How did Singapore government agencies end up wrongly charging taxpayers an extra S$7.5 million in Goods and Services Tax (GST) from 2019 to 2023?

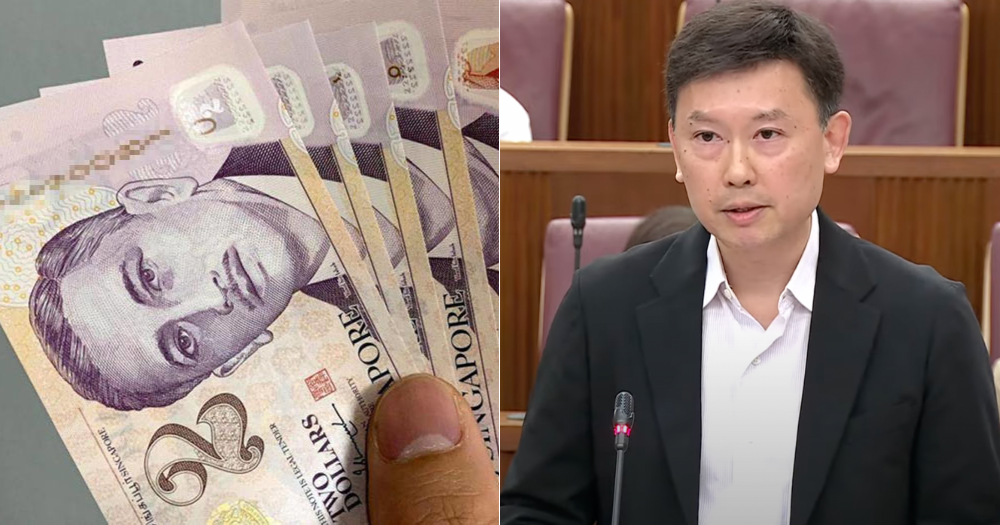

The question was addressed by Minister for Transport Chee Hong Tat in Parliament on Feb. 26.

Chee said that the agencies had wrongly deemed certain processing fees as GST-chargeable, when they were in fact regulatory fees that shouldn't incur GST.

He also elaborated on how affected taxpayers would be refunded the excess monies.

GST wrongly charged by six agencies on 'processing fees'

According to Chee, in November 2023 the Ministry of Finance (MOF) discovered inconsistencies in the application of GST on certain government fees.

MOF conducted a review and subsequently issued a statement on Feb. 14 indicating that six agencies had wrongly charged GST on 18 fees.

According to notices found on their websites, the six agencies were:

- Land Transport Authority (LTA)

- Housing and Development Board (HDB)

- Singapore Food Agency (SFA)

- Urban Redevelopment Authority (URA)

- Council for Estate Agencies

- Office of the Public Guardian, under the Ministry of Social and Family Development (MSF)

They were found to have wrongly charged GST for services such as the renewal of real estate agent licences, the application to operate a food processing company, the registration of a Lasting Power of Attorney, and rental of an HDB flat or bedroom.

Chee said that most of these 18 fees were for the processing of applications rather than licence fees, but the agencies had deemed them to be "taxable provisions of services".

He raised a hypothetical example of an agency charging GST on the application fee for a licence while not charging GST on the licence itself.

"The correct treatment should have been to not charge GST on both the application fee and licence fee," Chee said.

Following the review, the six affected agencies have ceased charging GST on the fees and will refund all affected taxpayers with interest of 5.5 per cent per annum, Chee noted.

Regulatory fees are not GST-chargeable

Chee explained that such government fees are considered regulatory in nature. These are fees are imposed for purposes of control and regulation and should not incur GST.

Non-regulatory fees, on the other hand, include fees for the provision of services, such as "the use of public sports facilities, or rental of hawker stalls and exhibition spaces", and the GST applies in such cases, Chee noted.

"Each government agency, like any GST-registered business, has to assess whether its fees should be GST chargeable whenever a fee is introduced or revised. Agencies do so based on the law," Chee said.

Meanwhile, MOF and the Inland Revenue Authority of Singapore (IRAS) provide guidance to agencies on what constitutes a regulatory fee.

Affected taxpayers will be refunded for at least past 5 years' transactions

Chee also provided some details about the refund process.

He noted that the refund will minimally cover transactions since Jan. 1, 2019 as the agencies are required by law to keep their records for five years.

"Agencies will proactively and automatically credit the refunds to individuals and affected businesses. Otherwise, agencies will contact taxpayers to provide or update such information before refunds are effected," Chee said.

Affected taxpayers who are not contacted by agencies by Jun. 30, 2024 can reach out to the agencies to seek a refund.

And in cases where the affected company has been dissolved, or the individual is deceased, agencies will make refunds to the official receiver and the executor, administrator or Public Trustee respectively.

Chee said the agencies should be able "to refund the vast majority of the affected taxpayers".

"But if there are any unrefunded amounts, then they will be considered part of the government's GST collections and broader tax revenue used for nation building purposes," he added.

Why not remove GST from all government fees?

Progress Singapore Party (PSP) Non-Constituency MP (NCMP) Leong Mun Wai suggested that all government fees could be exempted from GST.

In response to that, Chee noted that some government fees will continue to incur GST for the sake of consistency and "parity in tax treatment".

These include fees charged for the provision of services, like public sports facilities, which could well have been outsourced to private sector providers or other organisations.

"GST should therefore be applied consistently to such services, regardless of whether the entity providing the service is from the public or private sector," he clarified.

Was it a technological issue?

Chee also responded to questions from People’s Action Party (PAP) Members of Parliament (MPs) Shawn Huang Wei Zhong and Yip Hon Weng on whether the government would leverage on technology to guard against future recurrences of GST overcharging.

Chee, however, noted that it was "not down to lack of technology, but different interpretations of the law".

To address this, MOF will simplify and clarify the rules and processes to indicate which are regulatory fees where GST should not be charged, Chee said.

He said that MOF will be tabling an amendment to the Goods and Services Tax Act in order to clarify the GST treatment for such fees, and prescribe a list of regulatory fees where GST should not be charged.

"So I think this will provide clarity and take away the uncertainty for all stakeholders whether is it the agencies or public officers who are involved in administering these fees," Chee said.

'We will rectify the errors and make good': Chee

Yip also asked what steps the government would take to rebuild trust and prevent similar issues from happening.

Chee highlighted the "thorough review" done by MOF leading to identification and rectification of the inconsistent fees, and the refunds that will be made to taxpayers.

He said this shows the government takes the issue of integrity and governance very seriously.

"It doesn't mean that we don't make mistakes. But when we discover that mistakes are made, we will be upfront, we will be open and we will deal with those mistakes. We will rectify the errors and we will make good," he concluded.

Top image by Mothership & MCI / YouTube.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.