In the classic British TV series "Yes Minister", protagonist Jim Hacker is presented with a dilemma. For his next job, does he wish to become the UK's Foreign Secretary (equivalent to our Foreign Minister) or the Chancellor of the Exchequer (our Finance Minister equivalent)?

He goes to his principal private secretary Bernard Woolley for advice, who points out: "The Chancellor is Mr Killjoy. Raising taxes on beer and cigarettes, cutting down on public spending goes down awfully badly with the electorate."

"Maybe I don't want to be Chancellor of the Exchequer," Hacker mused.

'Mr Killjoy' for 2 years

Here in Singapore, Lawrence Wong, Deputy Prime Minister and Finance Minister, assumed his latter role in May 2021.

Just months prior, his predecessor Heng Swee Keat said, in his final Budget speech, that the Goods and Services Tax (GST) will need to be raised "sooner rather than later". Not that year, but definitely by 2025.

As it turned out, Heng "stepped aside" as 4G leader and relinquished his finance portfolio, but that didn't mean the plans were scuppered. The GST hike proceeded as planned, only it was a new man responsible for overseeing its implementation.

While Cabinet has collective responsibility, and any finance minister would have done the same in Wong's place, Wong should take credit for gamely defending the hike and explaining the government's rationale behind it at almost every opportunity.

I sat through marathon debates as Wong was served questions about the GST hike and returned volleys of his own.

The hike was delayed but not cancelled, rising by 1 per cent at the start of 2023 and another at the start of this year.

But the GST wasn't the only tax that Wong oversaw in his next two Budgets.

2022 saw the announcement of an "upward adjustment" to the carbon tax, while 2023 saw increases to the luxury taxes on high-end cars and property, as well as hiking the "sin tax" on tobacco. Quite the "killjoy", in Bernard's words.

So as we turn our eyes to the 2024 Budget, it is notable for containing very little in the way of "bad news."

There were no major tax increases. There were no new taxes introduced, save for the 15 per cent Income Inclusion Rule adjustment for large multinational enterprises, and even that was previously mentioned.

Winning now

Let's get it out of the way — this is rightly perceived by some as an election budget.

No, I don't have any secret insider information on the timing of the next general election.

But if the lack of "bad news" didn't clue you in, let's take a look at where some of the announced financial support is going, and who benefits.

- S$600 in Community Development Council (CDC) vouchers for 1.4 million Singaporean households.

- S$200 to S$400 in cash, the Cost-of-Living special payment, for 2.5 million adult Singaporeans.

- A one-off U-Save rebate to help nearly a million Singaporean households deal with increased utility bills.

- A one-off Service and Conservancy charges rebate to help nearly a million Singaporean households with half a month of bills.

- A one-off MediSave bonus for Singaporeans aged 21 to 50 of up to S$300, benefitting 1.4 million Singaporeans.

- S$200 in LifeSG credits for all past and present national servicemen.

And that's just the direct cash boosts and support.

There is also a personal income tax rebate of 50 per cent for the Year of Assessment 2024, capped at S$200, to benefit mostly middle-income workers.

Pulling back a little, we see support for workers who want to go back to school, support for the ageing population, low-wage workers, young couples, people with special needs, parents and also artists and athletes.

There is something for everyone.

Obviously voters have considerations other than financial support, but it's never a bad idea for a political party to give them reasons to vote for you.

There were no sweeping giveaways, nothing that could strictly be called big angbaos. Every measure was targetted and had a reason behind it.

And if some still want to call them angbaos, as a wise man once said, it can be two things.

Governing long-term

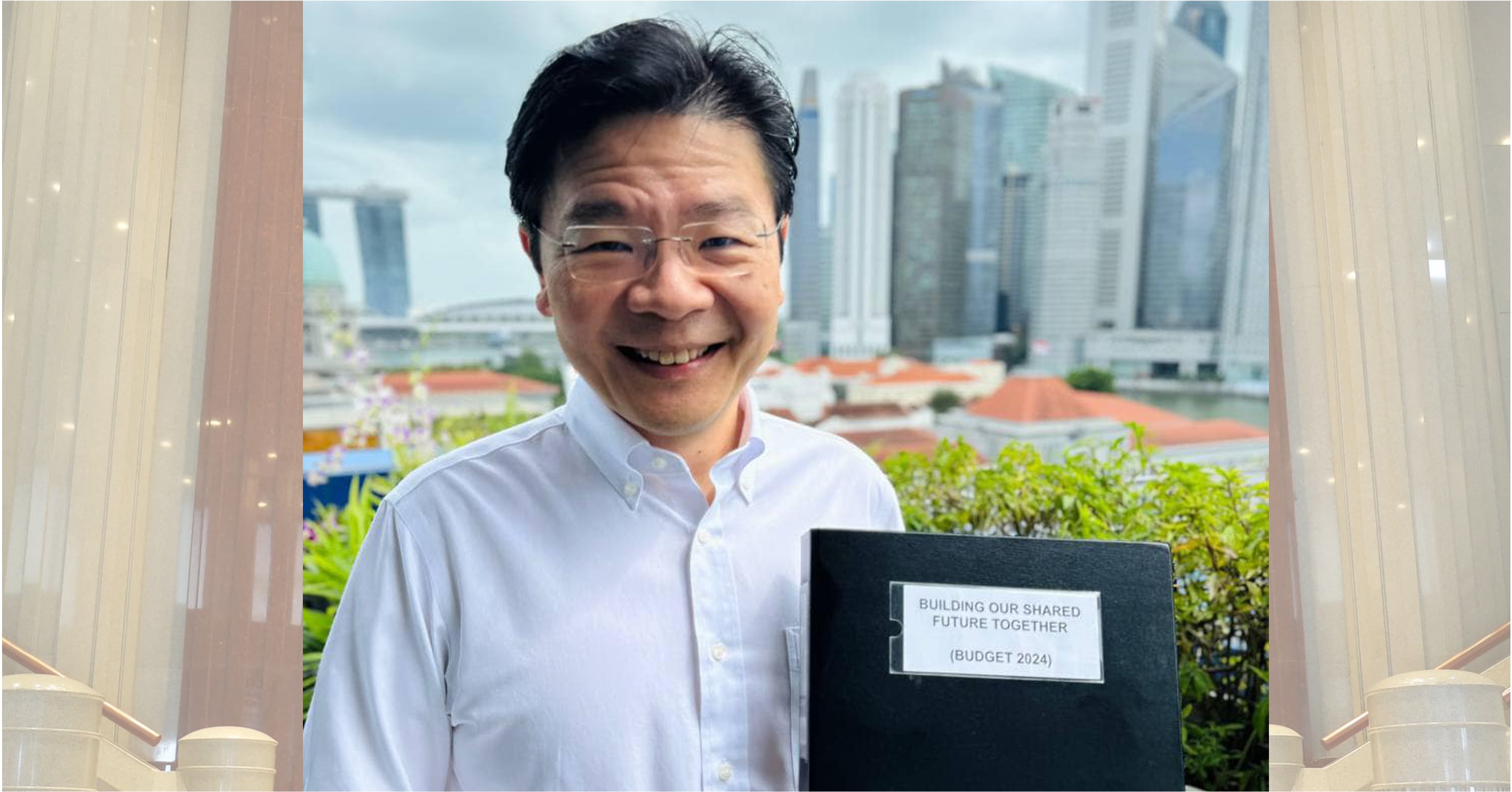

But along with the short-term benefits, there were a slew of measures that laid down the building blocks for a long-term future as well, in this "Building Our Shared Future Together" budget.

One of the most intriguing was the announcement of a mysterious temporary financial support scheme for the "involuntarily unemployed, while they undergo training or look for better-fitting jobs".

There were no details at this point, and MOF's copy of Wong's speech didn't use capital letters, so even the name might change.

Workfare 2.0? Trainfare? Workbridge?

At face value, this may signal more robust support for those who have been retrenched, something new in the Singaporean landscape.

Given the recent headline-grabbing news of mass layoffs, particularly for those in the tech sector, the impetus for such support may have been brought forward.

Here and there were more hints that the government is looking towards the future, like support for faster broadband speeds with an eye towards AI development, considerable investments towards a National AI Strategy 2.0, a new cybersecurity command centre in Punggol and another Liquefied Natural Gas terminal to meet future energy needs.

Wong described Budget 2024 as the roll out of "the first instalment of our Forward Singapore programmes".

This speaks to the government's focus on the long-term as well as the short and medium.

And perhaps, also their confidence that they will still be the government when these investments come online.

Related story:

Top image from Lawrence Wong's Facebook page.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.