Like most people, I experienced many significant milestones in my first year as a working adult.

One of the memorable ones was financial planning.

I remember it as a rather serious affair, transacted over the course of three long weekday evening meetings with an agent at various fast food restaurants in a shopping centre in Serangoon.

Each meeting was highly illuminating but also quite stressful for me, a financial newbie at the time.

Yes, I could have taken more time to decide, but I was also keen to get it over and done with.

Now, four years later, I’m happy with the decisions I made back then, but I do wish things could have been different.

An easy first-step insurance

Enter SNACK by Income.

The financial lifestyle provider is named for how it doles out investment and insurance products in bite-sized portions through its mobile app.

It offers “an alternative approach” to the high dollar value purchases typically involved when it comes to buying insurance coverage, or investing.

Instead of thousands, the possible premiums for SNACK Insurance start from S$0.30, while one can pick up SNACK Investment products for as low as S$1.

These premiums are paid every time the app detects that you have completed a pre-set “Lifestyle Activity”, such as when you take public transport, order food delivery, or exercise.

You then accumulate insurance coverage in incremental amounts of a few hundred dollars each time.

After trying out the app for a week, I was covered for S$46,333 (including S$6,000 of free coverage across three policies — life, accident, and critical illness).

Parts of your daily routine trigger insurance purchases

The first step in setting up the app was to decide which activities to link to insurance purchases.

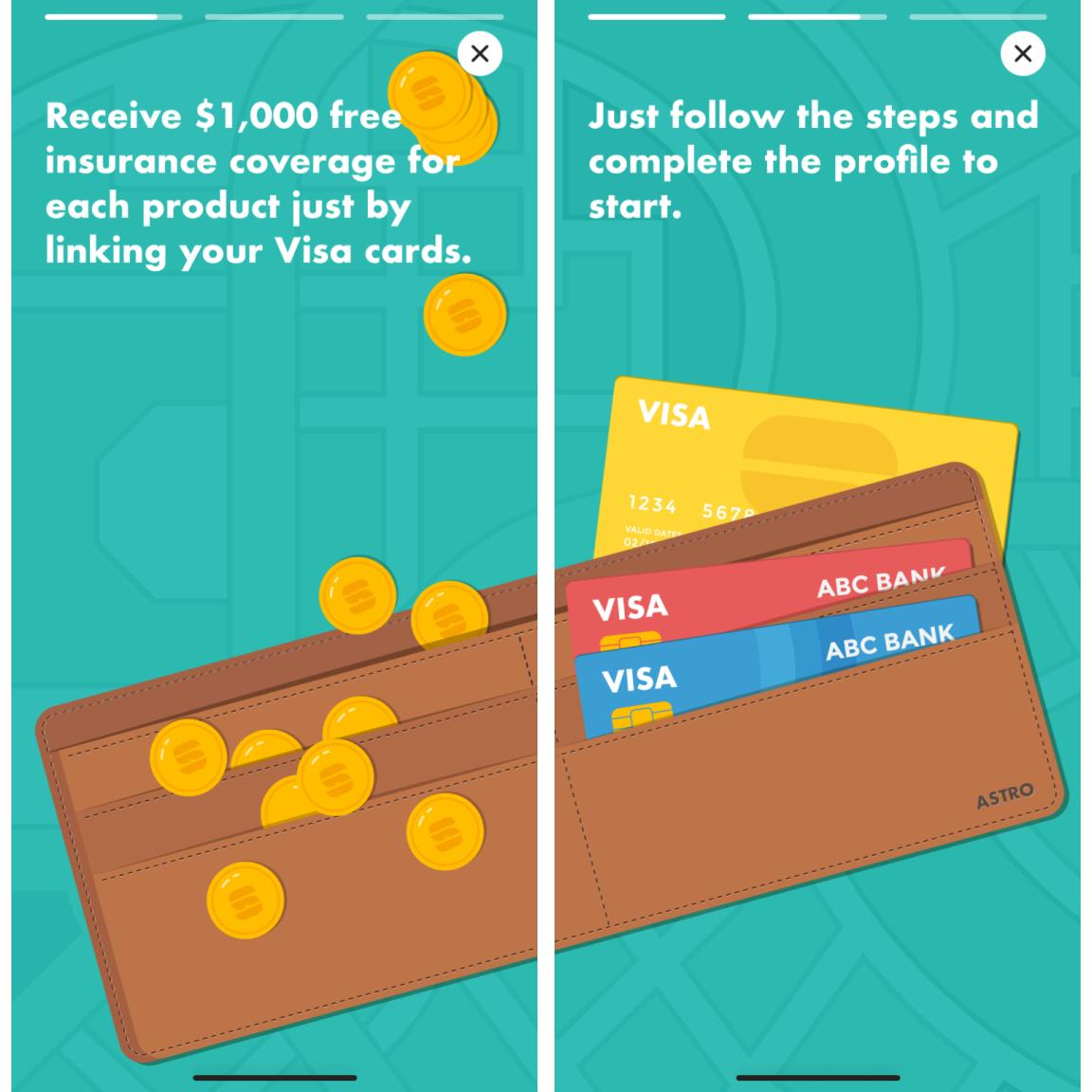

The revamped app interface includes full-screen information panels, and you can tap your way through at your own pace. Screenshot via SNACK app.

The revamped app interface includes full-screen information panels, and you can tap your way through at your own pace. Screenshot via SNACK app.

The list of activities you can choose from includes various spending categories:

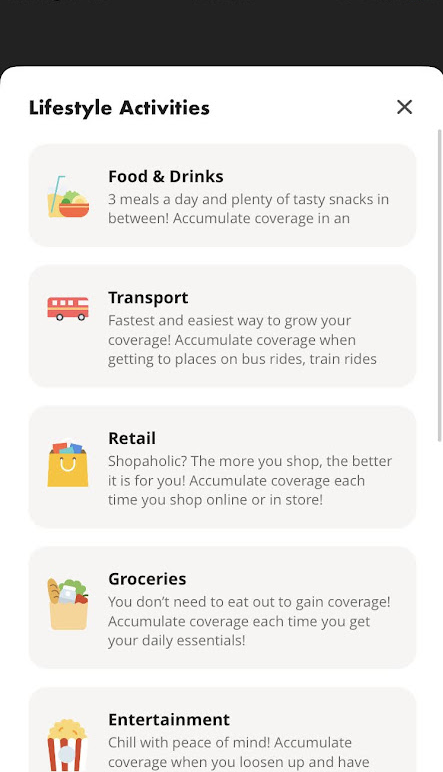

Screenshot via SNACK app.

Screenshot via SNACK app.

As well as hitting the rather achievable target of 5,000 steps per day.

I selected all the categories, knowing that I could always return to the app to disable some if needed.

Going out, getting rewarded

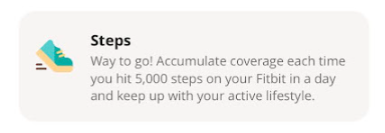

SNACK communicates with “Activity Sources” such as VISA, EZ-Link, and activity tracking apps (Garmin, Fitbit, or Apple Health) so it knows when you have performed these activities.

I duly registered all my VISA cards to not miss out on any free coverage. Screenshot via SNACK app.

I duly registered all my VISA cards to not miss out on any free coverage. Screenshot via SNACK app.

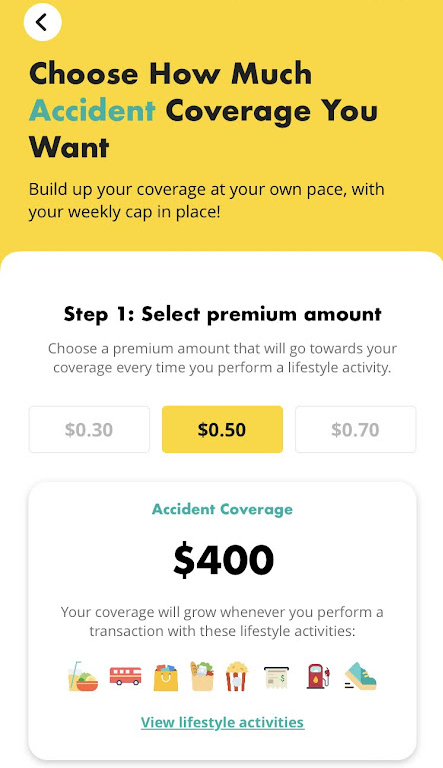

Choosing premium amount

I was also asked to choose the premium amount: either S$0.30, S$0.50, or S$0.70.

Choosing the middle option. Screenshot via SNACK app.

Choosing the middle option. Screenshot via SNACK app.

With the wisdom of Goldilocks, I chose S$0.50. After all, it didn’t really matter since 1) it was a relatively small amount, and 2) I could always go back to the app to raise or lower the amount.

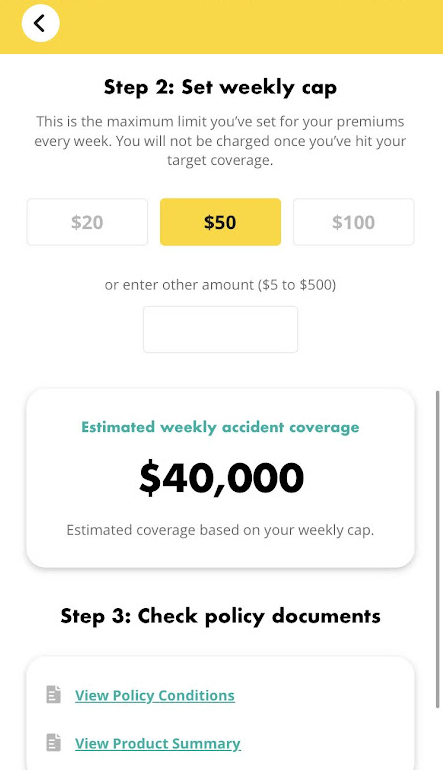

It also helped that I could set up a weekly cap (I chose S$50).

Spoiler alert: I didn’t hit S$50 by the end of the week. Screenshot via SNACK app.

Spoiler alert: I didn’t hit S$50 by the end of the week. Screenshot via SNACK app.

So now whenever I used one of my Visa credit cards to pay for a “Lifestyle Activity” like going to the cinema, I would automatically be charged S$0.50 until I hit the weekly cap of S$50 — all the while accumulating accident coverage.

It was a similar set-up process for the other two policies (critical illness and life).

And with that, I was ready to go out into the world to earn my coverage.

Screenshot via SNACK app.

Screenshot via SNACK app.

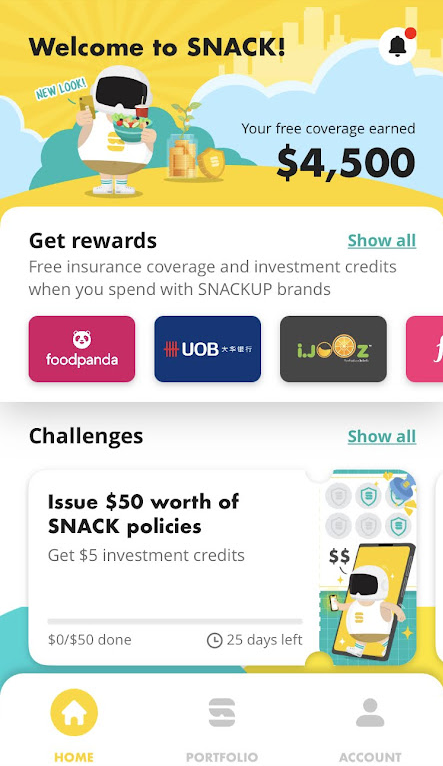

But not before scoring S$4,500 of free coverage — S$1,000 in each category as a starting bonus from SNACK, and S$500 for completing the set-up process for each of the three.

Challenge accepted. Screenshot via SNACK app.

Challenge accepted. Screenshot via SNACK app.

On that day itself, I started to accumulate activities, and with that, coverage.

My first transaction recorded by SNACK: a lunch of Nasi Lemak. Photo by Nigel Chua.

My first transaction recorded by SNACK: a lunch of Nasi Lemak. Photo by Nigel Chua.

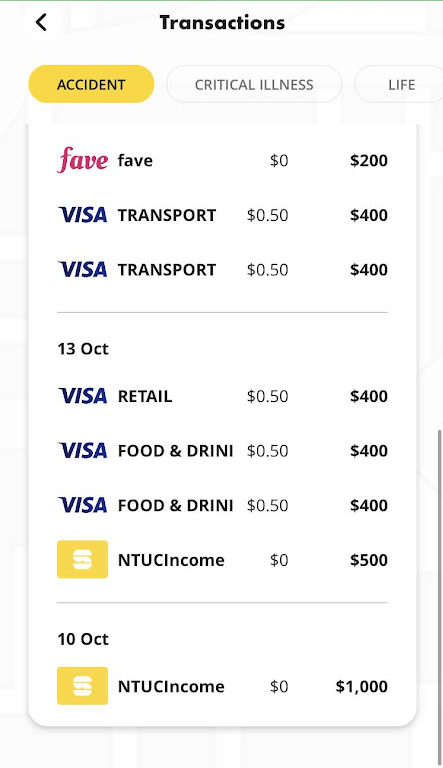

Oct. 13: Lunch, dinner, and picking up some household items on the way home. Three transactions, and S$1,200 coverage for S$1.50. Screenshot via SNACK app.

Oct. 13: Lunch, dinner, and picking up some household items on the way home. Three transactions, and S$1,200 coverage for S$1.50. Screenshot via SNACK app.

Each bite-sized chunk of insurance coverage is valid for 360 days — roughly a year.

Which means that as I continue to live my life in the course of the year ahead, I’ll continue to accumulate coverage and keep the policy running.

Biological age calculated daily

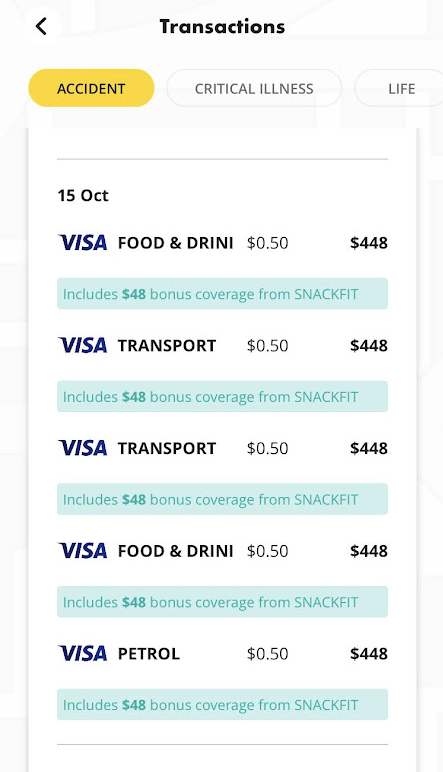

As someone who generally tries to keep healthy and active, I was very pleased to know that I am getting bonus coverage for all my efforts, under a feature called SNACKFIT.

Screenshot via SNACK app.

Screenshot via SNACK app.

Each day, SNACKFIT tracks five key metrics: steps, calories burnt, BMI, resting heart rate, and sleep.

The younger your body, the more bonus coverage you get, with a maximum of 20 per cent bonus coverage for those whose biological age is five years younger than their actual age.

Oct. 15: 12 per cent bonus coverage for my accident policy, thanks to my biological age being detected as 3 years younger than my calendar age. Screenshot via SNACK.

Oct. 15: 12 per cent bonus coverage for my accident policy, thanks to my biological age being detected as 3 years younger than my calendar age. Screenshot via SNACK.

It’s definitely an incentive to get enough rest and exercise, and to stay consistent with these healthy habits because the data is pulled daily.

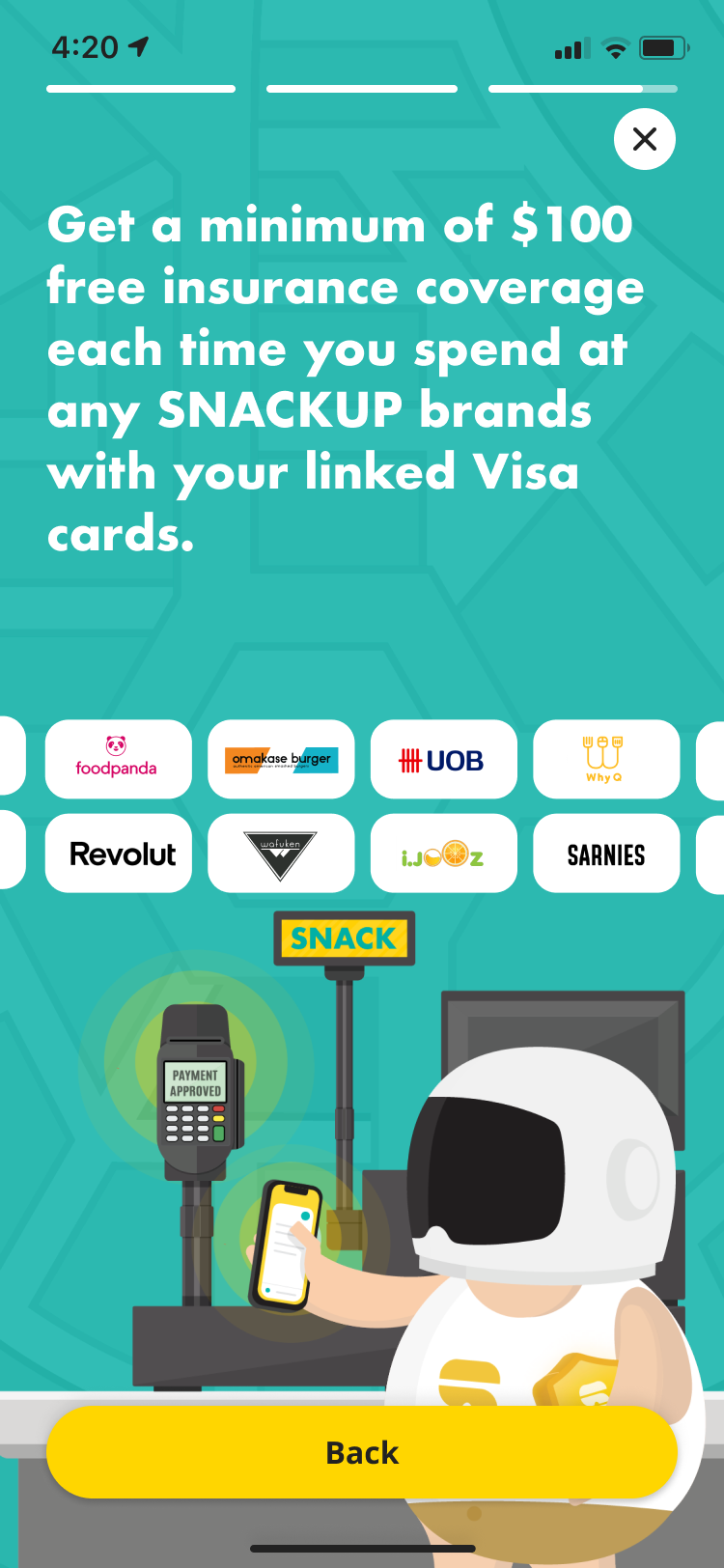

Another way to get bonus coverage and investment credits is to make purchases with SNACK’s partner merchants — or, SNACKUP merchants — where spending with your linked VISA card gets you bonus coverage and investment credits.

One of them being orange juice vending machine brand IJOOZ.

Juiced-to-order. GIF by Nigel Chua.

Juiced-to-order. GIF by Nigel Chua.

S$2 for four oranges, juiced on the spot, S$100 free insurance coverage, and S$0.20 free insurance credits? Cheers to that.

Cheers. Photo by Nigel Chua.

Cheers. Photo by Nigel Chua.

I also got bonus insurance by paying with Fave, and ordering on foodpanda — both are SNACKUP merchants.

This meal at Wafuken also got me S$100 free insurance coverage and S$0.20 free investment credits.

Healthy meal, free insurance and free investment credits. Nice.

Healthy meal, free insurance and free investment credits. Nice.

Easy win

At the end of one week, I accumulated S$46,333 coverage, with S$40.5 of premiums in total:

- Life: S$19,533, with S$13.50 in total premiums paid

- Accident: S$13,400, with S$13.50 in total premiums paid

- Critical illness: S$13,400, with S$13.50 in total premiums paid

A good chunk of the total — S$6,000 — was free coverage that I scored, by staying healthy and active, and from SNACK’s various giveaways and promotions with their partner merchants.

Of course, I could have signed one big policy for equivalent or even greater coverage in just a day, but that might have taken over a month to research and plan.

Overall, SNACK by Income serves as a low-cost, low-effort way to get involved in the world of insurance, with challenges, bonuses, and free coverage to help keep you engaged in the process.

It’s something I imagine would have been endlessly helpful for me, back when I was considering my first insurance plan.

It can also serve as an add-on to existing financial products. At the minimum, I’m going to keep the accident policy for sure, as I didn’t have one prior to this.

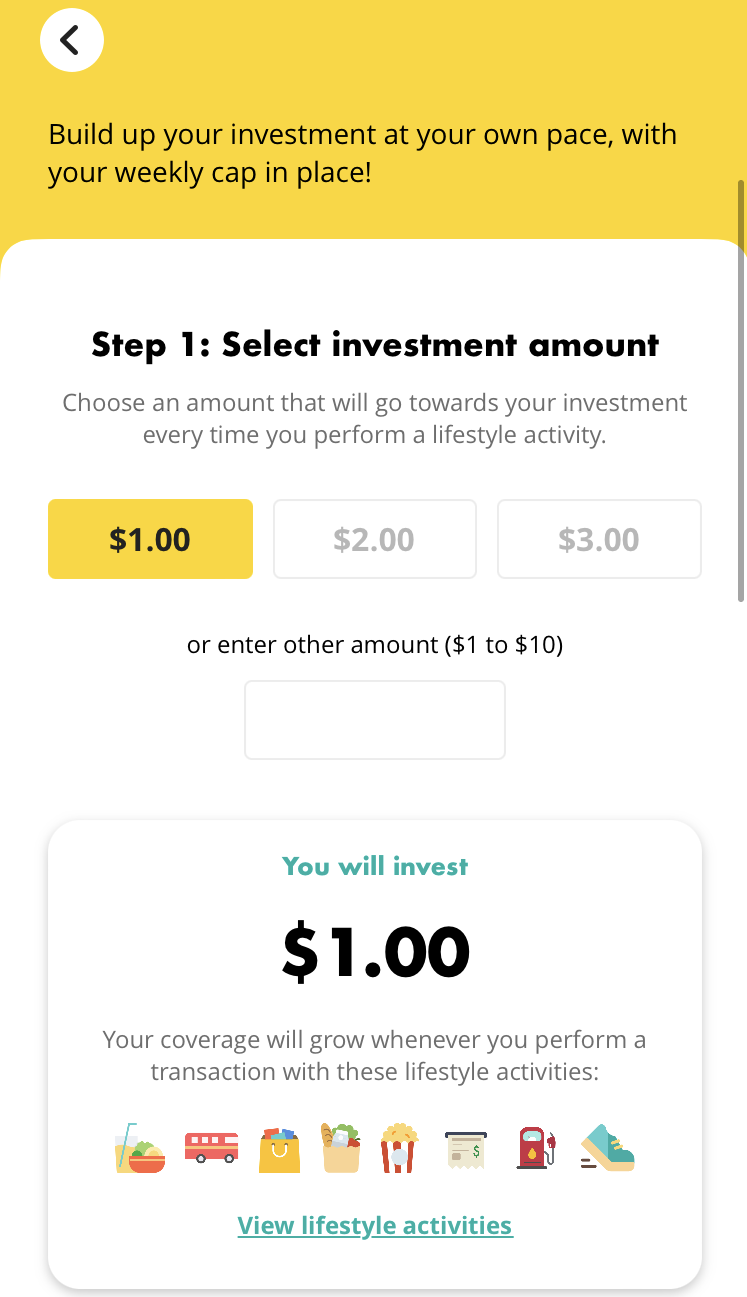

Get started on investment just as easily

SNACK is not just an insurance provider.

It also allows you to get started on investments, with very similar mechanics to how SNACK Insurance coverage is accumulated.

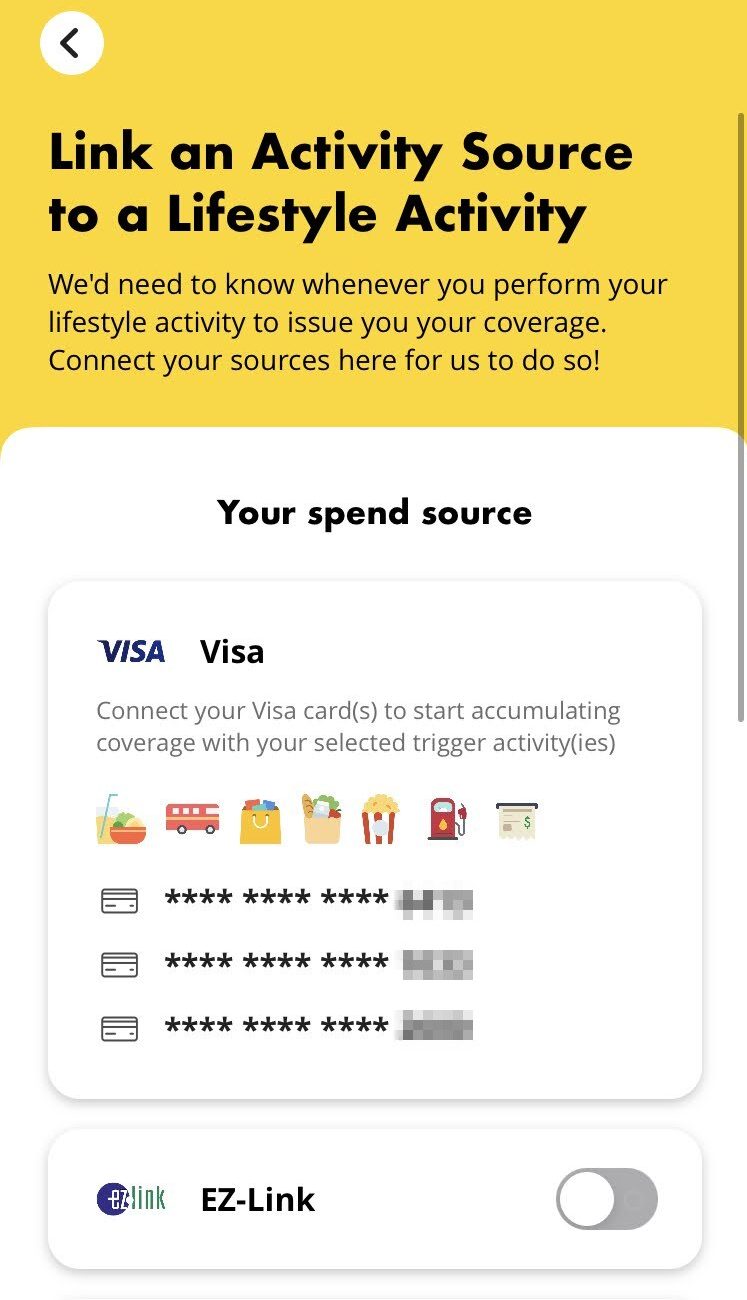

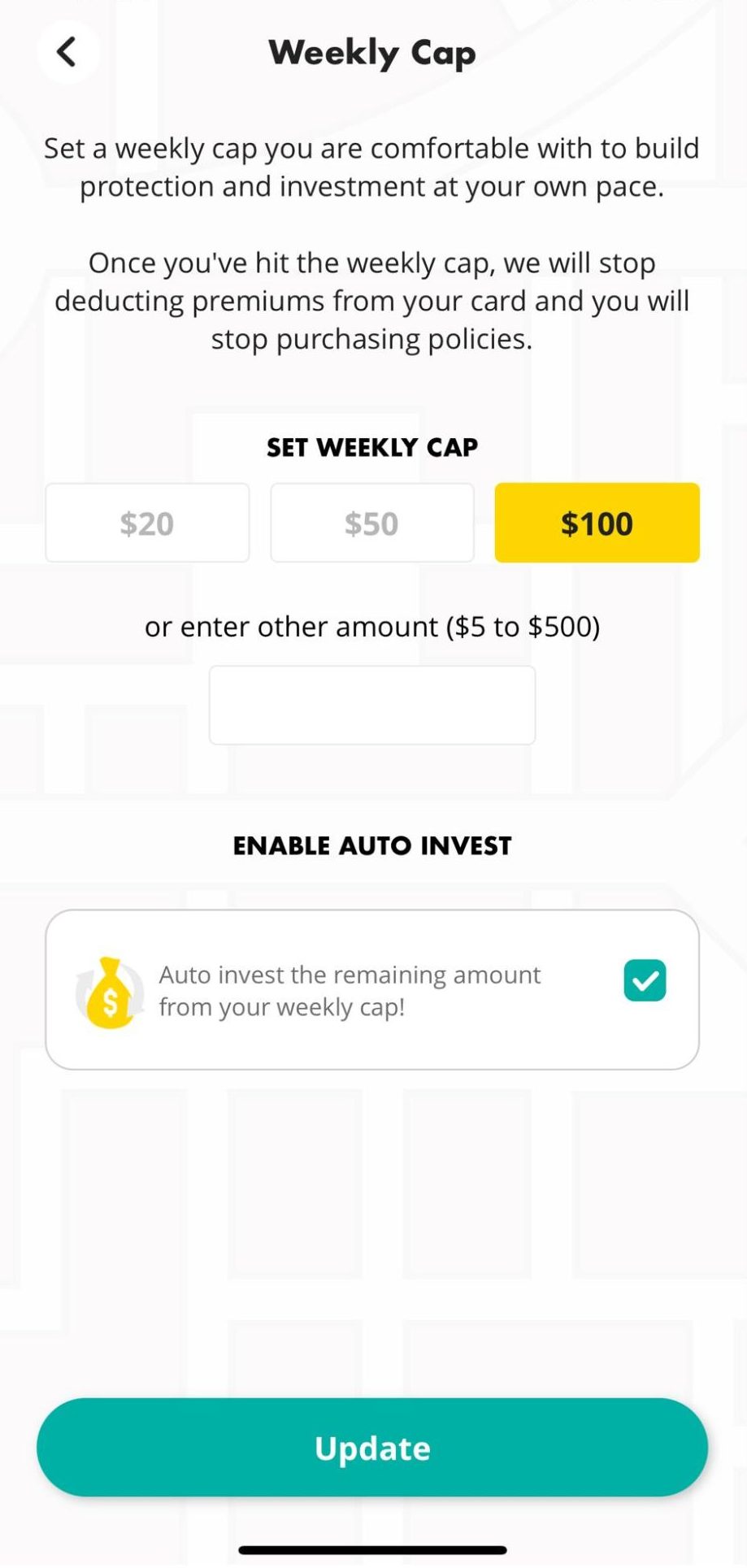

Day-to-day lifestyle activities (the same ones that trigger insurance premiums) can be set up to trigger investment purchases in amounts of S$1, S$2, or S$3, with a weekly cap you can set depending on your budget for investment.

Screenshot via SNACK app.

Screenshot via SNACK app.

Just like SNACK Insurance, it’s a set-and-forget mechanism that allows you to build your financial portfolio without needing to constantly monitor it.

There’s also an auto-invest feature which allows SNACK to automatically invest the remaining amount from the weekly cap that you have set.

You can enable or disable this depending on your preference.

Screenshot via SNACK app.

Screenshot via SNACK app.

S$80 investment credits for new users till Dec. 31

If you’re a new SNACK user, you can get S$80 investment credits when you sign up for a SNACK account with referral code <MS80> and start your SNACK Investment.

You can also check out other exciting promotions and bonuses through the SNACK app itself.

Just follow these steps:

- Create a SNACK account with referral code <MS80>

- Go to “PORTFOLIO” and tap “Start now” on Investment

- Set up your account and link your Visa card

- Complete the Customer Knowledge Assessment (CKA) and ensure you’ve boosted your Investment

If you’re interested to try it out, download the SNACK app and check out SNACK’s step-by-step guide here to help you get started with SNACK Investment.

This sponsored article by SNACK by Income allowed this writer to get fuss-free extra insurance.

Top images by Nigel Chua.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.