'Fine balancing act' needed in S'pore’s response to S$3 billion money laundering case: Indranee

To keep Singapore business-friendly.

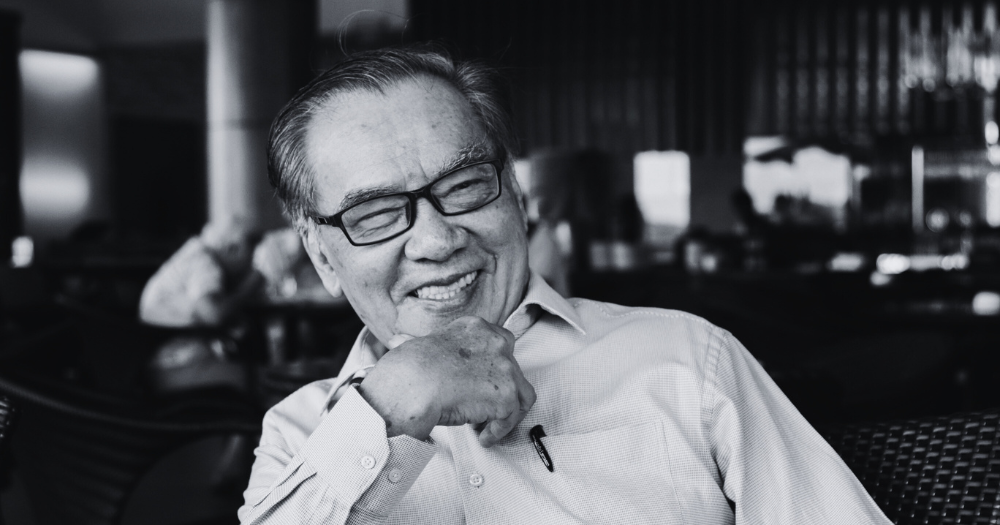

Singapore needs a "fine balancing act" with regard to anti-money laundering restrictions, so as not to stifle genuine law-abiding businesses, said Second Minister for Finance Indranee Rajah.

The recommendations by an Inter-Ministerial Committee (IMC) to improve Singapore's anti-money laundering framework were published on Oct. 4.

Indranee said the government is already implementing the recommendations, and elaborated on the rationale behind them at a press conference on the same day.

These were some of the recommendations:

- Engagements with individuals in the first line of defence to educate them on money laundering risks.

- Striking off inactive companies which might be misused as shell companies.

- A new data-sharing interface for government agencies to detect money laundering risks.

Indranee said:

"As you will appreciate, this is a fine balancing act, because for every step and every measure, there are trade offs.

The system cannot be too lax, but at the same time it cannot be too stringent, because we do not want to stifle genuine law abiding businesses.

It has to be just right and allow Singapore to be a free and open economy, while at the same time being inhospitable to illicit funds."

Took lessons from S'pore's largest money laundering case

The committee had been set up in end-2023 after Singapore authorities exposed the nation's largest money laundering case to date.

In August 2023, 10 foreigners were arrested and charged in court following island-wide raids.

More than S$3 billion in assets have since been seized by the state.

These include properties, vehicles, ornaments, bottles of liquor and wine, cash, luxury bags and watches, electronic devices, jewellery, gold bars, bank accounts and documents with information on virtual assets.

The 10 foreigners, nine men and one woman, aged 31 to 44, were suspected to be involved in a transnational money laundering syndicate.

More training, engagements for various sectors

In its Oct. 4 report, IMC recommended strengthening anti-money laundering standards for those serving as touchpoints for clients, to prevent criminals from laundering illicit proceeds through purchases like properties, jewellery, luxury cars and collectible items.

These individuals, referred to as gatekeepers, include corporate service providers, lawyers, real estate salespersons, precious stones and metal dealers, car dealers and more.

Gatekeepers are currently obliged to conduct due diligence with regards to the information provided by clients, and submit timely reports to the Singapore authorities when they detect suspicious transactions.

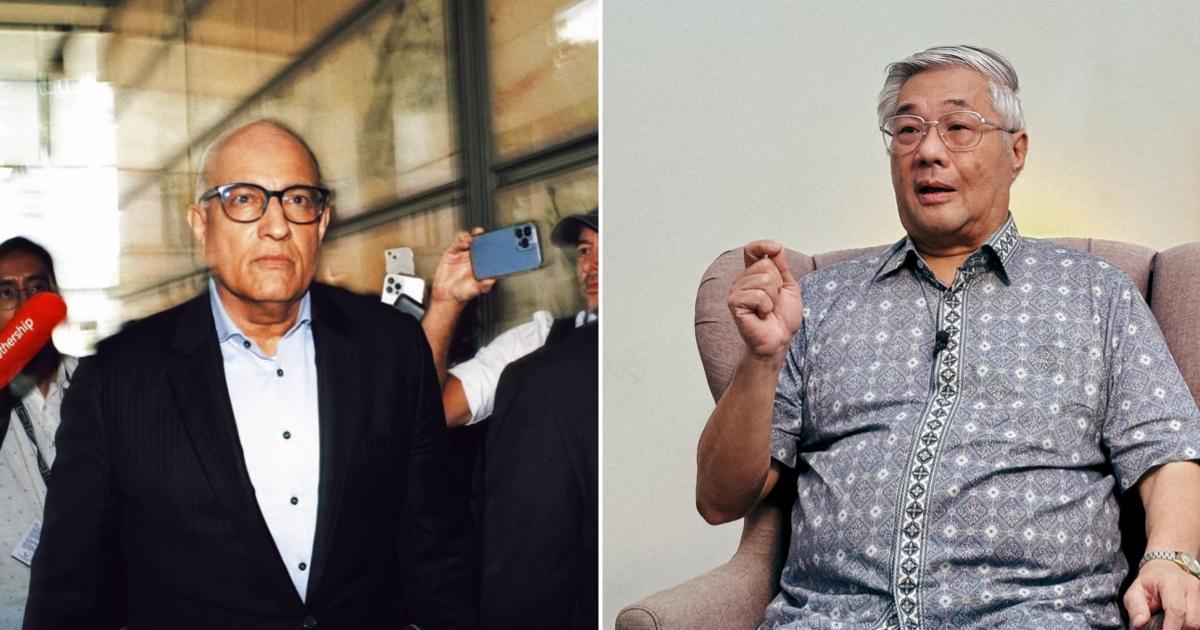

Minister of State for Trade and Industry Alvin Tan said that while the financial sector has "strong and robust" anti-money laundering requirements, with clear expectations for employees, the implementation of such practices can vary across sectors.

As such, engagements will be held with unregulated sectors, including dealers of high-value goods like cars, to raise their awareness of money laundering risks.

Minister of State for Home Affairs Sun Xueling added that these engagements are meant to help dealers look out for risky elements in transactions, such as when clients make high-value purchases in cash.

These engagements will be held by sector supervisors like the Monetary Authority of Singapore (MAS), the Accounting and Corporate Regulatory Authority (ACRA), Ministry of Law (MinLaw) and the Urban Redevelopment Authority (URA).

Additionally, those in the real estate and legal sectors will soon have their job scope clarified to require them to verify the identities of the individuals that their clients may be acting on behalf of.

This will be carried out “over the next few months”, said Indranee.

ACRA to strike off more inactive companies

To prevent companies from being misused for money laundering purposes, ACRA will also be heightening its efforts to strike off inactive companies, the IMC report noted.

ACRA will flag up companies that exhibit signs of inactivity, such as failing to file their annual returns, failing to respond to mail sent by the registrar, or when company directors are uncontactable.

Companies will not be struck off ACRA's registry unless they are repeatedly non-compliant.

According to ACRA, its rate of striking off inactive companies has more than doubled in the first six months of 2024, compared to the last three years.

New data-sharing interface for agencies, heavier penalties

Over the next few years, Singapore authorities will progressively roll out a new data-sharing interface, to allow government agencies to share data on and flag up entities of concern.

A new inter-agency workgroup will also be set up in Singapore to coordinate cooperation between agencies and enforcement action on money laundering.

IMC also noted that penalties have been increased for service providers and managers who breach their anti-money laundering obligations.

Non-compliant service providers and managers found liable for such breaches can be fined up to S$100,000, up from a maximum of S$25,000 before July 2024.

Recommendations not a 'silver bullet': Indranee

In the Oct. 4 press conference, Indranee noted that the report calls for a whole-of-society approach.

This involves individuals in the first line of defence doing their part to prevent money laundering.

Noting that "no defence is foolproof", Indranee said that the recommendations also look to help authorities detect such activities in a timely manner, and to strengthen the means and resolve to take effective enforcement action.

"We have already started implementing recommendations that were in the pipeline or which will be done quickly. We will implement the other recommendations as soon as possible," she said.

That said, Indranee added that the authorities are "under no illusion" that these recommendations will be a "silver bullet" to eradicate money laundering for good, as criminals will inevitably adjust their tactics in response to enforcement.

"What is possible, and which is our goal, is strong deterrence, good detection and effective enforcement," Indranee said.

"So in conclusion, let me say: Singapore is open for business. We welcome clean funds and legitimate investments, which generate economic growth, generate jobs and create real value for our people and our country.

But we will be hostile ground for illegal funds and criminal activities, and should they find their way to our shores, we will not hesitate to take action against the individuals involved in accordance with the full force of the law."

You can see the full IMC report here: go.gov.sg/imc-aml-report

Top image from Singapore Police Force / MDDI on YouTube

MORE STORIES