Buyers of Housing and Development Board (HDB) resale flats that cost S$1 million or more have been on average taking out smaller HDB loans over the last three years.

This was according to a statistic revealed in a written parliamentary reply on Nov. 7, 2023.

Context of question

Gan Thiam Poh, MP for Ang Mo Kio GRC, asked the National Development Minister Desmond Lee what was the average annual amount of housing loans taken by HDB resale flat buyers, who paid more than S$1 million for their flats in the past three years.

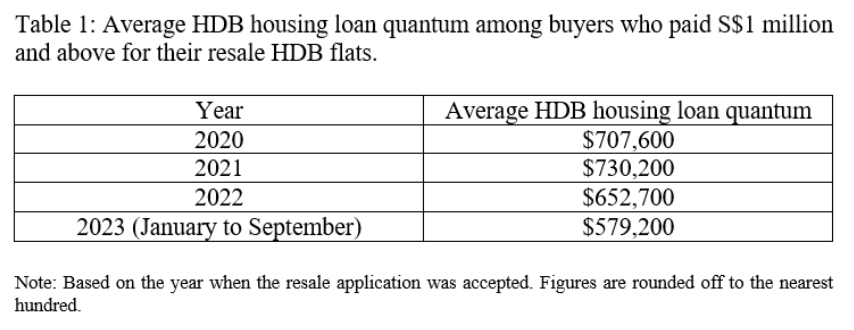

A table showed that the average HDB housing loan quantum going up from S$707,600 in 2020 to S$730,200 in 2021, before falling to S$652,700 in 2022, and dipping further to S$579,200 in 2023, according to data culled from January to September this year.

via MND

via MND

A decreasing loan quantum over the past three years for S$1 million or more HDB resale flats sheds some light on the affordability of such purchases for this group of buyers.

The data suggest buyers of such resale flats can afford to pay more upfront over the last few years and take smaller loans.

Currently, buyers of HDB flats are able to use cash, funds from the Central Provident Fund ordinary account, or a combination of both, as well as use grants from the government and take a loan for the outstanding amount, to finance their purchases.

The concessionary interest rate for HDB housing loans is 2.6 per cent.

The maximum amount of HDB housing loan a flat applicant can take up is capped at 30 per cent of the borrower's gross monthly income.

It applies only to housing loans for the purchase of an HDB flat, or an executive condominium where the minimum occupation period of the executive condominium has not expired.

Background

The Ministry of National Development (MND) had previously revealed in a written response on Sep. 18 that the number of Housing and Development Board (HDB) resale flats sold for S$1 million or more made up less than 1 per cent of registered transactions between July 2015 and June 2023.

This figure was in response to a question previously also posed by Gan, who had asked the age of buyers of million-dollar HDB resale flats in the past eight years and what percentage of such buyers were permanent residents (PR).

It was revealed that the median age for buyers of HDB flats sold for S$1 million or more was 40 years old in the last eight years, with about 94 per cent of buyers Singaporeans and about 6 per cent PR.

In a written reply to a separate question, the ministry also revealed that 21 HDB towns and estates had resale price transactions of S$1 million or more as of July 22, 2023.

The reply also stated that such flats tend to be in "very favourable locations" or "come with larger floor areas".

The ministry was responding to the MP for Bishan-Toa Payoh GRC Saktiandi Supaat, who had asked the ministry how many HDB estates have had flats that fetched a resale price exceeding S$1 million and the location of such estates.

The locations were Ang Mo Kio, Bedok, Bishan, Bukit Batok, Bukit Merah, Bukit Timah, Central Area, Clementi, Geylang, Hougang, Jurong East, Kallang Whampoa, Marine Parade, Pasir Ris, Punggol, Queenstown, Serangoon, Tampines, Toa Payoh, Woodlands, and Yishun.

Among these 21 towns and estates, the housing board had offered 13 Build-To-Order (BTO) projects under the Prime Location Public Housing (PLH) model.

These projects under the PLH model were launched in Bukit Merah, Central Area, Kallang Whampoa, and Queenstown between 2021 and the first half of 2023.

Top photo via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.