Singaporeans can use their OCBC Digital app to make cashless payments at shops supporting Alipay+ in China from Sep. 22, 2023.

The exchange rate managed by Alipay+ is expected to be competitive and in real-time, with no added fees or charges.

This new payments option will not require the user to download a third-party payment app.

First bank in S'pore to offer Alipay+ through digital app

OCBC is the first bank in Singapore to offer Alipay+ through its digital banking app.

Alipay+ is operated by Ant Group and allows for international cross-border payments.

OCBC said in a press release on Sep. 19 that OCBC Singapore customers travelling to mainland China, Malaysia and South Korea will be the first to enjoy this service.

Since Sep. 8, 2023, they have been able to pay at Alipay+ QR-enabled merchants in Malaysia and South Korea.

The opening up of the payment option will see OCBC Singapore customers being able to pay with their app at tens of millions of merchants in China.

In all these three markets, merchants include key tourist sectors such as retail, food and beverage, attractions, and transportation, OCBC said.

The tie-up coincides with the commencement of the 19th Asian Games in Hangzhou, China on Sep. 23.

China has also resumed the 15-day visa-free entry for Singaporeans, and removed the requirement for a pre-departure Covid-19 antigen test.

OCBC is expected to roll out this feature by the end of the year for Japan, Hong Kong, and Macau, as well as other markets where Alipay+ is also widely supported by merchants.

How it works

Payments can be made directly from your OCBC Singapore bank account to a merchant in China that supports Alipay+.

The daily transaction limit is S$1,000.

You can check the exchange rate on your OCBC Digital app before confirming your transactions.

There are two payment methods:

- You can have your QR code scanned by the merchant to start the transaction (customer-presented mode)

- Or you can scan the merchant's QR code instead (merchant-presented mode)

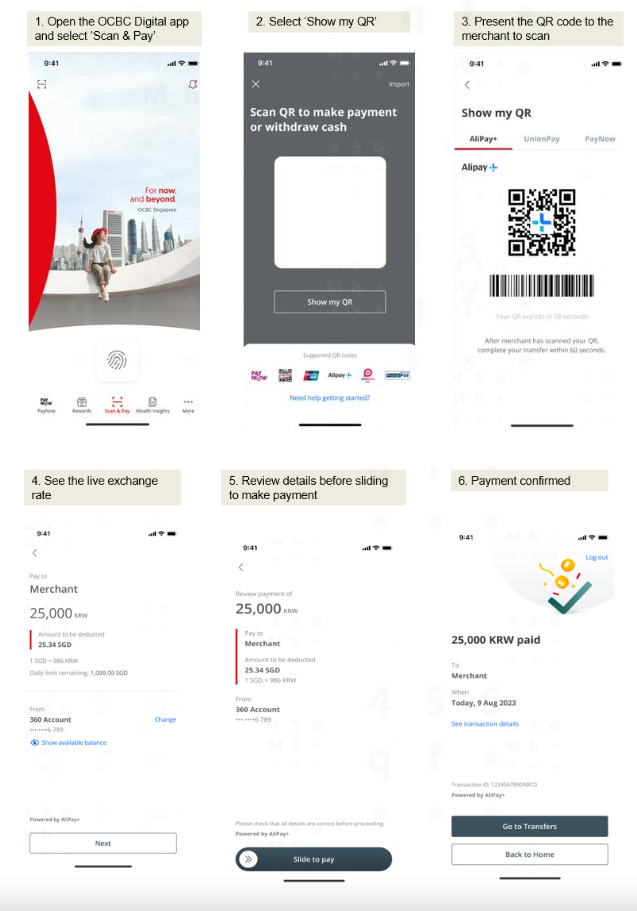

Steps in customer-presented mode

You can make payment via the following steps if you choose to let the merchant scan your QR code.

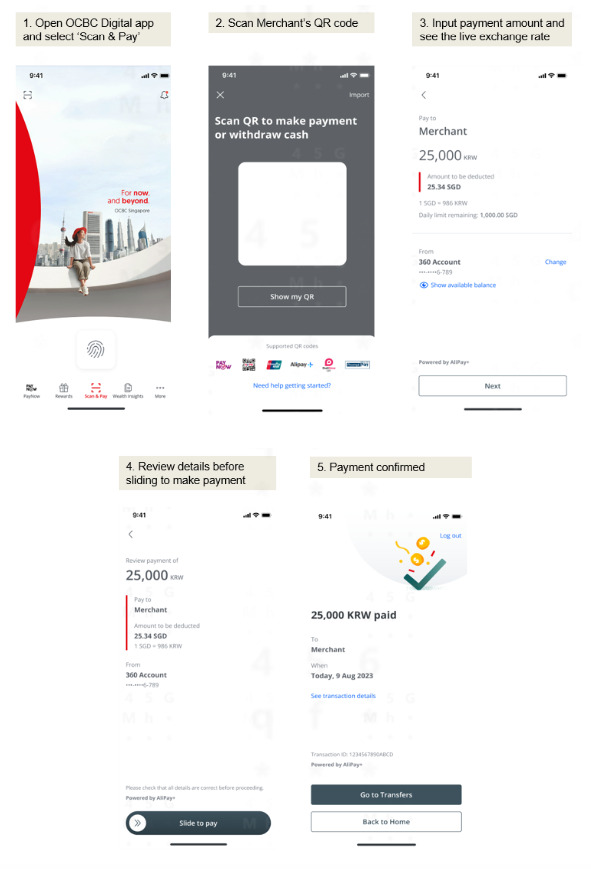

Steps in merchant-presented mode

Or you can pay via the following steps if you choose to scan the merchant's QR code.

Singaporeans can also use DBS app in China

Singaporeans who are DBS users can also make QR code payments in China through the bank's PayLah! app.

Since June 2022, DBS users can shop at 31 million bricks-and-mortar retailers supporting UnionPay across 45 markets, including China.

Through a tie-up with Alipay Wallet, DBS users can also use the bank's mobile fund-transfer platform, DBS Remit, to make cross-border transfers easier and more seamless.

Top image from Canva.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.