As of June 2022, 1,400 Singaporeans and Permanent Residents (PRs) are employed by single family offices that have applied for and been awarded tax incentives, Senior Minister Tharman Shanmugaratnam said in a written reply in Parliament on Jul. 6.

About 900 of these jobs were created in the last three years, and are generally well-paying jobs, Tharman added.

Two-thirds of Singaporeans employed by single family offices under the Sections 13O and 13U tax incentive schemes earned more than S$5,000 per month, the minister, who is also the outgoing chairman of the Monetary Authority of Singapore (MAS), highlighted.

In addition, more than 400 earned between S$2,000 and S$5,000 per month, and fewer than 50 earned less than S$2,000 per month.

Family offices contribute directly to job creation

Tharman was responding to questions posed by PAP Members of Parliament Gan Thiam Poh and Mariam Jaafar.

Gan asked for data pertaining to the number of jobs created for Singaporeans and PRs arising from the establishment of family offices and the range of the salaries being earned.

As for Mariam, she had asked if a study has been done to quantify the contributions of the family offices set up in the past three years to the Singapore economy, and how such contributions compare to those of other citizens and foreigners under employment passes.

In response, Tharman pointed out that single family offices contribute in two key ways:

- Creating jobs directly when they hire individuals, such as investment professionals as their employees.

- Generating revenue and helping to create jobs for external service providers, such as private banks, and legal, custody, fund administration and tax firms.

As for the contribution of these offices in the form of revenue generation in other businesses and being a source of capital, MAS currently does not have the data, but intends to conduct surveys to obtain a better understanding of these contributions, he said.

Tharman also cited an announcement by MAS on Jul. 5 regarding changes to tax incentives for single family offices.

Such changes, Tharman added, are intended to encourage single family offices to channel more of the wealth they manage towards local enterprises, blended finance structures aimed at supporting sustainable development, climate-related investments, and charitable contributions, for the benefit of Singapore, Singaporeans and the region.

Tax incentive schemes do not accord PR or citizenship status to foreign owners setting up single family offices

Tharman also clarified that the Sections 13O and 13U tax incentive schemes do not accord PR or citizenship status to the foreign owners setting up single family offices in Singapore.

What MAS will do is to continue to review these two tax incentive schemes to ensure they continue to make meaningful contributions to Singapore, he added.

As for the Global Investor Programme (GIP), which accords PR status to eligible global investors who intend to drive their businesses and investment growth from Singapore, around 30 owners of single family offices have been supported under this programme based on their investment track record, investment mandate here, and the projected size and experience of their Singapore team.

The GIP is administered by the Economic Development Board (EDB) and is subjected to regular reviews to ensure it is effective in attracting top-tier business leaders, the minister elaborated.

Tharman also pointed out that earlier in March 2023, the EDB and Ministry of Trade and Industry announced changes to the GIP which includes a requirement for the applicants of single family offices to deploy S$50 million of their Asset-Under-Management into four investment categories that would benefit and support the growth of businesses based in Singapore.

The minister further wrote that having a high net worth and setting up family offices in Singapore does not guarantee Singapore citizenship (SC) or PR.

He said:

"Each SC and PR application is assessed based on a range of factors. These include the ability to contribute to Singapore, the number of jobs that the applicant and his or her businesses may be able to create in Singapore, special skills or education the applicant may possess, the applicant’s family ties to Singaporeans, the ability to integrate, and the commitment to sink roots in Singapore."

Related stories:

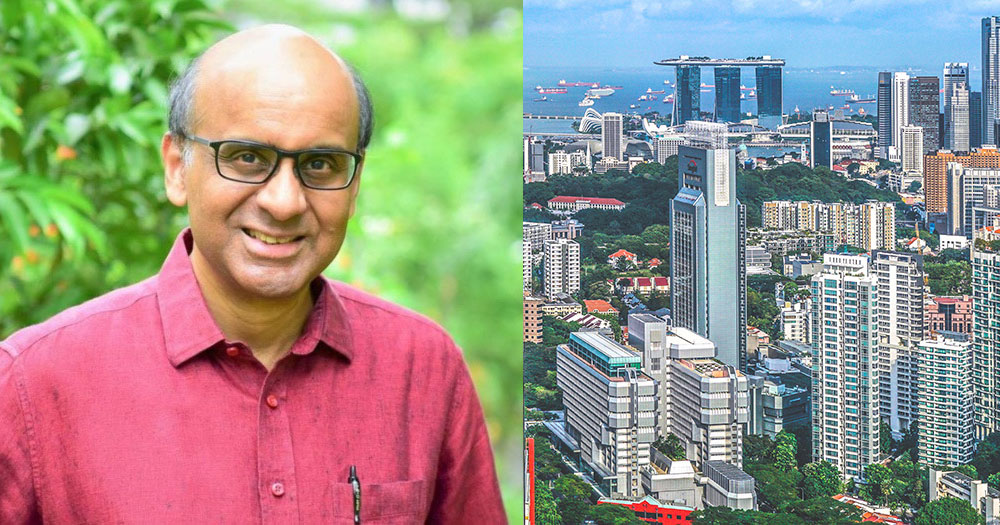

Top left image via Tharman Shanmugaratnam/FB, right photo by Mike Enerio via Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.