A total of 10 travellers, aged 31 to 71, were caught moving cash exceeding S$20,000 or its equivalent in foreign currencies into Singapore without declaration at Singapore Changi Airport from Jun. 17 to 23.

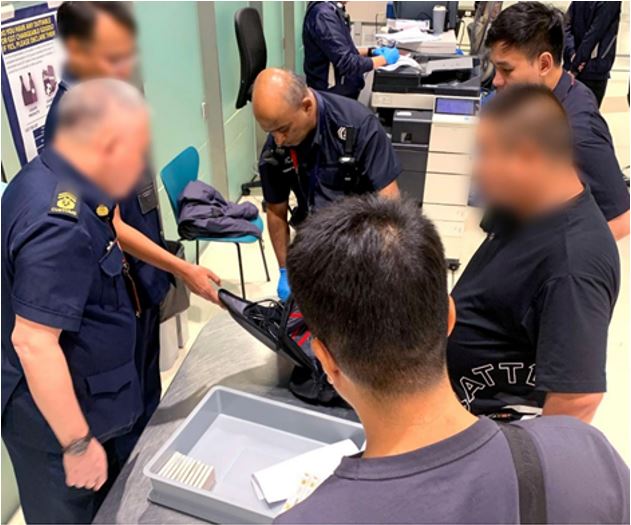

The multi-agency enforcement operations are part of efforts to clamp down on non-compliance with Singapore’s Cross-Border Cash Reporting Regime (CBCRR) and other illegal cross-border activities.

Officers from the Singapore Police Force (SPF), Immigration & Checkpoints Authority (ICA), Central Narcotics Bureau (CNB), Singapore Customs (Customs), National Parks Board (NParks) and Health Sciences Authority (HSA) identified more than 10,000 travellers for checks, with more than 18,000 luggage and hand-carry bags scanned or searched.

Photo via ICA website.

Photo via ICA website.

10 travellers caught moving cash exceeding S$20,000

Two male Singaporeans and one female foreign traveller, aged between 31 and 50, were separately detected bringing cash of various currencies amounting to between S$30,000 and S$35,000 into Singapore without declaration on Jun. 20.

On Jun. 22, four male foreign travellers, aged between 37 and 61, were separately found having cash of various currencies amounting to between S$24,000 and S$109,000 into Singapore without declaration.

Three male foreign travellers, between the ages of 60 and 71, were separately detected with cash of various currencies amounting to between S$22,000 and S$28,000 into Singapore without declaration on Jun. 23.

Two of the 10 travellers caught were issued with notices of warning.

The other six were issued with composition sums amounting to S$23,000 in all.

The last two are currently under investigation, both of whom carried money of various currencies exceeding S$140,000 in total into Singapore without declaration.

Photo via ICA website.

Photo via ICA website.

Photo via ICA website.

Photo via ICA website.

A requirement to report CBNIs if the total value exceeds S$20,000

The authorities reminded the public that while there are no restrictions on the amount of Cash or Bearer Negotiable Instruments (CBNIs) that can be moved into or out of Singapore, it is a statutory requirement to report the cross-border physical movement of CBNIs if the total value exceeds S$20,000 (or its equivalent in foreign currency).

Travellers are required to submit a declaration electronically within 72 hours before entering or leaving Singapore via the MyICA mobile app or ICA website.

"With effect from May 13, 2024, the CBCRR penalties have been enhanced to strengthen deterrence," the joint release stated.

Travellers who fail to report or to accurately report the movement of CBNIs exceeding S$20,000 is an offence liable to a fine of up to S$50,000, an imprisonment term of up to three years, or both.

Photo via ICA website.

Photo via ICA website.

Photo via ICA website.

Photo via ICA website.

77 travellers were detected for customs offences

Separately, a total of 77 travellers were detected for customs offences of failing to declare and pay taxes on dutiable cigarettes or tobacco products and liquors exceeding their duty-free allowance.

Among those, some failed to declare and pay taxes for items exceeding their Goods and Services Tax (GST) import relief allowance.

The total amount of duty and GST involved was more than S$11,000, and the total composition sum (penalty) imposed was more than S$17,000.

Notable items included a luxury watch and a luxury handbag undeclared by two different travellers, as well as a case involving 800 sticks and 500 sticks of cigarettes.

"To avoid the hefty penalties and for their own convenience, foreign travellers and local residents are strongly encouraged to make an advance declaration and payment for their dutiable or GST goods up to three days prior to their arrival in Singapore, using the Customs@SG Web Application," said authorities.

Offenders guilty of any fraudulent evasion of, or attempt to fraudulently evade, any customs duty or excise duty may be convicted of a fine of up to 20 times the amount of duty and GST evaded, or jailed for up to two years.

Top image via ICA website.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.