If you’re travelling overseas and are unsure if the items you buy will need to be declared, read on to better understand the regulations.

What type of items acquired overseas are taxable?

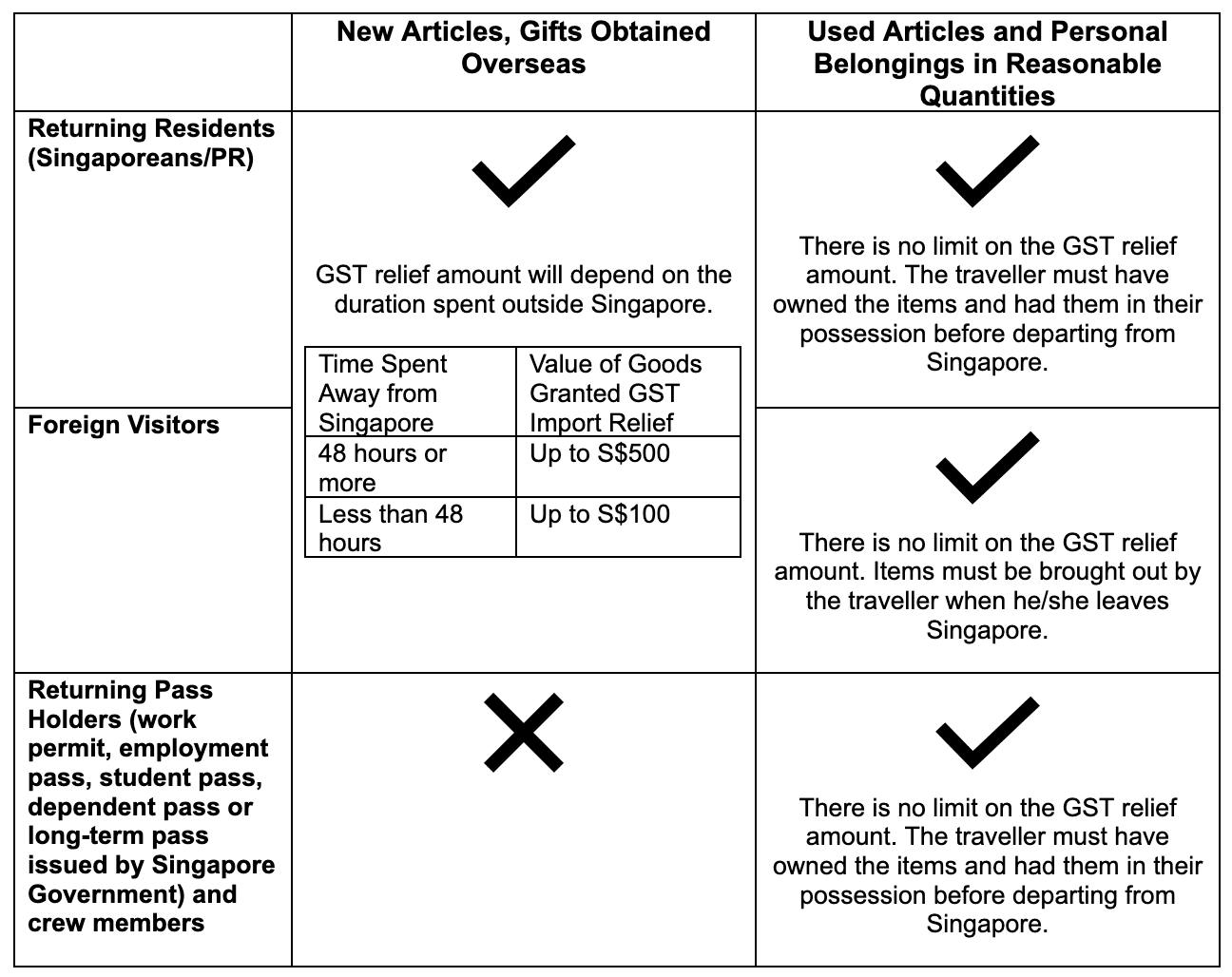

All goods brought into Singapore by all travellers, including foreign visitors and returning residents, are subject to GST.

This is regardless of whether foreign sales taxes or value-added taxes have been paid on the goods.

However, a traveller can enjoy some GST import relief on a good if it meets the following two conditions:

What types of goods are not entitled to GST import relief?

Intoxicating liquor and tobacco, as well as goods imported for commercial purposes, are excluded from this GST import relief for new articles.

Duty rates imposed on these goods can be found here.

What if I already used the item I bought overseas and there’s no receipt?

The item is still subject to GST if they are to be brought into Singapore because it is acquired overseas. It cannot be classified as a “used article” — which are items that you already had before departing Singapore.

Similarly, items purchased at the duty-free shops within the Changi Airport transit area are subject to GST when they are brought back into Singapore.

If the receipt is not available for an item, whether it’s a gift or bought at a small shop, the value will be assessed based on the value of identical or similar goods when computing the GST payable.

How is the payable GST calculated?

If you have been away from Singapore for more than 48 hours, you will be entitled to a GST import relief amount of S$500.

Using an item valued at S$2,000 as an example, the GST payable is [S$(2,000 – 500) x prevailing GST rate].

If you have been away from Singapore for less than 48 hours, you will be entitled to a GST import relief amount of S$100.

Therefore, the amount of GST that you will have to pay is [S$(2,000 – 100) x prevailing GST rate].

How do I pay GST for items I bought overseas?

You can make an advance declaration and payment of GST before your arrival via Customs@SG Web Application.

Once tax payment is successful, the web app will create an e-receipt and you may exit the checkpoints via the Green Channel.

If you are stopped for checks, you can show the e-receipt as proof of payment to the officers.

Alternatively, you may visit our Customs Tax Payment Office at the checkpoints or use the Customs Declaration Kiosks at the Woodlands and Tuas Checkpoint, Singapore Cruise Centre and Marina Bay Cruise Centre.

All major credit cards (Mastercard, Visa and American Express), mobile wallets, NETS and Cashcard are acceptable.

It is the responsibility of travellers to declare all goods in their possession which exceed their GST import relief.

Failure to do so is an offence under the Customs Act and the GST Act, and offenders can be fined up to S$5,000 or face prosecution in court, depending on the severity of the offence.

For more information, visit Singapore Customs’ website.

Top images via Singapore Customs.

This sponsored article made this writer aware of what needs to be done when she shops overseas.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.