Retirement and re-employment ages, as well as CPF contribution rates are slated to be raised by 2030.

These measures were announced by Prime Minister Lee Hsien Loong at the National Day Rally on Aug. 18, 2019.

Measures accepted by MOM

The recommendations were put forward by a Tripartite Workgroup on Older Workers established by the Ministry of Manpower (MOM) in 2018 to study the matter of older workers.

MOM has since accepted all of the recommendations.

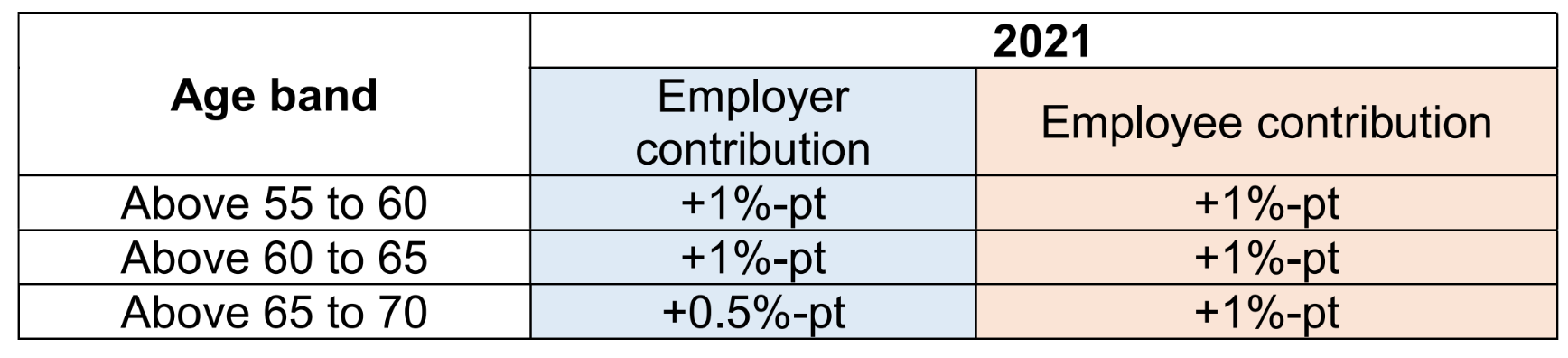

CPF contribution rates: Exact figures

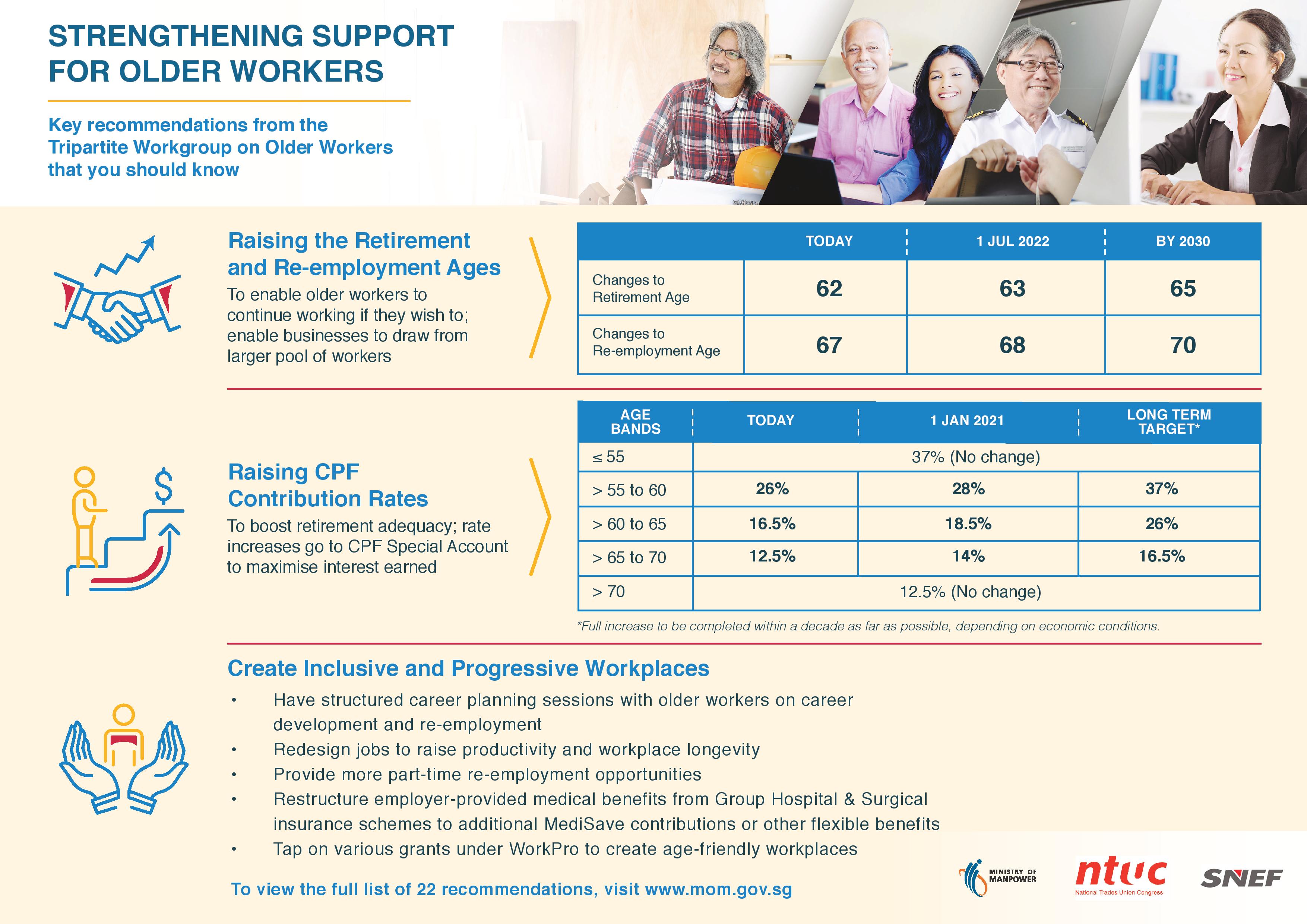

The total CPF contribution rate for those aged 55 to 60 will be raised to 37 per cent by 2030.

For those aged 60 to 65, the rate will be raised to 26 per cent by 2030.

Meanwhile, for those aged 65 to 70, the rate will be raised to 16.5 per cent.

For those above 70, the total CPF contribution rate will remain unchanged at 12.5 per cent.

Who will benefit?

These increases will benefit all cohorts born on January 1951 and after.

It will be done in gradual steps, with the first increase to be done on January 1, 2021, at a rate of 0.5 per cent to one per cent.

Source: Ministry of Manpower

Source: Ministry of Manpower

Increase in contributions

All increase in contributions will be allocated to the Special Account (SA) to ensure that they earn the highest interest rate of up to 6.5 per cent, and will not affect the current amount of contributions flowing in to the Original Account (OA).

- For example, a 56-year-old worker under the increased contribution rate of 37 per cent will still have 12 per cent flowing into his OA.

The increase in the contribution rate for employers is expected to be lower than that of employees, due to the former having borne a larger share of previous contribution rate increases.

- For example, the current CPF contribution rate for workers aged 55 to 60 is 26 per cent with the employer and employee each contributing 13 per cent.

- Under the increased rate of 37 per cent, the employer will be contributing 17 per cent, while the employee would contribute 20 per cent.

Retirement age

The retirement age will be raised from 62 to 63 on July 1, 2022.

It will eventually increase to 65 by 2030.

The retirement age was last raised in 1999, when it went up from 60 to 62.

It was first introduced in 1993.

Re-employment age

The re-employment age will be increased from 67 to 68 on July 1, 2022.

It will eventually increase to 70 by 2030.

The concept of re-employment age was pioneered in Japan.

It was announced in Singapore in 2007, and later legislated in 2012.

Under the current re-employment age of 67, eligible employees who turn 62, up to age 67, must be offered re-employment to continue their employment in the company.

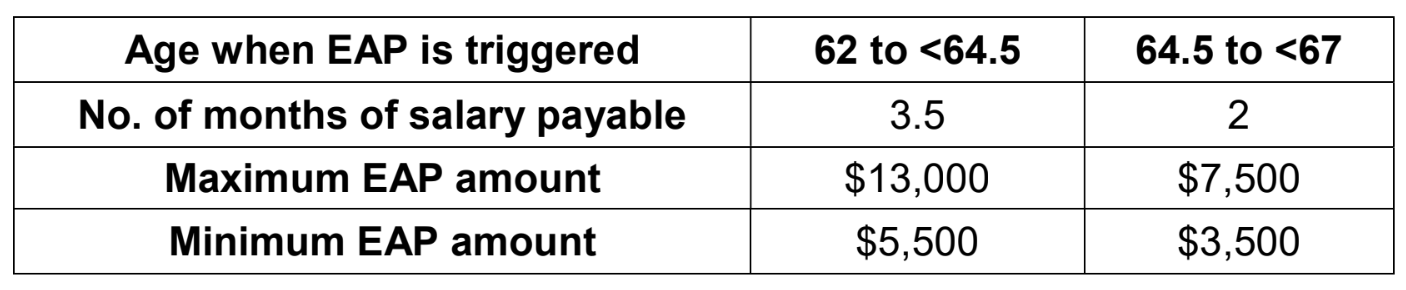

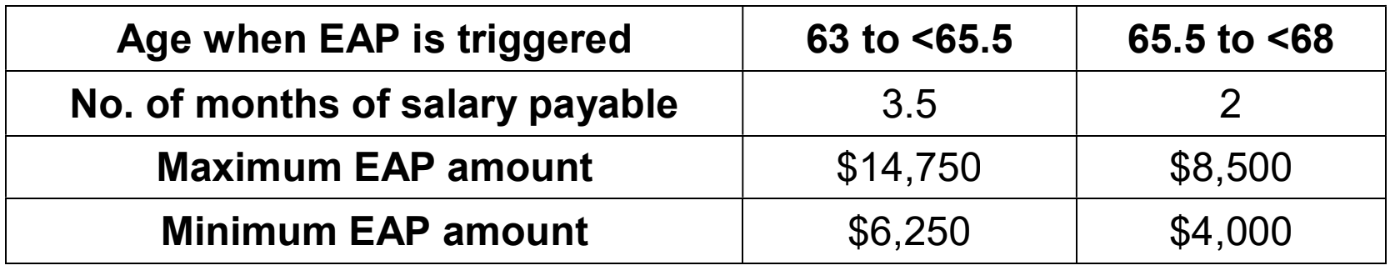

The Employment Assistance Payment (EAP) scheme will also be changed on July 1, 2022, with the maximum and minimum EAP levels increased, and the age bands updated.

Here is the current EAP scheme:

Screenshot from MOM

Screenshot from MOM

And here is the new EAP scheme expected to take effect on July 1, 2022:

Screenshot from MOM

Screenshot from MOM

Exemptions

However, there are exemptions to the increase in retirement and re-employment ages.

These include employees who work up to 20 hours per week, usually casual or temporary workers.

It also includes employees on fixed term contracts or Work Passes, due to the fixed validity of their contracts or permits.

Employees hired at age 55 and above are exempted from the retirement age and the re-employment age if they have worked less than three years with an employer.

The qualifying period for employees, hired at age 55 and over and to be eligible for re-employment, will be reduced from three to two years as part of the larger measures.

National security and civil defence-related occupations are also exempted, due to the need for a higher level of physical fitness to respond to emergencies and threats.

How should the government support such moves?

Recommendations include:

- The provision of a wage offset scheme to accompany the raising of the retirement and re-employment ages.

- Providing one-off wage offsets to employers in mitigating the higher CPF contribution rates.

- Working with employers, including public sector agencies, to conduct periodic reviews to ensure the relevance of the current exemptions for specific groups.

- The Public Service Division raising the retirement and re-employment ages of its officers in 2021 instead of 2022.

More details are expected to be announced by Deputy Prime Minister Heng Swee Keat in 2020’s Budget.

Measures welcomed by the NTUC

The National Trades Union Congress (NTUC) welcomed the proposed measures.

By Melanie Lim

By Melanie Lim

In a media statement, it said: "We are happy with the new tripartite consensus to move towards equalising CPF contribution rates for employees up to age 60, and to improve contribution rates for employees of higher age cohorts up to the proposed re-employment age ceiling of 70."

NTUC further added: "Enabling this choice is important not only to our older workers, but also our economy and society, given Singaporeans' increasing longevity. We must make that longevity productive."

Useful infographic:

Image via Ministry of Manpower

Image via Ministry of Manpower

Related Articles

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.