The CPF Board on Monday responded to deny allegations from a Facebook user named Michael Toh Thiam Hock, who claimed that most of his retirement funds were transferred to his MediSave Account without his consent.

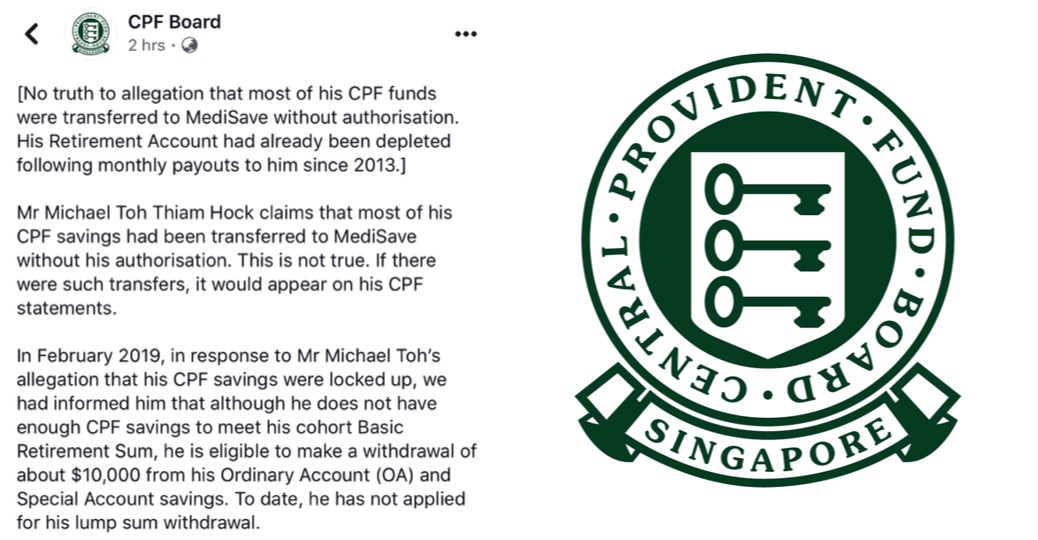

In a statement posted to Facebook in the evening, CPF said there was "no truth" to multiple allegations he made — which included the following:

- That Toh's retirement savings were transferred to his MediSave account without his consent,

- That he was only given S$15 in payout "for his retirement expenses", and

- That he was still waiting for a "lump sum" payment of "all the money with accumulated interest" that was supposed to be given to him at age 55.

It said, firstly, that if Toh's CPF savings had really been transferred to MediSave without his consent, the transfers would have appeared on his CPF statements.

The S$15 payout was actually an extra interest payout from the government on his Ordinary Account balances.

And to top it off, with respect to the lump sum payment Toh said he didn't get, CPF said they had actually informed him that he could withdraw "about S$10,000" from his Ordinary Account and Special Account even though he did not have enough savings to meet the basic retirement sum for his age batch.

Up till now, however, CPF said he had not yet applied for that payout.

It seems there is more to the story Toh didn't tell

It also revealed the following additional information Toh didn't say in his viral Facebook post:

- Toh's contributions were divided among the Ordinary, MediSave, and Special Accounts to meet his housing, healthcare and retirement needs, like all CPF members.

- He has already used more than S$86,000 of his CPF savings.

- S$54,000 was used to purchase a flat, which is fully paid up.

- S$9,000 was used for his retirement needs.

- His Retirement Account is now depleted.

They did offer a few suggestions for Toh to enhance his retirement income:

"...we urge him to consider monetising his flat by either renting out a room, right-sizing his flat, or selling a portion of his flat’s lease back to HDB under the Lease Buyback Scheme."

You can see their full post below:

Here's the first story:

And more stories about people's CPF:

Top images adapted from CPF Board Facebook page.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.