Calling all NSFs who want more spending money, DBS/POSB's "Save As You Serve" programme aims to help you get a head start on your savings journey.

Besides attractive interest rates and financial tips, NSFs who open DBS/POSB accounts stand to enjoy perks and limited-time promotions that can help cut costs and earn rewards.

Up to S$130 cash reward and a Lazada lucky draw

DBS/POSB is offering its very own "sign on bonus" for NSFs who credit their NS allowance into their DBS/POSB accounts, with up to S$130 in cash rewards to be earned.

Participants have to register here, and must credit their allowance into their account for at least three consecutive months, with the first salary credit taking place within the promotion period which starts from Apr. 1, 2023.

That itself earns you S$70. Opening a DBS Multiplier account and/or a POSB Save As You EARN (SAYE) account online during the promotion period will net you an additional S$30 for each account, for a total of S$130.

See here for the full terms and conditions of the promotion.

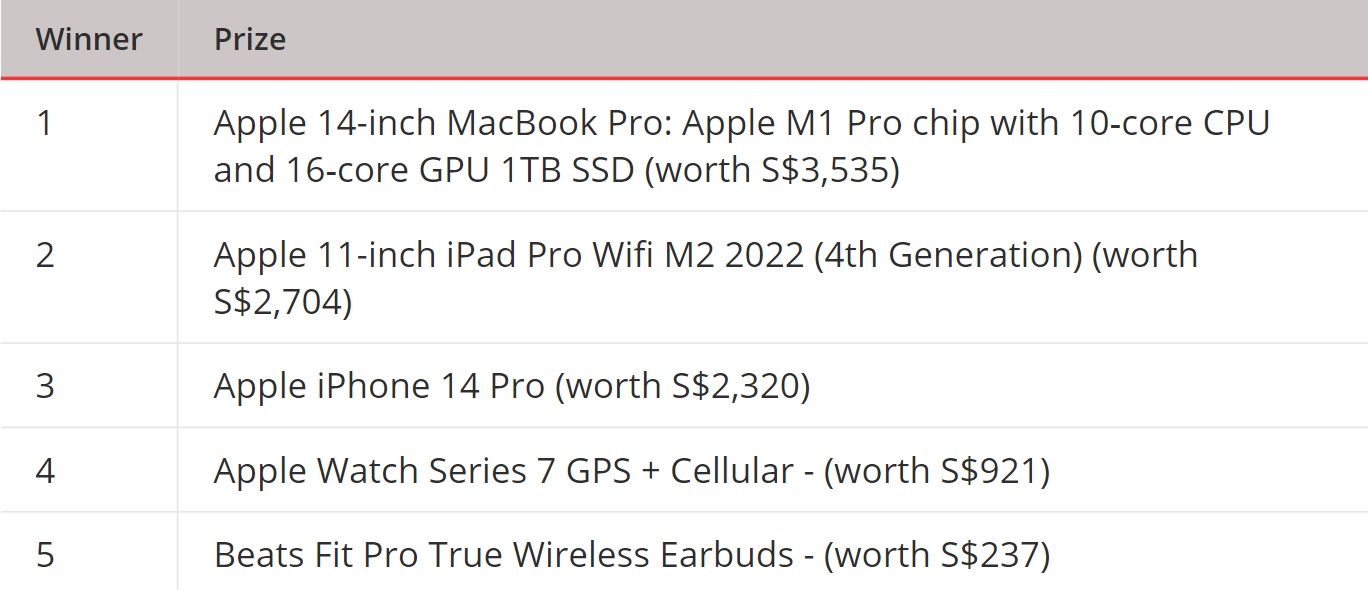

For more free stuff, DBS and Lazada are partnering to create a lucky draw just for NSFs to celebrate SAF day, with the grand prize being a MacBook Pro worth S$3,535. Check out the table below for a full list of rewards.

Table from DBS' website.

Table from DBS' website.

To qualify, NSFs just need to credit at least one month's allowance into their personal DBS/POSB accounts during the promotion period (Jul.1 - Aug. 31 2023).

By following any of the steps below, participants can increase their chances of winning by 300 per cent:

- Make at least one visit to the "Savings" tab on the digibank app (+1 chance)

- Have a DBS Multiplier Account (+1 chance for New/Existing account holders)

- Make at least one purchase on Lazada/RedMart Singapore (no minimum spend) via PayLah! express checkout or any DBS/POSB Credit or Debit Card (+1 chance)

Visit the website for more detailed steps to participate in the lottery.

Save more with great perks, including better cashback

NSFs who sign up for a SAFRA DBS debit card or credit card can get a S$30 cash rebate if they spend S$388 within 30 days of their card getting approved.

What's more, NSFs get to avoid the minimum S$400 monthly spending requirement to earn up to 2 per cent of cash rebates from their local contactless spend and online spending.

In addition, with a DBS/POSB account, NSFs can find themselves enjoying perks and great deals:

- Better interest rates with a POSB Save As You Earn account

- Use the PayLah! app to snag discount for food deliveries and movie tickets

Check out DBS' website here for a full list of deals and perks available to NSFs.

Top image via Wikipedia and The Singapore Army/Facebook

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.