2022 has been a tough year indeed.

Just as Covid-19 restrictions eased and people felt like life could finally return to normal, the Russia-Ukraine conflict began, bringing with it even more economic pain globally.

Supply chain disruptions, food shortages, extreme weather events and growing inflation rates have affected households around the world, including those in Singapore.

The Singapore government has given billions to ease the pain that hit every Singaporean’s back pocket.

From cash payouts and increased support for students in need to rebates for household utilities, the government put together support measures that have so far totalled S$3.56 billion to help Singaporeans and businesses cope with elevated inflation and challenging global growth.

In addition, an Assurance Package of S$6.6 billion has been put together to cushion the impact of the upcoming GST rate increase, with more help for lower-to-middle income groups.

This will come in the form of:

- Cash payouts

- CDC Vouchers

- Additional GST Voucher (GSTV) – U-Save rebates

- MediSave top-ups

Speaking in Parliament on Nov. 7, DPM and Finance Minister Lawrence Wong said the government would add S$1.4 billion to the Assurance Package (AP) for GST, bringing the total value of the package to around S$8 billion.

More details will be announced at Budget 2023.

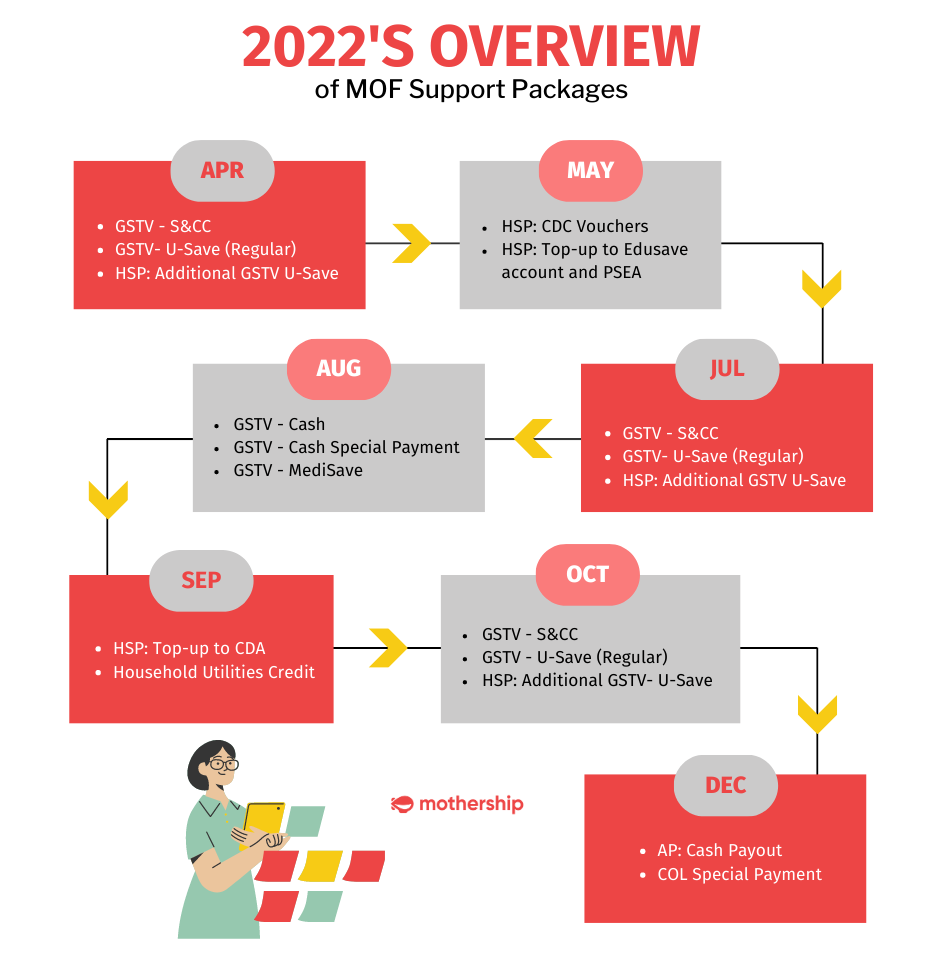

An overview of the support measures in 2022

Three key measures to help Singaporeans were announced in 2022:

- The Household Support Package (HSP), S$1.5 billion support package each in June and October to help people and businesses cope with cost-of-living expenses totalling S$3.56 billion.

- The Assurance Package to cushion the impact of the upcoming GST rate increase which will be disbursed over five years from 2022 to 2026.

- Enhancements to the permanent GST Voucher (GSTV) scheme to provide ongoing help to defray the GST expenses for lower- to middle-income Singaporean households.

This raft of support measures is on top of the permanent GST Voucher (GSTV) scheme which was introduced in Budget 2012 to help lower- and middle-income Singaporeans defray their GST expenses and was enhanced in 2022.

This includes Cash, MediSave for seniors, U-Save and Service and Conservancy Charges (S&CC) rebates for utilities and S&CC bills.

With so many payouts, it is not surprising some people are confused. So here are the measures, explained.

Household Support Package (HSP): Additional GSTV – U-Save: Additional rebates to help families stretch their budgets further. These were on top of the regular U-Save rebates.

HSP: Community Development Council (CDC) Vouchers: Singaporeans received $100 in CDC vouchers, which can be spent at participating hawkers and heartland merchants.

HSP: Top-up to Edusave Account and Post-Secondary Education Account (PSEA): A one-off $200 top-up for eligible students.

GSTV – Cash Special Payment: A one-off payment of up to $300 for eligible Singaporeans, on top of the regular GSTV – Cash.

HSP: Top-up to Child Development Account (CDA): A one-off top-up of $200 for Singapore children up to 6 years old. The CDA is a special savings account for children. The money accumulated can be spent at Baby Bonus approved institutions.

Household Utilities Credit: Singaporean households received a one-off $100 household utilities credit to offset their utility bills.

Cost-of Living (COL) Special Payment: A one-off payment of up to $500 for 2.5 million adult Singaporeans, which will be paid out progressively beginning in December together with the AP Cash Payout.

What to expect in Dec. 2022 and 2023

Here are some of the support measures that are heading your way:

COL Special Payment and AP Cash Payout: Up to S$500 cash for eligible adult Singaporeans, to be disbursed in December 2022 together with the AP Cash Payout of up to S$200 announced during Budget 2022. Do visit go.gov.sg/assurancepackage to check your eligibility for the cash payouts.

CDC Vouchers: A total of S$300 CDC vouchers will be disbursed to all Singaporean households in January 2023. It comprises $200 CDC Vouchers under the AP for GST and additional $100 CDC Vouchers as part of the $1.5 billion support package announced in October.

Public transport subsidies: Additional subsidy of about S$200 million in 2023 to cover the 10.6 percentage-point fare increase that will be carried over to future fare review exercises.

Public Transport Vouchers (PTVs): 600,000 PTVs worth S$30 each for resident households with monthly household income per person of not more than S$1,600.

Ministry of Education’s (MOE) financial assistance schemes: From Jan. 1, 2023, MOE will increase transport and meal subsidies for primary and secondary students. There will also be an increase in income eligibility thresholds for primary to degree students in our schools and publicly funded post-secondary education institutions, which takes effect from Jan. 1, 2023, or AY2023. Bursaries for pre-university students and full-time Institute of Technical Education (ITE) students will also be enhanced in AY2023. Close to 135,500 students will benefit from these enhancements.

Additional GSTV - U-Save: In January 2023, all eligible HDB households will receive an additional GST Voucher (GSTV) – U-Save of up to S$95 to offset utilities bills. This is on top of the regular GSTV – U-Save under the permanent GSTV scheme of up to S$95 for eligible HDB households.

GSTV – Cash (Seniors’ Bonus) and MediSave: Lower-income senior Singaporeans will also get a further cash boost in February 2023 - up to S$300 under the GSTV – Cash (Seniors’ Bonus) while eligible seniors 55 and above, and children 20 years and below will receive S$150 in their CPF MediSave Account under the AP MediSave.

The need for continued assistance comes as no surprise, of course.

DPM Wong had also reassured the public in Parliament in November: “We will help every Singaporean family through the Assurance Package. We will continue to uphold these commitments even as the inflationary outlook evolves.”

This is a sponsored article by the Ministry of Finance.

Top image via Canva

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.