Unless you’ve been living under a rock, you’ve probably heard that investing is a must in sunny Singapore.

And while much has been said and done about why you should invest, advice on just how to begin investing is equally important.

We crowdsourced questions our readers had about investing and got Lorna Tan, the Head of Financial Planning Literacy at DBS Bank, to answer some of them.

If you’d like to know more about the topic of investing or aren’t sure how to begin your investing journey, this article is for you.

1) What is the most important factor to think about as a beginner in investing?

As a beginner in investing, it is quite likely that you have yet to acquire a deep understanding of investing.

If you have little to no experience, learning how to invest can be a daunting task.

Having said that, the fact remains that investing presents opportunities to make your money work harder for you over time.

Important factors to think about as a beginner in investing include:

- Arming yourself with more knowledge on the wide range of investment choices

- Understanding your risk profile and investing time horizon

There are many reputable sources out there, including DBS’ online repository of financial planning articles (nav.sg) that are catered to help the public understand these concepts better and make informed decisions.

Here’s a checklist of questions for beginners to consider when making an investment decision:

- Are you feeling pressured to buy a stock because the price keeps rising?

- Are you buying the stock or fund only because your friends are?

- Do you have a sufficient understanding of the investment product in question?

- Are you putting most of your available savings into one stock or product?

- Will you struggle financially if you make losses on your investment?

Young investors should take note that investing is just one component of a holistic financial plan.

Executing an all-rounded investment strategy well can help you achieve overall financial wellness.

2) What age must I be to invest and at what age should I start investing?

In order to open a brokerage account to purchase individual stocks or sign up for pooled investment products like robo-advisors and unit trusts in Singapore, you’ll need to be at least 18 years old.

However, one should never be in a rush to invest.

Before using your savings to invest, your priority should always be to:

- Do effective budgeting for your monthly expenses

- Have at least three to six months worth of emergency savings

- Have a suitable hospitalisation insurance plan

Although there is no definite age that individuals should start investing by (it is never too late), it is also important to note that time in the market trumps timing the market.

3a) Can I just save and not invest?

For most people, just saving alone – and not investing – will not enable them to achieve their life goals.

Not investing because you don’t want to take any risks also poses a risk because your purchasing power with the same dollar shrinks with time.

This is because you are effectively losing money any time your savings don’t grow at the same rate as inflation.

This is a very real possibility considering that presently, the interest rate for savings (in many banks) is virtually zero.

Some retail investors may see financial security as synonymous with the absence of volatility or price fluctuations.

However, in seeking security, they overlook the danger of outliving their savings due to longevity and inflation.

Here’s an example of what I mean:

Let’s assume that you hide S$1,000 in your biscuit tin. Based on an inflation rate of 2 per cent each year, you will be able to purchase goods worth only just over S$800 in 10 years’ time (or less than S$700 after 20 years). When seen this way, the biggest risk is not taking any risk.

As saving and investing are two sides of the same coin, adopting a disciplined saving habit and learning how to invest wisely will make your money work harder for you.

For the wealth preservation portion of your portfolio, you may consider the following options:

- The Central Provident Fund accounts

- Higher yielding interest bank accounts like DBS Multiplier and other low-risk investments like Singapore Savings Bonds

- Principal-guaranteed endowment insurance plans

- Fixed income products

3b) Any suggestions if I don’t have much savings but still want to invest?

If you’re still a student or just starting out in your career, it is understandable if you do not have a comfortable level of savings.

Emergency fund

As a rule of thumb, you should have at least three to six months worth of emergency cash before investing.

This means that if your monthly expenditure is S$1,000, you’ll need to set aside S$3,000 to S$6,000 so that unexpected events don’t disrupt your daily life.

For gig economy workers or freelancers, a recommended figure for an emergency fund would be at least 12 months in monthly expenses.

Insurance coverage

Once the emergency cash is set aside, you may wish to consider your basic insurance needs, especially if you have dependents.

A top priority is getting adequate health insurance while you’re in the pink of health so that you are still considered insurable for plans that cover hospitalisation, like an Integrated Shield plan, and critical illnesses.

Regular Savings Plan

If you’re a first-time investor with little savings, the most practical approach to take when starting your investment journey is through a Regular Savings Plan (RSP) like DBS Invest-Saver.

RSPs - accessible to first jobbers given their low entry point - let you set aside a predetermined amount of money into exchange-traded funds and/or unit trusts each month.

You can start investing in most RSPs including DBS Invest-Saver for as little as S$100 per month.

Robo-advisors

Another option for first jobbers is the increasingly popular robo-advisors.

They are digital platforms that provide either fully automated or hybrid algorithm-driven investment services.

Minimum investment sums for robo-advisors are relatively low.

With DBS’s digiPortfolio, first-time investors are able to build diversified portfolios with a minimum lump-sum investment of S$1,000.

All you have to do is fill in a short questionnaire covering your age, investment horizon, risk tolerance and investible savings.

Robo-advisors then run those answers through an algorithm and use an asset allocation approach to build a portfolio that meets your goals and is aligned to your risk profile.

4) What are some of the most common investment mistakes people have made?

Here are three common investment mistakes.

1) Overconfidence

Since the Covid-19 pandemic, retail investor involvement in financial markets has grown considerably.

A good portion of this group are young, first-time investors (aged 18 to 25 years old).

Unlike seasoned investors, many of these new investors have largely seen markets rebound and not experienced prolonged periods of decline.

As a result, some of these new investors might get overconfident in their own abilities - a common behavioural bias among all investors - even if they have not done sufficient research.

This trend has been compounded by speculation, which can be exciting and attractive to many.

While speculation on certain stocks can result in huge gains as seen in meme stocks like GameStop and AMC, less experienced investors should only do so with funds that they can afford to lose or have no immediate need for.

2) Putting all your eggs in one basket

Investing all your savings in one stock or security exposes you to higher potential losses if the investment tanks.

It is prudent to manage your risk by diversifying your investments across different asset classes, companies, industries and geography.

Diversification is key to greater peace of mind and sustainable returns.

3) Thinking short term

Make time your ally and adopt a long-term investing approach so as to ride out ups and downs in the market.

Investing for the short term may not give your investments sufficient time to grow.

When you build a portfolio that takes into account your risk profile and goals, you can stay invested and avoid timing the market.

Additional Tips:

It is critical that investors, young and old, do their due diligence via researching a variety of sources when investing.

After all, it is your hard-earned savings and it’s your primary responsibility to understand whether investing in a particular product is suitable for you.

For young investors who have little or no experience in understanding financial concepts, learning how to invest can be a daunting task.

Still, the fact remains that investing presents opportunities to make your money work harder, so do not feel intimidated by having to learn some basics of investing.

There are many reputable sources out there, including DBS’ online repository of financial planning articles (nav.sg) that are catered to helping the public understand these concepts better and make informed choices.

5a) Is there an optimal number of companies one should buy stocks of? What should I research about a company before investing in them?

The exact number of stocks in your portfolio is a personal choice based on your knowledge, skills, risk profile, and time horizon.

Some financial experts believe that holding 20 to 30 stocks is necessary in order to see the benefits of a diversified investment portfolio while others advise holding 15 to 20 stocks in the portfolios.

If you find it challenging to research on 20 or more stocks, you may wish to consider using index funds or exchange traded funds (ETFs) which enable you to buy into a basket of stocks to provide diversification across different companies and sectors.

Diversification is all about spreading your investments across many different baskets.

Placing your capital in different investments reduces the likelihood of your investment being wiped out.

While not exhaustive, here are some tips on what to look out for when considering whether to buy a stock:

- How does the company make its money?

- Revenue and net profit (has it been growing over time, and is the growth sustainable?)

- Is the company borrowing to fund its growth at a level that is comparable to its peers?

- Does the company have a track record of being able to repay its debt on time?

- Does the management team of the company instill confidence in you as an investor?

- Do valuation metrics suggest the company is trading at a level that you are comfortable with investing at?

5b) What are index funds?

An index fund is a type of unit trust or exchange-traded fund (ETF) that is designed to track or match the performance of a financial market index.

Examples of indices are Singapore’s Straits Times Index and the S&P 500 in the US.

There are also sector-specific indices, which track the performance of different areas of the economy.

This includes an index covering the top technology companies globally or even the top consumer brands.

With an index fund, you are purchasing a Unit Trust or ETF that tracks the performance of a particular market or sector, allowing you to diversify your investable funds, at a relatively low cost.

Furthermore, building an investment portfolio from scratch with individual stocks can be an arduous task.

There is much research to be done on individual stocks as well as sectors (e.g Oil and Gas, Property, etc).

What’s more, you have to align it with your risk appetite, take note of the changing economic conditions and consider how they affect the stocks you have picked.

That’s a lot of work for an individual to do, let alone a beginner.

Investing through unit trusts and ETFs allows you to diversify your investment portfolio with relative ease to capture broad-based performance of a particular market or sector.

By using a combination of unit trusts and ETFs covering different markets and sectors, retail investors have a hassle-free way to construct an investment portfolio.

That said, always remember to do your due diligence and do not rush into selecting ETFs when building up your portfolio.

6) Lump Sum or monthly investment? When it comes to investing monthly from your salary, what should you invest in?

When it comes to investing via a lump sum or a monthly sum, it boils down to personal preferences as each approach has its own set of specific advantages.

It is important that you invest according to which of these two methods is most advantageous to you.

Lump Sum Investing

The benefit of lump sum investing is that you can take advantage of market sell-offs to purchase stocks, ETFs and even Unit Trusts at an attractive price level.

Of course, this usually works best if you have done your research and are of the view that they might be undervalued.

Lump sum investing also works best if you have sufficient cash on hand.

A by-product of this is that you can minimise fees as you are making fewer transactions.

If you have just gotten your bonus, received some inheritance or want to invest money you have slowly built up over the years, you can consider lump sum investing in ETFs or Unit Trusts.

Monthly Investing

An alternative to making lump sum investments is dollar-cost averaging (DCA) through a regular savings plan.

When investing through DCA, you are committing to making monthly regular investments of a predetermined amount in the same product.

An advantage of DCA is that by making regular but small investments, you are averaging out the cost of the shares, ETFs or Unit Trusts.

This means buying more units when prices are low and fewer when prices are high.

With DCA, you are relying on “time in the market” rather than “timing the market.”

And this is important because historically, good quality stocks have their ups and downs, but over the long term, their prices will tend to trend higher.

By staying invested for longer, you achieve the “time in market” factor.

In contrast, timing the market is a very difficult task because it involves trying to pick the moment when stock prices are at lows.

Even highly trained professionals find it difficult to do this consistently.

DCA is one of the most accessible ways for beginner investors or those who are not able to make lump sum investments to get started on their investment journey.

DBS Invest-Saver is an investment product that uses DCA, where you can invest from as little as S$100 per month on a selection of ETFs and Unit Trusts.

7) How long should I invest my money for and when should I withdraw it?

How long you should invest your money boils down to three key factors:

- Your financial goals

- Resources

- Investment time horizon

When investing, it helps to set financial goals as they form an important step in your journey to securing your financial health in both the short and long-term.

If you do not set such goals, you might end up spending more money than you should or even come up short when planning for certain milestones like your wedding or your retirement.

Taking note of your goals will also enable you to live comfortably within your budget and boost your confidence in making informed decisions.

Planning for retirement

When it comes to planning for one’s retirement, a key question that pops up is always how much and when you should withdraw your retirement funds.

You should not withdraw all your funds at one go as you will still need to invest with some degree of risk to ensure your assets do not run out during your lifetime, as well as to mitigate inflation.

One common approach to investing for short-term and long-term goals like retirement is by using a time-segmented bucket strategy.

As its name suggests, this strategy involves placing your assets in a few retirement income segments – called buckets.

Rather than having all your assets in a single portfolio—with a single risk profile and asset allocation—you can split your assets into different buckets, each with a different time frame, risk profile and asset allocation.

This allows you to maximise your investment returns for each stage of life you are at.

Each bucket is meant to provide income over progressive fixed periods (e.g. five to 10-year periods).

For example, your first bucket can hold cash and near-cash assets that are to be used for immediate income needs.

In other words, this bucket consists of low-risk assets that are highly liquid, which can be used for your spending needs in the coming years.

Each subsequent bucket of yours should contain riskier assets, with the holding period for each one increasing with higher levels of risk.

This would mean bucket three would be of higher risk and a longer time horizon than bucket two, and so on and so forth.

As each bucket nears the end of its investment horizon, the proceeds can then be transferred to your first cash bucket for withdrawal.

Use the DBS NAV Planner as you embark on your Investing Journey

Investing is not an easy task, and monitoring your investments can be equally arduous.

If you’re thinking of growing your wealth via investing, it helps to have the following things at your fingertips:

- Investment insights

- Access to a good variety of products

- Tailored recommendations

Thankfully, DBS has developed the DBS NAV Planner to help you along your investing journey.

The DBS NAV Planner is a pocket-friendly digital advisor that not only helps you track and protect your money, but grows with you in the different stages of your life from graduation to the workplace and even retirement.

Here are some of its key features:

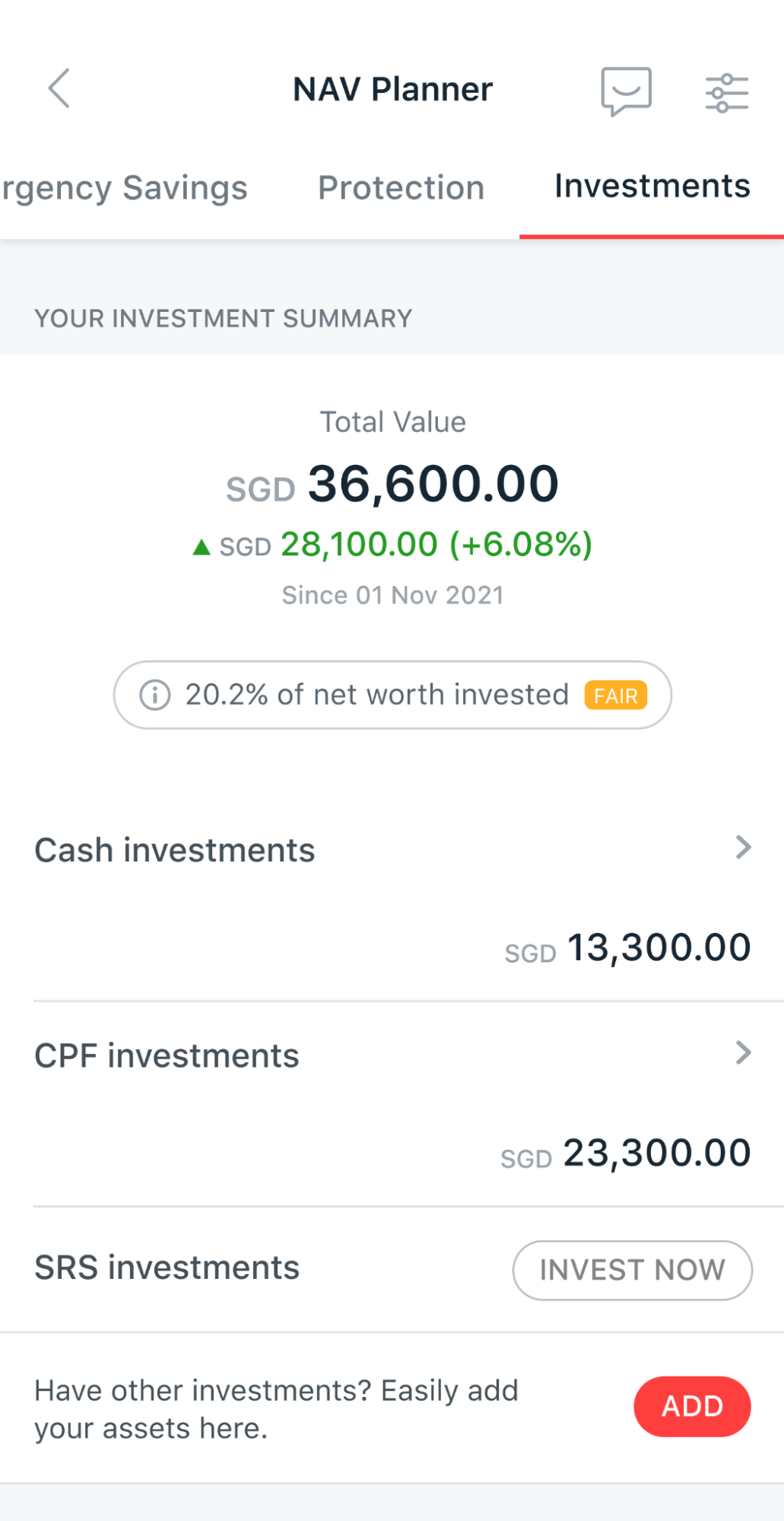

- Helps to track and monitor your investments in your portfolio, including those held in CPF and SRS accounts (you can make it more accurate by keying in your investment holdings or linking up with SGFinDex to consolidate your investments information from other financial institutions).

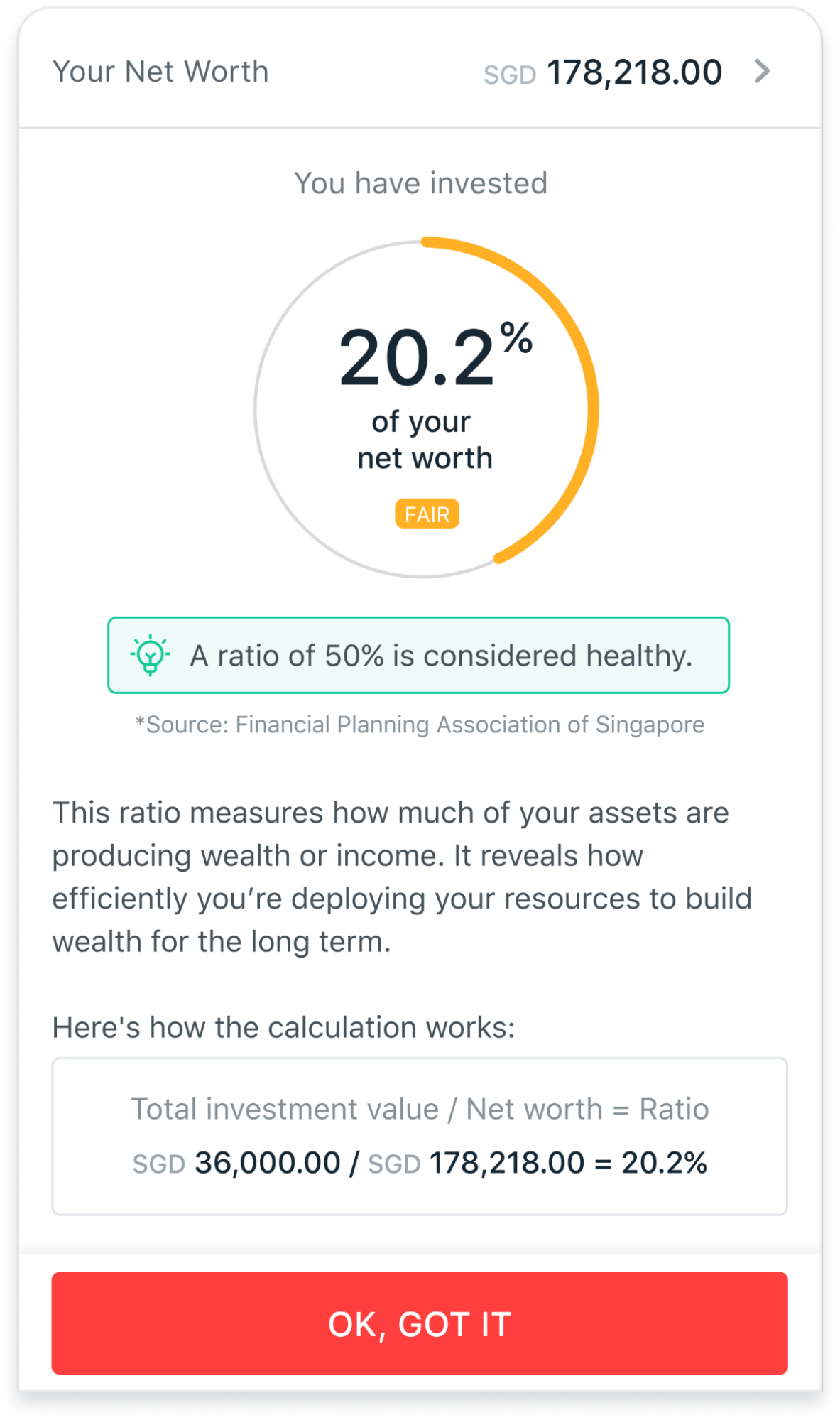

2. Contains a nifty tool to let you know if you are investing enough to make your money work hard for you. A good rule of thumb is to invest 50 per cent of your net worth.

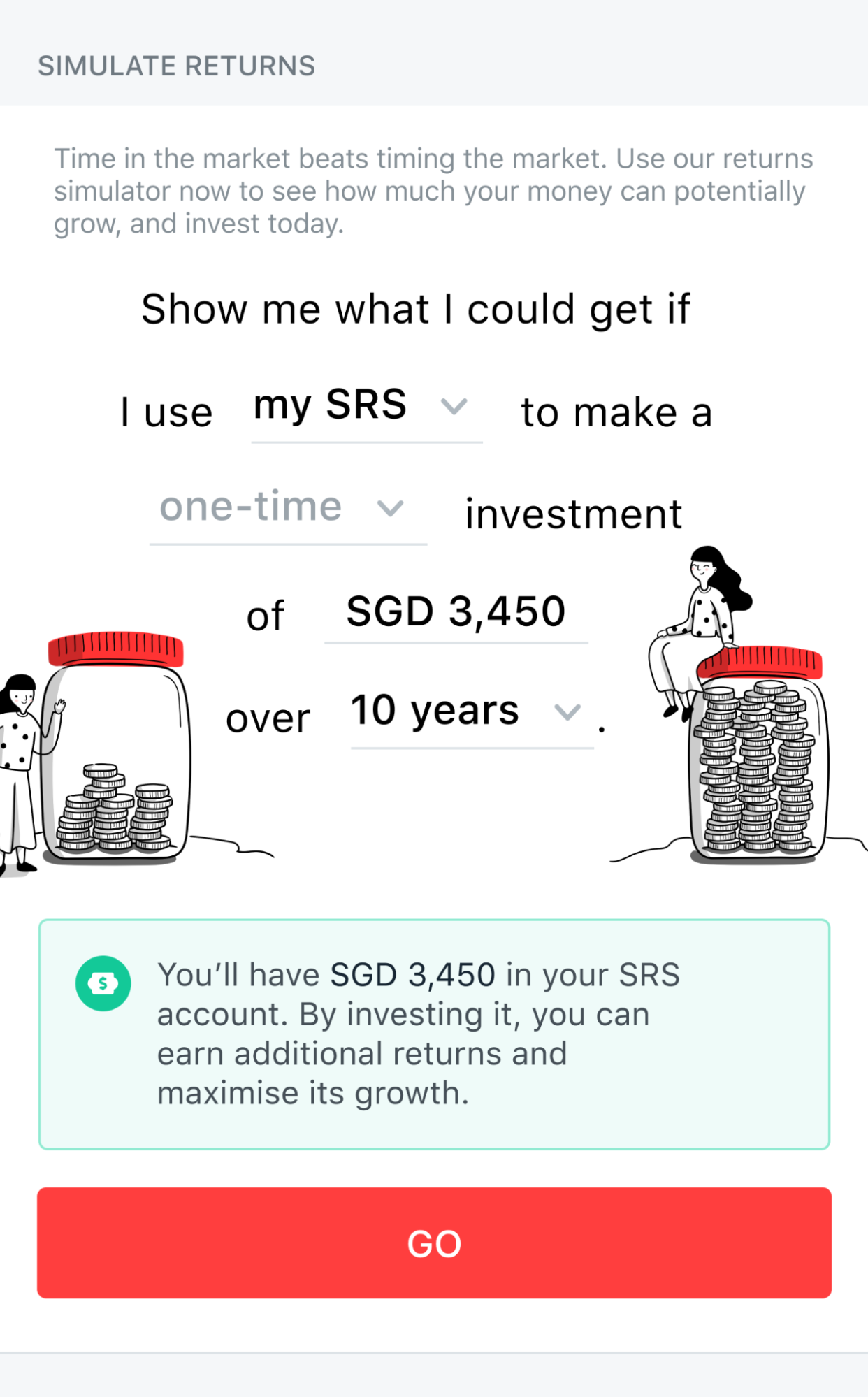

3. Has a projection tool that allows you to simulate your returns based on the funds and products you are looking to invest in, instead of losing your purchasing power to inflation.

4. Provides product recommendations and advice on investing

If you’d like to find out more about the DBS NAV Planner and its many capabilities, you can click here for more details.

This sponsored article by DBS helped this writer learn more about the basics of investing.

Top image by Joshua Mayo on Unsplash

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.