The median household income from work grew to S$10,869 in 2023 from S$10,099 in 2022 for resident employed households in Singapore.

Median household income increasing since 2018

This marks an increase of 7.6 per cent in nominal terms or 2.8 per cent in real terms, after adjusting for inflation.

A resident employed household refers to a household where the household reference person is a Singapore citizen or permanent resident (PR), and with at least one employed person.

Meanwhile, accounting for household size, the median monthly household income from work per household member rose from S$3,287 in 2022 to S$3,500 in 2023 — an increase of 6.5 per cent in nominal terms, or 1.7 per cent in real terms.

These were the figures released by the Singapore Department of Statistics (Singstat) on Feb. 7, 2024.

In a press release, Singstat noted that from 2018 to 2023, the median monthly household income from work increased 3.1 per cent cumulatively or 0.6 per cent per annum in real terms.

Per household member, the change over the same period was 10.5 per cent cumulatively or 2 per cent per annum in real terms.

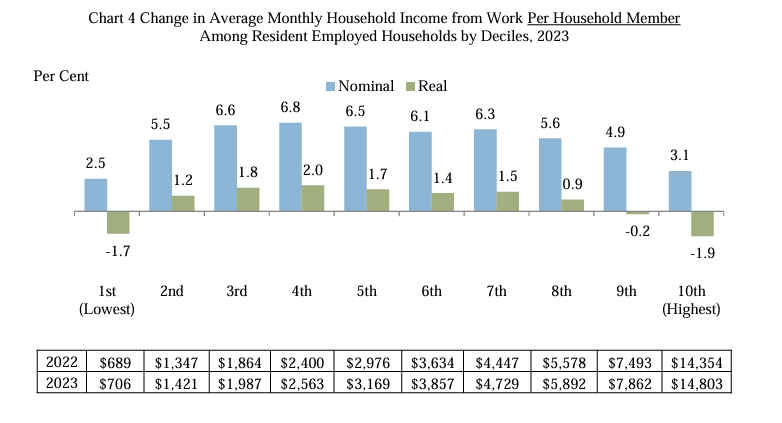

Median income of the lowest, second highest and highest decile declined

Singstat also stated that while most households saw their median income increase by 0.9 to 2.0 per cent in real terms per household member, the lowest, second highest and highest deciles respectively recorded a decline of 1.7, 0.2 and 1.9 per cent instead.

Source: Screenshot via Singstat

Source: Screenshot via Singstat

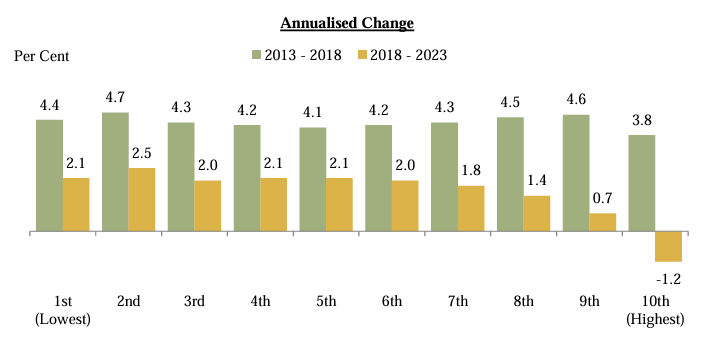

In addition, between 2018 and 2023, the income from work per household member in the first to ninth deciles experienced a growth of between 0.7 and 2.5 per cent per annum in real terms.

On the other hand, households in the top decile experienced a decline of 1.2 per cent per annum in real income over the same period.

Source: Screenshot via Singstat

Source: Screenshot via Singstat

Some households in lowest 10 per cent live in private property

Singstat also highlighted that within the lowest 10 per cent, 16 per cent of these households owned a car, 14.7 per cent employed a domestic worker, while 8 per cent lived in private property.

In addition, 36.6 per cent of these households had a household reference person aged 65 or older.

Singstat also pointed out that not all households are consistently in the same decile group from one year to the next.

Singstat explained that a household may move down from a higher decile in a particular year due to the temporary unemployment of a household member, before moving up the deciles when the member resumes employment in the subsequent year.

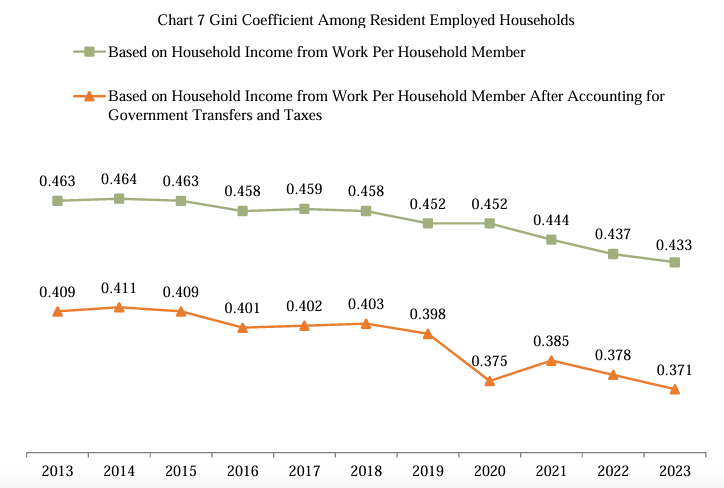

Household income inequality fell for a third consecutive year

As for household income inequality, Singstat said that the Gini coefficient, based on household income from work per household member before government transfers and taxes, fell from 0.437 in 2022 to 0.433 in 2023.

With the "redistributive effect" of government transfers and taxes accounted for, the Gini coefficient for 2023 is reduced further to 0.371.

A Gini coefficient equal to zero indicates perfect income equality, while a coefficient equal to one means total inequality.

Source: Screenshot via Singstat

Source: Screenshot via Singstat

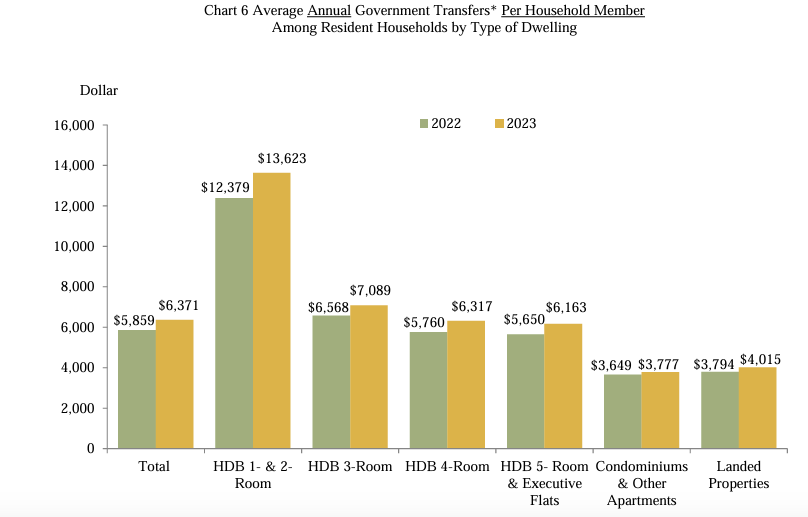

Average amount of government transfers for 2023 was S$6,371 per household member

The average amount of transfers that each member of a household received in 2023 was S$6,371.

This was higher than the average figure of S$5,859 in 2022 due to the enhanced and additional support measures rolled out in 2023 to support households during the period of high inflation and to cushion the impact of the increase in the goods and services tax (GST) rate.

Such measures included the enhanced Assurance Package (AP) Cash, the transitory AP Seniors’ Bonus and AP Medisave, the one-off AP Cash Special Payment, the Cost-of-Living (COL) Seniors’ Bonus, COL U-Save Special Payment, top-ups to children’s development and education accounts, and CDC Vouchers.

Households staying in Housing and Development Board (HDB) one- and two-room flats continued to receive the most government transfers, with each household member receiving an average of S$13,623 in 2023.

This is close to double the transfers received by resident households staying in three-room flats.

Singstat also clarified that the nature of the government transfers received by households are also dependent on their household composition.

For example, households in five-room and executive flats have more children of school-going age on average than households in four-room flats.

Hence, they received more education subsidies on average which resulted in such households having similar level of transfers as those in four-room flats.

Source: Screenshot via Singstat

Source: Screenshot via Singstat

Top image by Mothership

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.