All of the S$2.4 billion that the government raised from the first tranche of Singapore's first sovereign green bond has been earmarked for the development of the upcoming Jurong Region Line and Cross Island Line.

A total of 30 per cent of the S$2.4 billion, or S$700 million, has already been allocated for capital expenditure on both MRT lines.

The remaining S$1.7 billion is expected to be fully allocated by the end of the 2024 financial year.

First edition of Singapore Green Bond Report

The Ministry of Finance announced this in its first edition of the Singapore Green Bond Report which was published on Sep. 21.

Singapore sovereign green bonds are used to finance the development of major, long-term infrastructure that are nationally significant.

Each project that is funded by these green bonds must also fulfil eligibility criteria specified in the Singapore Green Bond Framework.

The framework lists eight categories of green projects that may be financed by Singapore sovereign green bonds; one of them is "Clean Transportation", which both the Cross Island Line and Jurong Region Line qualify under.

Both lines, which run on electricity, have zero direct or tailpipe emission.

In addition, the indirect emissions from powering the electric rails (i.e emissions from generating electricity) are expected to decrease over time as Singapore progressively decarbonises its national grid.

Beyond that, the development of these MRT lines also serve Singapore's wider green objectives.

The expansion of Singapore's electric rail network works together with other initiatives, such as vehicle electrification and greening infrastructure, to encourage greener commutes.

This, in turn, reduces carbon footprint in the land transport sector, which currently accounts for 15 per cent of carbon emissions in Singapore.

Singapore aims to reduce land transport emissions to net zero by 2050.

The Singapore Green Bond Report also contains an Impact Report which quantified the impact arising from the investment of the green bond proceeds.

MOF said that based on the share of green bond financing that has been allocated as a proportion of the total project costs, allocating S$700 million so far is expected to result in avoiding 1,200 to 1,800 tonnes of CO2-equivalent emissions anually.

You can read the full Singapore Green Bond Report for Financial Year 2022 here.

What are Singapore sovereign green bonds?

These are bonds issued by the Singapore government in return for borrowing money to finance major, long-term green infrastructure in Singapore.

They are separate from green bonds issued by Singapore statutory boards.

As a whole, Singapore has committed to issuing up to S$35 billion of green bonds by 2030. This includes sovereign green bonds and green bonds issued by statutory boards.

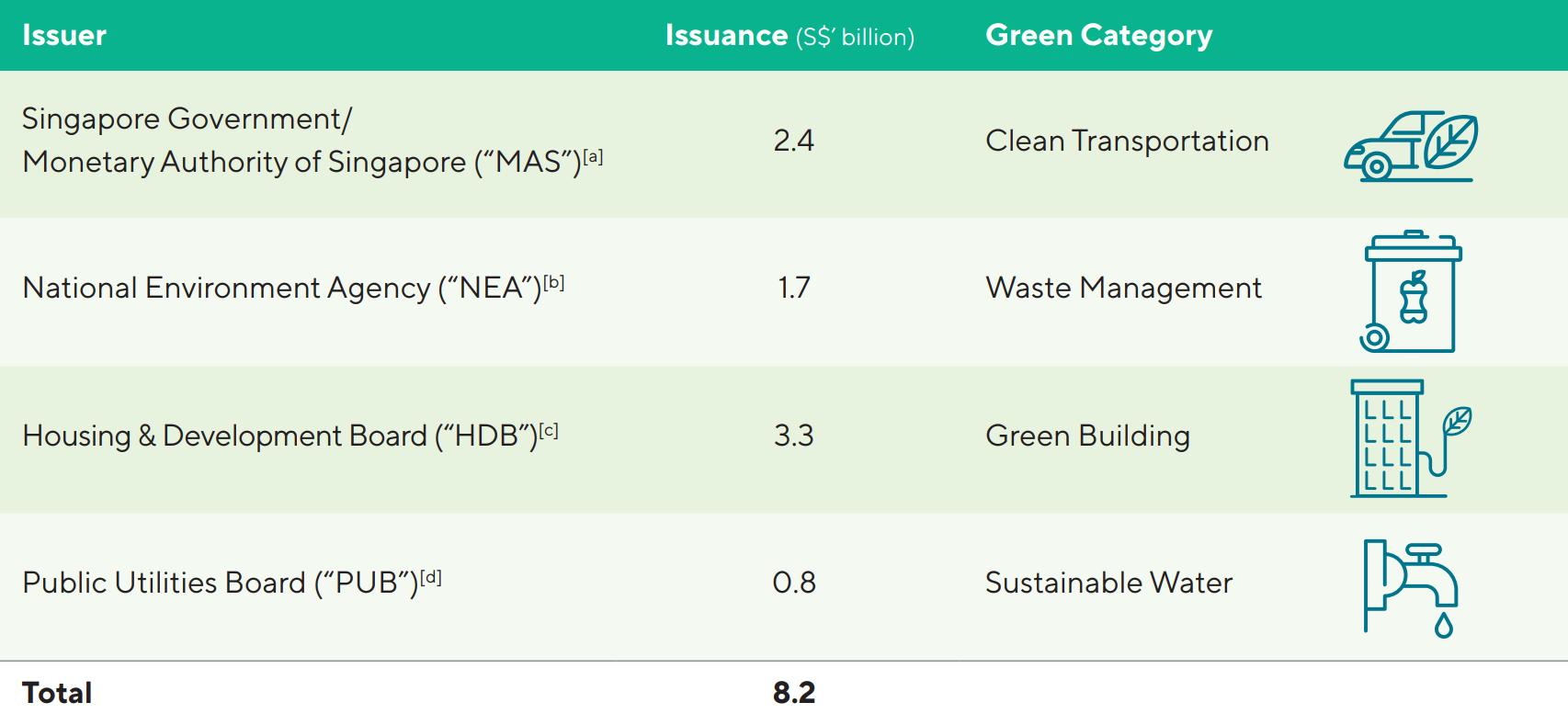

As of March 31, 2022, the public sector has issued a total of S$8.2 billion of green bonds across four green categories:

The government only recently started borrowing again to finance large infrastructural development.

When Singapore was a younger nation with few resources, the government had to borrow to finance projects like Changi Airport Terminals 1 and 2, and the North-South and East-West lines.

By the 1990s, Singapore's rapidly growing economy led to high revenues and surpluses, which enabled the government to pay for Singapore's infrastructure expenditure.

Faced with a less productive economy and mounting expenditure projections, the government turned once more to borrowing, but only for significant, long-term projects.

Choosing to borrow for these long-term infrastructure spreads the costs across generations that will benefit from the projects.

Then-Finance Minister Heng Swee Keat said in 2021 that the alternatives would be raising taxes or diverting resources from other spending needs like social spending, but these would be "less efficient and more costly to the nation".

Top image: Aedas

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.