Living pay cheque to pay cheque is basically millennial culture in a nutshell.

There’s a Chinese term to describe people with this lifestyle: yue guang zu, which translates to “moonlight clan”.

This refers to people, mostly working millennials and Gen Zs, who spend their entire pay cheque and end up essentially broke at the end of the month.

Singapore can be an expensive city to live in, even in the best of times.

At the not-so-young age of 26, I have a HDB loan, a study loan, and other inconvenient financial commitments like a Spotify subscription and health insurance.

As a result, I more often than not end up being a member of this not-so-elusive clan.

Health scare

Despite my fairly meagre bank account, I’ve always taken a somewhat cavalier approach to savings.

I retained this attitude all the way until last year, when my dad had a health scare.

Without going into too much detail, we were told he needed surgery.

With little cash on hand, we were fully dependent on the insurance payout.

That helped tide us through.

But due to the nature of the insurance policy, we were informed that the payout would be a one-time thing — if my dad had a recurrence, we were on our own.

Unfortunately, the nature of his condition means he is prone to relapse. The chances are about 20 to 30 per cent.

Photo by Ilyda Chua

Photo by Ilyda Chua

Rainy days

It’s hard to think of your parents as anything other than invulnerable. Saving for their old age had occurred to me, but it just seemed so distant.

The health scare, however, made it much more immediate.

I used to work in a hospital, so I know that lucky as we are to live in Singapore as Singaporeans, there’s plenty of government financial assistance available.

Even so, without that insurance payout, we would’ve been in a tight spot.

As the oldest child in the family, it would — and should — have been up to me to step in to help out. But I had no savings and no capacity.

I’m not being a martyr here. Saving money in Singapore can be hard. Especially as a young millennial, with so many expensive milestones to pay for.

Still, it wouldn’t hurt to put a little more thought and time into the prospect of saving for a rainy day.

As I’ve now learnt, rainy days do come. It’s not a matter of if but when.

Plan on DBS Digibank

I’m a bit of a financial idiot and there’s really no use pretending otherwise.

For all the talk of stocks and bonds and crypto and FIRE, I doubt I will ever obtain the capability nor confidence to do anything requiring even the slightest bit of financial intelligence.

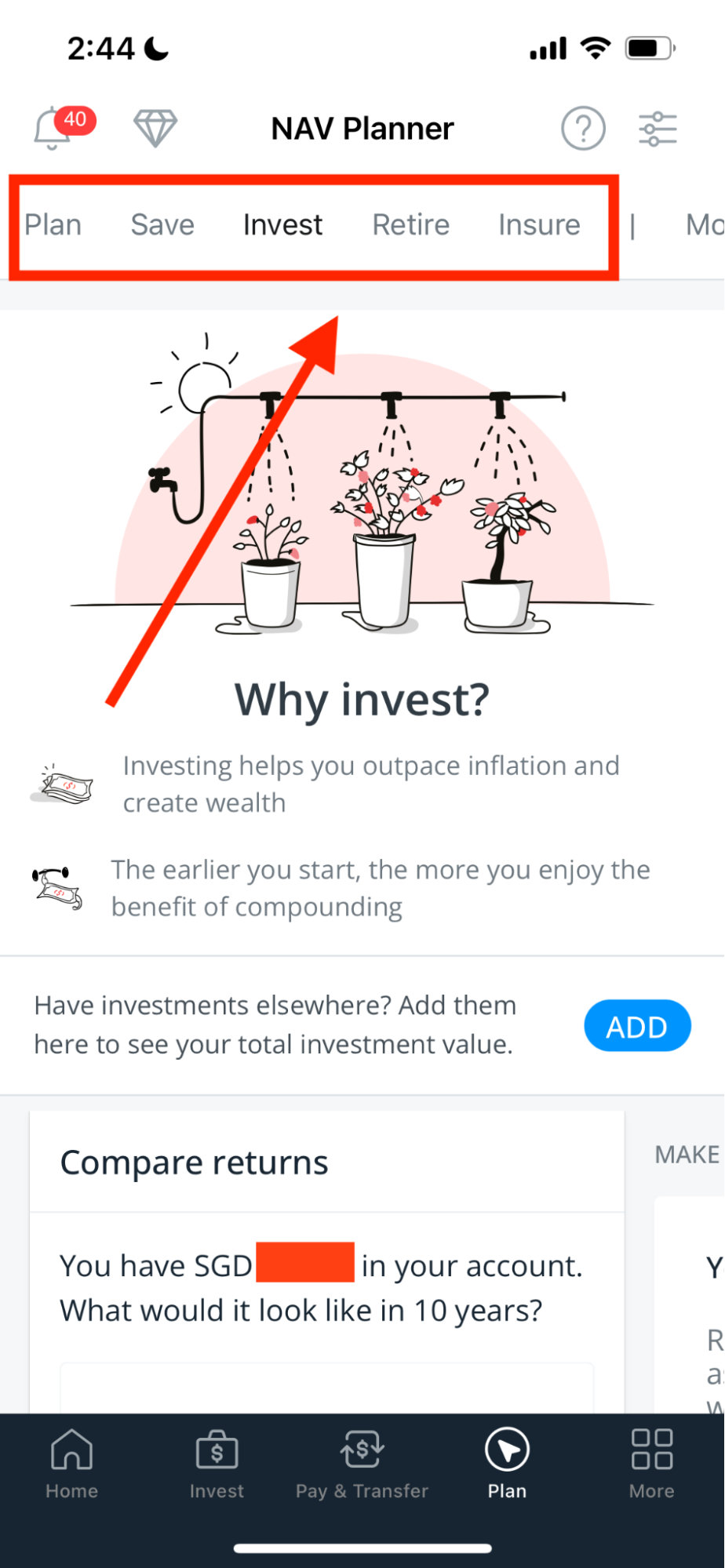

But what I can do is make use of the tools I have around me. Take, for instance, DBS’s financial planning tool: Plan on digibank.

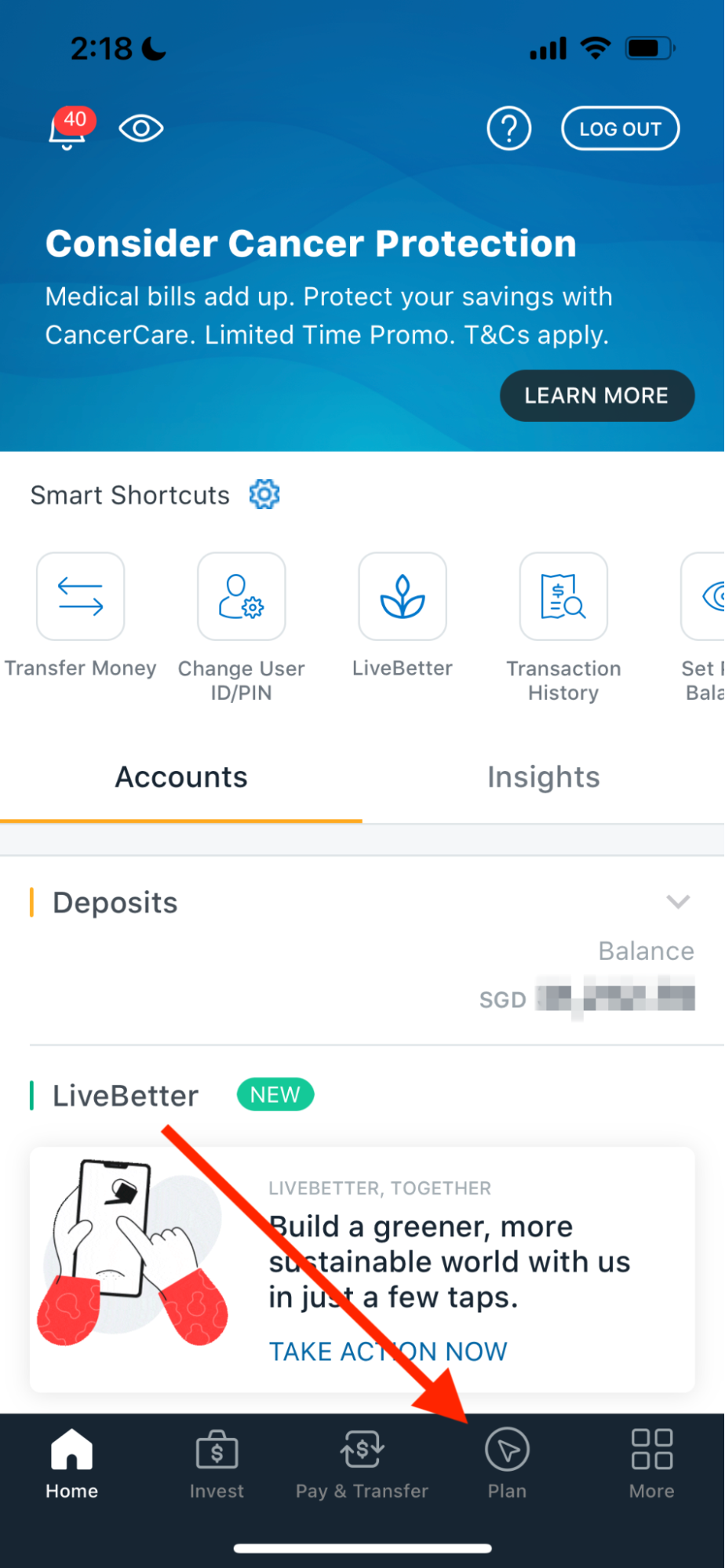

You might have already seen it if you’re a user of the DBS digibank app. Here’s a quick screenshot of how to access it:

Image from Ilyda Chua

Image from Ilyda Chua

There, you can track your spending versus your income, and what your expenses typically are. (In my case, it alerted me to the fact that I spend a fair bit on entertainment and leisure. Mea culpa.)

You can also keep an eye on things like your loans, insurance policies (it even suggests how much coverage you need), and set retirement, investment, or savings goals for yourself, depending on your priorities.

I was pleasantly surprised at how the feature automatically identified the financial focus most suitable for me, complete with a customised dashboard.

In my case, as my goal was to make sure I had a decent emergency fund, it identified my focus as saving.

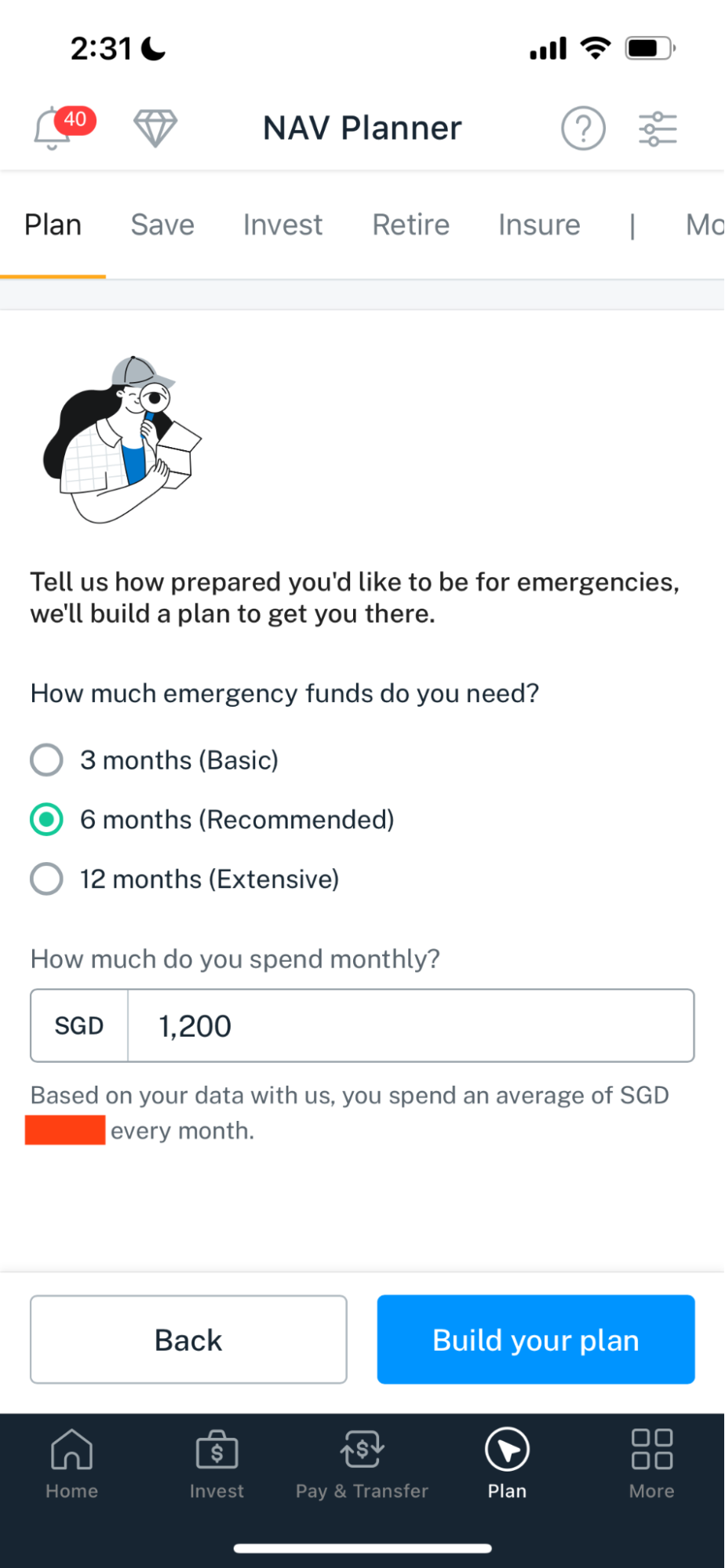

Upon pulling up Plan on digibank, it asked me how big of an emergency fund I would like to aim for.

Image from Ilyda Chua

Image from Ilyda Chua

I chose six months — DBS’s recommended fund size.

As the months pass, you can go back to Plan on digibank regularly to check your progress on your emergency fund.

Here’s what it’ll look like:

Image courtesy of DBS

Image courtesy of DBS

Image courtesy of DBS

Image courtesy of DBS

Once you hit your goal, you’re presented the option of taking your savings a step further with investment.

Plus, digital confetti.

Image courtesy of DBS

Image courtesy of DBS

As of the time of writing this article, I’m still far from my personal goal.

But hey, admitting you have a problem is the first step to recovery.

The best part? Since it’s in the DBS app itself, all your information is already there.

The numbers practically crunch themselves. (You can also get more accurate calculations when you sync your SGFinDex with your Singpass.)

Plus, you can easily switch between the different modes within the dashboard — be it your emergency fund goals, your investment goals, your retirement goals and so on.

Image from Ilyda Chua

Image from Ilyda Chua

Helpful, especially if you’re like me and struggle to calculate anything more complicated than a dinner bill.

Umbrella, ella, ella

Honestly, I’ll probably never be rich. And that’s not my aim either.

Maybe I’m simple-minded or just simple, but I know my limits. I can’t flip properties or guess the ups and downs of the stock market.

I’m cool with that. All I really want is to be able to eat, sleep, and spend time with friends and family.

Most importantly, my dad is healthy. He’s out of the hospital, playing badminton, and even has enough leftover time and energy to nag at me for not having grandchildren or for travelling too much. I’m ridiculously privileged and for that, I’m very grateful.

At least for now, it’s all sunny weather. In this period of clear skies, I’m just living my life, spending what I must, saving what I can. I’m not doing great, but I’m doing okay.

But I do hope that when that rainy day eventually comes around, I’ll be able to do more than stand around and wait for the storm to pass.

Learn more about Plan on digibank here.

Writing this sponsored article made this writer feel like she should probably stop eating out so much, and start planning her finances seriously with DBS digibank.

Top image from Ilyda Chua and Zheng Zhangxin

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.