The Singapore dollar advanced to the strongest it had been in 10 years on Aug. 25, 2024, Bloomberg reported, thanks to a "relatively hawkish" policy outlook from the Monetary Authority of Singapore (MAS) and impending interest rate cuts by the Federal Reserve in the United States.

According to Bloomberg, the Singapore dollar is currently the second-best performing currency in Asia behind the Malaysia ringgit.

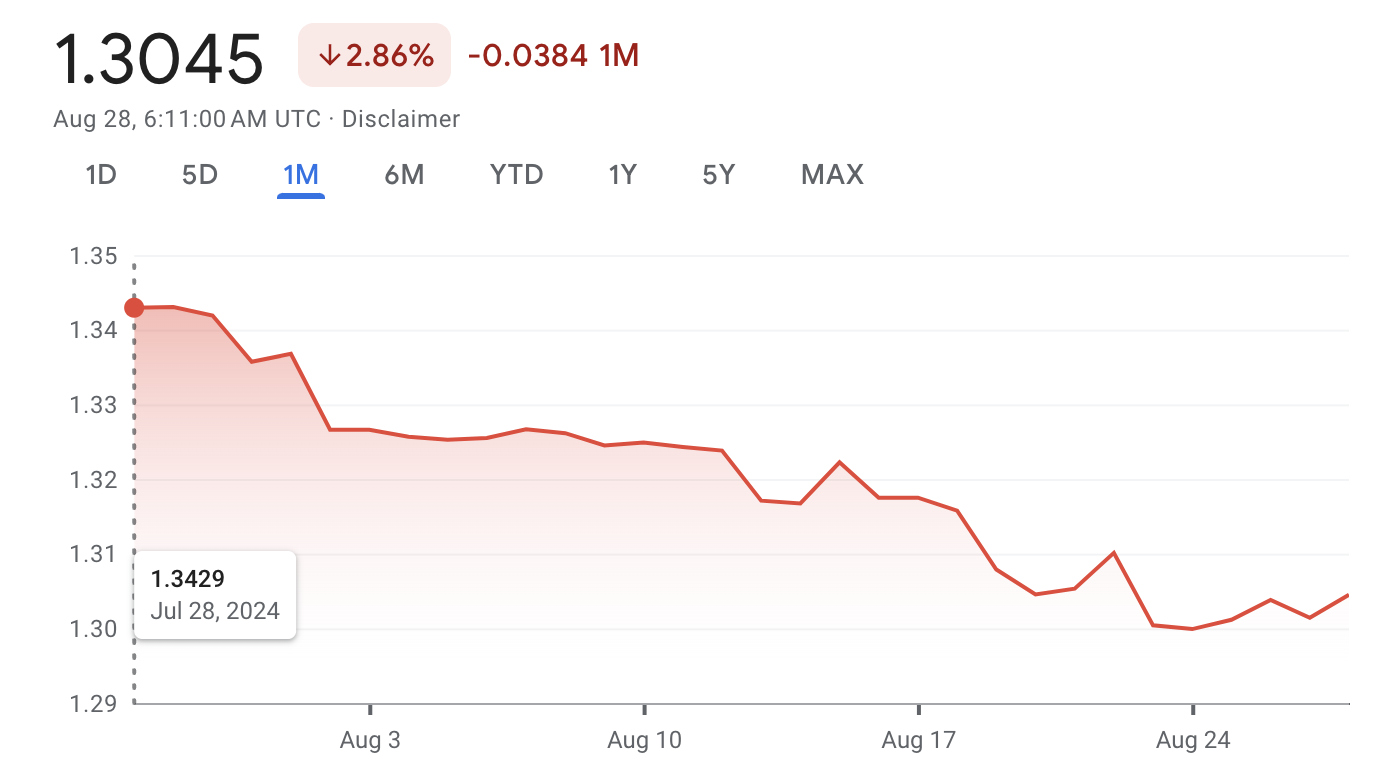

The Singapore dollar is currently doing well against the U.S. dollar, trading at S$1.304 to US$1 as of Aug. 28, 2024, according to Google Finance.

The last time the Singapore dollar did this well against the greenback was back in 2014, Bloomberg wrote.

Screenshot from Google Finance.

Screenshot from Google Finance.

As the graph above shows, the Singapore dollar has been steadily strengthening against the U.S. dollar since Jul. 28, 2024.

Thus far, in 2024, the Singapore dollar gained 1.5 per cent against the U.S. dollar.

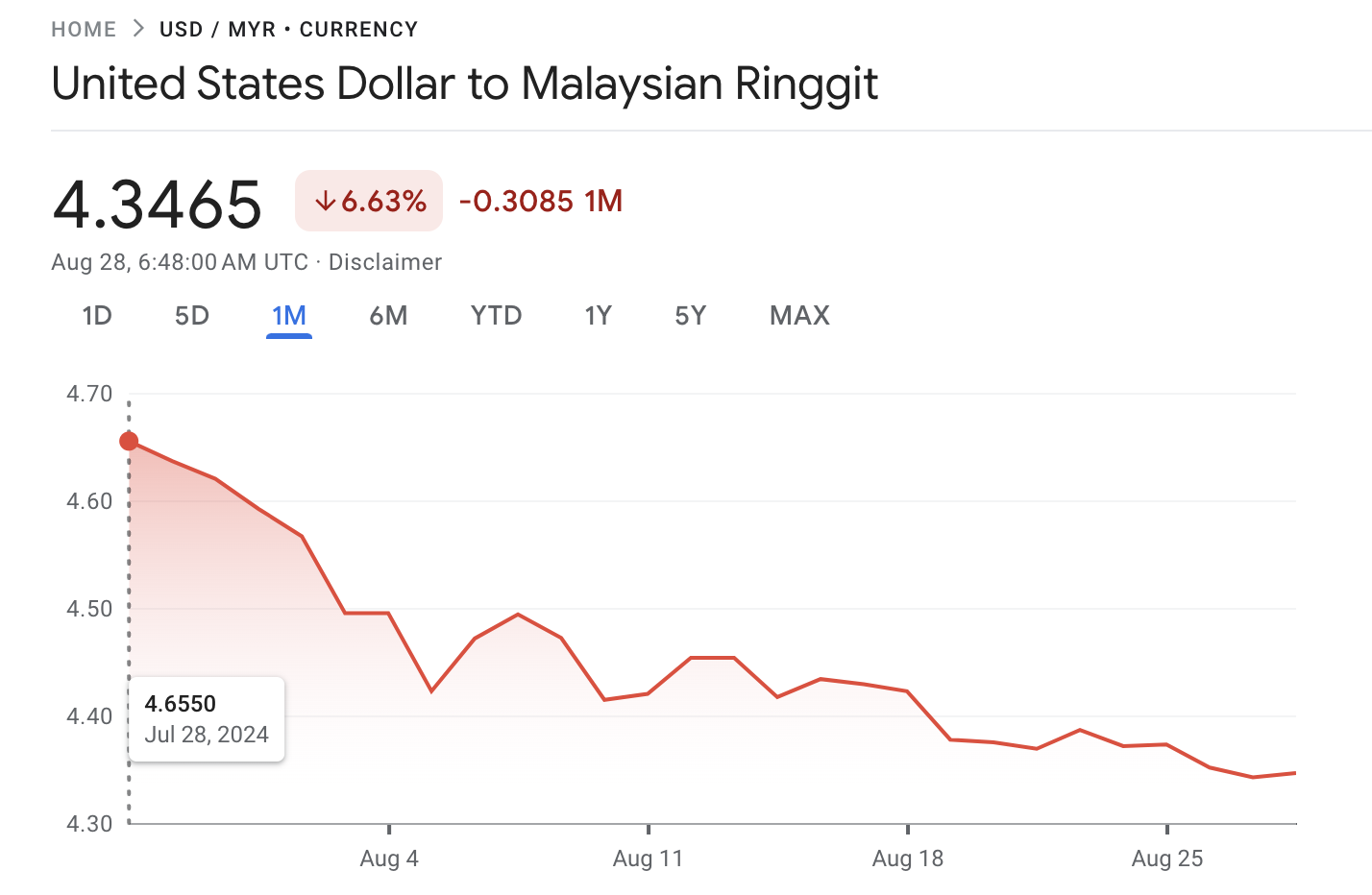

The Malaysia ringgit is also performing strongly against the U.S. dollar, with US$1 trading for 4.3465 ringgit:

Screenshot from Google Finance.

Screenshot from Google Finance.

Hawkish monetary policy

On. Jul. 26, MAS issued a monetary policy statement that it would maintain the prevailing rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER).

S$NEER refers to a combined index of bilateral exchange rates between Singapore and its major trading partners.

MAS takes a unique approach to monetary policy, compared to central banks in other countries, by adjusting the exchange rate of its dollar as opposed to changing domestic interest rates.

MAS, however, does not control the exchange rate level in real-time.

Instead, it sets a certain policy band within which the S$NEER is allowed to move up and down.

If the S$NEER were to move out of this band, MAS would intervene by buying or selling Singapore dollars.

MAS maintained the prevailing appreciation on Jul. 26 of the S$NEER to ensure "a restraining effect on imported inflation as well as domestic cost pressures, and ensure medium-term price stability".

A stronger currency makes imported goods more affordable.

Since then, the Singapore dollar has been prevailing against the greenback.

Federal Reserve to cut interest rates

Bloomberg reported that traders are currently weighing the difference between the "relatively hawkish" policy outlook of MAS, which has maintained the Singapore dollar on an appreciating bias, and that of the United States Federal Reserve.

Federal Reserve chief Jerome Powell indicated on Aug. 23, 2024, that the Federal Reserve will be cutting interest rates, with growing confidence that inflation is back on track to go down to 2 per cent.

Interest rate cuts typically lead to a weaker currency.

According to Reuters, the Federal Reserve is likely to announce the rate cuts during its Sep. 17 to 18 policy meet.

Top photo from Canva.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.