Local bank DBS/POSB has launched a slew of measures to ease cost-of-living pressures experienced by low income families.

In a media release, the bank said:

"Amid an uneven economic recovery and high inflation, DBS/POSB is committing S$40 million this year to intensify efforts to help Singaporeans and residents ease cost-of-living pressures."

The bank said that these measures will defray everyday expenses, reduce mortgage payments, and bolster savings.

Cost-of-living measures

This month, there are three new measures being rolled out.

1. Monthly transport rebate of up to S$20

This is for the first 100,000 people who sign up for the scheme and use their DBS/POSB debit cards for public transport, groceries and shopping.

Those with a monthly income of less than S$2,500 only need to spend S$80 every month to offset the cost of their public transport rides.

DBS/POSB debit cardholders will need to sign up for the transport rebate scheme on DBS PayLah! to qualify for this rebate.

2. Enhanced POSB Housing & Development Board (HDB) home loan package

There is now an all-in interest rate of 2.6 per cent per annum, for borrowers with a monthly income of S$2,500 and below.

This package, which is similar to the current HDB concessionary home loan, is available to new homeowners and those who want to refinance their HDB mortgages.

In partnership with Chubb Insurance, successful applicants will receive a one-year complimentary fire mortgage insurance.

3. Enhanced DBS Multiplier high-yield savings programme

This programme makes it easier for low-income and gig workers to triple the interest rate to 1.8 per cent p.a. on higher balances.

Other ongoing measures

DBS also has other measures that were launched earlier this year.

In June, it started a S$2 weekly allowance subsidy to reduce expenses among students who use POSB Smart Buddy for their transactions.

The first 15,000 students who cumulatively spend S$2 within the week via their POSB Smart Buddy watch or card will be reimbursed. This will run till Nov. 30.

Another measure that was rolled out in February 2023 subsidises five million hawker meals until January 2024.

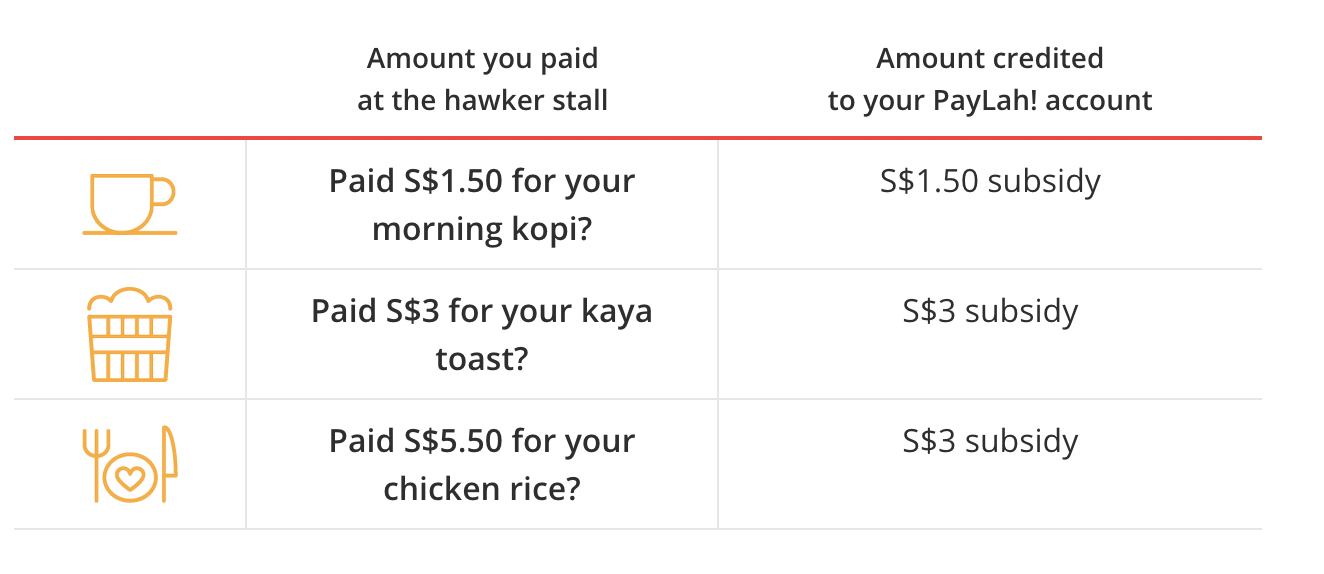

It provides up to S$3 cashback to the first 100,000 diners who use DBS PayLah! to scan and pay for their meals at 11,600 SG-QR-enabled hawker stalls every Friday.

An example of how the cashback works. Image via DBS.

An example of how the cashback works. Image via DBS.

A commitment to do good

These measures were announced at an event at West Coast Food Centre today (Aug. 12).

It was graced by Deputy Prime Minister Lawrence Wong and West Coast GRC MP Desmond Lee.

DPM Wong praised the bank's efforts in his speech.

"... it shows their commitment as a company, not just to do well as a company, but to do good and to be a good corporate citizen contributing to Singapore's success and really making an extra effort to uplift all our vulnerable and disadvantaged families in our community."

Top images via DBS/FB and Julia Yee.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.