Managing your personal finances can be intimidating, especially for young working adults.

If you showed me my bank account, I'd probably (read: most definitely) start crying.

While I can afford to be more financially prudent, I think the hardest part for me is trying to find the best financial products to suit my needs.

There are too many to choose from and I recently found myself getting overwhelmed by the amount of offers available for various credit cards and insurance plans.

But you know what? Personal finance doesn’t have to be complicated, especially if you know where to go for help.

SingSaver: personal finance made easy

Like SingSaver, for instance.

It’s a one-stop platform offering a variety of financial services, and ensures that you get rewarded generously when you apply for a financial product.

It also provides easy-to-understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.

The best part? It’s suitable for people from all walks of life.

So it doesn’t matter if you’re a fresh grad, a frequent traveller, or a full-time working adult like me. We can all benefit one way or another from SingSaver.

"Best Deal Guarantee" promotion

From now till Nov. 30, 2023, SingSaver is having a "Best Deal Guarantee" promotion with all the best deals for credit cards and insurance plans.

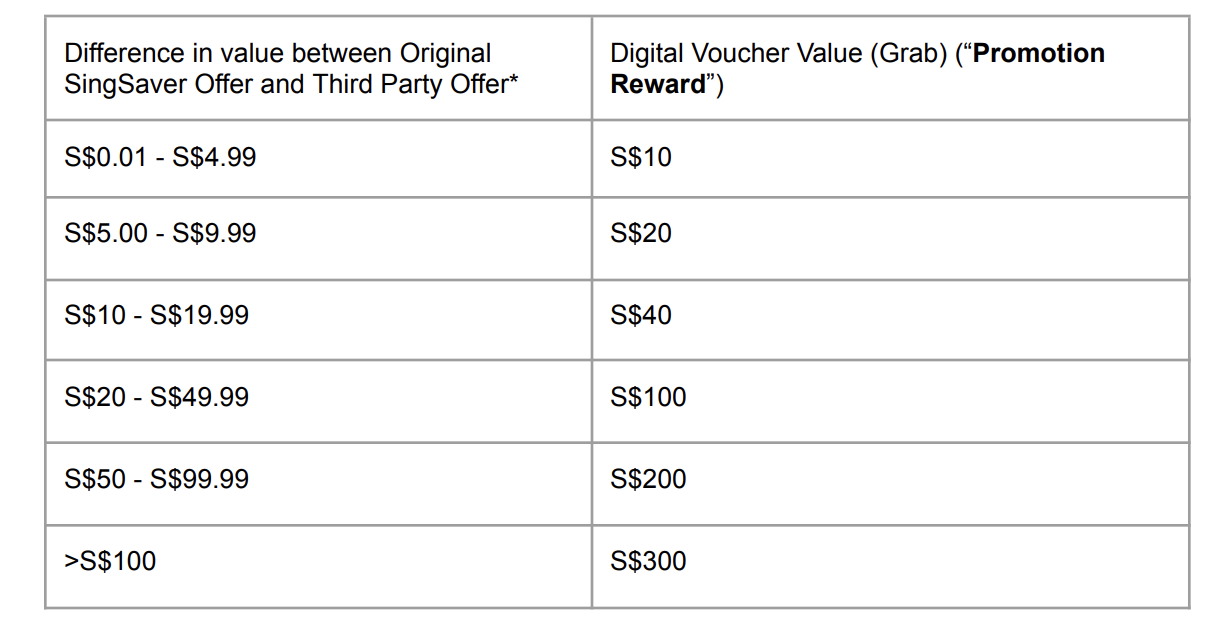

If you find a better deal somewhere else, submit it here and SingSaver will double the price difference and reward you with vouchers worth up to two times of the deal price/quote difference*.

Image via SingSaver.

Image via SingSaver.

Based on the difference in value between the offers, you can stand to get the following vouchers if your claim is successful:

Screenshot via SingSaver.

Screenshot via SingSaver.

To be eligible for this promotion, you must be a resident of Singapore, and have a SingSaver account.

The promotion is applicable when you sign up for select credit cards or insurance (car, home, travel, maid) with SingSaver.

Here are examples of credit card and insurance deals you’d want to look into:

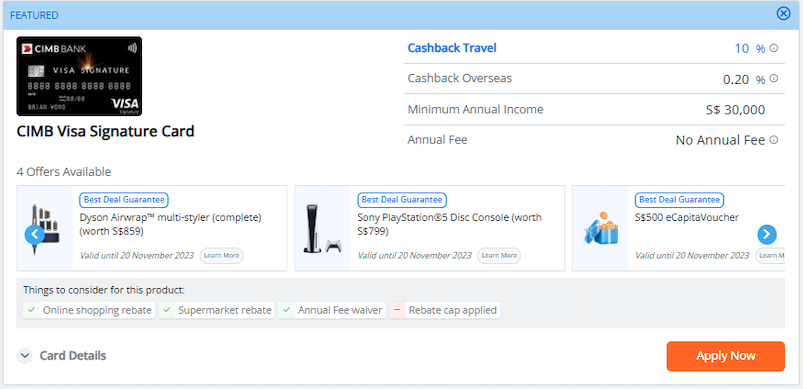

CIMB Visa Signature Card

Image via CIMB Singapore.

Image via CIMB Singapore.

You’ll get the best deal if you apply for the CIMB Visa Signature Card with SingSaver.

You can earn 10 per cent cashback (capped at S$100 per statement month) on online shopping, groceries, beauty and wellness, pet shops and veterinary services, and cruises.

Additionally, you don’t have to pay an annual fee.

From now till Nov. 19, all applicants of participating Citibank, CIMB and Standard Chartered Bank products will receive the following rewards as part of SingSaver’s limited time "MEGA Upsized Deal":

- Dyson Airwrap multi-styler (complete) (worth S$859)

- Sony PlayStation 5 Disc Console (worth S$799)

- S$500 eCapita Voucher

However, if you find another comparison platform offering more, you can file a claim to SingSaver and get bonus vouchers.*

Screenshot via SingSaver website.

Screenshot via SingSaver website.

Standard Chartered Simply Cash Credit Card

The Standard Chartered Simply Cash Credit Card also offers the same sign up rewards as part of SingSaver’s “MEGA Upsized Deal”.

With this credit card, you will earn 1.5 per cent cashback on all spending, with no minimum spend or cap.

Image via Standard Chartered.

Image via Standard Chartered.

Screenshot via SingSaver website.

Screenshot via SingSaver website.

MSIG Travel Insurance

Another deal you’d want to take note of is the MSIG Travel Insurance plan.

With SingSaver’s flash deal, you’ll be able to get 40 per cent off this plan and up to S$38 Grab vouchers.

From now till Dec. 31, you’ll also be able to score an Apple AirTag or ReboundTag when you apply.

Again, if you find another comparison platform offering better deals, you can file a claim to SingSaver and get bonus vouchers*.

Screenshot via SingSaver website.

Screenshot via SingSaver website.

Check out SingSaver’s website for all of the best deals.

*Terms and conditions apply. The full terms and conditions can be found here.

This article sponsored by SingSaver made the writer less afraid of handling her personal finances, hopefully.

Top images via Canva.

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.