Call me old fashioned, but up until recently, I was still exchanging money at a physical money exchanger whilst preparing for a trip.

Friends around me had long hopped on the bandwagon of travel cards, but there I was, sitting in the dust.

Thankfully, I have since wisened up, and am now making full use of the convenience that a travel card brings.

While there are a plethora of travel cards available, here’s why the amaze card is a game-changer and one you should take on your travels.

Competitive exchange rates

When it comes to travel cards, one of the things that sets the amaze card apart is its favourable foreign exchange rates.

Furthermore, amaze’s multi-currency wallet allows you to lock in these rates by exchanging currencies when rates are in your favour and hold them for your future travel.

So whether you're exploring new destinations or indulging in online shopping with foreign currencies, you can do away with hefty foreign exchange fees and save on your international spending.

But that's not all – with the amaze card, you can also save on the usual foreign exchange admin fees that banks charge while making cash withdrawals overseas.

All without worrying about hidden fees eating into your budget. Sweet.

Image courtesy of Instarem.

Image courtesy of Instarem.

Double Rewards and 4MPD Bonanza

By linking amaze card to a Mastercard, you not only earn 0.5 InstaPoint per S$1 spend (capped at 500 InstaPoints per overseas transaction) from Instarem (2,000 InstaPoints equal to S$20 cashback), but if you've linked a rewards-based card to amaze, you'll also cash in on your card's existing reward system.

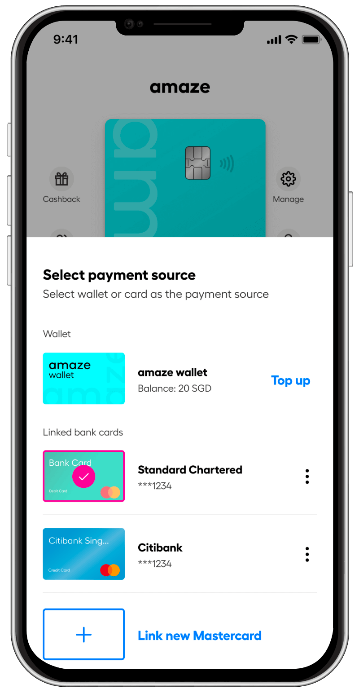

With the ability to link up to five different Mastercard credit or debit cards, you don’t have to worry about not having the right card with you to reap the right rewards.

All you need to do is toggle between the different cards on the Instarem app.

When making offline transactions with amaze linked to select bank cards, they are ingeniously converted into online transactions, earning you a 4 Miles Per Dollar (4MPD) on your linked bank card, taking your rewards game to the next level.

And there is even more – on top of all of the mentioned above, amaze offers travel benefits by Mastercard like complimentary HoteLux Elite Membership, complimentary fast-track to I Prefer Elite status that offers benefits like early check-in, late check-out, complimentary room upgrades and more.

Stacks on stacks, amirite?

Best of both worlds for ultimate convenience

The amaze card provides users with the option to make both e-wallet and linked-card transactions.

Image courtesy of Instarem.

Image courtesy of Instarem.

If you’re not too familiar with these terms, I got you.

You can typically make use of two modes of payment on your phone or digital devices: linked cards or e-wallet.

Linked card transactions

Linked card transactions need to be paid directly with a credit or debit card. This allows you to earn double the rewards – from amaze and from your linked card.

Pair and toggle between any five Mastercard debit/credit cards easily with just a few taps on the app to maximise your rewards anytime with any purchase.

Rewarding and convenient.

E-wallet transactions

On the other hand, e-wallets are wallet-based transactions that require you to top-up to the wallet prior to making payment.

This is especially helpful if you wish to lock in favourable exchange rates in advance, for future spending or if you want to set yourself a budget and keep your spending in check.

The amaze card allows you to seamlessly switch between both transaction types to make payments in Singapore and overseas.

What about the fees?

What’s even better about this card is the fact that it’s basically free.

The only charges you’ll encounter are minimal fees on select transactions made in SGD, topping up your wallet with a Visa card (Paynow and Mastercard top ups are free) or withdrawing money overseas.

There’s absolutely no fees on transactions made in FX, neither an application fee, issuance or annual fee. Find out more on the fees here.

So, whether you’re a frequent traveller, or just someone looking to save money and maximise your rewards on spending, download the Instarem app and register for your free amaze card in just a few taps.

And for all Mothership readers, here’s a lil something from Instarem.

The first 1,000 Mothership readers that sign up for Instarem amaze using referral code MTSHIP will get 1,000 InstaPoints worth S$10.

InstaPoints will be directly credited to your Instarem account within 7 days from the end of the offer period.

Offer ends Dec. 31, 2023. Sign up here now.

It’s that easy.

This sponsored article by Instarem made this writer want to recommend the Amaze card to her friends.

Cover photo courtesy of Instarem.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.