Prices of goods and services have been skyrocketing for some time now.

Starting from 2023, the one per cent increase in GST will also add on to the higher prices.

With each passing month, my salary feels like it is shrinking, with savings accumulating ever more slowly.

Frustrated, I decided to educate myself on ways to make my money work for me.

My default savings account is with DBS, so I dug in and did some research on their website.

As I’m no finance junkie and mathematics often leaves me confused, I expected a difficult slog to get wise.

However, what I found out was that saving up for the future can be easy with DBS, even as I earn and spend.

Here are four ways you can learn how to multiply your savings and fight inflation too.

1) Multiplying everything

Rather than letting your money sit in the trusty savings account that you have always had, switch to a Multiplier account.

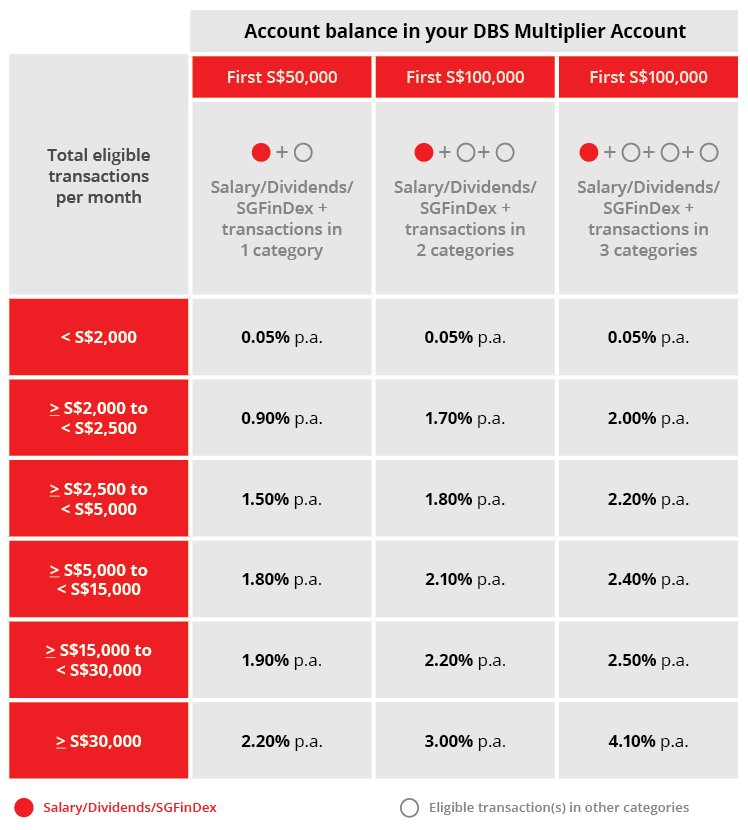

With an eSavings account, the interest rate you get on your savings would at most be 0.05 per cent per annum, regardless of how much you have saved or spent.

With a Multiplier account, the more you save or spend, the higher the interest rate you enjoy.

Image via DBS.

Image via DBS.

What’s more, on Nov. 1, DBS/POSB has increased their interest rates on the Multiplier account.

Now, the Multiplier account offers up to 4.1 per cent p.a. instead of the previous 3.5 per cent p.a., making it even more attractive than sticking to the usual eSavings account.

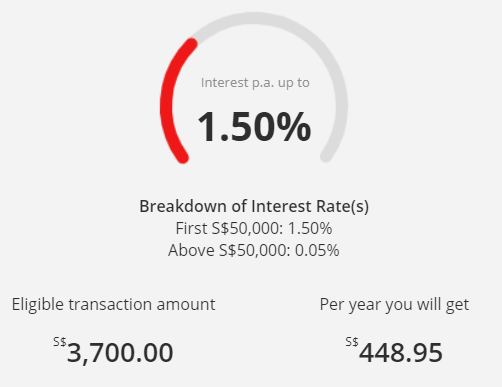

To figure out how much I could earn from the new interest rates, I did the maths based on my own profile – a single, mid-twenties first jobber looking to build up my savings while continuing to have fun in life for a while more.

Admittedly, my math is pretty bad, but thankfully there is a handy calculator on the DBS website that can help.

So, let’s say I have around S$30,000 in my bank account so far, after all the savings from national service and past part-time jobs.

Each month, I take home around S$3,500.

Disclaimer: not the real numbers.

Hypothetically, I spend around S$200 on expenses like transport and leisurely activities using my credit card.

If I credit my monthly salary to the DBS Multiplier account, guess how much cash I’ll earn in a year?

A whopping S$448.95 based on an interest rate of 1.5 per cent p.a.

Image via DBS.

Image via DBS.

On a typical eSavings account, I will only earn S$14.60 per year.

In other words, based on my spending habits, I stand to earn 30 times more in interest with the DBS Multiplier account.

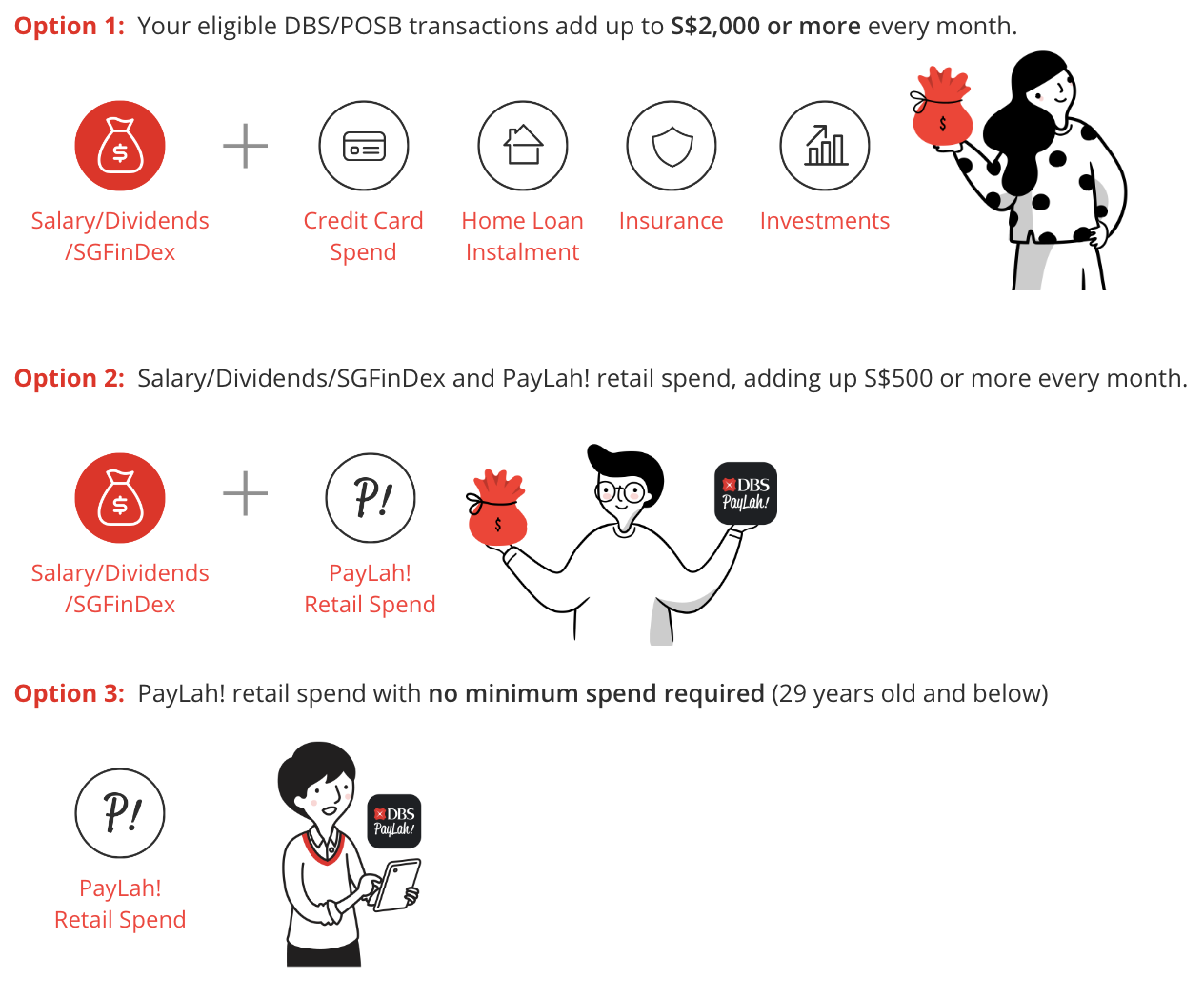

To qualify for the added interest rates, you just have to make eligible transactions under one of these three options:

Image via DBS.

Image via DBS.

The more you spend, the higher the interest rate you enjoy.

The interest rate earnings will help to offset some of the monthly expenses that you need to make regardless of the state of the economy.

But wait, there’s more!

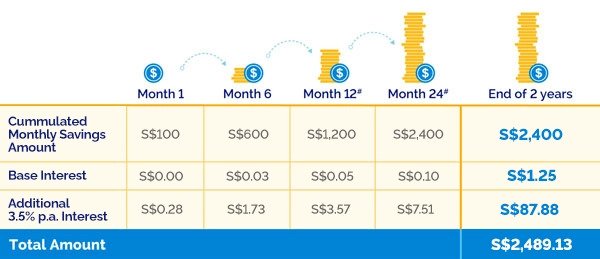

During my search, I found out I could pair up my DBS Multiplier account with a POSB Save As You Earn (SAYE) account.

Simply put, the SAYE account is just another account where you can apportion and credit part of your monthly salary into as savings.

Along with the DBS Multiplier interest rates adjustment, POSB SAYE accounts now offer a cash gift interest of 3.5 per cent p.a.

Here’s how it works.

Let’s say my monthly salary of S$3,500 is credited into my DBS Multiplier account, and I debit S$100 per month out of that amount into a POSB SAYE account as savings.

In two years, the cash earnings on the interest rates would amount to S$89.13, leaving my SAYE account with S$2489.13 in total, including the accumulated monthly savings.

Image via DBS.

Image via DBS.

Good news for those who have started on their home-owning journeys too.

DBS has recently launched its HomeSaver programme in October, which rewards customers who save diligently every month, helping them get more value out of their DBS/POSB home loans.

If you have a POSB SAYE account, you will get rewarded with a S$500 cash bonus if you take out a home loan.

If you sign up for a Mortgage Reducing Term Assurance (MRTA), you will get another S$200, bringing the potential cash bonus from the HomeSaver programme up to S$700.

The best part is, payments for monthly mortgage and MRTA contributes to your monthly Multiplier transactions, which means you stand to enjoy higher Multiplier account interest rates too.

2) Get a POSB Everyday credit card

Now, it might seem counterintuitive to get yourself a credit card in order to save money, but hear me out.

No matter the level of inflation, you will still have to spend on necessities like transport and food each month.

Getting a credit card can help you defray some of these costs through the deals that they offer.

The POSB Everyday Card offers cash rebates across a range of monthly necessities with no minimum spend required, like seven per cent on groceries from Sheng Siong and up to five per cent on electricity bills.

The most attractive deal of all is the five per cent cash rebates it offers on transport.

I spend about S$100 on transport and about S$100 on groceries a month.

If I use the POSB Everyday Card, I would earn around S$12 in rebates - a humble amount of money, but enough to pay for at least two meals.

Plus, if you have a Multiplier account, the expenditures on your card may qualify you for higher interest rates and thus, more savings.

Since you are already going to spend, you might as well get some rebates on those expenditures.

If you consolidate your monthly expenditures on your POSB card and hit S$800 a month, you will be able to enjoy up to 10 per cent of cash rebates on dining, online shopping, phone bills and more.

If you are applying for a POSB or DBS card for the first time, sign up for a POSB Everyday Card before Jan. 31, 2023.

They are currently having a promotion whereby meeting the qualifying criteria will grant you S$150 in cashback.

3) PAssion POSB debit card deals

When I first signed up for a credit card, I was apprehensive.

I, too, have heard about the consequences of credit card debts due to spending more than what they can actually afford.

So, if you are not ready for a credit card just yet, I understand.

The trusty PAssion POSB debit card that I am convinced is everyone’s starter ATM card in Singapore comes with plenty of deals and rewards too.

You can get up to 8 per cent savings when you spend at places like Cold Storage, Toast Box and 7-eleven.

There are also one-for-one deals on the tenth of every month and one per cent cashback at Takashimaya for the days you head to town.

So, no need to FOMO.

4) 24,000 deals in one kit

It’s almost in our blood as Singaporeans to hunt down the best deals.

Knowing this, DBS has put together a Lobang Kit to point you to the right deals.

This kit features deals from across 12 categories which you can browse through.

With over 24,000 deals across 550 merchants, you can save up to S$59 per month and up to 50 per cent across all DBS or POSB cards.

If you are thinking of trying out car rental with vendors such as BlueSG, DBS Lobang Kit even has a promo code for first time users.

From now till Dec. 31, movie lovers can also enjoy discounts for Golden Village tickets as well as promotions on popcorn and drinks.

There are many other deals you might find yourself enticed by, so go check it out for yourself.

To enjoy lobang from the kit, all you have to do is pay for the corresponding expenditures with a DBS or POSB debit or credit card.

Earn, save, spend and fight inflation

It is likely that the high inflation rates will carry on for some time.

Thankfully, DBS/POSB has rolled out a range of inflation relief solutions that are simple, affordable and accessible to tide you through the soaring prices.

All it takes is a few clicks to figure out how you can best take advantage of them.

This sponsored article made the writer realise that he does not have to be afraid of the rising price of his favourite mixed vegetable rice combo.

Top image via DBS, Downtown East

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.