Nvidia saw its market valuation rally to a record high on Jun. 5, 2024, overtaking Apple to claim the title of the second most valuable company in the world, according to Reuters.

By the end of the day on Jun. 5, Nvidia's stock price rose 5.2 per cent to US$1,224.40 (S$1,649.43), making the company's overall valuation US$3.012 trillion (S$4.057 trillion). This edged out Apple, which was last valued at US$3.003 trillion (S$4.045 trillion).

The most valuable company is still Microsoft, which is valued at US$3.15 trillion (S$4.243 trillion).

AI is causing the disruption

Apple finds itself overtaken by the graphics processing unit (GPU) manufacturer amid a shift in market dynamics that is due in part to the disruptive impact of Artificial Intelligence (AI) technology.

The rise in generative AI technologies requires powerful computer chips. Back in February 2024, Sam Altman, chief executive officer of OpenAI, put out a call to raise trillions of dollars for global semiconductor chip production.

The market nodded in agreement. As of Jun. 4, 2024, according to Investor's Business Daily, Nvidia's shares have increased by 132 per cent, partly due to Elon Musk buying Nvidia chips for the development of a supercomputer by xAI, an AI startup founded by Musk.

SoftBank also invested about 150 billion yen (S$1.3 billion) into Nvidia chips to train large language models.

With the hype train taking off, some forecasts estimate the value of the global AI market in 2030 to balloon to about US$901 billion (S$1.214 trillion). As of now, it is currently on track to hit US$184 billion (S$247 billion) by the end of 2024.

An arms race for advanced chips

Nvidia, whose bread and butter has been cutting-edge graphics processors, is uniquely poised to take advantage of this extraordinary boom in demand by producing chips, such as the H100.

Yet demand for the chips is far outstripping supply, causing Nvidia chips to surge in price. Back in August 2023, Elon Musk said that a H100 GPU was "considerably harder to get than drugs".

Then, in March 2024, Nvidia unveiled a flagship AI computer chip processor, now being purchased and used by the likes of Amazon, Alphabet, Meta, OpenAI, Tesla, and Oracle.

To put it another way, while other tech companies have been buying their way into AI, Nvidia has been profiting from it.

This is also precipitating a kind of "arms race" between Nvidia, AMD, and Intel to produce cutting-edge, competitive AI chips and take control of the emergent market.

Tech companies worldwide are also trying to bite into Nvidia's "virtual monopoly", as a report by The Verge put it, on the AI chip market.

Nvidia most certainly is booming. Back in May 22, 2024, Nvidia added over US$200 billion (S$269 billion) in market valuation, buoyed by AI optimism.

A stock split expected

Reuters also reported that Nvidia is planning a ten-for-one stock split on Jun. 7 to draw in investors.

A stock split is a way for a company to increase its number of shares while maintaining the total dollar value of all outstanding shares.

This lowers the price of each individual share, making it more accessible to investors looking to buy in, and more easily sold and liquidated. In other words, the same cake is sliced into more, thinner slices, so that more people can join in.

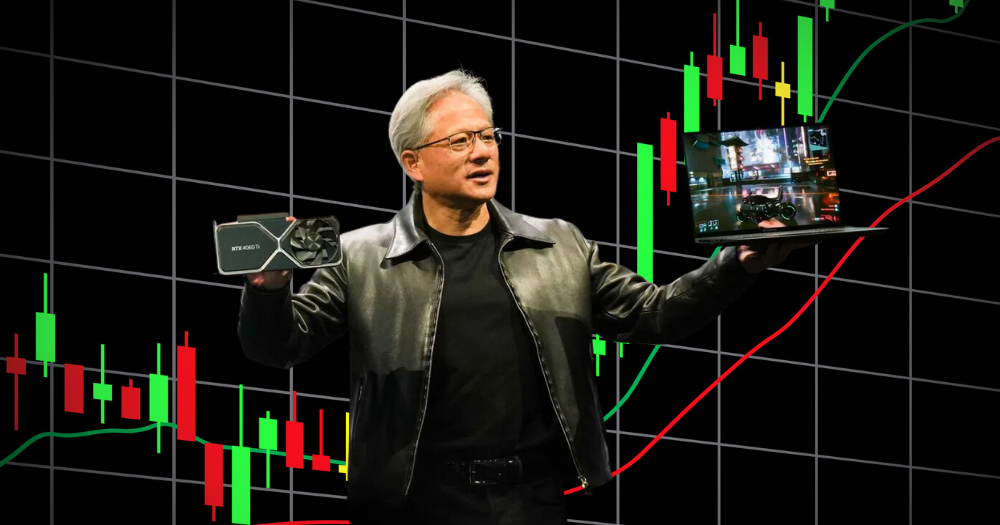

Just as investors look to get on the Nvidia gravy train, Jensen Huang, Nvidia's CEO, is also becoming something of a "rockstar" celebrity.

When attending a computer expo in Taiwan, Computex, on Jun. 5, he found himself mobbed by eager fans and one particularly enthusiastic woman looking to have her chest signed.

Top photo from Canva & Computex

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.