UOB is cutting the interest rates for its savings account from May 1, 2024, in view of the U.S. Federal Reserve cutting rates as early as June.

This makes UOB the first local bank to lower interest rates.

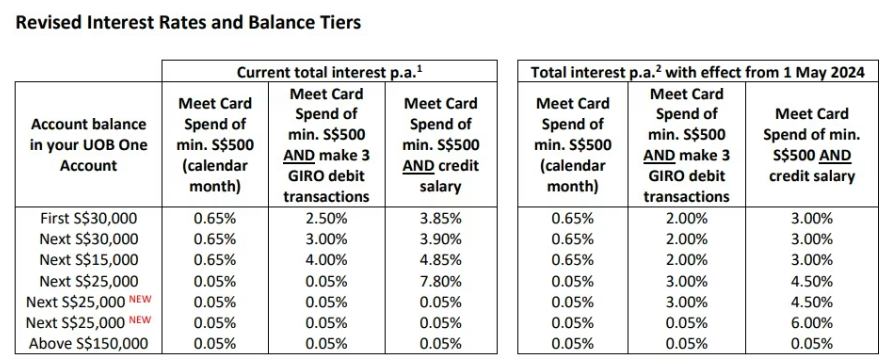

The new interest rates will range from 3 per cent to 4.5 per cent per annum, down from 3.85 per cent to 7.8 per cent.

New and existing accounts

The new interest rates are applicable to all new and existing UOB One accounts between S$30,000 and S$75,000, and when customers spend at least S$500 a month on an eligible UOB card and credit their salary of over S$1,600 via Giro.

The lower maximum bonus interest rate applies to the first S$30,000 balance in the account.

A table showing the revised rates was provided for the bank's customers.

via UOB

via UOB

Rates went up in late 2022

UOB offered the highest maximum interest rate of 7.8 per cent in late 2022, when it aggressively hiked rates in a rising rate environment in response to the Fed then.

The downward revision of interest rates for its UOB One Account is done to align with long-term interest rate environment expectations, the bank told customers in a letter on Monday, April 1.

How UOB's interest rates work

Similar with other banks, the flagship UOB One account provides tiered interest rates that increase when customers meet certain criteria.

These requirements include growing the account balance or spending a minimum on select cards, as well as conducting transactions with the bank, such as taking up a mortgage.

Two new tiers

UOB is introducing two new tiers amidst amendments.

The new criteria involves account holders being required to have account balances above S$100,000 to qualify, while meeting the same salary and spending requirements.

The change will see interest earned on balances between S$100,000 to S$125,000 go up to 4.5 per cent per annum from the current 0.05 per cent.

Savings between S$125,000 and S$150,000 will earn the maximum bonus interest rate of 6 per cent a year, up from the existing 0.05 per cent.

The bank said its customers can effectively earn up to S$6,000 total interest in a year for deposits of S$150,000 by spending a minimum of S$500 on eligible UOB cards and credit their salary via GIRO/ PayNow each calendar month.

Currently, OCBC pays a maximum of 7.65 per cent a year for its 360 savings account.

The highest rate on the DBS Multiplier account stands at 4.1 per cent per annum.

Top photo via Google Maps

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.