Finance Minister Heng Swee Keat delivered the 2016 Budget statement at 3.30pm in Parliament today (Mar 24).

Budget 2016 is the first budget after Singapore's 50th birthday. It is also Minister Heng's first budget as a Finance Minister.

The aim of the budget is to 1) transform our economy through enterprise and innovation, and 2) build a caring and resilient society.

Source: Ministry of Finance Facebook

Source: Ministry of Finance Facebook

Here are 8 key points of Minister Heng’s Budget Statement:

1. Industry Transformation Programme through one-stop portals, grants and innovation programmes.

i) Launch of one-stop portal and one-stop information system:

1) Business Grants Portal (the fourth quarter of 2016) will start with grants from IE Singapore, SPRING, STB and Design Singapore. 2) National Trade Platform (NTP) - trade information management system, to support firms, particularly in the logistics and trade finance sectors.

ii) Other Grants: SME Mezzanine Growth Fund will be expanded to $150 million, Automation Support Package, which includes a grant of up to $1 million, at up to 50% of project cost.

iii) Innovation programmes: $450 million to support the National Robotics Programme, Up to $4 billion to industry-research collaboration under the Research, Innovation and Enterprise (RIE) 2020 Plan, and a top-up of $1.5 billion to the National Research Fund.

2. On Property Cooling measures: Heng said that the measures introduced since 2010 were aimed at keeping the market 'stable and sustainable' and that relaxing the measures were 'premature'.

3. Helping Families with children who need support: i) A new pilot initiative, KidSTART, will help parents who may need more support to give their children a good start in life; ii) Fresh Start Housing Scheme for Families with Children and Living in Rental Housing - Families with young children will soon be eligible for a grant of up to $35,000 to own a 2-room flat.

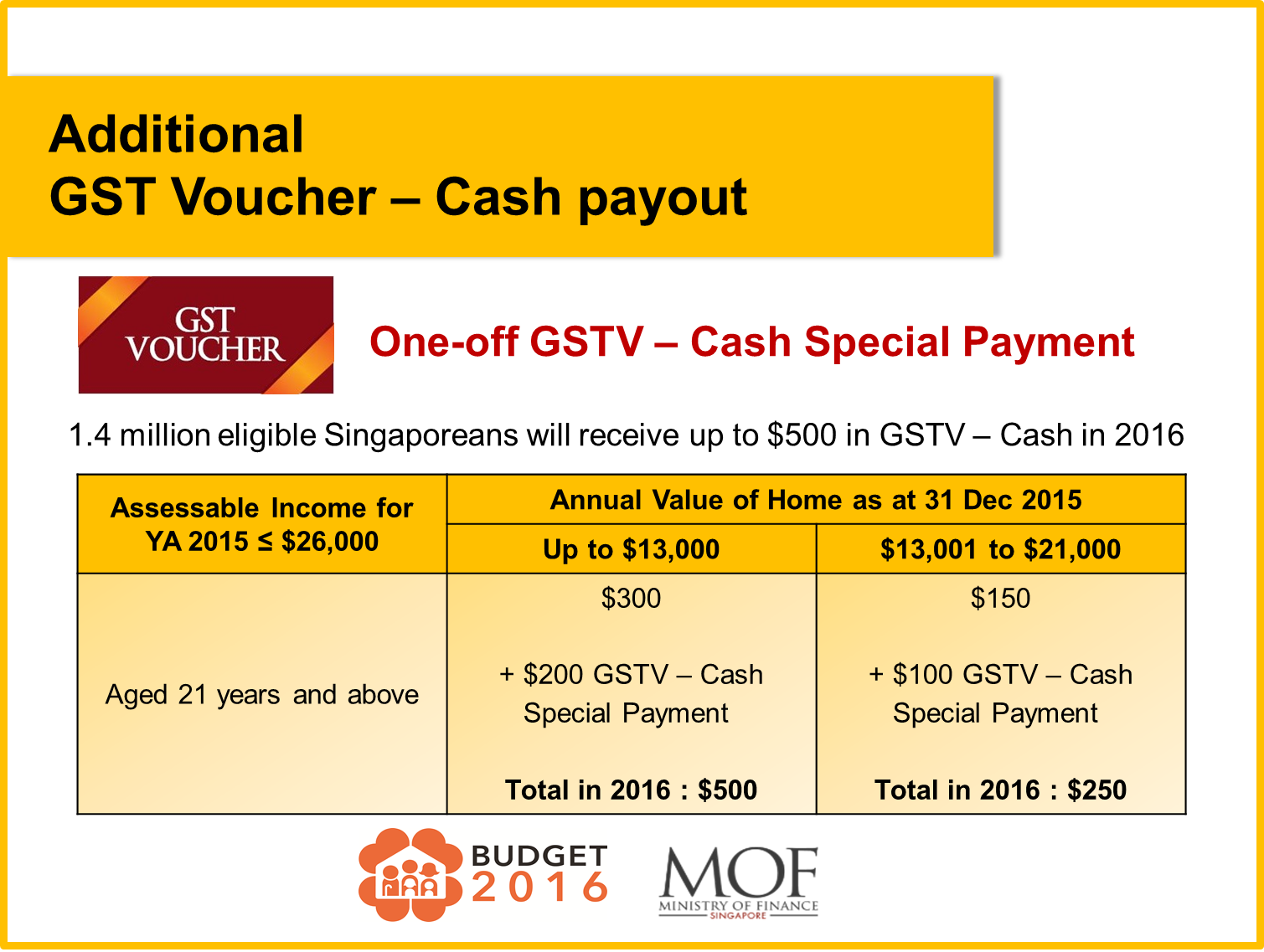

4. One-off Ang Bao! 1.4 million Singaporeans will receive a one-off GST Voucher – Cash Special Payment of up to $200 in 2016, depending on the annual value of their home, in addition to existing GSTV – Cash payouts.

Source: Ministry of Finance Facebook

Source: Ministry of Finance Facebook

Another ang bao (kind of): 840,000 HDB households will receive a total of 1 to 3 months of Service & Conservancy Charges (S&CC) rebates this year, based on their flat type.

5. Helping Low Wage Workers: From Jan 2017, workers earning an average wage of up to $2,000 per month (up from the current $1,900 ceiling) will be eligible for Workfare Income Supplement (WIS). About 460,000 Singaporeans are expected to benefit from WIS.

6. Making Singapore a more caring society

To boost to Corporate Social Responsibility and make it easier for employees to contribute through their workplaces, Heng said businesses that lets employees volunteer with IPCs, including secondments, will get a 250% tax deduction on associated costs.

Following the success of the SG50 Celebration Fund where over 400 projects were funded, a new fund, Our Singapore Fund, will be set up to support projects that "build the spirit of caring and resilience, nurture our can-do spirit, and promote unity and our sense of being Singaporean."

7. Hello Temasek: Temasek will be added onto Singapore's Net Investment Returns framework and this will be a source of revenue for the long term.

8. First surplus in the last two years: This year's Expenditure is expected to be $5.0 billion, 7.3% more than 2015. For FY2015/16, Singapore ran a budget deficit of $4.9 billion. For FY2016/17, despite higher expenditure, a surplus of $3.4 billion is expected.

Related article:

Other than that black briefcase, S’pore Finance Ministers are significantly different

If you like what you read, follow us on Facebook and Twitter to get the latest updates.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.