Malaysia is in the midst of a debate about civil service pension reform, with the Malaysian government saying that newly hired civil servants will no longer be eligible for a government pension.

Instead they would go on other contributory retirement schemes, such as the Employee Provident Fund (EPF).

This was due to concerns that the government’s pension obligations run the risk of ballooning as the population ages.

Pension phase out

On Jan. 24 Deputy Prime Ahmad Minister Zahid Hamidi gave a speech, covered by the New Straits Times, where he said that the government would introduce a new civil service hiring policy.

Part of the new policy would require new permanent civil service to contribute to existing retirement schemes, such as the EPF or the social security organisation (Perkeso), with contribution rates expected to be in line with current private sector rates.

The EPF is a compulsory savings fund, similar to that of Singapore's Central Provident Fund.

This was part of the government's attempts to phase out traditional government pensions.

According to Zahid existing civil servants would continue with the current system, with implementation of the new system expected to begin in 2024.

Civil service wage reforms

The Malaysian government is reportedly concerned that pension liabilities will reach prohibitive levels in upcoming decades.

As far back as 2018, the Malay Mail published an article saying that the cost of Malaysian pensions between 1990 and 1999 was roughly RM4 billion, about S$1.7 billion in 1999.

However, pension costs for 2015 alone had reached RM18.87 billion, about S$6 billion at the time.

Bernama reported that second minister for finance Amir Hamzah Azizan, newly appointed in the recent cabinet reshuffle, spoke about proposed pension changes.

New hires might be affected

On Jan. 26, Amir Hamzah emphasised that the Malaysian government did not intend to change pensions for incumbent civil servants, and that changes would only apply to new hires.

He also revealed that the government had allocated RM31 billion (S$8.8 billion) for pension payments for 2024, reiterating that the number was expected to increase to RM120 billion (S$34 billion) by 2040.

Pensions and emoluments consisted 48 per cent of the government's total budget, funds that Amir Hamzah said could have been spent on other important infrastructure, if the government's existing burden could be lightened.

But he also acknowledged the important role that civil servants played, saying that the government was committed to improving the welfare of civil servants.

He referred to a RM2,000 (S$567) bonus to be paid in February, and RM2.4 billion (S$680 million) to build and maintain quarters for civil servants such as teachers, hospital staff, policemen, firemen, and military personnel.

The civil service was also expected to finalise salary adjustments at the end of 2024.

Abolition impact

Unsurprisingly this has attracted pushback from multiple areas.

Utusan Malaysia reported that opposition Parti Islam se-Malaysia (PAS) Member of Parliament (MP) Shahidan Kasim, formerly of UMNO, said that proposed changes were taking place too quickly, and had surprised many parties, especially civil servants.

He pointed out that such changes would have a large impact on bumiputra civil servants, saying that they would be the most affected by the abolition of pensions.

According to the Malaysia Post, former Chief Minister of Malacca Abdul Rahim Thamby Chik said the proposed changes was part of a strategy by the Democratic Action Party (DAP, part of the ruling Pakatan Harapan government) to "weaken Malays", as they were the ones who dominated the public service.

Malaysia operates a system which prefers bumiputra candidates for civil service positions.

Abdul Rahman, who was a former UMNO politician under former prime minister Najib Razak, suggested that instead of abolishing pensions, the government should reimplement the Goods and Services Tax.

The GST was a revenue raising tax that had been implemented by Najib, but which was rescinded by the Pakatan Harapan government after he lost power in 2018.

Bankrupt

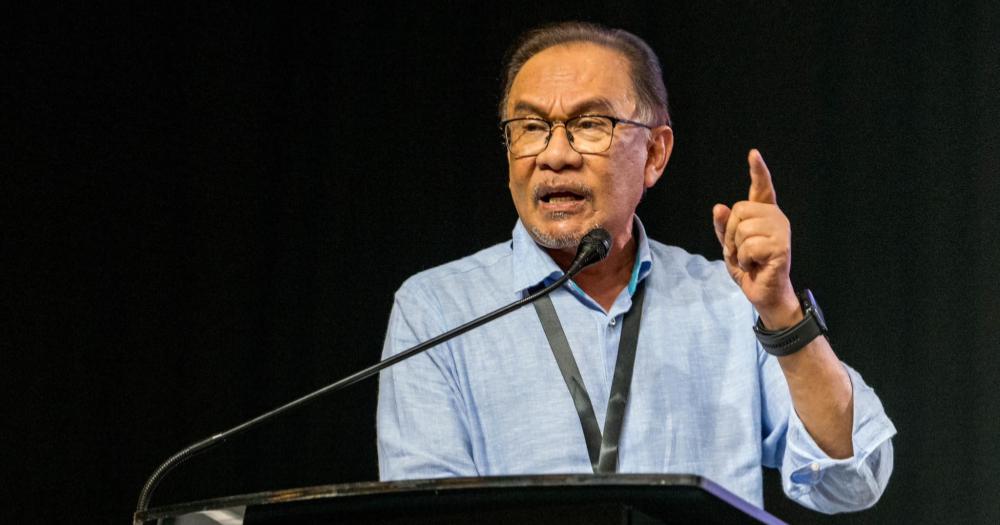

Malaysian prime minister Anwar Ibrahim spoke on the topic on Jan. 28.

As reported by Free Malaysia Today, he dismissed concerns that the abolition of the pension scheme would victimise Malays, saying that the proposal was necessary in order to avoid the risk of the Malaysian government becoming bankrupt.

Anwar was quoted as saying that such pension reforms have been studied since the 1990s, but there had never been political will to implement the changes.

He dismissed the concerns about the victimisation of Malay civil servants, saying that the opposition was playing on religious sentiments without presenting facts.

Anwar said that many developed nations had already abolished pension systems for civil servants, and that politicians should accept that their pensions would also be affected.

Anwar said that any new proposals would also strip pensions from politicians.

Future candidates should expect that they will not be eligible for a pension should they win, and it would be up to them to decide if they wanted to contest in future general elections or not.

Anwar had previously said that members of the government who were eligible for multiple pensions, for example, as an MP, as a cabinet minister, or other government appointed positions, had the moral responsibility to only accept one pension.

By way of example, he cited his own wife, Wan Azizah Wan Ismail, who qualified for pensions as a former government doctor, assemblyman in Selangor, and as an MP, but would only be accepting one pension.

Moral Responsibility

Speaking on Feb. 1, the Malay Mail reported Anwar as saying that any proposal to abolish politician's pensions would require cabinet discussion and parliamentary approval.

Anwar said it was "difficult for me to rationalise" exclusion of politicians from pension abolition, saying that if civil servants didn't have pensions, neither should politicians.

He questioned the feasibility of the pension scheme, saying that "even wealthy countries" could not sustain pension schemes, having largely abolished them.

But he also reemphasised that those currently on pension schemes will not be affected, saying "they cannot be touched, it will continue".

Related stories

Top image via Anwar Ibrahim/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.