The Basic Healthcare Sum (BHS) for CPF members will be raised with effect from Jan. 1, 2020.

The CPF Board announced in a joint new release with HDB on Nov. 19 that the current sum of S$57,200 will be raised to S$60,000.

This is because the elderly are expected to use more of their funds for MediSave.

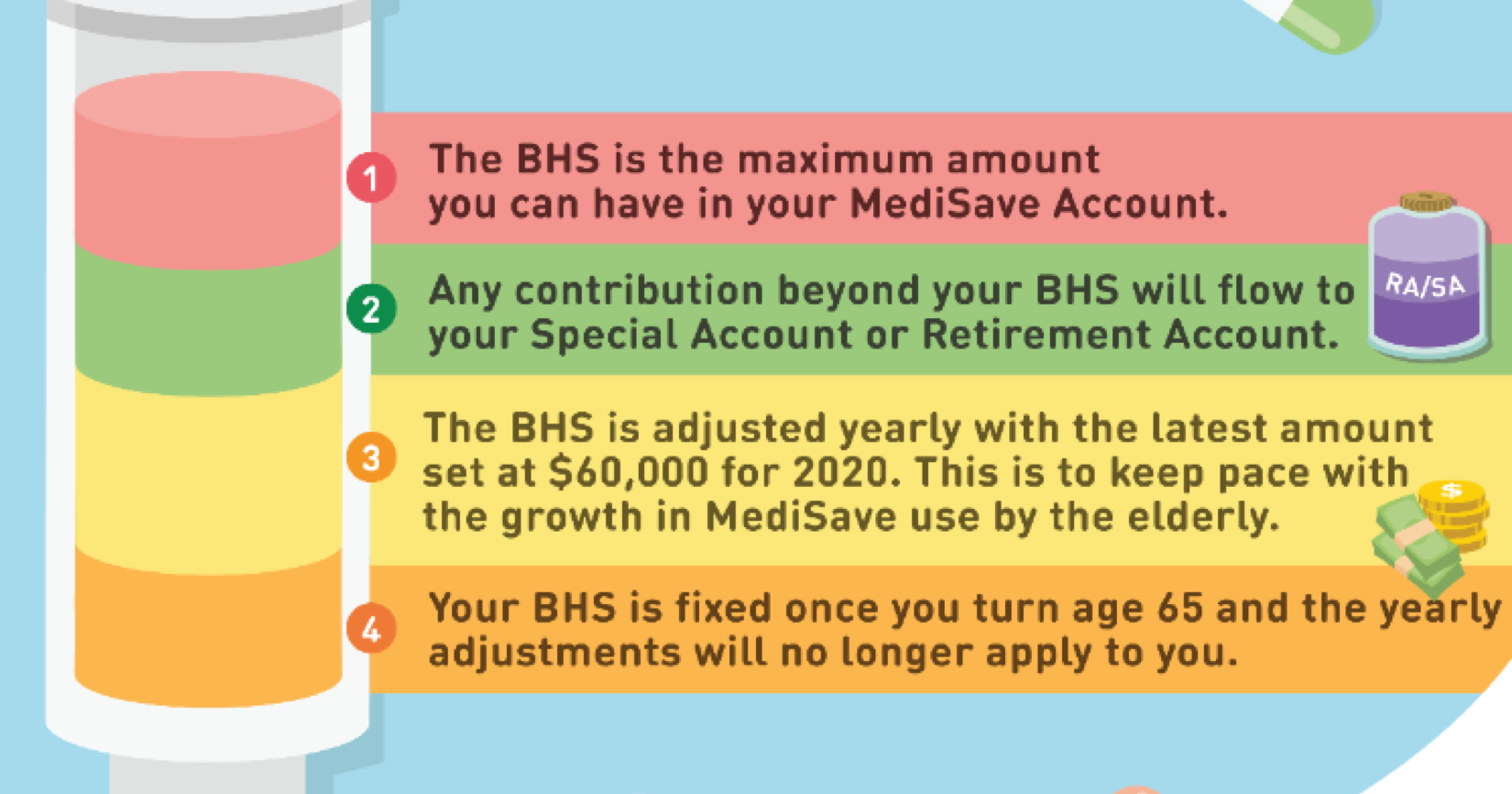

What is the BHS?

The BHS is the maximum amount of money that you can have in your MediSave account, and is adjusted on an annual basis.

Any additional savings over the BHS will be transferred to your Special Account or Retirement Account instead.

With the hike in the BHS, it means that CPF members will have to allocate more money to their MediSave account.

But if a CPF member has less money in their account than what is needed for the BHS, they don't have to top it up.

65 and above

The BHS is frozen once you reach 65.

This means that for members aged 65 on Jan. 1, 2020, their BHS will be fixed at S$60,000 for the rest of their lives.

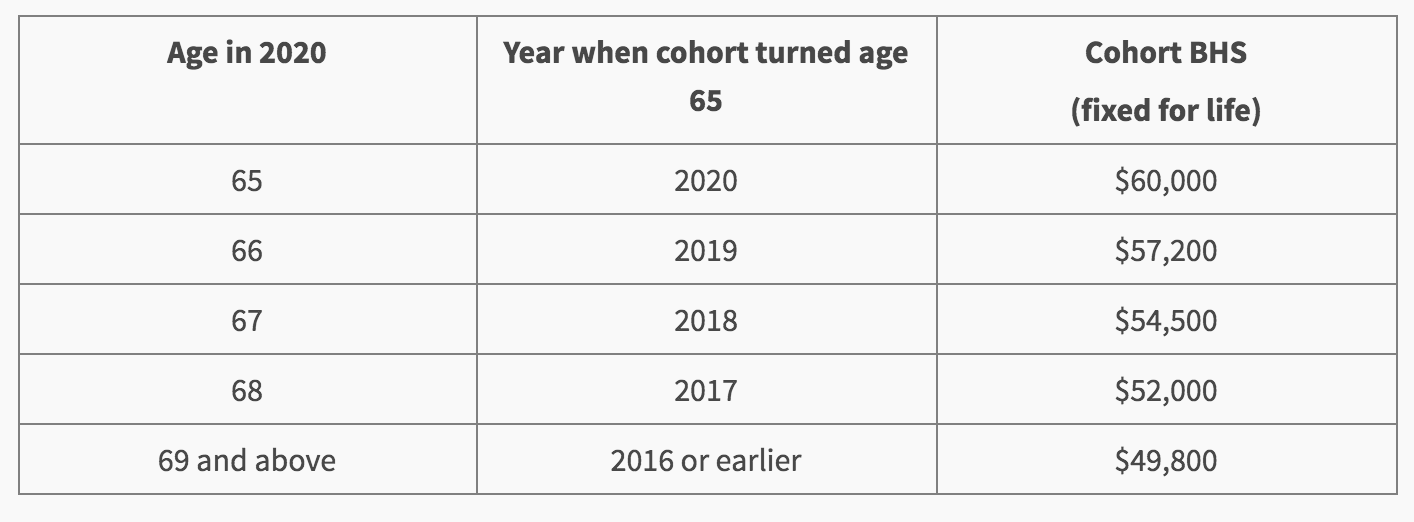

Check out the table below to see how the BHS has changed over the years:

Screenshot from CPF Board's website

Screenshot from CPF Board's website

Interest rates for Q1 2020

In addition to the BHS news, CPF Board also announced that the interest rates for their members various accounts will not change for the first quarter of 2020 (i.e. January to March 2020).

- Ordinary Account monies will earn up to 2.5 per cent per annum.

- Special Account monies will earn 4 per cent per annum.

- MediSave Account monies will earn 4 per cent per annum.

But as part of the government's plan to enhance retirement savings, all CPF members will earn an extra 1 per cent on the first S$60,000 of their combined CPF balances.

For members aged 55 and above, interest rates will be made more attractive.

They will earn an additional 1 per cent on the first S$30,000 of their combined CPF balances, on top of everything else.

Retirement Account and HDB mortgage rate

Meanwhile, members with Retirement Account monies will earn an interest rate of 4 per cent from Jan. 1, 2020 to Dec. 31, 2020.

As the Ordinary Account interest rate has been set at 2.5 per cent, the concessionary interest rate for HDB mortgage loans will be set at 2.6 per cent, for the first quarter of 2020.

This is because the mortgage rate is pegged at 0.1 per cent higher than the Ordinary Account rate.

Top image from CPF Board's website.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.