With so many things to take note of if you want to travel this Covid-19 season, a one-stop marketplace or app would be great.

After all, a holiday should be relaxing.

Enter DBS Traveller Kit, a curated list of travel-related perks for your travel preparations, which has all the resources a traveller needs.

Here are some of the things to take note of and how the Traveller Kit can help.

1. Polymerase Chain Reaction (PCR) and Antigen Rapid Tests (ART)

Yes, prepare your nose as you will need to take multiple tests depending on which countries you fly to via the Vaccinated Travel Lane (VTL).

For Germany, Denmark, France, Netherlands, Spain, Switzerland or Canada, there are no pre-testing or quarantine requirements for you to enter these countries.

If you’re heading to South Korea or Canada: A PCR test is required 72 hours before your flight.

If you’re off to Italy, a PCR or ART test is required 72 hours before your flight.

If you’re flying to the US, an ART test is required 72 hours before your flight.

If you’re going to the UK, no need to take tests before you go, but you have to do a PCR test on Day 2 of your arrival. You can check out the providers here.

For entry to Brunei, both quarantine (two to 14 days depending on the self-isolation notice that is given upon arrival as determined by Brunei’s Ministry of Health’s risk assessment) and testing are still required.

According to ICA, from Oct. 26, 2021, 2359 hours, only travellers with 14-day travel history to Category (I) countries/regions (namely: Hong Kong, Macao, Mainland China, Taiwan) are required to take the on-arrival PCR test in Singapore.

Here’s a list of PCR and ART test providers in Singapore approved by the Ministry of Health.

DBS Traveller Kit: you can get your pre-departure PCR test done at Doctor Anywhere from S$132 nett and Healthway Medical from S$128 nett.

2. Travel Insurance

If you are looking for travel insurance, there’s the complimentary travel insurance coverage when you book through DBS Travel & Leisure Marketplace. Do note that the complimentary coverage will be extended to include Covid-19 only from Jan 2022 onwards though.

For even greater coverage, we’ve got TravellerShield Plus. Purchase it from early Nov. 2021 onwards and you will be able to enjoy Covid-19 coverage.

From now till Dec. 31, 2021, there’s a 55 per cent discount for Single Trip Plans and 25 per cent discount for Annual Multi-Trip Plans.

3. Taxi and Private Hire Vehicles

This is perhaps minor but if you need to take an on-arrival Covid-19 PCR test, you cannot take public transport to your accommodation (where you are supposed to be self-isolating until you receive a negative PCR test result).

DBS Traveller Kit: 10 per cent admin fee waiver for ComfortRIDE and Pay for Street Hail via ComfortDelGro Taxi Booking App.

4. Be aware of the changing travel situation and restrictions at your destination

You may be an expert in all the Covid-19 measures in Singapore but it’s a whole different ball game in other countries.

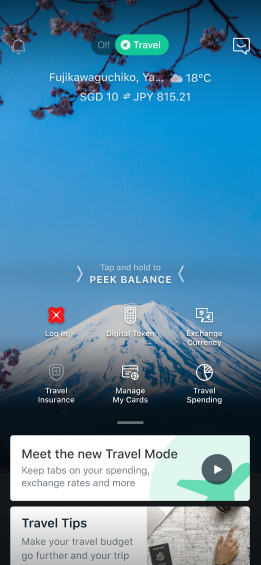

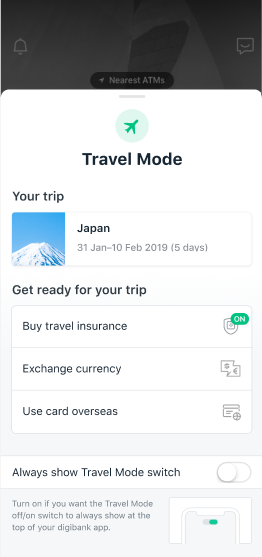

Check out DBS Travel Mode, which can be found on the DBS digibank app, for the latest Covid-related travel rules, provided by the Ministry of Foreign Affairs. Perfect for safe and worry-free travel.

5. Look out for the best buys and travel deals as more VTLs start to open up

Travelling during the pandemic may be costly, so please do yourself a favour by checking out the DBS Traveller Kit, where you will find a range of exclusive offers to DBS/POSB Cardmembers.

And here are some of the best deals.

Agoda

Additional 18 per cent off hotel bookings

Trip.com

S$50 off all Singapore Airlines VTL flight bookings

iShopChangi

Up to 20 per cent off

Lotte Duty Free

10 per cent off with minimum spend of S$100

For the full list of deals and perks, click here.

If you’d like to find even more options for flights, accommodation, and more, check out DBS Travel & Leisure Marketplace, where you can compare over 250 airlines, and a million hotels.

Make your booking on the platform by Nov. 21, 2021 and receive up to 2,000 DBS points (4,000 miles) with a minimum spend of S$1,500 for any flight or hotel booking.

6. Track your spending

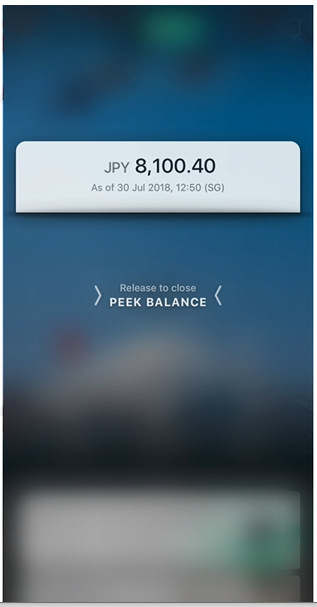

Sometimes it’s difficult to track your spending, especially when you are paying in foreign currency. The Travel Mode saves the day again with the latest currency rates.

Simply use the Multiplier or Multi-Currency Account to convert Singapore dollars into your currency of choice, and store up to 12 different currencies conveniently within your account.

Simply link your DBS Visa Debit card to the account, and use it to shop, dine and basically live like a local. You can top up your travel currency anytime during your trip and transfer your excess funds back into your account, or keep it for the next quick getaway -- no fees at all.

Additionally, the DBS Visa Debit Card also lets you score two per cent cashback when you spend in foreign currencies. With no FX fees incurred on 11 foreign currencies such as CAD and GBP, you can also shop and dine overseas with ease. Nice.

There’s also the Overseas Spending function, which helps to track, categorise and analyse all your international expenses. So that you will know exactly where your money is going and enjoy your vacation fully.

7. Accumulate more mileage and points as you travel

Even when you are on a holiday, you can still continue to accumulate mileage and points. Do check out DBS exclusive card benefits and DBS Travel & Leisure Marketplace. To make your expenditure work for you.

With the DBS Altitude Card, you won’t even have to rush to use them, because your miles don’t come with an expiry date. Not to mention, you’ll be able to score more miles on overseas spending and travel-related bookings.

Perks are also plenty with DBS partners such as Expedia and Kaligo, and you’ll be able to rack up additional miles when you make purchases on these platforms.

DBS Altitude Card perks:

- Three miles per S$1 on online flight and hotel transactions, including travel bookings made on DBS Travel & Leisure Marketplace

- Two miles per S$1 on overseas spend (foreign currency spend)

- 1.2 miles per S$1 on local spend

- Complimentary Digital Priority Pass membership that gives DBS Altitude Visa cardmembers access to over 1,300 airport lounges worldwide

Earn more miles with DBS partners:

- Up to 10 miles per S$1 on hotel transactions on Kaligo

- Up to six miles per S$1 on flight and hotel transactions on Expedia

- Up to S$100 savings on hotel transactions on Agoda

- Up to S$40 savings on hotel and activities on Klook

DBS Travel Mode

As mentioned above, the Travel Mode is a nifty function on your app that allows you to convert your Singapore Dollars to other currencies plus get all the latest Covid-19 advisories of the country you are visiting.

There’s more.

You can rely on its real-time indicators to remind you to purchase travel insurance before travelling and check the policy details if you already have travel insurance.

It also allows for easy access to card services you’ll need for your trip, such as activating overseas use for your debit or credit card for your travel dates, obtaining a temporary limit increase so you can spend more overseas, and permanently blocking your card if you lose it abroad.

Cool.

Top Photo by Damaris Isenschmid on Unsplash.

This article is sponsored by DBS.

Terms & conditions may apply for all DBS/POSB Cards benefits.

TravellerShield Plus is underwritten by Chubb Insurance Singapore Limited (“Chubb”) and distributed by DBS Bank Ltd (“DBS”). It is not an obligation of, deposit in or guaranteed by DBS. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by Chubb.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Chubb or visit the General Insurance Association or SDIC websites.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.