After accounting for global inflation, GIC's annualised real rate of return over a 20-year period that ended on Mar. 31, 2023, was 4.6 per cent, according to the sovereign wealth fund's annual report released today (Jul. 26).

This marks an increase from last year's number, which stood at 4.2 per cent, and is its highest in eight years. Its real returns hit 4.9 per cent in 2015.

Why over a 20-year period?

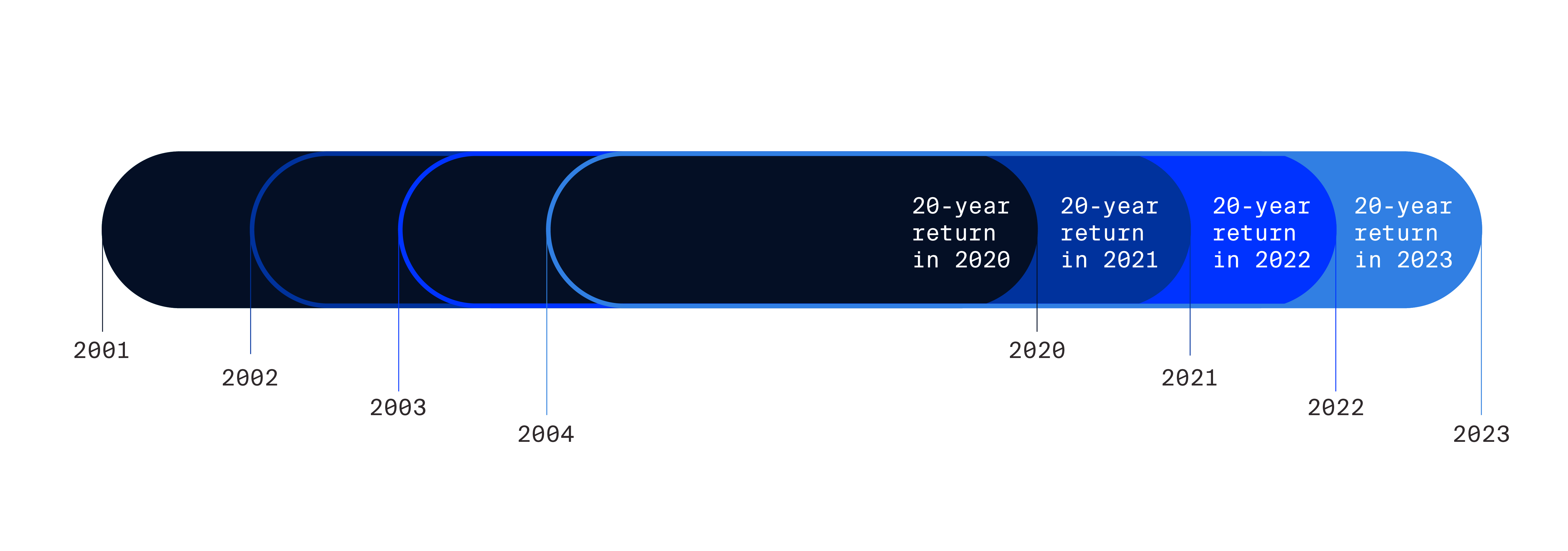

The primary metric GIC uses to evaluate its investment performance is the annualised rolling 20-year real rate of return.

Here is a visual of how this average time-weighted portfolio return is calculated from year to year:

Image via GIC

Image via GIC

The number 4.6 per cent means that over the past 20 years (from April 2003 to March 2023), on top of having protected the value of the portfolio against global inflation, the portfolio generated a return averaging 4.6 per cent per year.

To put it in concrete terms, if you invested US$ 1 million with GIC in 2004, it would have grown to approximately US$3.8 million today.

However, despite registering an increased annualised real rate of return this year, GIC estimated that global economic growth would be slow in 2023 due to tight monetary and fiscal policies.

Chronic geopolitical risks, including further Russia-Ukraine escalation and tensions between the United States and China, also add an element of uncertainty to the investment outlook.

Investing in generative AI?

Another disruption that the world would grapple with is generative Artificial Intelligence (AI), according to GIC.

Addressing media queries on GIC's response, GIC's Chief Executive Officer Lim Chow Kiat acknowledged that AI appears to possess great potential in transforming many industries and businesses, including how GIC process its research, comes up with new investment ideas, and improves the efficiency of its models.

Lim revealed that the teams at the sovereign wealth fund have already begun analysing and assessing the opportunities available within the investment universe, such as in the areas of advanced chip production, infrastructure for AI-related technologies, and their applications.

Nevertheless, GIC would exercise discretion as it might be too early to identify the winners in the industry, Chief Investment Officer Jeffrey Jaensubhakij said.

He noted:

"Every week, literally every week, there is a new AI company being set up. Everybody has some history of doing machine learning. But out of 50 companies that attack the same problem, which one will really dominate isn't very clear. What we found with a lot of these technology waves is that it pays not to put too much in, too broadly and too early, because it's very hard to identify the winners."

Investing in infrastructure

To navigate this era of continued uncertainty, GIC has been taking various steps to make its portfolio more resilient, including by building up its infrastructure assets, according to its annual report.

Specifically, GIC's infrastructure investment team has been working with infrastructure businesses that seek good and sustainable growth.

One such business that GIC has invested in is Aegea, a Brazilian water supply and sewage treatment company.

Since 2013, GIC has supported the company through multiple investment rounds and helped strengthen its governance.

As a result, Aegea has improved the lives of millions as many can now access clean water and benefit from proper sewage treatment — some for the first time in their lives and at preferential rates for the lower income.

By drastically reducing or eliminating the discharge of raw sewage into the river systems and seas, Aegea's services have also noticeably benefitted the environment and the well-being of the communities it served.

Top image via GIC

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.