If you're someone who has not started investing, chances are, there are multiple barriers that are stopping you from trying it.

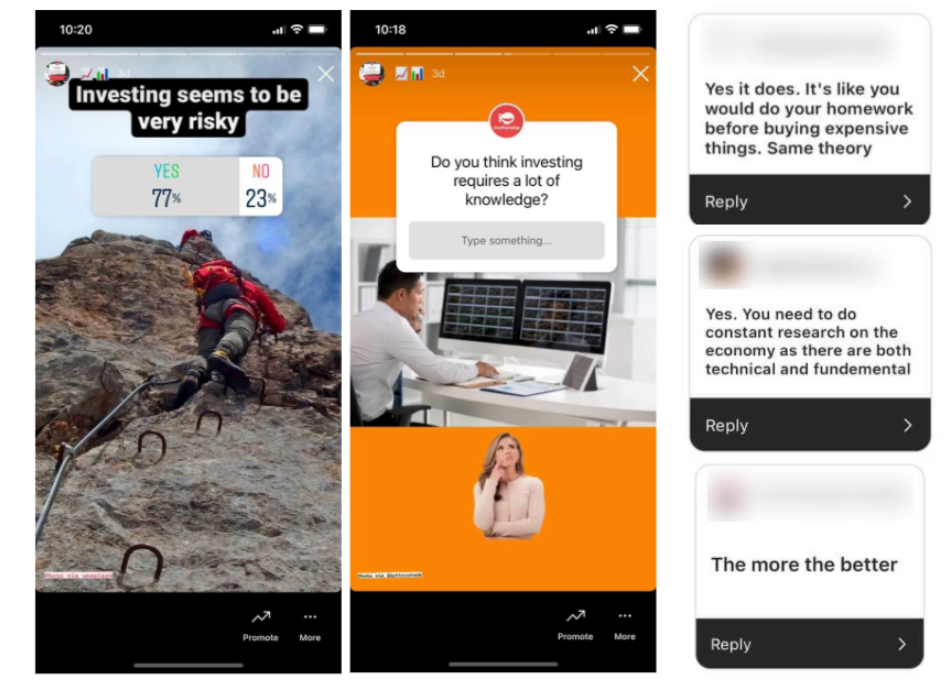

In an Instagram poll we recently conducted with more than 3,750 respondents, our readers shared the various reasons why they hesitate to invest:

- 77 per cent feel investing seems very risky,

- 73 per cent believe investing requires a lot of knowledge,

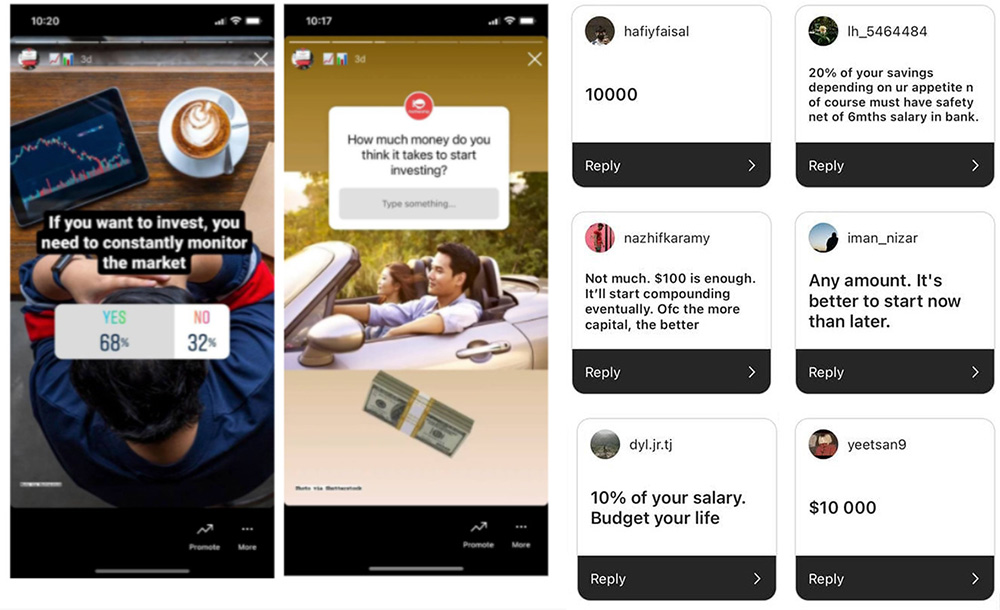

- 68 per cent feel it is necessary to constantly monitor the market,

- Some feel investing requires thousands of dollars, although a few also pointed out that it was possible to start with a few hundred dollars.

Given how our readers feel about investing, it was unsurprising that close to half (44 per cent) of the respondents reported they have not started doing so.

I also felt reluctant to begin investing at one point, on the grounds that it required a substantial amount of money, knowledge, time and effort.

Many of my friends who did invest were constantly monitoring the market, and complaining on a near-daily basis when they lost money, or did not make enough, which conveyed the impression that one had to have a certain level of expertise for investments to pay off.

I also simply had no idea where to start. Should I go into stocks? Crypto? Or a robo-investor? Would I have enough money for any of them?

However, things changed with the onset of the pandemic

Once the Covid-19 pandemic began to take off in March 2020, my perception of investing started to change.

From the conversations I had with my friends who were already investing, one thing stood out to me and became more convincing during the pandemic – the dip in the market could be a good time for me to start investing.

One of my friends then introduced me to his financial advisor at my request as I decided that it would be safer to solicit the opinion of an expert rather than make my own ill and potentially uninformed decisions.

It was after speaking with the advisor that I realised what one simply needed was awareness — essentially, awareness of your own financial goals, expenses, appetite for risk and the amount of effort you want to expend in investing.

Taking a more long-term approach given the lack of time to constantly monitor the market

In my case, my goal is to retire early. Since I am investing to build up my investment nest egg, I have a longer investment horizon, which means I can take a bit more risk with my investments than someone who might need the money sooner than me.

I also lack the time to constantly monitor the market.

This means that rather than having to do my own research about where to place my investments and manage the risks, I prefer to have experts do the work for me and make adjustments according to changes in the market.

As for the amount of money that is required to start investing, I decided to set aside a proportion of my salary: about 20 per cent or a few hundred dollars to invest each month.

I realised that investing could be quite affordable in this way, and you don't need a large sum of money to get started. I can also increase how much I invest over time, as my salary rises.

Ok, so what does all this mean for me and why should I care?

The point is that taking your first steps to invest for the future is not all that hard.

There are now platforms such as UOB SimpleInvest which gives you a simple way to start investing with just a few taps on your phone.

My decision on what to invest in was easier with SimpleInvest providing three different solutions created by UOB Asset Management that are easy to understand: Liquidity, Income or Growth, depending on one’s investment aims and appetite for risk.

The breakdown of each solution by objective, projected return and risk was key in helping me determine how to allocate my funds.

The platform also allows one to start with as little as S$100, with no platform fees, and a sales charge of up to only 0.8 per cent on one’s own investment amount.

In addition, the funds are under the watch of experts who manage a total of almost US$10 trillion in funds, including Fidelity International, JPMorgan Asset Management and UBS Asset Management.

This means you don’t have to do too much research into the world of investing and can let the experts make adjustments when market conditions change. This helps you to be better prepared for unpredictable events, compared to say, a bot, which may only rebalance at certain intervals.

All in all, a good option to consider for investors who are just starting out.

You can find out more information here.

This sponsored article is brought to you by UOB.

Top Image by Patthida Chinnawong from Shutterstock

The information herein is given on a general basis without obligation and is strictly for informational purposes only. It is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Nothing herein shall be construed as accounting, legal, regulatory, tax, financial or other advice. You should consult your own professional advisors about issues mentioned herein that may be of interest to you as the information contained herein does not have regard to any specific investment objectives, financial situation and/or particular needs of any specific person. The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. The views expressed in the articles linked to this publication are solely those of the authors’, reflect the authors’ judgment as at the date of the articles and are subject to change at any time without notice. United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accepts no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication. This publication shall not be reproduced, re-distributed, duplicated, copied, or incorporated into derivative works, in whole or in part, by any person for whatever purpose without the prior written consent of United Overseas Bank Limited. Any unauthorised use is strictly prohibited.

United Overseas Bank Limited Co. Reg. No. 193500026Z

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.