Temasek Holdings reported a net portfolio value of S$382 billion for its latest financial year, which ended on Mar. 31, 2023.

This is a noticeable drop from its record high of S$403 billion in the previous year.

Image via Temasek.

Image via Temasek.

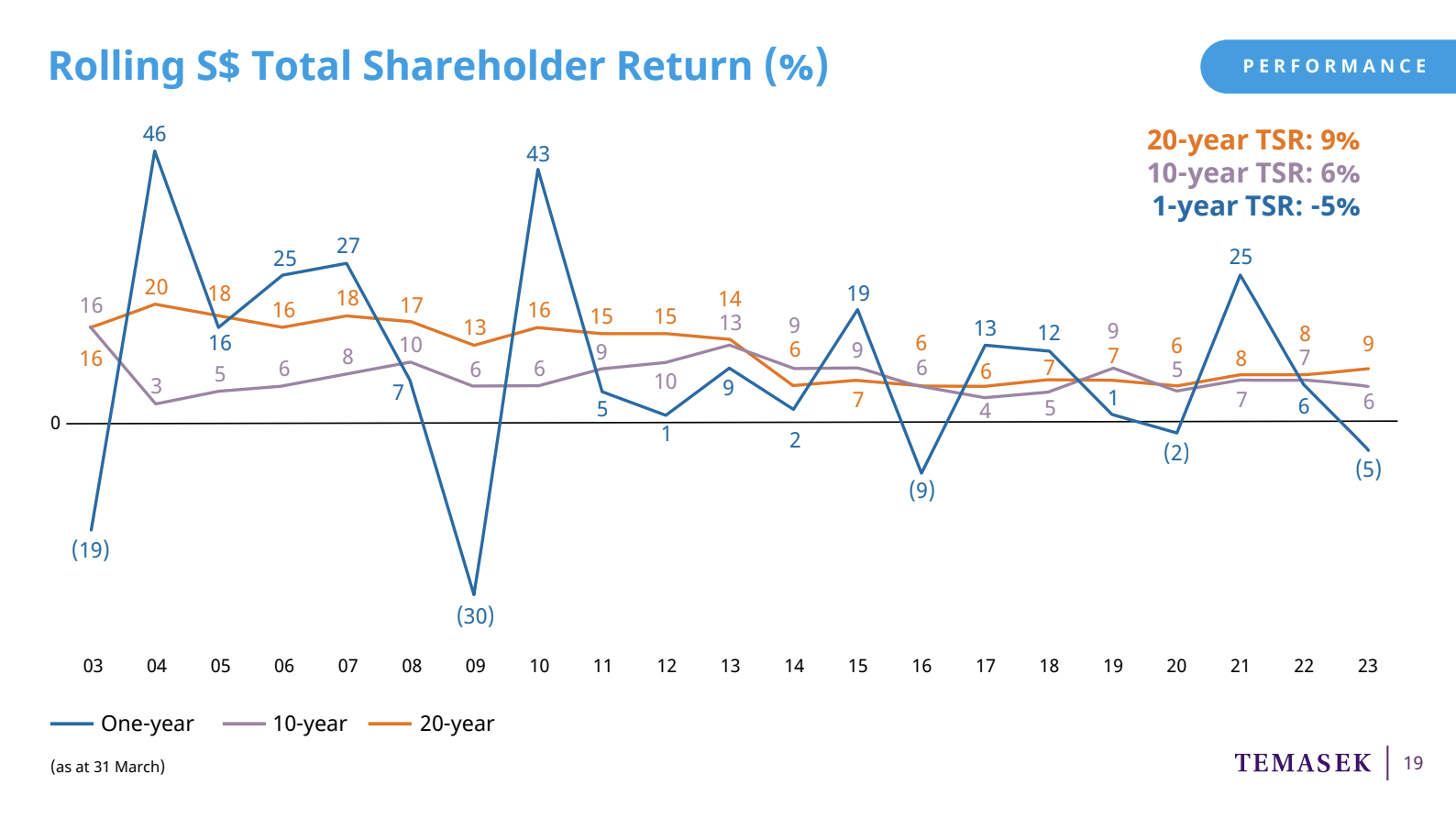

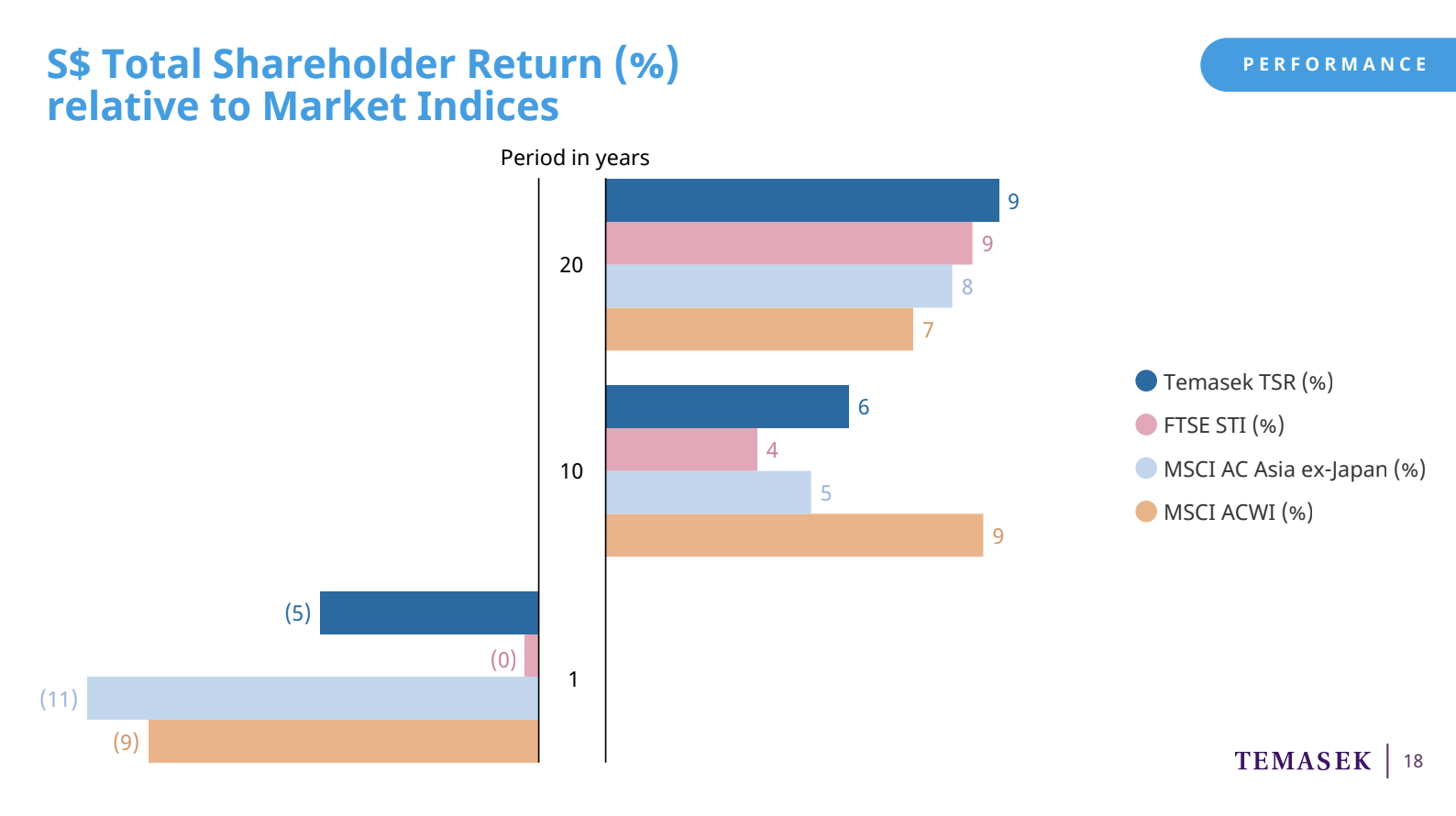

The company's one-year Total Shareholder Return (TSR) turned negative at -5.07 per cent, down from its 5.81 per cent gain last year.

Image via Temasek.

Image via Temasek.

In its annual review held on Jul. 11, Temasek shed some light on the economic circumstances that contributed to this year's fall in NPV and TSR.

Volatile global markets & macro environment

Since its record numbers in 2022, Temasek has faced persistent inflation and intensifying geopolitical conflicts such as the US-China tensions and the Russian-Ukraine war, said its executive director and chief executive officer, Dilhan Pillay.

"The investment climate has become much more complex than what we have encountered since the Global Financial Crisis — the confluence of rising geopolitical tensions, the risk of decoupling amidst a rethinking globalisation, the emergence of potentially restrictive, nationalistic and protectionistic policies amidst the proliferation of foreign investment regimes and the costs associated with energy security and energy transition portend lower global growth and lower real returns..."

Temasek reiterated that its Singapore portfolio companies have remained resilient despite the drawdowns in global markets and a challenging macro environment.

Overall, Temasek's portfolio sustained its recovery from the lows during the pandemic, with its 10-year and 20-year TSRs reporting 6 per cent and 9 per cent respectively.

Image via Temasek.

Image via Temasek.

In 2022, the company's 10- and 20-year TSR returns were 7 per cent and 8 per cent respectively.

Maintaining a cautious investment stance

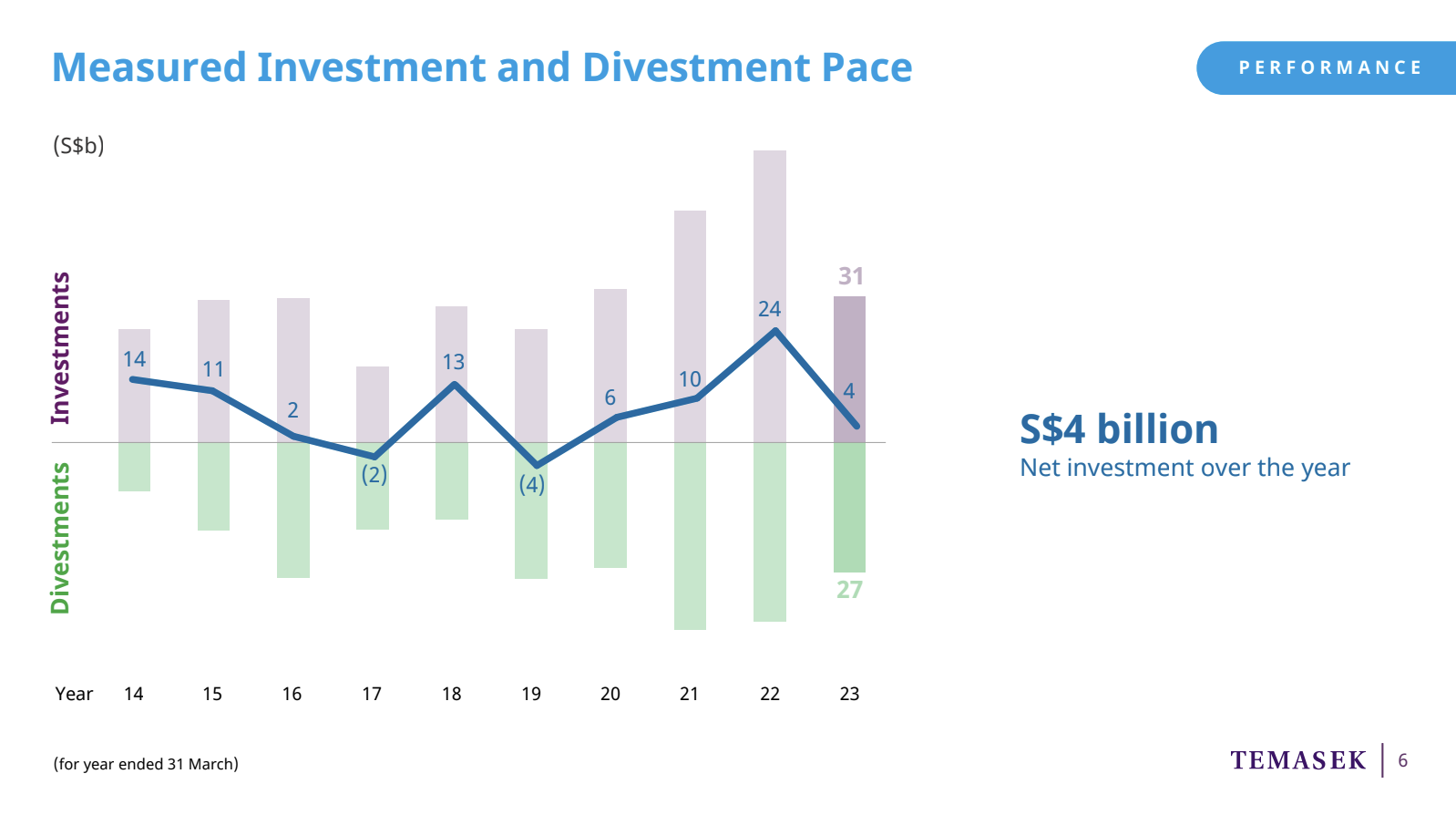

In light of the challenging macro-environment, Temasek invested S$31 billion and divested S$27 billion in the last financial year, taking a more cautious approach.

Image via Temasek.

Image via Temasek.

This was a marked drop in net investment from a year ago, where the company stressed its role as an active investor, having invested S$61 billion and divested S$37 billion.

Temasek's chief investment officer, Rohit Sipahimalani, explained that the company was maintaining a cautious investment stance.

Pillay shared that its investment decisions hinged on long-term sustainability.

"Our focus for portfolio instruction is to build a portfolio that can withstand exogenous shocks and perform through market cycles both up and down. We want to continue to focus on growth opportunities for both our existing portfolio companies and the new investments we will make, all for the purpose of generating sustainable returns over the long term."

Looking forward

As the global economy remains uncertain, with slowing global growth and a looming risk of recession in key developed markets, Temasek is looking to continue investing at a moderated pace this financial year, although still being ready to step up on market dislocations.

The company will take into consideration structural trends and geopolitical risks in its investments, putting a greater focus on companies with stronger pricing power and cash flows.

Temasek also continues to place sustainability at its core by investing and sees the need to build future-centric capabilities such as artificial intelligence, blockchain and cybersecurity.

Related story

Top image via Temasek

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.