Victims of reported cases of scams lost S$334.5 million in the first half of 2023, according to the Mid-Year Scams and Cybercrime Statistics 2023, released by the police on Sep. 13.

Of these, job scams were the most common, accounting for more than 25 per cent of reported scams during this period.

The other top five scams included e-commerce scams, fake friend call scams, phishing scams, and investment scams.

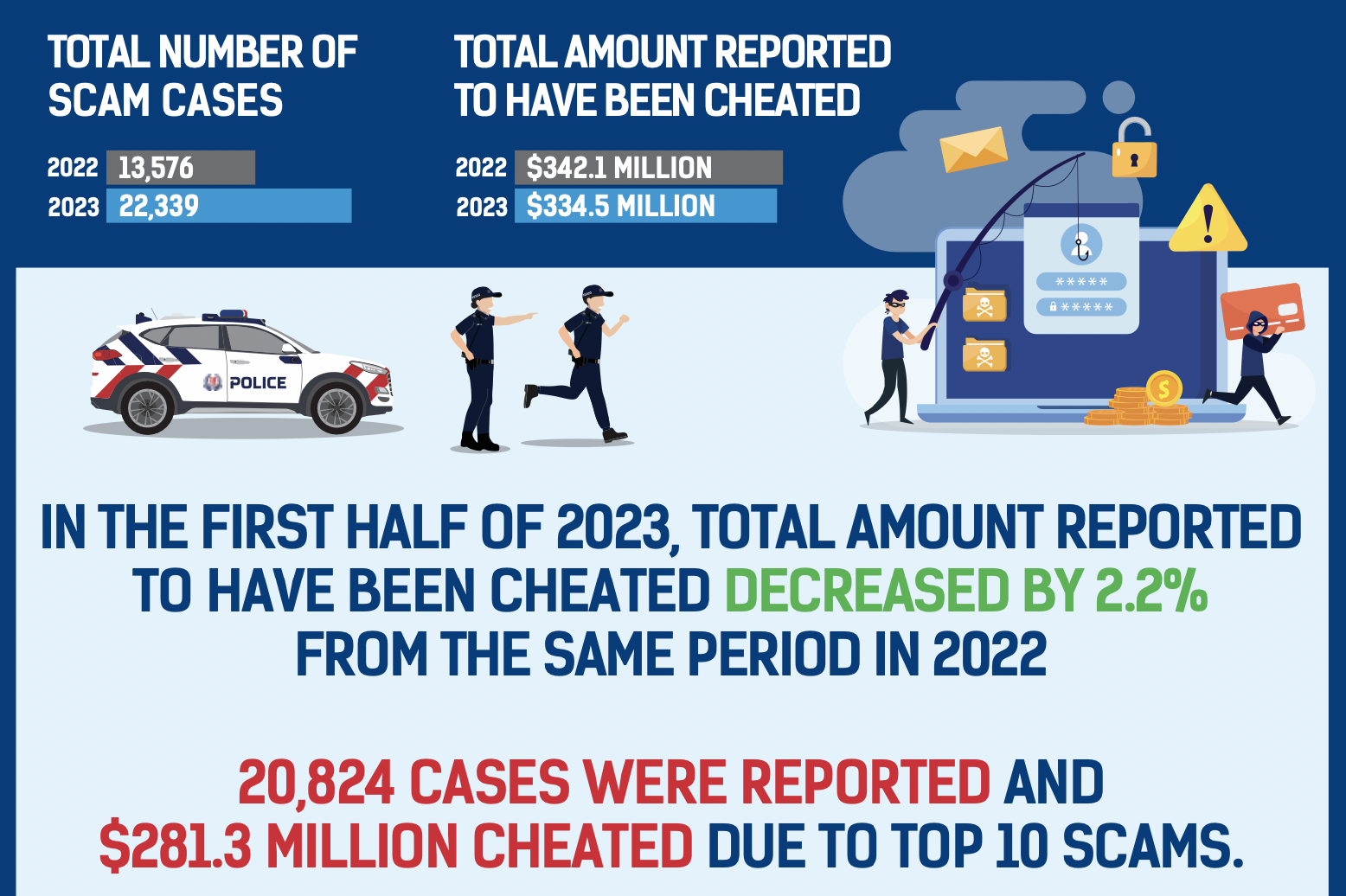

More scam cases, slight decrease in scam losses

There were over 22,339 scam cases reported in the first half of 2023.

This is an increase of 64.5 per cent from the same period last year.

Nevertheless, the total amount of money lost to scams decreased by 2.2 per cent from the same period in 2022.

Infographic from Singapore Police Force.

Infographic from Singapore Police Force.

What is a job scam?

Job scams accounted for the highest number of reported scam cases in the first half of 2023, leading to losses of S$79.4 million in total.

In this scam, victims are contacted through popular messaging platforms like WhatsApp and Telegram.

They are offered online jobs that can be performed from home.

These include simple tasks like making advance purchases, liking social media posts, rating apps or products, and completing surveys.

To earn commissions from these tasks, they are asked to create accounts on fraudulent websites.

The scammers will then request them to transfer funds to provided bank accounts.

Victims will initially receive a small commission.

They will then end up transferring more and more funds, supposedly to get higher earnings.

When the victims fail to receive their commissions or can't withdraw money from their accounts, they tend to realise that they had been scammed.

More than half the scam victims aged 20-39

Young adults aged 20 to 39, accounted for 50.8 per cent — more than half — of the total number of scam victims.

This is contrary to popular belief that seniors are more vulnerable to scams.

The trend, which has persisted since 2022, is likely because young adults conduct a lot of their daily activities online.

As such, they have higher exposure to potential scams.

Of this age group, job scams accounted for 33.9 per cent, or about one-third of young adult scam victims.

Young adults also seemed to be vulnerable to e-commerce scams (23.9 per cent) and phishing scams (12.6 per cent).

Other scams of concern

Another popular type of scam, e-commerce scams, resulted in victims getting cheated of S$7.3 million in total.

It was the second most-reported scam in the first half of 2023.

It involves victims making online payments for goods or services that they noticed on platforms like Facebook, Carousell and Telegram, but ultimately not getting what they paid for.

In other cases, scammers might pretend to be interested buyers, but not pay the victims after receiving the goods or services.

The most typical items involved in such scams included rental of residential units and electronic goods.

A breakdown of the top 10 scams is shown in the graphic below:

Infographic from Singapore Police Force.

Infographic from Singapore Police Force.

Another trend was the rise of malware-enabled scams, where victims get cheated after downloading malicious software onto their phones.

This typically happens when victims respond to advertisements for services on platforms like Facebook and Instagram.

Scammers might send them a URL link under the pretext of payment.

Accessing the link typically downloads a file on the victim's device to let scammers access banking or card details.

There were more than 750 of such cases in the first half of 2023, resulting in at least S$10 million lost.

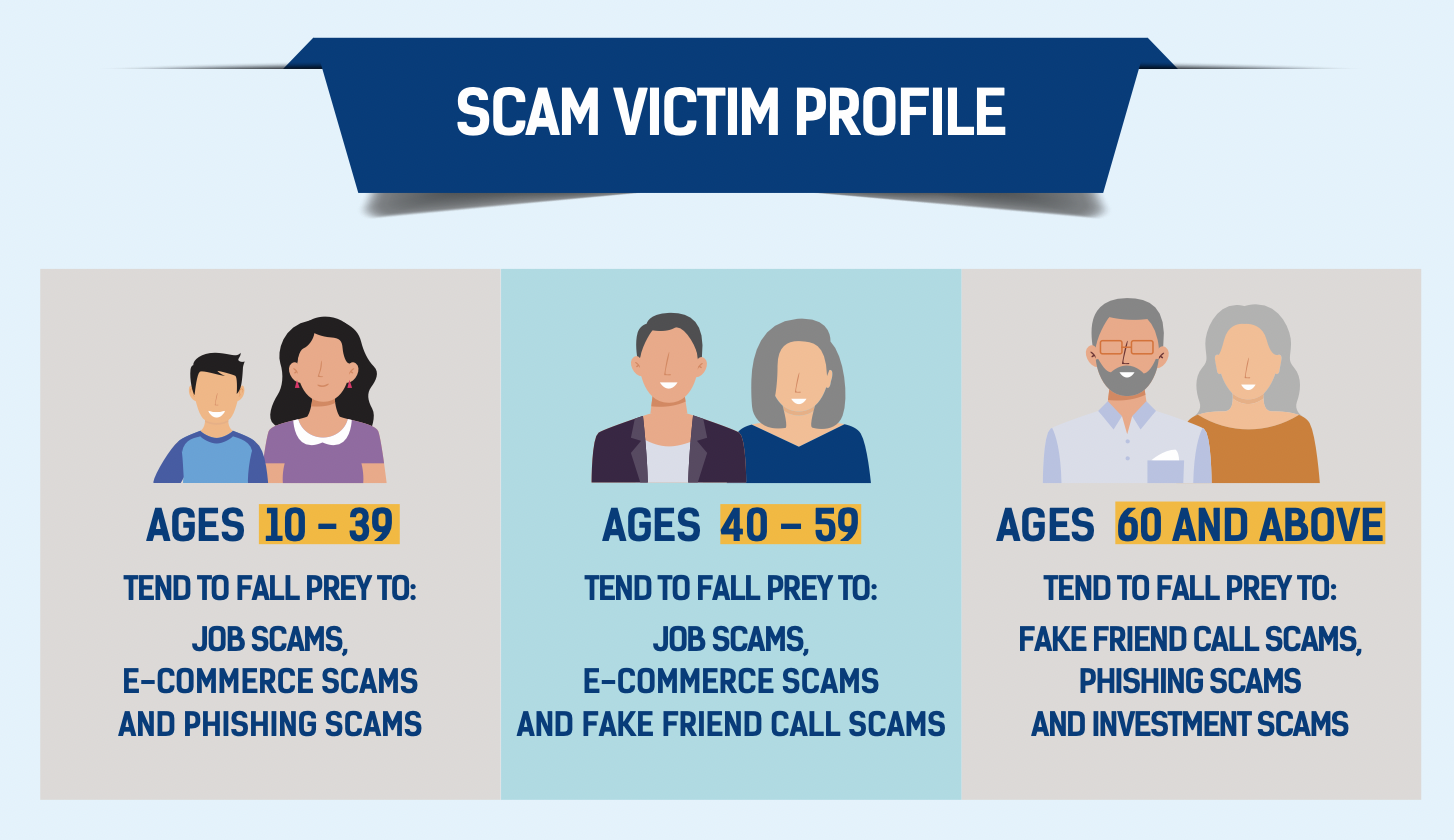

Top scams vary based on age profile

Adults aged 40-59 made up the second largest group, or 32.1 per cent of scam victims.

Meanwhile, elderly victims aged 60 and above accounted for about 11.7 per cent of victims.

Both groups tended to fall prey to fake friend call scams, typically carried out via phone calls or WhatsApp.

In this scam, the scammer would pretend to be the victim's friend or acquaintance in order to request money from them.

The victims would then end up transferring money to bank accounts belonging to unknown individuals.

A breakdown of common scams by age profile is illustrated in the graphic below:

Infographic from Singapore Police Force.

Infographic from Singapore Police Force.

Public vigilance is essential to fight scams: Police

SPF continued to emphasise that public vigilance is essential in safeguarding against scams, and that the public can combat scams by following the ACT framework:

- Add security features such as ScamShield and enable 2-Factor Authentication for personal accounts

- Check for potential scam signs by asking questions, fact checking requests for personal information and money transfers, and verifying the legitimacy of online listings and reviews

- Tell the authorities and platform owners about your scam encounters

Top image from Unsplash.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.