top 1% global wealth holders

This is according to a 2019 Global Wealth Report by Credit Suisse out in October 2019.

In Credit Suisse's report, an individual's net worth, or “wealth,” is defined as the value of financial assets plus real assets, including housing assets, minus their debts.

It compared the household wealth of 5.1 billion people worldwide.

Switzerland, Hong Kong and the United States were identified as having the world’s three richest people.

The report said it took its numbers from “reliable” household sector balance sheet data.

About half of people in Singapore part of top 10%

The report also said 2.18 million people in Singapore were part of the top 10 per cent of the global wealth population, with at least US$109,400 (S$147,400) to their name.

This is almost half the 5 million adults living here, according to the report.

5% of Singaporeans belong to world's richest 1 per cent

Some 5 per cent of Singaporeans -- or 226,000 individuals -- belonged to the world’s richest 1 per cent of people.

To qualify, one needs at least US$936,400 (S$1.26 million) to their name.

Photo via 2019 Credit Suisse Global Wealth Report

Photo via 2019 Credit Suisse Global Wealth Report

14% of Singaporeans have less than S$13,500

However, the report added that around 14 per cent of Singapore's population held below US$10,000 (S$13,500) to their name, making up to at least 700,000 of the local population.

However, the percentage was well below the global average, which sat at around 58 per cent.

Singaporeans are the second richest people in Asia, as a result of the average person’s wealth tripling from around US$115,000 in 2000 to about US$300,000 (S$404,100) in 2019.

Hong Kong is top in Asia.

This US$300,000 net worth typically came from US$200,000 in financial assets (such as stocks) and US$150,000 in real assets (such as property).

The average debt was US$50,000, which the report called “moderate for a high-wealth country”.

Top photo via YouTube

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.