Singapore's core inflation, which excludes the costs of accommodation and private transport, is expected to rise in the current quarter of 2024, due in part to the one-off impact from the 1 per cent hike in the goods and services tax in January 2024, the Monetary Authority of Singapore (MAS) announced in a statement on Jan. 29.

The increase in the carbon tax, from S$5 per tonne to S$25 per tonne for 2024 and 2025, was also cited by MAS as a factor.

In addition, water prices will rise from the second quarter of 2024 amid increases in production costs.

Inflation for certain services, including public transport and healthcare, could also stay elevated as "less frequently-adjusted" prices rise to catch up with higher cost levels.

Inflation for 2024 expected to be lower than 2023

However, setting aside the transitory impact of the GST increase, core inflation is forecast to decline gradually over 2024, MAS said, reiterating its previous policy statement in October 2023.

For 2024 as a whole, core inflation is expected to slow to an average of 2.5 to 3.5 per cent.

As for overall inflation in 2024, it is forecast to be lower at 2.5 to 3.5 per cent, following a decline in Certificate of Entitlement (COE) premiums since November 2023 and an anticipated increase in COE supply this year.

Excluding the effects of the increase in the GST rate, both overall and core inflation are forecast at 1.5 to 2.5 per cent.

In comparison, core inflation for 2023 as a whole came in at 4.2 per cent, slightly higher than the 4.1 per cent in 2022.

Excluding the impact of the GST increase in 2023, core inflation is estimated to have fallen by about 0.6 per cent, compared to 2022.

As for overall inflation in 2023, this was about 4.8 per cent, down from 6.1 per cent in 2022.

MAS noted that accommodation inflation eased as the supply of completed housing units increased.

This helped to offset rising private transport inflation amid higher petrol prices.

Why will inflation moderate in 2024?

According to MAS, lower imported costs and a slower pace of domestic cost increases should underpin the moderating trend in inflation.

Global energy and food commodity prices have fallen and are expected to remain largely stable, while the imported costs of most intermediate and final goods should be "tempered" by favourable global supply conditions.

Within Singapore, wage growth is expected to slow from 2023 as the labour market slowly cools.

Increases in unit labour cost should there moderate "significantly" from last year and help alleviate cost pressures for businesses.

MAS cautioned however, that risks to the inflation outlook still remain.

"Shocks to global food and energy prices or domestic labour costs could bring about additional inflationary pressures. However, an unexpected weakening in the global economy could induce a faster easing of cost and price pressures," it said.

MAS will maintain current rate of Singapore dollar appreciation

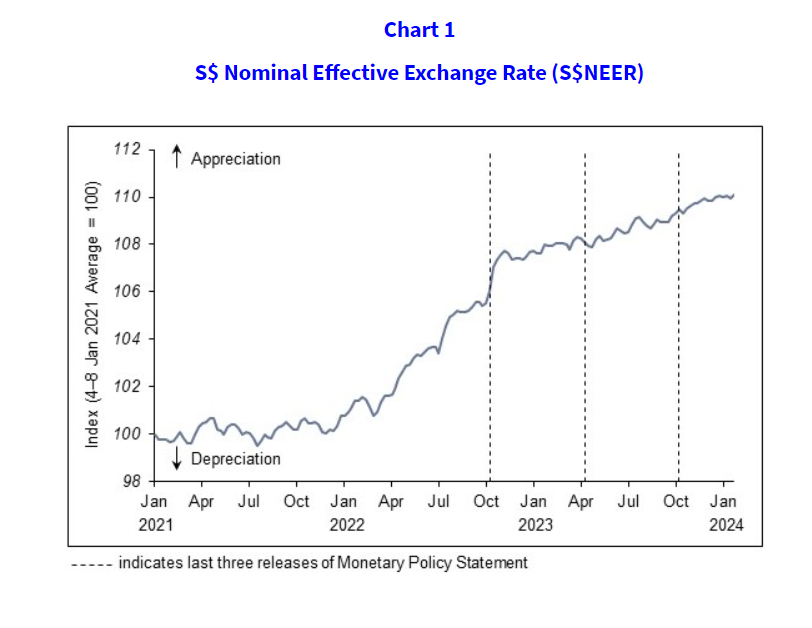

In light of such a forecast, MAS said its current monetary policy settings remain "appropriate" and that it will maintain the current rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER) policy band.

There were no changes to the width and the level at which the S$NEER is centred.

This sustained appreciation of the policy band will continue to dampen imported inflation and curb domestic cost pressures, thus ensuring medium-term price stability, MAS added.

Image via MAS

Image via MAS

The current rate has been maintained by MAS since October 2022 after it tightened its monetary policy five times within 12 months.

In August 2023, Trade and Industry Minister of State Alvin Tan said such a policy has successfully curbed imported inflationary pressures, with Singapore’s import price index falling by some 14 per cent between May 2022 and June 2023.

This decline in import prices has, in turn, contributed to lower domestic inflation, Tan noted.

Top left photo via MAS, right photo by Nigel Chua

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.