Missed the 2024 Budget announcement?

Here's a summary of what Deputy Prime Minister and Minister for Finance Lawrence Wong announced on Feb. 16 (Friday).

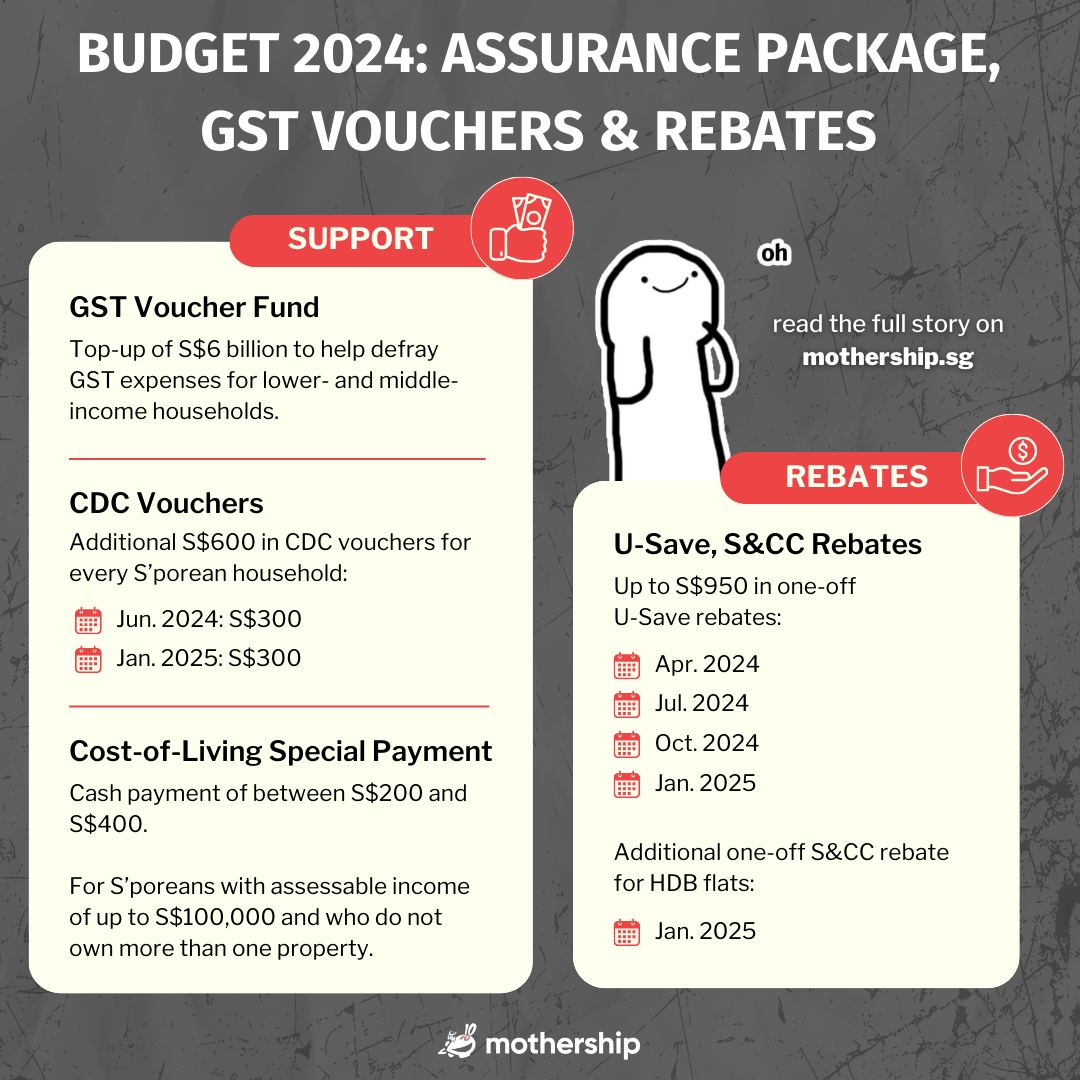

More CDC vouchers and one-off special payments

Eligible adult citizens aged 21 and above will get cost-of-living payments from the Singapore government of between S$200 and S$400 in cash.

The first S$300 will be disbursed by the end of June 2024, and the remaining S$300 will be disbursed in January 2025.

All Singaporean households will also get an additional S$600 in Community Development Council (CDC) vouchers.

Up to S$950 of one-time U-Save rebates for eligible Housing and Development Board (HDB) households will also be disbursed.

Here's a handy infographic:

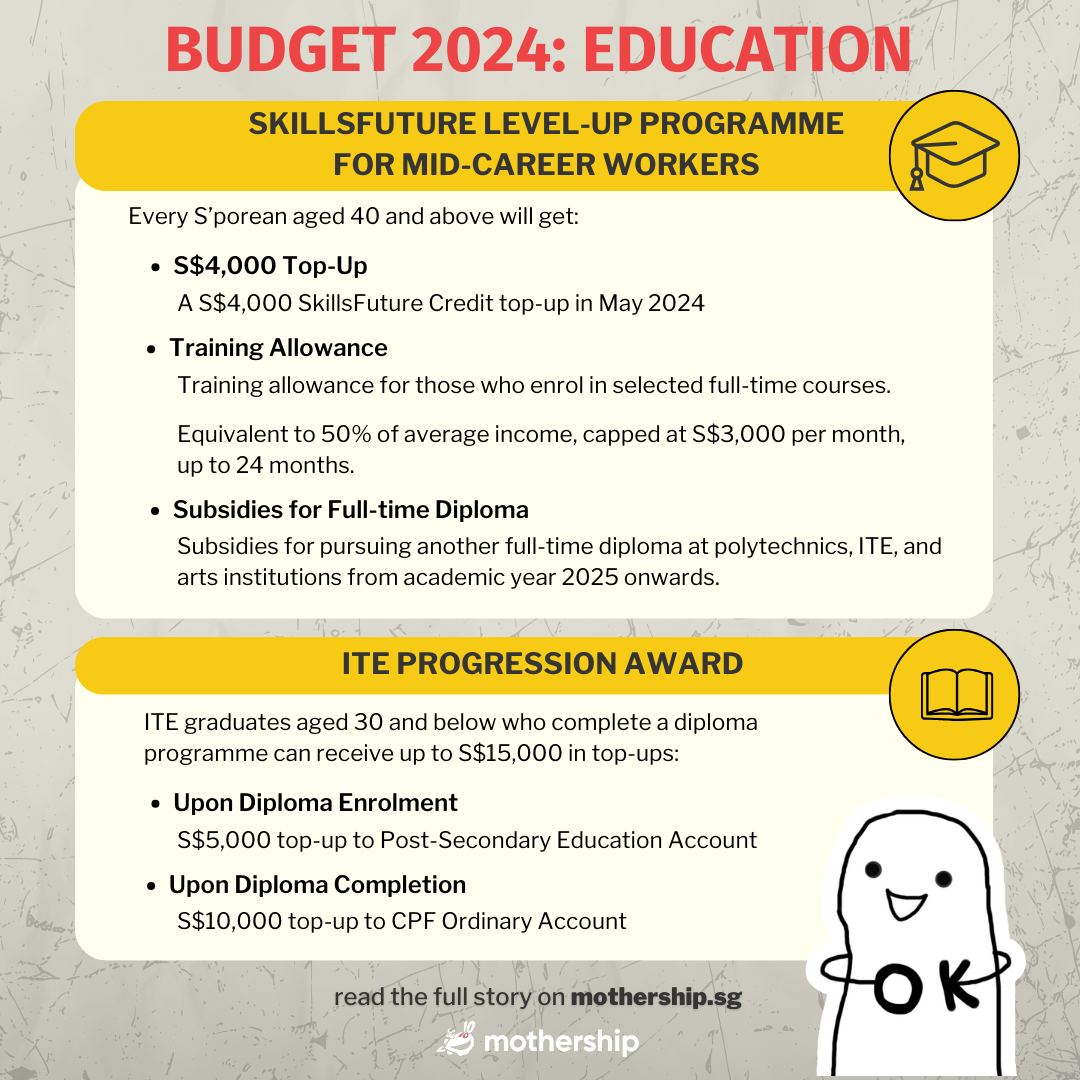

More support for up-skilling

Singaporeans aged 40 and above will receive a top-up in SkillsFuture credits of S$4,000 in May 2024.

All Singaporeans aged 40 and above will also get subsidies to pursue another full-time diploma at polytechnics, ITE, or arts institutions starting from the academic year of 2025.

The government will also provide a monthly training allowance for those who enrol in full-time courses, capped at S$3,000 per month.

A new ITE Progression Award will also be launched to provide more support for graduates aged 30 and below.

Those enrolling in a diploma programme will get a S$5,000 top-up to their post-secondary education accounts.

These students will also get a S$10,000 top-up to their CPF Ordinary Accounts when they attain their diplomas.

Here's another infographic:

Recognition for NS contributions

All past and present national servicemen will get S$200 in LifeSG credits.

This includes reservists, current full-time national servicemen (NSFs), and NSFs who will be enlisting in 2024.

"I hope this will go some way in expressing our appreciation and gratitude to our national servicemen as well as their families," Wong said.

More financial support for retrenched workers

The government will introduce a temporary financial support scheme for those who are involuntarily unemployed while they undergo training or look for jobs that are a better fit.

The scheme will be designed "carefully" to avoid the pitfalls faced by other countries who introduced unemployment benefits.

More details will be announced later this year.

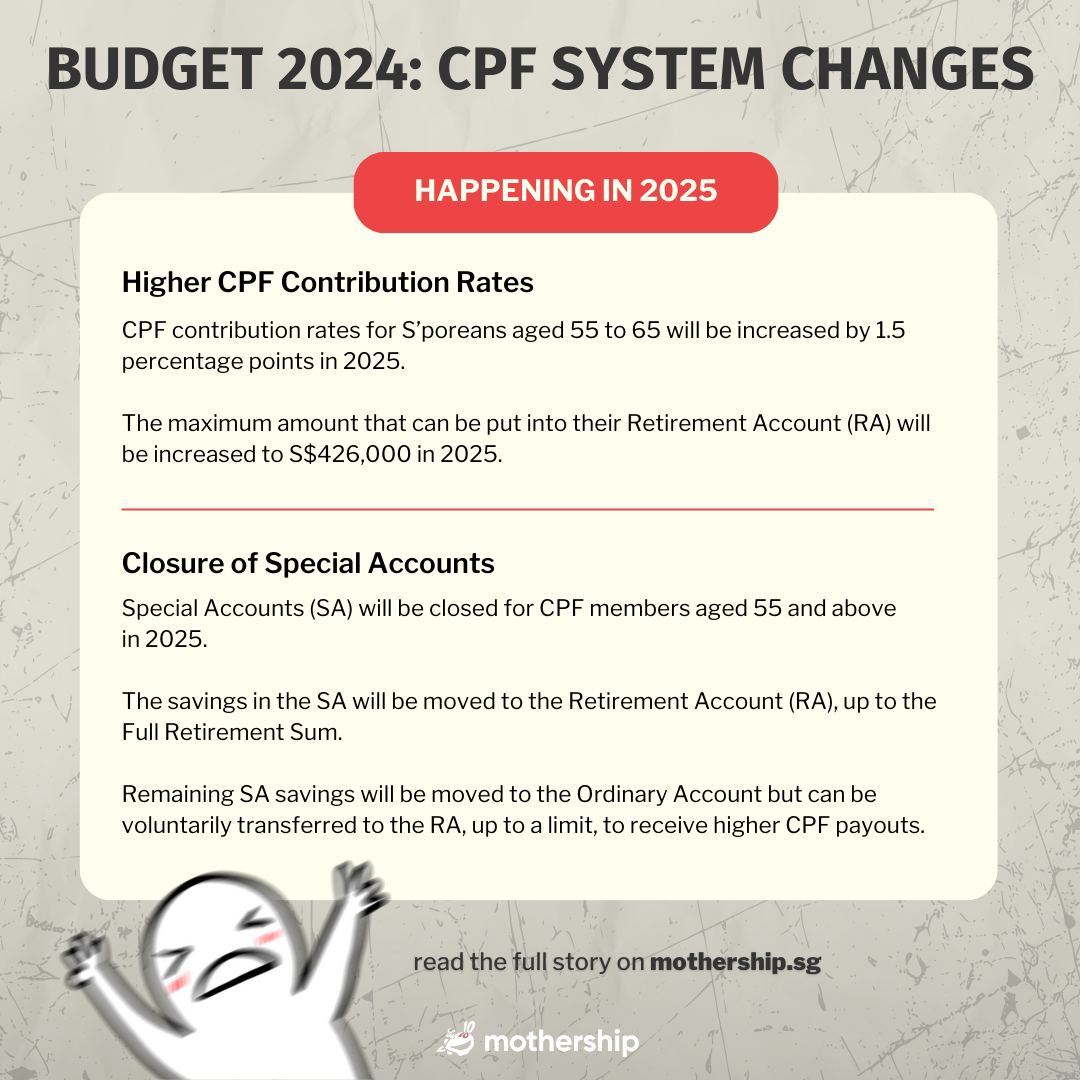

Changes to CPF to help save more for retirement

The Central Provident Fund (CPF) Enhanced Retirement Sum ceiling will be raised from S$308,700 to S$426,000 in 2025.

This will allow members to put more of their accumulated CPF savings into their CPF Retirement Account (RA) to receive higher monthly payouts.

The CPF contribution rates for those aged 55 to 65 will be raised by a further 1.5 percentage points in 2025.

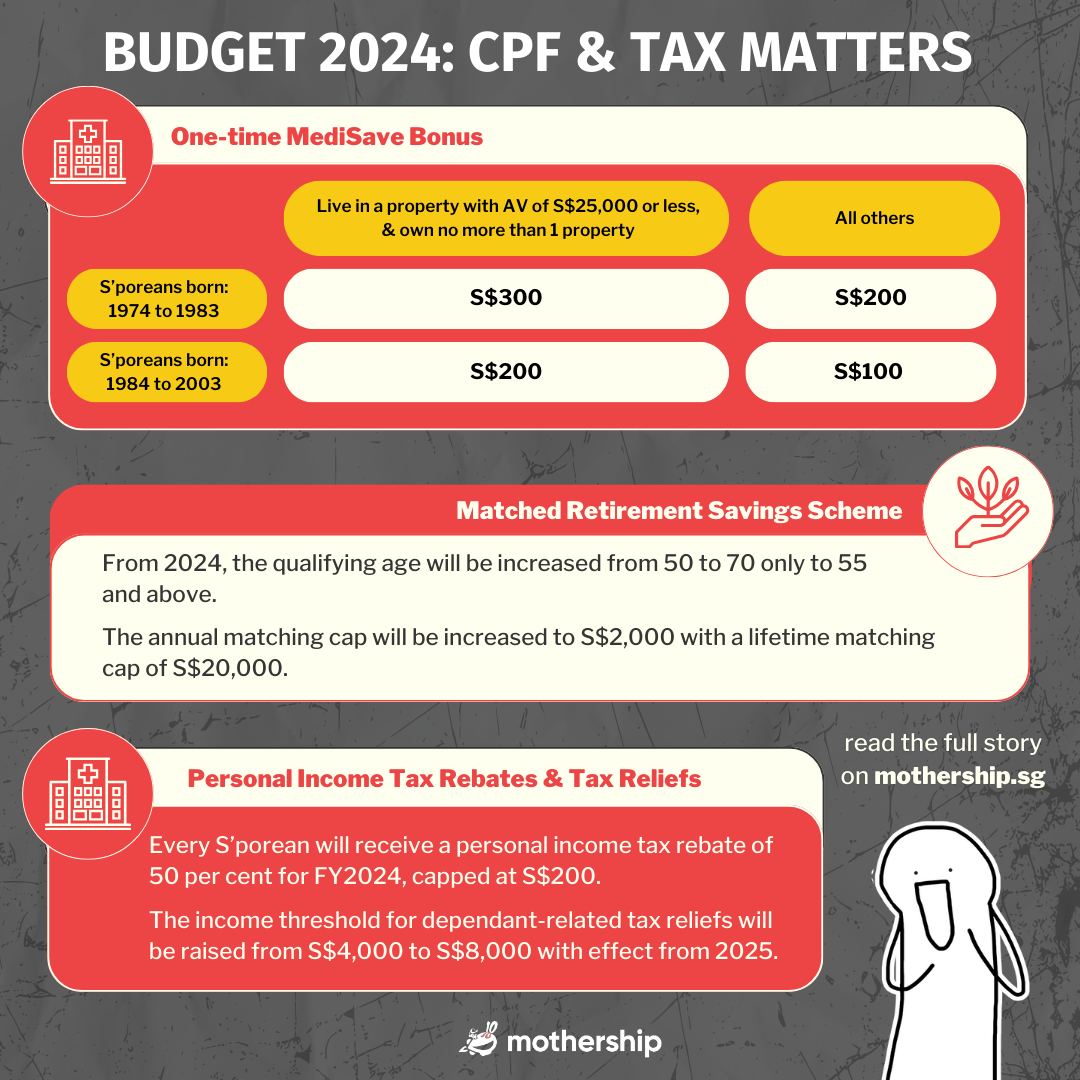

Adjustments will also be made to the matched retirement savings scheme, where the government matches every dollar of cash top-ups members make to their RA.

Its annual matching cap will be increased from S$600 to S$2000, with a lifetime matching cap of S$20,000.

Infographic:

Personal income tax rebate, Medisave top-up

There will be a personal income tax rebate of 50 per cent for the Assessment Year 2024, capped at S$200.

The income threshold for dependant-related tax reliefs will also be raised from S$4,000 to S$8,000 with effect from Assessment Year 2025.

This will help taxpayers claiming reliefs for caring for family members.

Adult Singaporeans aged 21 to 50 will also get a one-time Medisave bonus of up to S$300:

Property tax changes

Singaporean seniors will get more support when right-sizing their property.

They will be extended the additional buyer’s stamp duty (ABSD) concession currently enjoyed by single Singapore citizens aged 55 and above.

These seniors will be able to claim a ABSD refund paid on their replacement private property if they sell their first property within six months of buying a lower-value replacement private property.

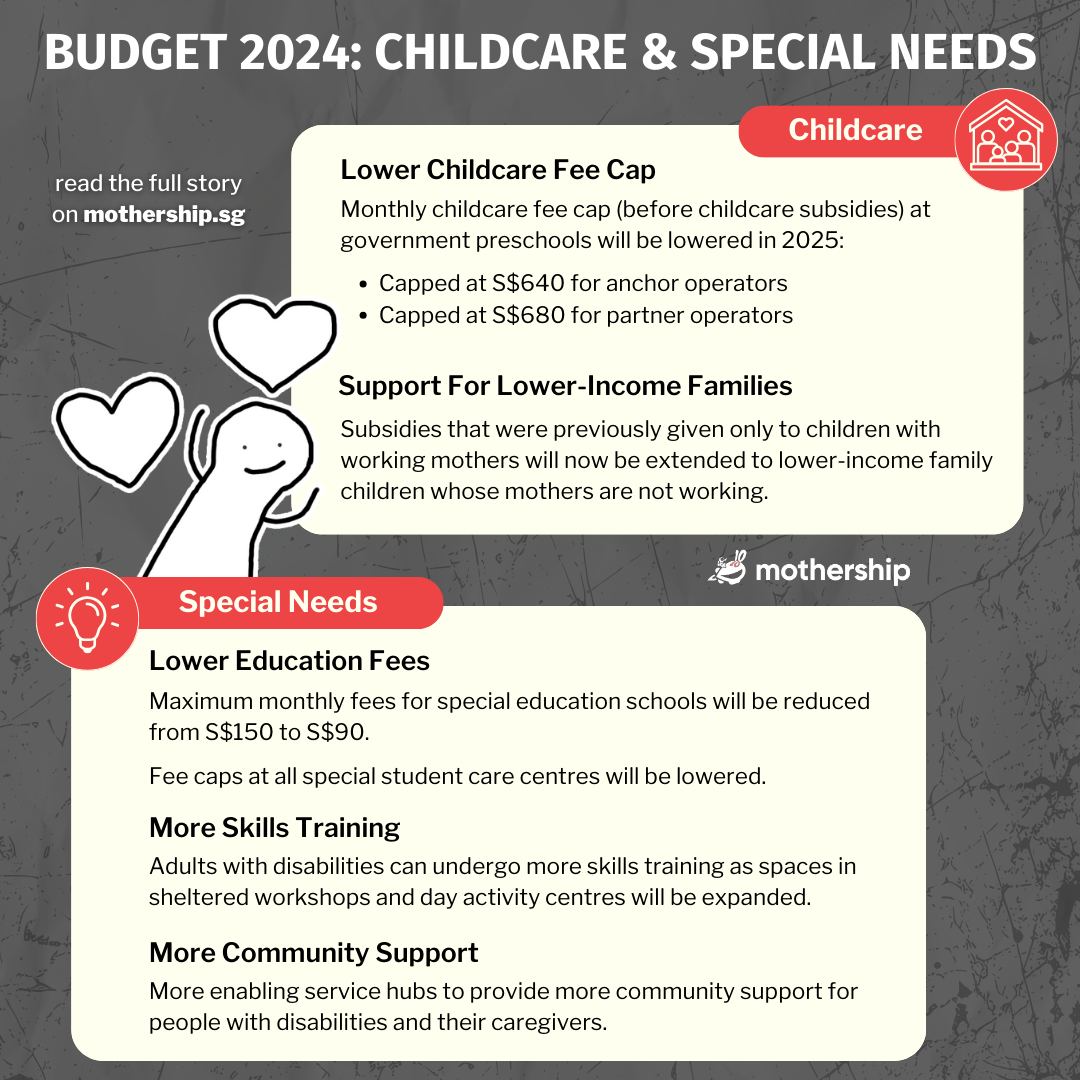

More support for childcare, special needs

The monthly childcare fee cap at government preschools will be lowered in 2025.

This will be capped at S$640 for anchor operators and S$680 for partner operators (before subsidies)

Childcare subsidies will be extended to lower-income families with children, even if their mothers are not working.

The maximum monthly fees for special educations schools will also be reduced from S$150 to S$90.

More skills training and community support will also be provided for adults with disabilities:

Support for businesses

All companies will get a 50 per cent corporate income tax rebate, capped at S$40,000, under a new Enterprise Support Package.

Companies that hire at least one local employee in 2023 will also receive a minimum of S$2,000 in cash payouts.

More support for transition to cleaner energy

Wong addressed the need for Singapore to transition to cleaner energy "in the near to medium term", going beyond its reliance on natural gas.

The government is currently looking at alternatives, such as importing low-carbon electricity, hydrogen, and geothermal energy.

To fund the transition, the government will set up a Future Energy Fund, with an initial injection of S$5 billion.

Importance of staying united

Wong ended his speech by emphasising the importance of staying united as a nation in the face of an increasingly unstable and unpredictable world.

"We can make it happen in Singapore. We are able to do so because our fiscal position is healthy and sustainable. Our government has the trust of Singaporeans. Our people are united and our social compact is strong."

Related articles:

Top image from MCI/YouTube & Canva.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.