It was an impulse purchase of concert tickets gone wrong.

Claire (not her real name) had not originally planned to attend the concert, as she’d been put off by reports of fans queueing days in advance for tickets, and of bots and scalpers complicating the online ticketing process.

Claire thought that since she wasn’t willing to queue up for tickets, she wasn’t a “big enough” fan who should attend.

How, then, did she end up agreeing to buy two tickets for S$750, only to have the seller go missing?

Claire’s experience is a story of how deals may come across as being legitimate but turn out to be a scam.

Claire spoke to Mothership about her experience as a scam victim, looking back on how she ended up getting fooled by a scammer, and sharing what she’s learnt about staying vigilant to protect herself from any future scams — including tapping on security features offered by banks.

digiVault, one such security feature by DBS, enables customers to safeguard their hard-earned money from scammers by locking their funds digitally in a designated account, preventing digital transfers out.

It’s one way of adding an “extra step” to complete before committing to a purchase — something Claire now sees as an important part of defending herself against scams.

Without it, the seamless transition between making the decision to make a purchase and actually paying for it becomes possibly too easy, as Claire learnt the hard way.

Bait and switch

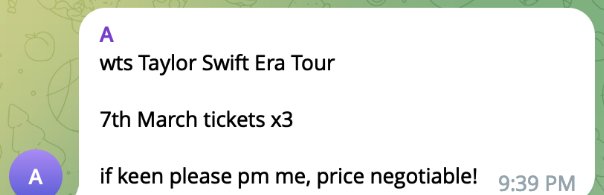

It all started with an innocuous-looking “wts” message in a Telegram-based marketplace chat group.

The group is used by students to buy and sell various university-related materials, ranging from textbooks to hostel furniture.

Claire “decided on impulse” to look into the offer of concert tickets.

After all, the seller was offering tickets on a day she was available, and was open to negotiating the price too.

Screenshot provided by Claire.

Screenshot provided by Claire.

Several factors influenced her decision

It was a combination of several factors that pushed her over the edge.

It was a convenient offer of tickets at a negotiable price, through a platform she was familiar with, and that she had previously used to purchase items.

“I thought, why not? If someone was willing to sell tickets, and I didn’t have to fight for it, it'd be nice to go [to the concert].”

Claire shared that one additional factor which made her more open to buying the tickets was the fact that it genuinely looked like the seller just happened to have extra — and had not purchased tickets with the intent of profiteering off genuine fans’ interest.

While scalpers were known to mark up ticket prices by up to 10 times, this seller was letting them go with what seemed like a reasonable markup of just S$20 to S$30 per ticket.

“The way he said it on the chat was that he was trying to help his friend, who couldn’t make it, sell the tickets. So he did sound like an honest person — it was a plausible reason.”

Nagging feeling

Claire recalled a “nagging feeling” that the deal could be too good to be true, just before she transferred the money to the seller.

She thought she’d addressed it sufficiently by requesting for personal details to verify his identity, thinking that it would attest to the seller being located in Singapore and identifiable, in the event the transaction went south.

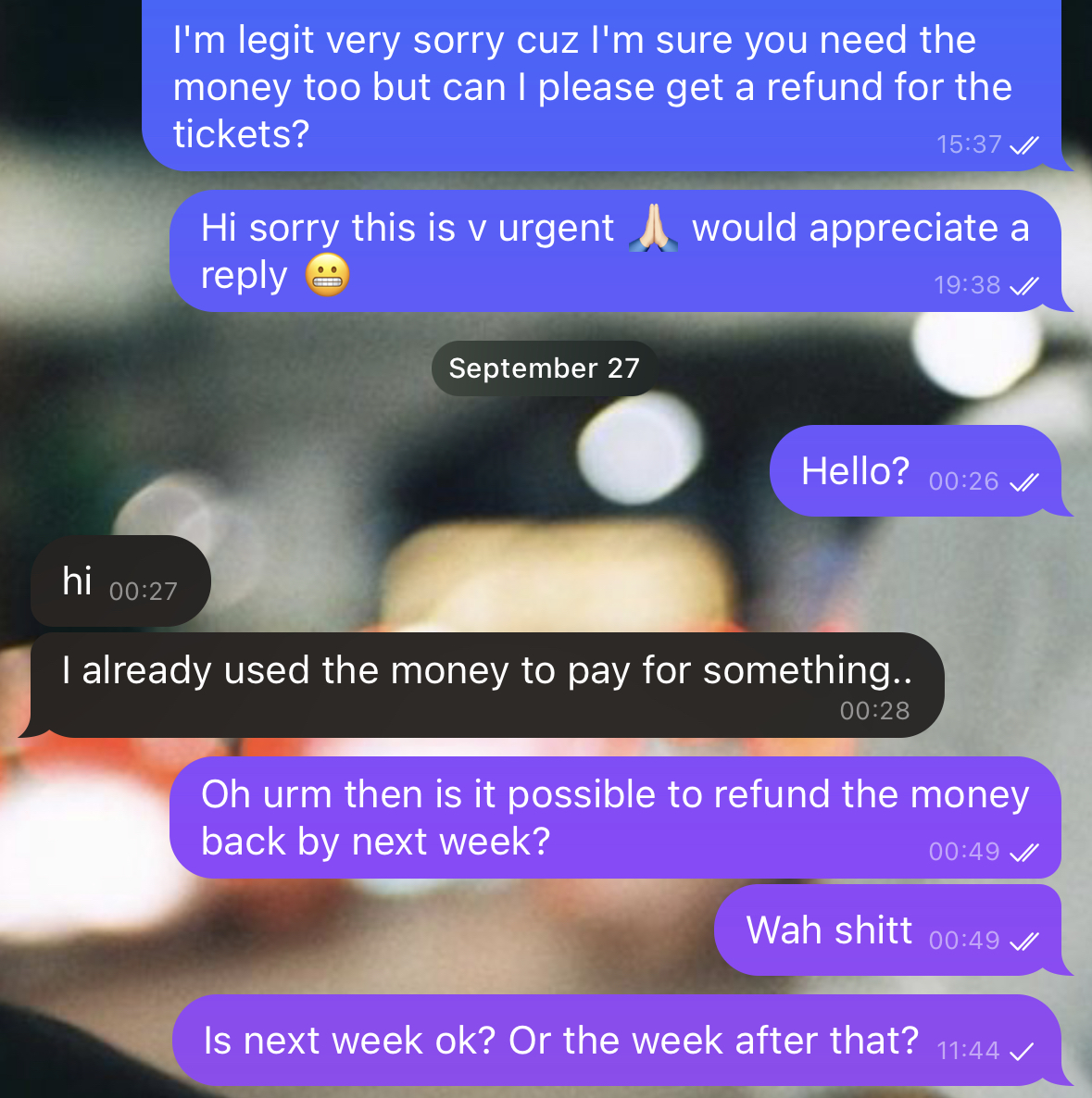

Of course, it turned out that the seller did not actually have tickets to sell, and would eventually become uncontactable after being asked for a refund.

Screenshot provided by Claire.

Screenshot provided by Claire.

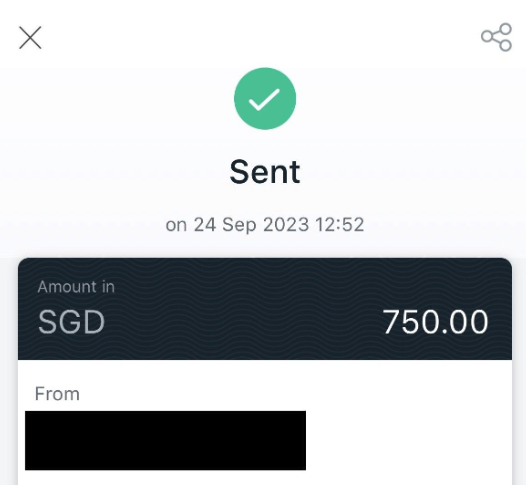

After the seller provided his identity details, Claire proceeded to transfer the agreed S$750 — a sum she fears she may never get back.

Screenshot provided by Claire.

Screenshot provided by Claire.

Claire realises now, in hindsight, that there was more she could have done.

For example, she could have verified that the seller was indeed offering valid tickets by requesting more detailed screenshots of the transactions, or even photos showing the last four digits of the credit card used to make the purchase.

Better still, she could also have asked the seller to list the tickets on a platform that would facilitate releasing payment to the seller only upon delivery of physical concert tickets, as the police have advised.

Months on, Claire still looks back on the incident as “disheartening”, though her main concern was that she had implicated her roommate, who had entrusted the job of buying the tickets to her.

She said:

“I was the one who suggested that we go to the concert, and I was the one who made the purchase, and she transferred the money. So I felt like I had gotten her scammed as well.”

Silver lining

There was one silver lining to the situation, though.

Claire was able to help her roommate avoid losing S$390 in a similar scam.

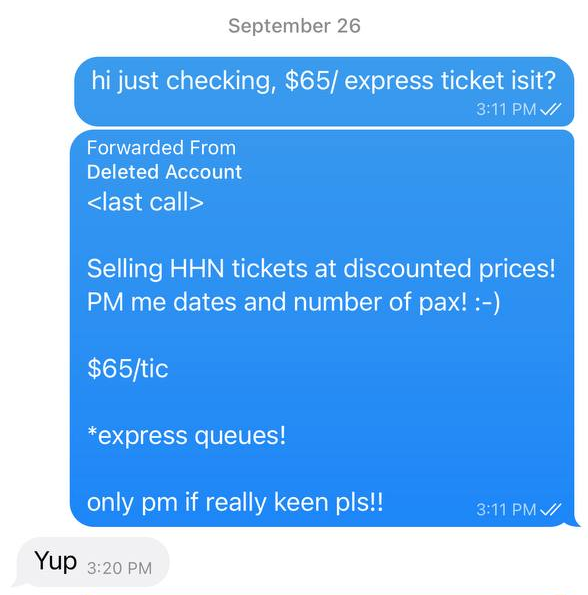

As it turns out, Claire’s roommate had also been trying to buy a set of tickets from an unofficial reseller on Telegram — this time for the Halloween Horror Night (HHN) event at Universal Studios Singapore.

The deal being negotiated was S$65 per express ticket, and Claire’s roommate had wanted to purchase six of them for her group of friends.

The tickets were usually sold at S$85, and the unexplained discount of over 20 per cent, as well as the suspicious circumstances of the ticket sale, put Claire on alert.

Screenshot of conversation between the scammer and Claire’s roommate. Image courtesy of Claire.

Screenshot of conversation between the scammer and Claire’s roommate. Image courtesy of Claire.

As her suspicion about the seller grew, and with her guard up after her own recent experience dealing with a scammer, Claire suggested that her friend seek more information from the seller before proceeding with the deal.

The seller apparently then got spooked and deleted their Telegram account.

How to protect against scams?

Claire’s story is one that highlights the way scammers and their tactics have become increasingly sophisticated.

Scammers often employ social engineering to gain the trust of their victims.

In Claire's case, the scammer appeared flexible during negotiations, feigning authenticity by offering to assist a friend in selling tickets.

Asked for her advice on how to prevent scams, Claire said:

“Don't be complacent, and don't think that you're too smart to get scammed, because then you will get scammed.”

She also took away a few practical lessons from her experience, including not buying tickets from resellers, even though they may be cheaper than those from legitimate sources.

She has also since started to set transaction limits on her debit card, adjusting the limit so she can pay for day-to-day expenses, but not be able to do so for bigger purchases like concert tickets or overseas trips until she adjusts the transaction limit.

“It's an extra step that makes you second guess your decision, so you can think about what you're really doing,” said Claire.

digiVault by DBS

One of the significant features of DBS’s digiVault feature is that it prevents unauthorised transactions in the event that scammers have fraudulently gained access to one’s account.

This could happen through a phishing scam, malware, or hacking. Should bad actors gain access to an account, they will not be able to transfer out any funds protected by digiVault.

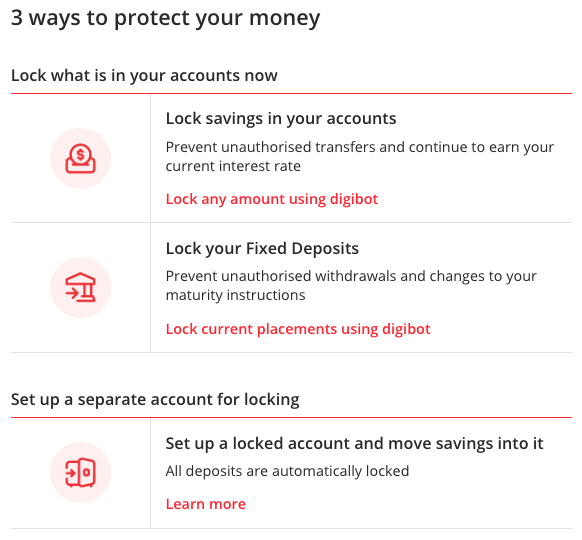

digiVault offers customers with three ways to lock up their funds while continuing to earn interest:

Screenshot via DBS website.

Screenshot via DBS website.

Putting money aside in digiVault — either by locking any amount in your existing account or fixed deposits, or by moving savings into a newly-created “locked” account — means that no one can access the funds, except you.

The funds can only be unlocked in person.

And digiVault slows down the process of paying for out-of-the-ordinary expenses, it does create — in Claire’s words — “an extra step that makes you second guess your decision”, which could be just what you need to prevent yourself from getting scammed.

There are no additional fees for the digiVault service.

Find out more about digiVault here.

Multiple ways to take charge of your own security

digiVault is part of the bank’s suite of self-managed security features, providing customers with more choice and control over the security of their funds.

Other features under this suite includes “Security Checkup”, which allows customers to monitor key security settings and take recommended actions to safeguard their bank accounts, as well as “Payment Controls”, which customers can use to manage important payment settings, including instantly locking their card if they suspect it has been compromised and setting monthly spending limits.

These features are both accessible via the DBS and POSB digibank apps.

DBS has also published an anti-scam quiz in partnership with the Cybersecurity Agency of Singapore. The six-question quiz helps you assess your knowledge of phishing scams so you can be better prepared to protect yourself. You can take the quiz here.

For more tips and information on how to protect yourselves against scams, you can visit DBS’ Bank Safely hub.

This sponsored article by DBS made the author start thinking about how much he could lock up for safekeeping.

Top photo via NTU website

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.