Financial planning is not a sexy topic.

After all, for most of us out here, it’s far more interesting to spend, than to save money.

However, this lack of planning might be problematic, as a survey revealed that two-thirds of working Singaporeans and Permanent Residents (PRs) do not have enough savings to last them beyond six months.

What does this mean? It means that for many of us, losing our jobs will be a crippling blow, as we may not have enough money to last until we find a new job.

After all, another study showed that 64 per cent of workers who experienced a fall in income had less than three months of emergency funds, and 27 per cent of workers had less than a month.

Amid the uncertainty of the Covid-19 pandemic, such worries are very real.

To learn more about managing one’s finances better, Mothership spoke to several young Singaporeans about their habits for saving money for the future.

Have financial goals

Quick question: how many of you have an actual goal that you’re saving for? If you don’t, it might be a good idea to have one.

Having a goal in mind can help you stop yourself from indulging in various wants, and motivate you to put money towards your savings instead.

Andrew (not his real name), 30, who works as a customer service manager, has goals that mirror those of many Singaporeans.

He wants to save up enough money for his wedding and his first house in the short term, and also set aside a sum of money to provide for his future children’s education.

For some people, saving for these big goals can be a daunting task, given that each one can easily cost hundreds of thousands of dollars.

For 25-year-old Belle (not her real name), who works in a PR agency, simply saving enough money to own a cat and a dog, and having spare cash to travel (when border restrictions are lifted), is good enough for her as a short-term goal.

In the long run, Belle will also have to save up for Singaporean staples, such as a wedding and a BTO flat.

Given that a 4-room BTO flat would typically cost at least S$300,000, with a downpayment of S$30,000 or more (depending on her choice of bank or HDB loan), it is important for her to start planning her finances early.

With these big commitments that could be daunting to save for in the long run, Belle’s shorter-term goal to save enough money to take care of her pets serves as a way to motivate herself on her financial journey.

As the saying goes, you can’t run before you can walk, so if you’re new to financial planning, having a short term goal like Belle might be a good start.

Tracking your spending

Pop quiz: do you know exactly how much you spent last month?

If you don’t, you probably haven’t been keeping an eye on your spending habits, and may be prone to lifestyle inflation.

After all, you can earn a million dollars a month, but if you spend more than that, you will still eventually end up broke.

In general, it’s a good idea for you to establish a budget for your major expenses, and ensure that you keep to it.

For example, for 39-year-old Charles (not his real name), who is a software developer, around a quarter of his monthly salary goes to investments and savings, with the rest going towards his expenses.

He confessed that he does not really keep a close eye on his actual spending, given that his spending patterns are relatively static, consisting mostly of car-related expenses and necessities for his two children.

Not tracking one’s spending can be quite common after all, if you’re busy taking care of your family, like Charles, the last thing on your mind would be how much you spent on coffee last month.

However, this may not be ideal, as you might find that you spent a lot more money than you originally intended.

For example, you may feel the need to splurge on some treats for your children occasionally, but without tracking how much you’ve spent, you might find yourself overspending in the long run.

And if your expenses are more fluid in nature, and you like having nights out with friends, keeping a closer eye on your expenses can be a prudent move.

There’s no point in making sure you eat S$2.50 cai fan every work day for lunch in your quest to save money, only to spontaneously spend S$300 drinking with friends over the weekend.

Know how much you’re saving & investing

So you have your goal in mind, and you are now starting to track your monthly spending.

The next step is to have a clear idea of where your assets and liabilities are.

As you grow older, you are likely to face more liabilities, such as housing loans and car loans.

This is in addition to debts that you may still be paying off, such as your student loans, which may further complicate your situation.

When you are 35, you may earn significantly more than when you first graduated from school, which may sound great.

However, if you find yourself saddled with outstanding loans, and your increase in salary does not outpace your increased liabilities, then you could possibly be worse off than your 25-year-old self.

In order not to get a rude shock somewhere down the road, you should always keep a close eye on what you owe, and what you own, to get a clearer picture of your financial status.

Consider using SGFinDex

To make your life easier, there are many free apps or platforms you can use.

Belle uses a free app to help track her spending. While the app has fairly simple functions, it allows her to review her expenditure every month, so she knows what expenses she can cut down on, in order to achieve her goals.

For Andrew, he uses a more old-school method, by recording his various assets and liabilities manually.

While the above-mentioned methods are commonly used, there is actually a better way.

For those of you who may have several credit cards and multiple bank accounts, and want a more seamless method, like Charles, you can consider using SGFinDex, which allows you to track all your finances and view it on one page via banks and MyMoneySense.

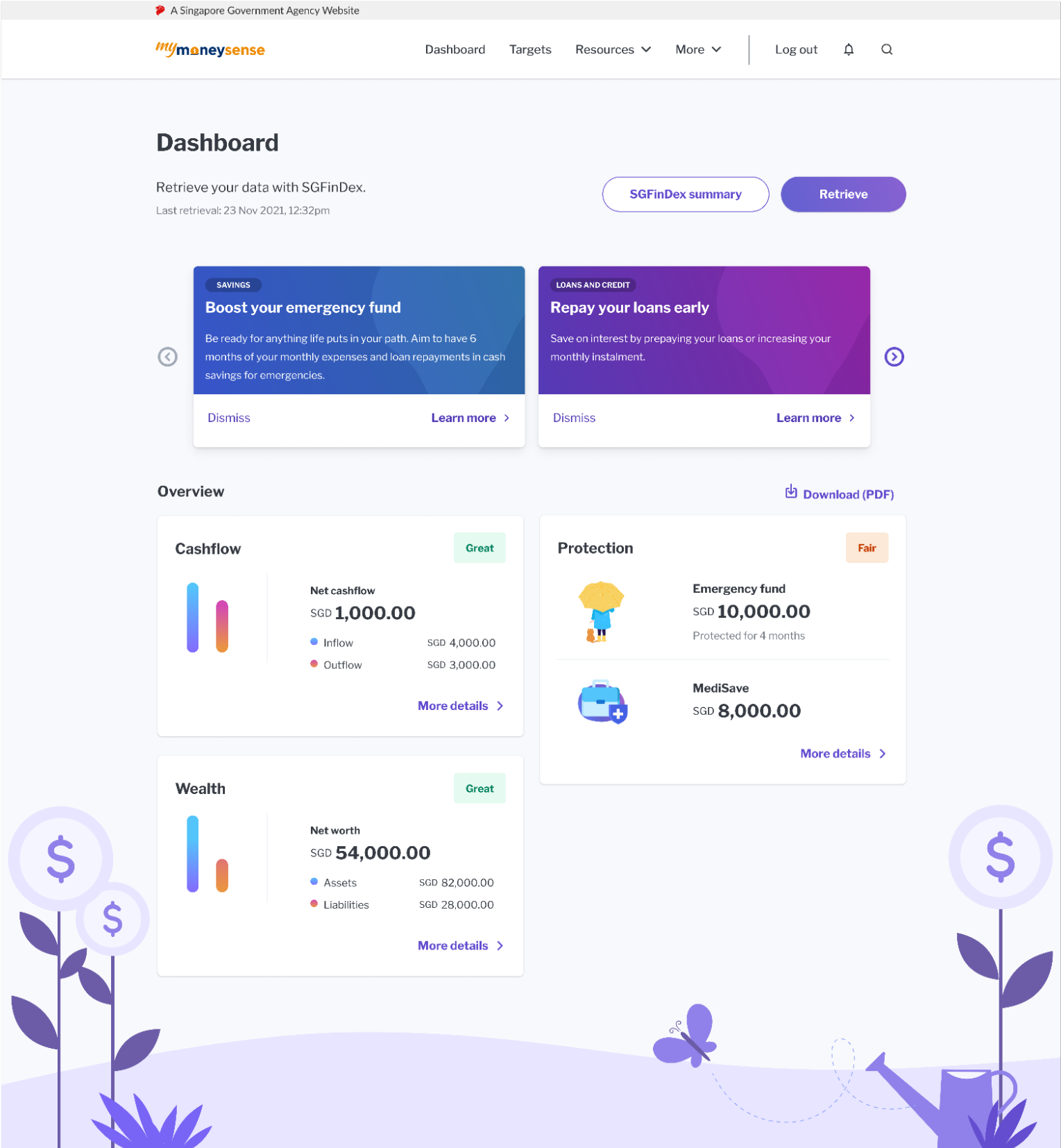

Here’s what you will see in your SGFinDex dashboard. Image via MyMoneySense.

Here’s what you will see in your SGFinDex dashboard. Image via MyMoneySense.

This means that if you have savings accounts with DBS and OCBC, fixed deposits with Maybank, unit trusts with Standard Chartered, Housing loan with UOB, while holding credit cards with Citi and HSBC, you no longer have to log in to the various banks’ apps or websites to see your balances and bills.

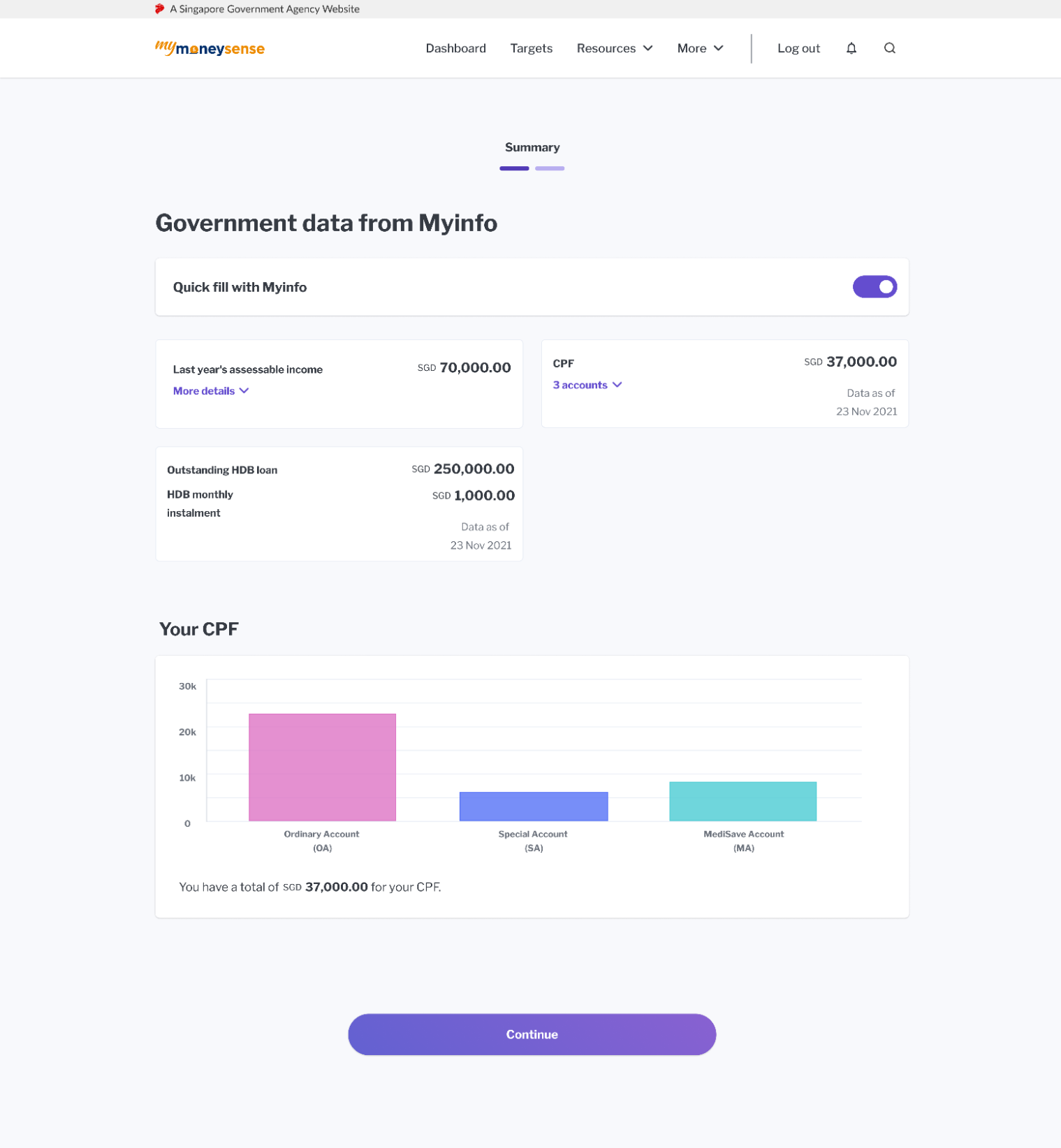

With SGFinDex you will be able to view your CPF account balances, your income, and your HDB loan amount and instalments, making it really easy to view your finances in one place to better plan for the future.

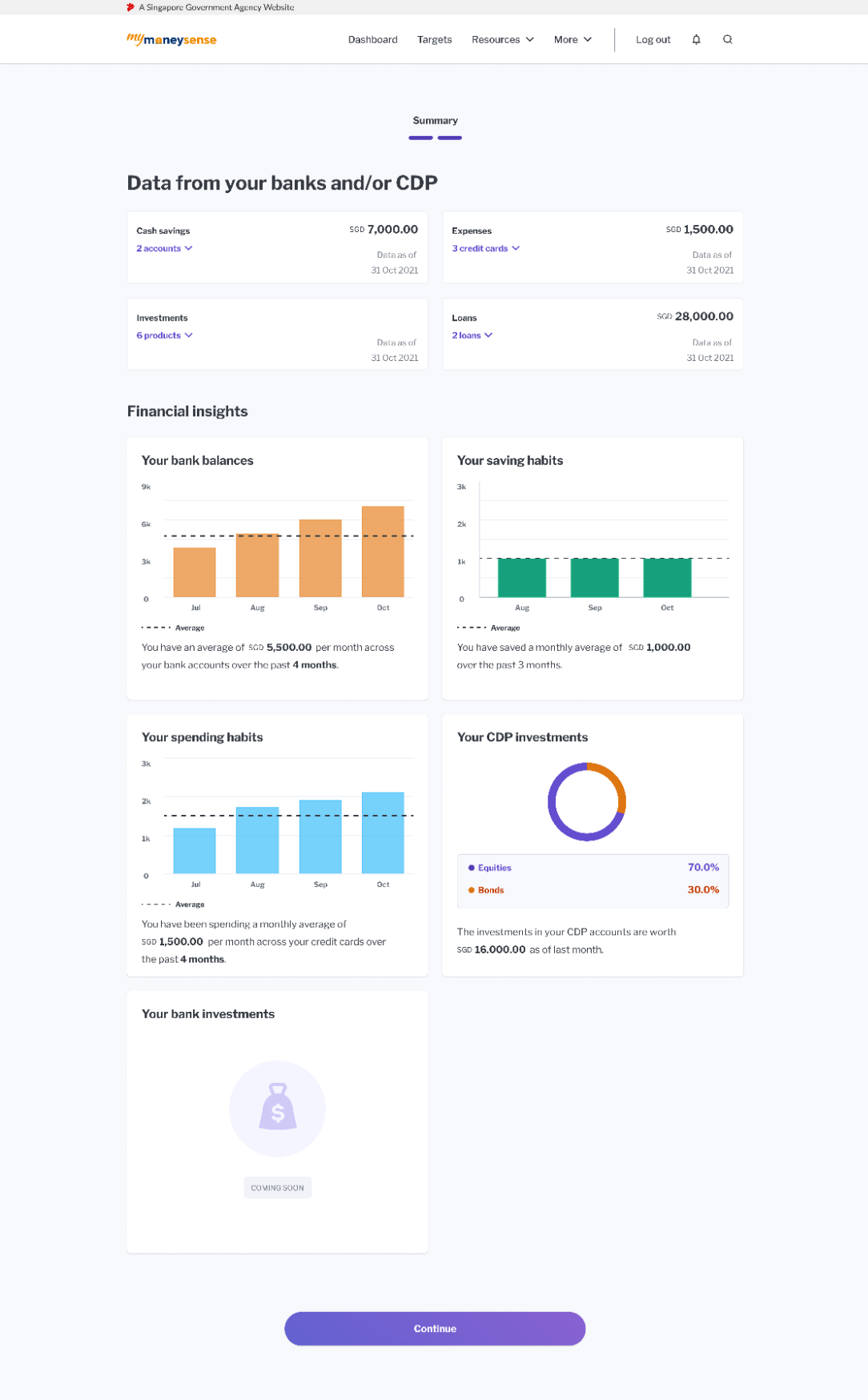

Say goodbye to having to check your different bank balances individually. Image via MyMoneySense.

Say goodbye to having to check your different bank balances individually. Image via MyMoneySense.

Have all your finances at your fingertips. Image via MyMoneySense.

Have all your finances at your fingertips. Image via MyMoneySense.

There are currently seven participating banks powered by SGFinDex: Citibank, DBS/POSB, HSBC, Maybank, OCBC, Standard Chartered Bank and UOB.

Besides being able to view the data from participating banks, you will be able to access your financial data from SGX Central Depository (CDP), CPF, HDB and IRAS too.

You can access SGFinDex via MyMoneySense or the banks above, and their respective platforms.

Note that the consent granted to these platforms to access your financial data are valid for one year and upon expiry, you can choose to re-consent again. During this one year period, you can also revoke your consent anytime.

Think of it as a financial manager, allowing you to have a better grasp of your finances, but one that you can access 24/7, and for free. Read more about it here.

Sounds good to me.

Top image via Unsplash.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.