A new day must be dawning for our favourite public transport operator SMRT.

On Monday, they posted their earnings for the third quarter of the financial year ending 2016, and it was reported on by The Straits Times and Channel NewsAsia as follows:

Screenshot from ST; click photo to read full article

Screenshot from ST; click photo to read full article

Screenshot from CNA; click photo to read full article

Screenshot from CNA; click photo to read full article

Now, all that is well and good. Fair reports were done of the financial results, no doubt. But the two stories, oddly enough, didn't perform very well online, so we thought we'd highlight a few figures from their report for your convenience.

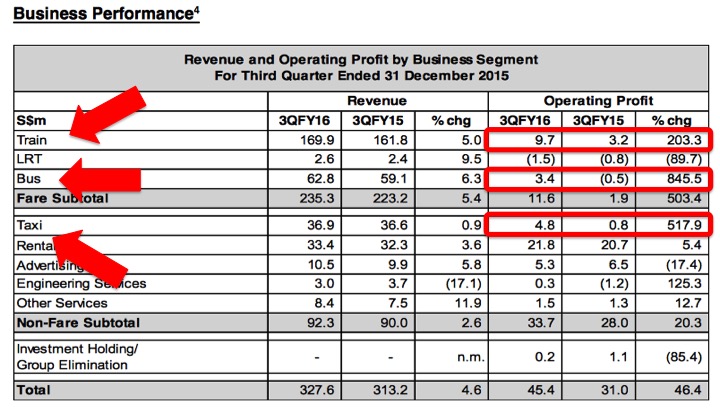

Here is a closer look at SMRT's business performance:

Screenshot from SMRT's website

Screenshot from SMRT's website

Will you look at that — in terms of takings from their train services, SMRT's operating profit jumped from $3.2 million over the same period last year to $9.7 million this year; a three-fold jump.

How about their buses? SMRT went from a $500,000 operating loss at the third quarter of financial year 2015 to a $3.4 million operating profit over the same quarter this year, soaring by an impressive 845 per cent.

It doesn't stop there — SMRT was reaping tonnes of profits from their taxi drivers in rentals too: from just $800,000 in the third quarter of FY2015, they made $4.8 million over the same period a year on. Percentage increment: Five times.

And we're not even pulling these numbers out of context — look at the earnings from the other parts of SMRT's businesses and you'll see that the three items we highlighted are really the best-performing aspects of the business year-on-year.

Profits earned from space and other rentals (their chief source of profits) between October and December last year only went up by 5.4 per cent, while profits from advertising over the same period even went down by 17.4 per cent year-on-year. Profits from their investment holdings also fell — 85.4 per cent.

This dude (SMRT CEO Desmond Kuek) must indeed be smiling — all the way to the bank.

Photo courtesy of Vanessa Chia

Photo courtesy of Vanessa Chia

Oops, wrong picture.

Photo from SMRT's Facebook page

Photo from SMRT's Facebook page

Just last year, it was reported that his pay actually doubled from the time he started in October 2012 until July 2015.

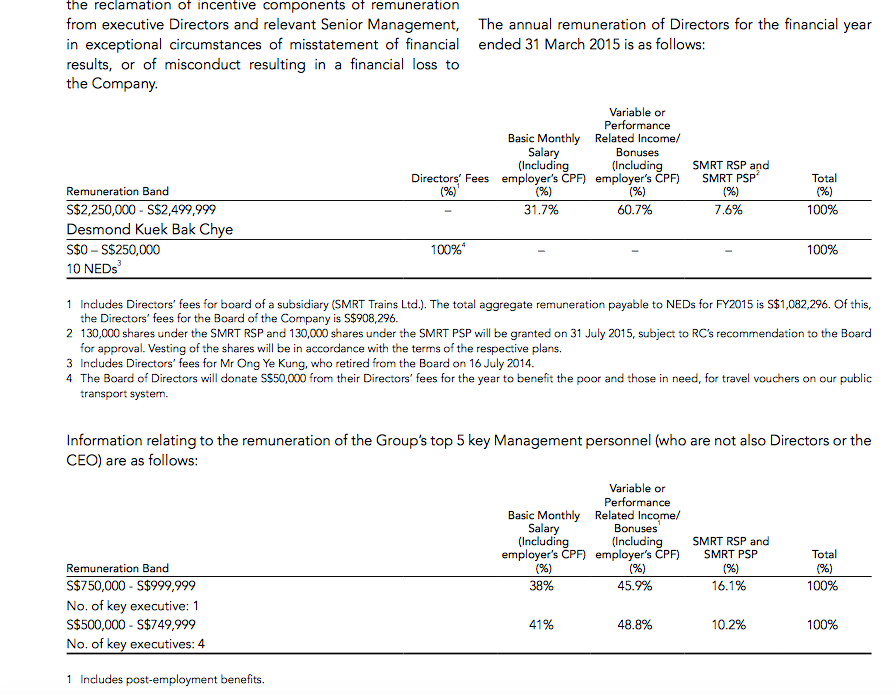

We thought we'd take a look at their 2015 annual report, too — here's how much the top six fellas at SMRT earned (not including the 10 non-executive directors):

Screenshot from 2015 annual report

Screenshot from 2015 annual report

But okay, what's happening here? Why are they earning so much money from their public transport businesses? According to SMRT in their earnings announcement:

"Operating profit from Train operations increased by $6.5 million due to higher revenue, funding from the Public Transport Security Committee and lower depreciation, which was partially offset by higher staff costs and repairs and maintenance related expenditure."

Public Transport Security Committee? It is a multi-agency body, chaired by the Chief Executive of Land Transport Authority (LTA) and oversees the security of Singapore's public transport system.

However much was given, though, here's hoping that most of the higher staff costs went to the drivers, station staff and engineers.

Bus profits were explained thusly:

"Bus operations posted an operating profit of $3.4 million in 3Q FY2016 on the back of higher revenue, training grants, reliability incentives and lower diesel costs, partially offset by higher staff costs, depreciation, and repairs and maintenance expenses."

Again, we hope the profits went to higher pay for bus drivers. Because we read a Straits Times report that the basic pay offered by London-based Tower Transit is 5 to 15 per cent higher than that offered by the two existing bus operators SBS Transit and SMRT.

Here's what SMRT said for their increased taxi profits:

"Taxi operating profit increased to $4.8 million in 3Q FY2016 due mainly to higher taxi rental contribution and more early retirement of taxis in 3Q FY2015."

So... because you guys had fewer taxis on the road, you had to spend less on their maintenance and therefore made more money from the ones remaining? Okay.

Healthy profits aside, commuters and taxpayers in Singapore will remember the dividend SMRT owes us.

For a start, the government pays for our public transport infrastructure, like our MRT/LRT lines and bus interchanges.

They've also in recent years signed up for much more liability through that $1.1 billion Bus Service Enhancement Plan, as well as their eventual takeover of ownership and maintenance of all of Singapore's buses (remember, the ones we had to vote the colour of?).

But hey, let's not be a downer. Congratulations to a successful third quarter, SMRT! Kuek is indeed doing a commendable job of making sure you folks are staying afloat, as a profitable transport provider.

Here's hoping we will see 845 per cent less of this:

And this:

Photo courtesy of Ooi Kang Sheng

Photo courtesy of Ooi Kang Sheng

As well as this:

Photo courtesy of a reader

Photo courtesy of a reader

And also this.

Photo courtesy of Clarabelle Lin

Photo courtesy of Clarabelle Lin

Top photo from SMRT's Facebook page.

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.