I was given the task to figure out how the KrisFlyer UOB Account and Debit Card would fit into my life and whether I could actually derive any usefulness out of it.

For starters, I have around $1000 worth of unavoidable monthly household expenses. So let’s see how this card can help.

Planning a family holiday is easy when it’s just me and my wife. Throw a kid into the mix and that’s when the costs start to escalate - especially when air ticket prices are inflated during school holidays.

So, there has to be another way to defray costs for travel and balance the books.

I’ve held on to the same debit card for so many years that I can remember the 16 digits by heart. However, it doesn’t really have that many benefits apart from its small cashback amount.

I could always get a credit card. But I prefer to spend only the money I already have, without having to worry about late payment charge or interest, so that is why a debit card works best for me.

So how can the KrisFlyer UOB Account and Debit Card potentially work for me? It checks off all the requirements for folks like me - it’s a debit card, and I don’t have to switch to a credit card just to accumulate miles.

But will it benefit me?

I set out to uncover how much I typically spend every month to see if the KrisFlyer UOB Debit Card actually makes sense given my lifestyle.

Confirm chop expenditure:

- Groceries: $200 / month

- Eating-out: $260 / month

- Transport (Monthly EZ link card top-ups and weekly private car rides to the in-laws for the whole family): $400 / month

- Handphone bills: $140 / month

Total: $1000

And that’s excluding stuff like these:

- Monthly movie outings: $50

- Enrichment classes: $350

- Tuition: $500

Combined total: $1900

Looking at the numbers, raising a kid in Singapore does cost a pretty penny. Sure, the wife and I could always cut down on the food and entertainment expenses but there are certain things that we strongly feel would benefit our daughter, like tuition. Outsource the pain, focus on the love.

The math

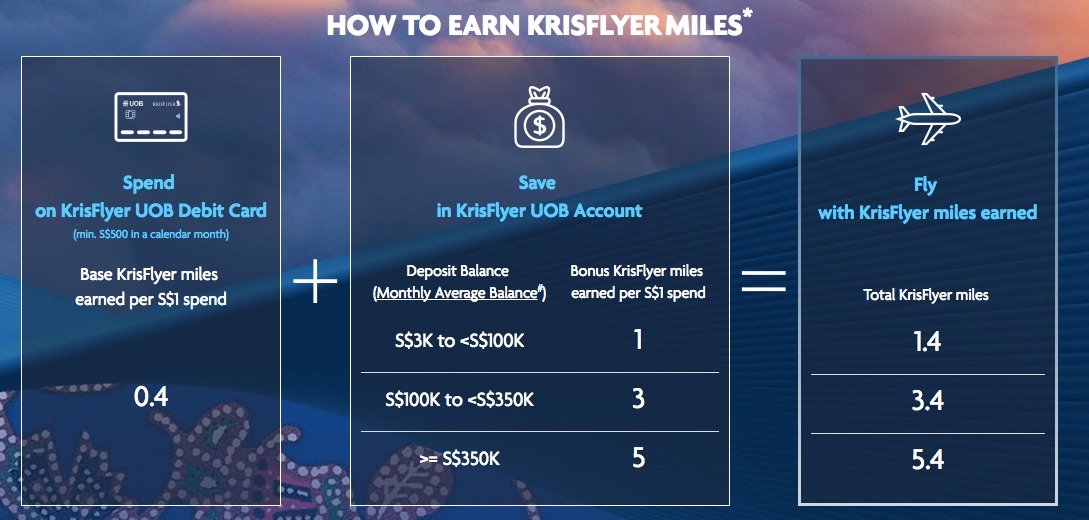

How the KrisFlyer UOB account works for me is based on how much I put into the account and how much I spend monthly. Check out the calculator here.

Anyway, back to my story.

Here’s how it all works out -

- My monthly expenditure: $1000

- With a constant monthly deposit balance: $20,000

- Miles I will accumulate in one year: 16,800 (enough for a return SIA economy saver ticket to Bali)

- Miles I will accumulate in three years: 50,400 (enough for 3 return SIA economy saver tickets to Bali or a return SIA economy saver ticket to Seoul).

Why this and not other savings accounts?

It depends on what you want really. I prefer to go travelling with my family than earn an interest of 0.05% pa on a normal savings account - that’s about $30 if you keep $20,000 in savings over three years.

Look, spread the price of the SIA ticket across 12 months and you will definitely beat 0.05% anytime. If you want higher returns from your savings, you’d have to dabble in investments or fixed deposits which may not necessarily fit your lifestyle at the moment.

There are a plethora of cards out there that offer a lot of perks, but if you do the math and have a spending pattern like mine, you’d find that you’re spreading your expenditure too thin to earn points in a significant manner. Besides, why complicate matters and pile multiple credit cards into an already fat wallet?

If you like going on holidays and want to keep things simple then the KrisFlyer UOB Debit Card is probably the ideal match for you.

This sponsored post is brought to you by UOB, which helps our Mothership writers afford the occasional holiday and offset the airfare with some miles.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.