A senior property consultant has come together with former GIC chief economist Yeoh Lam Keong and veteran architect and policy researcher Tay Kheng Soon to devise a list of four big policy proposals aimed at helping to solve the 99-year HDB flat "ticking time bomb" issue in Singapore.

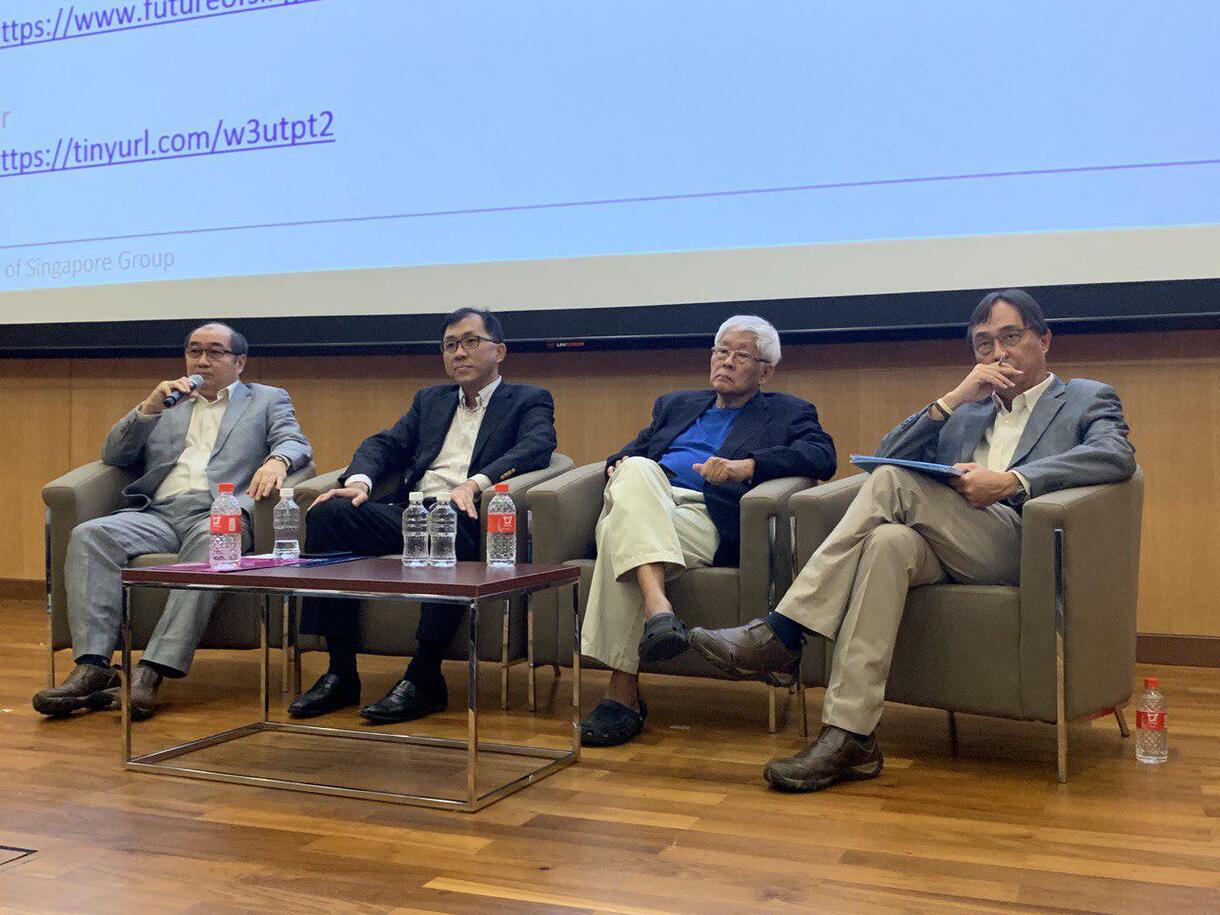

Introducing these proposals on Saturday (Nov. 30) at a policy forum organised by ground-up initiative Future of Singapore, Yeoh, Tay and Ku Swee Yong said they consulted widely with experts in various relevant fields as well as regular Singaporean homeowners. They collectively aim to address Singapore's "key potential long-term crises in public housing and to improve upon them".

In particular, they identified two main housing challenges Singapore is facing:

- The value depreciation of old flats in Singapore, especially after the 50-year mark of their 99-year-old leases, and

- The high cost of build-to-order (BTO) flats relative to first-time homeowners' incomes, as well as those who are lower-income or have irregular income.

The trio recommend the following to tackle them:

1) A one-time automatic top-up of leases for flats owned by Singapore citizens back to 99 years, once a flat turns 50 years old.

This, the researchers say, will immediately address the problem of declining property values of older HDB flats that have shorter remaining leases.

They also add that this can be a chargeable action, but should be priced at about 3 per cent of the cost of a recent resale flat in the vicinity. Additional support should also be accorded to lower-income families, determined through means testing, who might not be able to afford this top-up cost as well, in the manner current HDB upgrading schemes are done.

2) Funding the tearing-down and rebuilding of all HDB flats every 100 years.

The researchers note that the topping up of HDB flat leases means that older HDB flats may outlive their structural lifespans. Therefore, they propose as a follow-up measure that the government funds the tearing-down and rebuilding of all HDB flats every century, due to the existing technical issue that HDB flats must be torn down and rebuilt every 100 to 150 years for safety reasons.

How will this be financed? The trio estimates the cost of this to be about S$1.5 - 2 billion per year, which translates to S$150 - 200 billion over 100 years.

"While the cost of this program is large over the long term, it is nevertheless eminently affordable and sustainable when amortised over 100 years," they wrote.

They propose the establishment of a sinking fund dedicated to this purpose, to which the government can set aside S$1.5 - 2 billion each year — this translates to just about 0.3 to 0.4 per cent of GDP, or a few per cent of annual land sales value.

Additionally, after these flats are rebuilt, a fresh 99-year lease should be given in the way flats under the SERS programme are also accorded it.

3) To price all new BTO flats at construction cost of about S$150-200 per square foot.

This would find equivalence with the prices of flats in the 1990s — where a 1,022 sq.ft four-room BTO flat on average went for about S$170,000.

Currently, four-room BTO flats are on average sold at S$376,300 — which translates to about $389 per square foot.

These flats, the researchers propose, will not be eligible for sale in the resale market for the first 15 years — in order to prevent drops in the prices of flats in the resale market. Also, only one flat can be owned by a family unit at any point in time.

It is also proposed that flat owners aged above 65 should be allowed to exercise the option to downgrade their flats once to a smaller, low-cost BTO flat to boost retirement adequacy.

Ku notes that this measure would also allow HDB to remove most of their existing grants, and by extension relieve this burden on taxpayers.

He also believes the subsequent controls on resale will prevent "runaway" million-dollar resale prices.

4) To increase the number of good quality, subsidised rental flats in sufficient numbers and reasonable security of tenancy for citizens who cannot afford to own homes.

Currently, Ku notes, tenants have to make the case every three months that they are sufficiently poor to require rental housing from the government.

This measure, the researchers write, must be done to ensure that housing remains affordable to all Singaporeans, especially for the less well-off who operate in the gig economy, which offers significantly less stable employment and income.

Changes proposed are "eminently affordable and fiscally sustainable": researchers

The changes, while significant, are arguably very affordable and financially sustainable for the government, posit the trio.

"The proposals will preserve the life savings of the population invested in HDB flats, especially the bottom 50 per cent of income earners, thus reducing the burden on the state for what would otherwise be larger retirement financial support."

At the macro level, for instance, they say these changes will greatly boost retirement adequacy for Singapore's increasing elderly population, especially for the elderly poor, also freeing up monies for healthcare and investments.

Because less of Singaporeans' savings are locked up in housing, the measures will boost domestic demand and consumption — additionally, rebuilding housing to meet best architectural standards every century will present a fiscal boost.

All new flat buyers will also be able to pay off their homes within 10 to 15 years instead of the current 25 to 30, or more, hence releasing more savings for retirement and entrepreneurial activity; at the same time, the impact on resale prices of older flats is minimised.

The trio also says these proposed reforms are not expected to destabilise the existing HDB resale market or the private housing market.

Changes proposed are also not particularly novel

At the forum, Yeoh described these as sounding "too good to be true" and "utopian-sounding", but notes that these proposals have been done in other more established economies as well.

The lease top-up, for instance, is done in the United Kingdom, Hong Kong and China — in fact, the lease renewal practice proposed is less generous than those in Hong Kong and China.

The rebuilding proposal is in a large way an extension of SERS to all HDB flats, which the researchers argue that the government can "well afford".

They also point out that the government already owns the needed land, and HDB can sustainably afford to sell at construction costs as a nonprofit statutory board — especially considering the fact that they previously were able to do this.

The researchers say they plan to seek audiences with relevant authorities to table their proposals in due course.

To read the entire working paper with the trio's detailed proposals, you can access it here.

Top photo by Jeanette Tan

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.