With so many “shields”, we get that it can be a tad confusing. Don’t worry, help is here.

What is CareShield Life?

CareShield Life is a national long-term care insurance scheme that provides basic financial protection for you and your loved ones against severe disability.

One in two healthy Singaporeans aged 65 could become severely disabled in their lifetime.

If that happens to you or any of your family members (we don’t wish that on you, but it is important to plan for the future), you or your family member will receive monthly cash payouts.

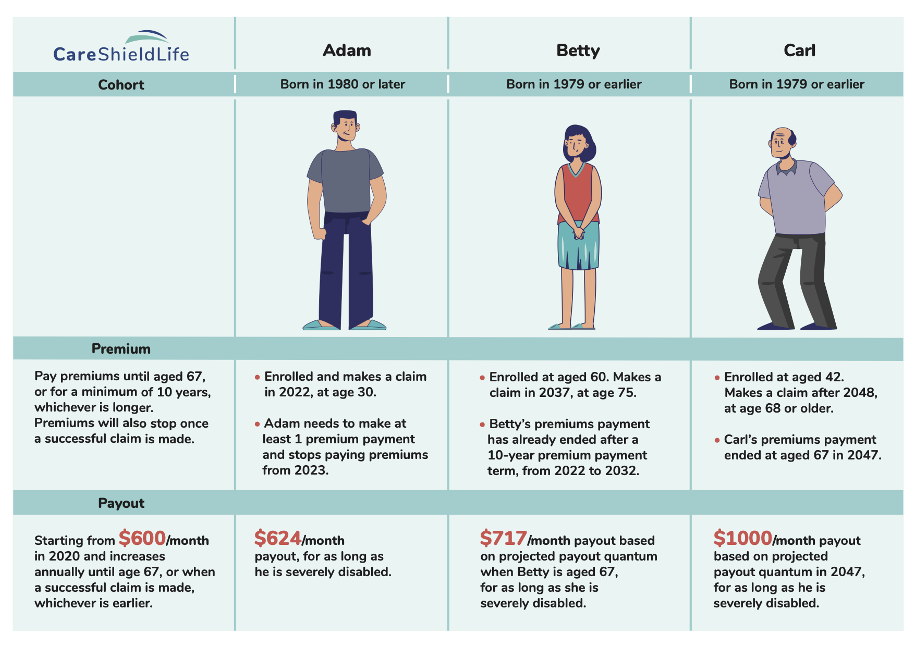

The quantum of monthly payouts started at S$600 in 2020 and increases annually until you turn 67, or when a claim is successfully made, whichever is earlier.

Payouts will continue for life, for as long as you remain severely disabled.

To pay for the premiums, you can use your own Medisave or your family members’ MediSave.

Once you reach 67 or 10 years after joining, whichever is later, you stop paying premiums and will be covered for life – even if you’re 100 years old.

Who is covered by CareShield Life?

From Oct. 1 2020, if you are a Singapore Citizen or Permanent Resident born in 1980 or later, you are automatically covered under CareShield Life or when you turn 30, whichever is later.

Here’s a nifty chart to show you how it works:

Image via MOH.

Image via MOH.

If you are a Singapore Citizen or Permanent Resident born in 1979 or earlier, CareShield Life is optional for you.

For those born between 1970 and 1979 who are insured under ElderShield 400, and not severely disabled, you will be automatically enrolled into CareShield Life from Dec. 1 2021.

No action is required unless you would like to opt out, which you can do so by Dec. 31 2023.

If you were born in 1979 or earlier and are not automatically enrolled, you can now join CareShield Life at careshieldlife.gov.sg/join if you are not severely disabled.

You can find out if you or your loved ones are covered or have been automatically enrolled at careshieldlife.gov.sg.

How much do I or my family members have to pay?

If you are currently covered by an ElderShield policy and want to make the switch, the ElderShield premiums that you had previously paid for will be taken into account when your CareShield Life premium is computed.

And remember, you can use your own Medisave or your family members’ (i.e. spouse, parents, children, siblings, or grandchildren) MediSave to pay for the full premiums – no out-of-pocket cash will be required in this case.

There are also premium subsidies available to ensure no one will lose coverage due to an inability to pay premiums.

You can access the CareShield Life Premium Checker e-Service at careshieldlife.gov.sg/cshl-premium-checker to view your premiums and subsidies available to you with your Singpass.

TL;DR: Long-term care insurance that pays out upon severe disability. Mandatory and universal for all Singapore Citizens and Permanent Residents born in 1980 or after. Those older can choose to join if not severely disabled.

What is ElderShield?

The predecessor of CareShield Life, ElderShield, was introduced in 2002 as an insurance scheme that provides basic financial protection to those who need long-term care, especially in old age.

ElderShield policies were previously administered by three private insurers appointed by the Ministry of Health – Aviva, Great Eastern, or NTUC Income.

Policyholder will receive payouts depending on the plans they are on.

ElderShield 300 (the default plan for those who joined ElderShield between Sep. 2002 and Aug. 2007) pays out S$300 per month, for up to 60 months.

ElderShield 400 (the default plan for those who joined ElderShield from Sep.2007 onwards) pays out S$400 per month, for up to 72 months.

As of Nov. 1 2021, the government has taken over the administration of the ElderShield scheme from the private insurers.

But no worries.

There will be no change to ElderShield coverage for existing policyholders if they choose not to upgrade to CareShield Life.

Private insurers also offer Supplements that provide higher coverage above the basic ElderShield or CareShield Life, at different pricing levels.

Who is covered by ElderShield?

From Sep. 2002 to Dec. 2019, Singapore Citizens or Permanent Residents with a MediSave account were automatically enrolled into ElderShield at the age of 40.

ElderShield is no longer open for joining.

ElderShield did not cover individuals who already had disabilities or who were too old to join the scheme at the launch of ElderShield.

These individuals are instead eligible to receive assistance under the Interim Disability Assistance Programme for the Elderly (IDAPE) if they are lower-income and become severely disabled.

TL;DR: Long-term care insurance that pays out upon severe disability. ElderShield policyholders can choose to join CareShield Life.

What is MediShield Life?

MediShield Life is a basic health insurance plan that helps Singapore Citizens and Permanent Residents pay large hospital bills and selected outpatient treatments like chemotherapy for cancer and dialysis.

MediShield Life replaced MediShield on Nov. 1 2015, offering wider coverage, higher payouts and protection for life, for all Singapore Citizens and Permanent Residents, including seniors and individuals with pre-existing health conditions.

MediShield Life premiums can be fully paid with MediSave too, and premium subsidies are available for lower to middle-income individuals, the Merdeka Generation, and the Pioneer Generation.

What about Integrated Shield Plans?

On top of MediShield Life, you can purchase an integrated shield plan (IP) from private insurers.

These plans are like an add-on to your MediShield Life coverage for hospitalisation expenses, and give you the flexibility to increase your coverage by paying additional premiums.

There are seven IP insurers, each providing a range of plans that allow you to vary your coverage according to your budget and needs.

Although these protection plans aren’t national insurance policies, you may consider purchasing them if you want additional coverage of hospital fees in unsubsidised A/B1 wards in public hospitals or private hospitals, and can afford the higher premiums.

Here’s a quick overview of everything you need know:

| Schemes | What is covered? | Who is covered? | Who is it administered by? | What else do you need to know? |

| CareShield Life | Long-term care expenses, e.g. care arrangements due to disability. | All Singapore Citizens and Permanent Residents born in 1980 or later. Optional for those born in 1979 or earlier. | CPFB and AIC | |

| ElderShield | Long-term care expenses, e.g. care arrangements due to disability. | Those who did not opt-out. | CPFB and AIC | |

| MediShield Life | Large hospital bills in subsidised B2/C wards | All Singapore Citizens and Permanent Residents. | CPFB | MediShield Life is a basic health insurance plan with benefits sized to cover Class B2/C bills in public hospitals. |

| Integrated Shield plans | Large hospital bills in unsubsidised B1/A wards in public hospitals or private hospitals. | Those who choose to take up these plans. | Private insurers | Integrated Shield Plans are optional health insurance plans that consist of two components: the MediShield Life component and an additional private insurance component offered by a private insurer, targeted at covering higher ward classes, such as B1/A wards in public hospitals or private hospital wards. |

In a nutshell, MediShield Life covers hospital fees, while CareShield Life and ElderShield provide financial support for individuals for their basic long-term care needs, should they become severely disabled.

You can be covered by MediShield Life, and either CareShield Life or ElderShield simultaneously.

It’s never too early to plan for your golden years.

CareShield Life is an improved and more comprehensive scheme that has higher monthly and lifetime payouts as compared to ElderShield.

It also has worldwide coverage, should you decide to move overseas.

These days, we live longer with a higher chance of chronic diseases (like diabetes) across all age groups.

Getting covered by a basic insurance plan like CareShield Life is ideal – it can truly help with the finances and stress that will surely come in the event of severe disability.

We need to plan for accidents and illnesses way before they happen, as they can happen to anyone, anytime, and can cause great financial strain if we aren’t prepared.

Thankfully, there are many insurance schemes that help to make medical and long-term care more affordable in the event that you need help.

This sponsored post is brought to you by MOH.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.