Hong Kong protesters are employing a new non-violent protest tactic to send a message to the People’s Republic of China and Hong Kong Chief Executive Carrie Lam.

Battle-hardened street protesters are withdrawing money out of ATMs and banks en masse.

What's the purpose?

Hong Kong protesters plan to withdraw as much money as possible from their banks or convert their currency into US dollars on Aug. 16.

This is done to protect their own assets and to show mainland China that the semi-autonomous island is not just a Chinese cash cow.

Forum organised

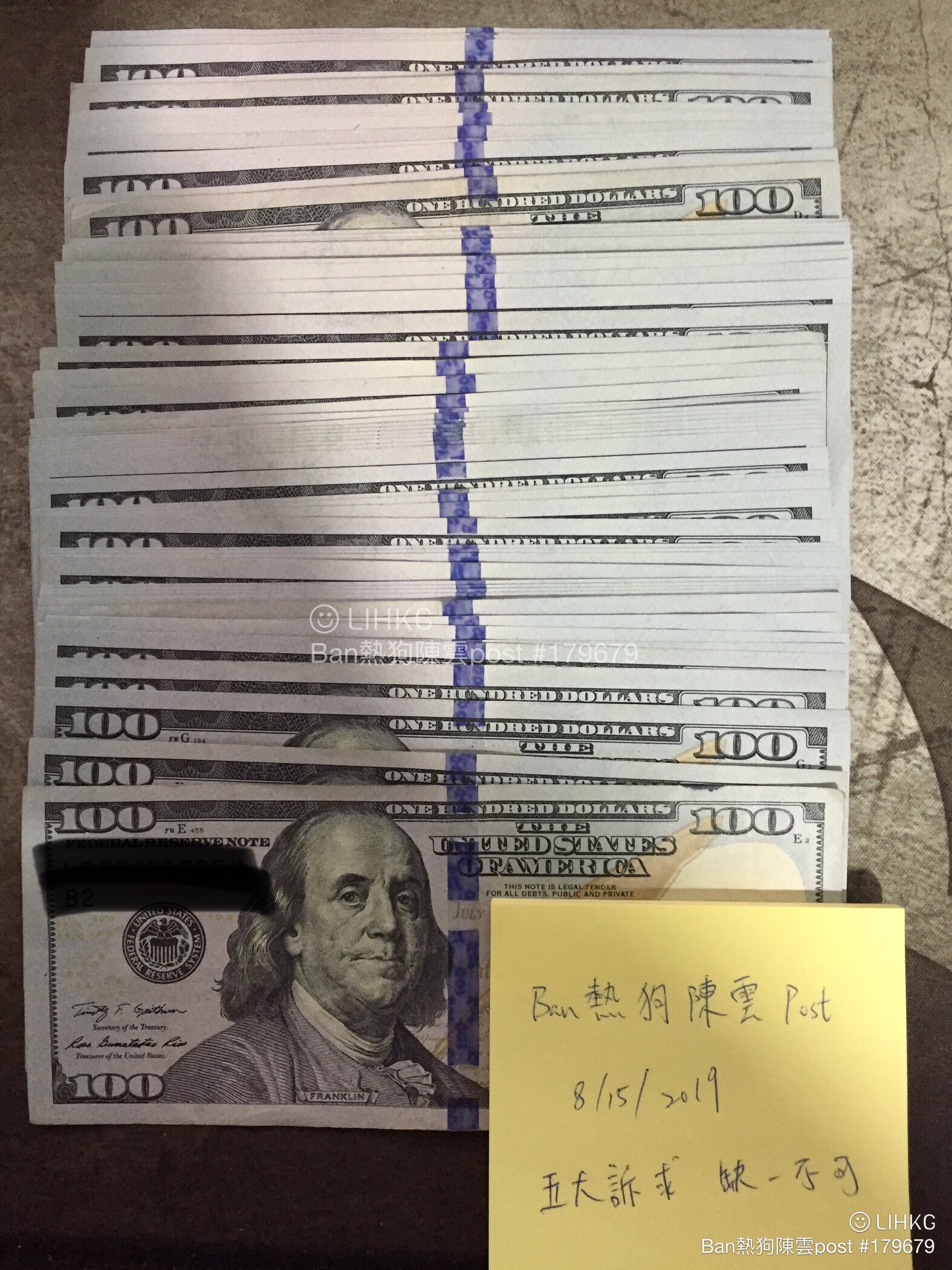

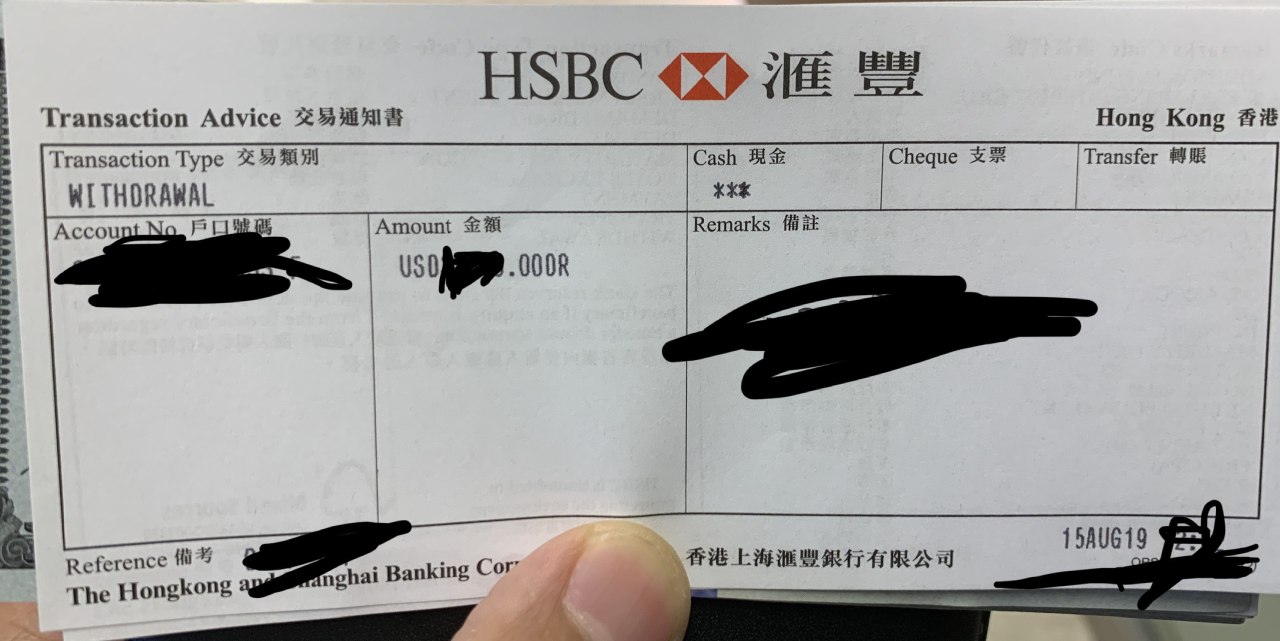

Photos of cold hard cash withdrawn from banks, and ATMs with messages they are out of cash, were put up on LIHKG, which is Hong Kong’s version of Reddit forum.

Hongkongers have begun to take out their cash a day in advance because they can withdraw between S$2,000 to S$14,000 per day from ATMs.

If you see #HongKong netizens posting photos of stacks of cash - this is why. In the latest move, #antiELAB protesters are withdrawing money from banks to put pressure on the financial system and prevent money from flowing to Chinese companies. pic.twitter.com/VY9XDzntdn

— Rachel Cheung (@rachel_cheung1) August 15, 2019

The protest is named the Cashout HKD to USD.

It was reported that over 70 million Hong Kong dollars (nearly S$12.5 million) had been withdrawn, both in Hong Kong currency and in US currency, as claimed by the protester who started movement.

However, this claim could not be independently verified.

More than 400 protesters have reportedly recorded their withdrawals.

One Telegram channel for the protest has over 1,500 members.

The student activist believes it is effective taking a chance with this novel approach.

“This may work because Carrie Lam and the PRC care much about the economy,” the Hong Kong student who started the protest told Insider.

Protecting own interests

Other activists expressed fear about the fate of Hong Kong’s currency, as a result of the instability.

A post in LIHKG speculated that the Hong Kong dollar will cease to be pegged to the US dollar within the year.

There is also the risk of foreign capital flowing out of Hong Kong.

“If you want to protect yourself, you must first convert most of the assets... in order to maintain value in US dollars or other reliable foreign currency,” it says.

China has always encouraged peace and stability in Hong Kong so that economic activity remains uninterrupted.

Hong Kong is China’s economic bridge to the rest of the world -- but might not be so in the future as the sleepy dragon awakens some more.

So far, regular Hongkongers have felt the brunt of being left behind.

China has seen its economy and standard of living grow exponentially in recent decades, but prosperity has not flowed to Hong Kong, leading to serious economic disparities.

Those affected include marginalised groups such as ethnic minorities, low-income workers, and women who are more likely to fall into poverty, the South China Morning Post reported.

Banks respond:

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.