Do you notice the increased online chatter about the Central Provident Fund (CPF) and the Minimum Sum Scheme?

Are you confused by the lengthy CPF articles with too many infographics?

Fret not, we decided to summarise the blog posts of Manpower Minister Tan Chuan-Jin and blogger Roy Ngerng.

Here's the wheat without the chaff:

|

Manpower Minister Tan Chuan-Jin |

Blogger Roy Ngerng “Your CPF: The Complete Truth And Nothing But The Truth” (May 20) |

| Aims of CPF

- CPF helps us retire.- Every individual saves for his own retirement via his personal individual CPF account.- The Government also contributes into the accounts for those who need more, through Workfare and other schemes such as Pioneer Generation Package. - The CPF account grows at a reasonable interest rate without risk, backed by the full faith and credit of the Singapore Government. - Money in your CPF account is your money. We use our CPF to help own our homes and pay for healthcare. |

Aims of CPF

- CPF is used as a tool to entrap Singaporeans. - PAP’s ability to thrive depends on how much they can entrap our CPF for their own uses and investment. -The only way to entrap your CPF is for you to work for longer periods of time, so that your labour can be used as collateral to generate the CPF they need to fuel their investments.

|

| CPF Minimum Sum

- When we turn 55, we set aside a Minimum Sum from our savings in the Ordinary and Special Accounts (OA/SA) to meet out retirement needs, and we can withdraw any remainder. - The current Minimum Sum for someone turning 55 from July 2014 is $155,000. This sum will provide about $1,200 per month, for life, through CPF LIFE. This is estimated to be what a lower-middle income retiree household requires to meet their basic daily needs. This is far more than the $230 per month that we would have received if the Minimum Sum had remained at the original $30,000, which was the Minimum Sum in 1987 when we first started the scheme. |

CPF Minimum Sum

- In 1984, the PAP government had wanted to increase the retirement age but they were unsuccessful at doing so. - In 1986, the PAP implemented the CPF Minimum Sum. This caused our CPF to be effectively locked up and because we couldn’t withdraw our CPF, we were forced to work longer and had to retire later. |

| Why CPF Minimum Sum is increasing

- We are living longer. We can probably expect to live 10 years longer than our parents did. Unless we intend to work and retire much later, we will spend more years in retirement. - Prices will increase over time. - Our daily needs have increased. The food we eat is of better quality, the medicine that we consume is more advanced, and technology that we now enjoy didn’t exist before. |

Why CPF Minimum Sum is increasing

- The CPF Minimum Sum grew much faster than inflation but wages and our CPF barely grew. - Recently, the government had increased the CPF Minimum Sum to $155,000. The CPF Minimum Sum increased by 4.7% even though inflation increased by only 2.4% last year.- In 2008, Temasek Holdings lost $58 billion, equal to 40% of the value of our CPF in 2008. - In 2009, the CPF Minimum Sum was suddenly increased by more than 10%. Does this have anything to do with it? |

| Singaporeans meeting the Minimum Sum:

- More Singaporeans have been able to attain the Minimum Sum, even as the Minimum Sum has increased in recent years. - About half of active CPF members are able to do so now, compared to one third just five years earlier. Source: CPF Annual Reports (2013′s Annual Report to be published soon), CPF Trends Article Feb 2011 |

Singaporeans meeting the Minimum Sum:

- If our wages had grown as fast as the CPF Minimum Sum had, it would mean that the lowest wage that Singaporeans should be earning today is $3,200. - But half of Singaporeans earn less than that. It was no wonder why nearly 90% of Singaporeans aren’t able to meet the CPF Minimum Sum. - In fact, you can see that from 1996 onwards, the CPF Minimum Sum have always grown by much faster than inflation. - The CPF Board might claim that 48.7% of CPF members were able to meet the CPF Minimum Sum. However, this is only for “active” CPF members who were able to meet the Minimum Sum “either fully in cash, or partly in cash and partly via a property pledge”.

|

| Other Misconceptions about CPF and Minimum Sum

- If a Singaporean do not have sufficient savings to set aside the Minimum Sum at age 55, you do not need to top up the shortfall in cash. One also does not need to sell your property just so that you could meet the Minimum Sum. - Only half of the Minimum Sum must be maintained in cash. The savings above that can be used for housing needs. |

Other Misconceptions about CPF and Minimum Sum

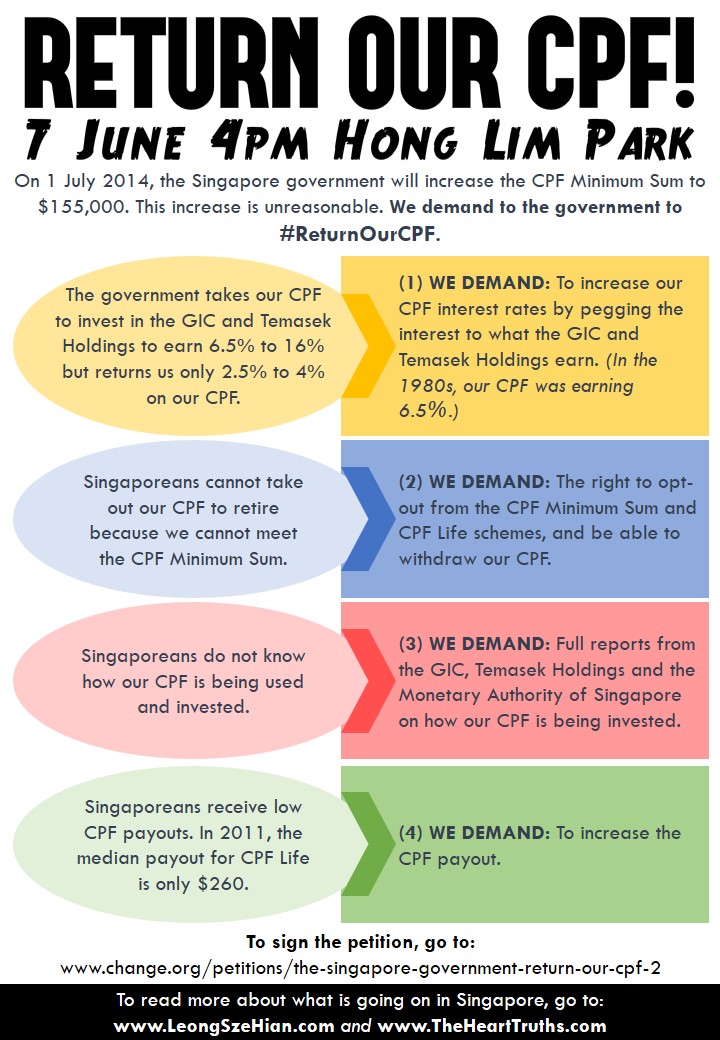

- Singaporeans cannot take out our CPF to retire because we cannot meet the CPF Minimum Sum.There are other issues highlighted by Roy Ngerng that were not addressed in Manpower Minister’s blog. They include: - Singaporeans not knowing how our CPF is being used and invested. - The discrepancy between Singaporeans’ CPF interest rates and what GIC and Temasek Holdings earn. (The government’s response can be found at “CPF Savings: How can I use my CPF Money? What are the myths and facts surrounding our CPF money?).

|

Top photo from Tan Chuan-Jin Facebook and Roy Ngerng blog.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.

+Proportion+of+active+CPF+members+meeting+MS.jpg)