In his National Day Rally speech on Sunday (Aug. 20), Prime Minister Lee Hsien Loong introduced a Majulah Package for "Young Seniors" – those in their 50s and early 60s – to meet their retirement needs better.

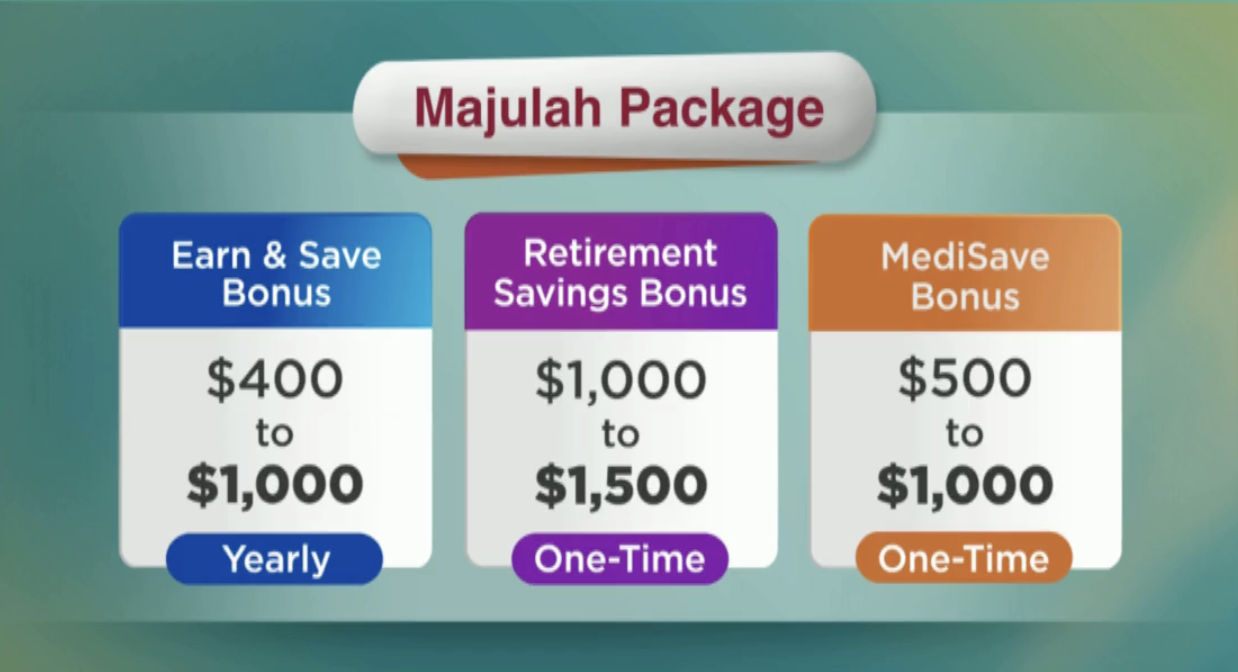

The package, which will cost the government about S$7 billion, consists of three components and will be available for 1.4 million Singaporeans aged 50 and above this year or those born in 1973 or earlier.

PM Lee explained that the Ministry of Finance (MOF) will create a new fund to meet the full lifetime costs of the package, using resources from this term of government to honour this commitment without burdening future generations.

The package aims to benefit those with lower incomes and less wealth, and support is tiered depending on income and CPF savings.

Who are the "Young Seniors"

PM Lee said that the government call the people in their 50s and early 60s "Young Seniors" as they are younger than the Pioneer and Merdeka generations yet will soon retire or even recently retire.

He said Young Seniors are in a unique position. Compared to their older generations, they generally "done better in life", but compared to those younger, they generally "earned less" and had less time to benefit from the CPF system's improvements.

PM Lee pointed out that Young Seniors are also "particularly sandwiched" between the responsibility of caring for both the young and old in their families.

While their kids may be young adults, they might not yet be fully independent, and many Young Seniors still have elderly parents.

"Beyond the daily cost of living pressures, you know that retirement is creeping up on you. You wonder: Will I have enough to get by? Can I cope?

But don’t worry – the Government will help you.

You will not be left behind."

Three components:

Image via PMO

Image via PMO

1. "Earn and Save" Bonus

This bonus aims to help Young Seniors build up CPF savings while they are still in the workforce and encourage those working to keep going for as long as possible.

Lower and middle-income workers will get a CPF bonus of up to S$1,000 annually.

The government will credit the bonus into one's CPF account on top of the usual employer and employee contributions.

The bonus will be received yearly as long as one works full-time or part-time.

For example, for a lower-income 55-year-old who plans to retire at 65, his Earn and Save bonus adds up to $12,000 in extra CPF savings (including interest) over 10 years.

2. Retirement Savings Bonus

The government will give Young Seniors a one-time S$1,500 bonus whose CPF balances have not reached the CPF Basic Retirement Sum.

Those who are not working, including homemakers who have given up their careers for their families, will also receive this bonus.

3. MediSave

The package will include a one-time MediSave bonus of up to S$1,000.

PM Lee explained that even though most Young Seniors have enough MediSave balances, most still worry about healthcare costs cause they will soon be "Not-So-Young Seniors".

He said the Medisave Bonus is a "modest" one to help give the Young Seniors "some extra buffer", to help them pay their medical expenses and insurance premiums.

Will apply to Pioneer and Merdeka Generations

PM Lee highlighted that while the Majulah Package will help Young Seniors, the government also wants to encourage "older seniors" to continue working for "as long as you can".

Hence, the Majulah Package also covers the Pioneer and Merdeka Generations.

Pioneer and Merdeka Generations who are still working and meet the income criteria will receive the Earn and Save Bonus.

Those not working can still gain from the one-time Retirement Savings Bonus and MediSave Bonus.

This will be in addition to the existing Pioneer and Merdeka Generation benefits they receive.

Moving forward

The government will also be enhancing existing schemes, like Silver Support Workfare Income Supplement and Matched Retirement Savings Scheme.

The details of the enhancements will be announced next year.

The improvements aim to help seniors meet basic retirement needs, especially for lower and middle-income Singaporeans.

Top photo via Ministry of Communications and Information

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.