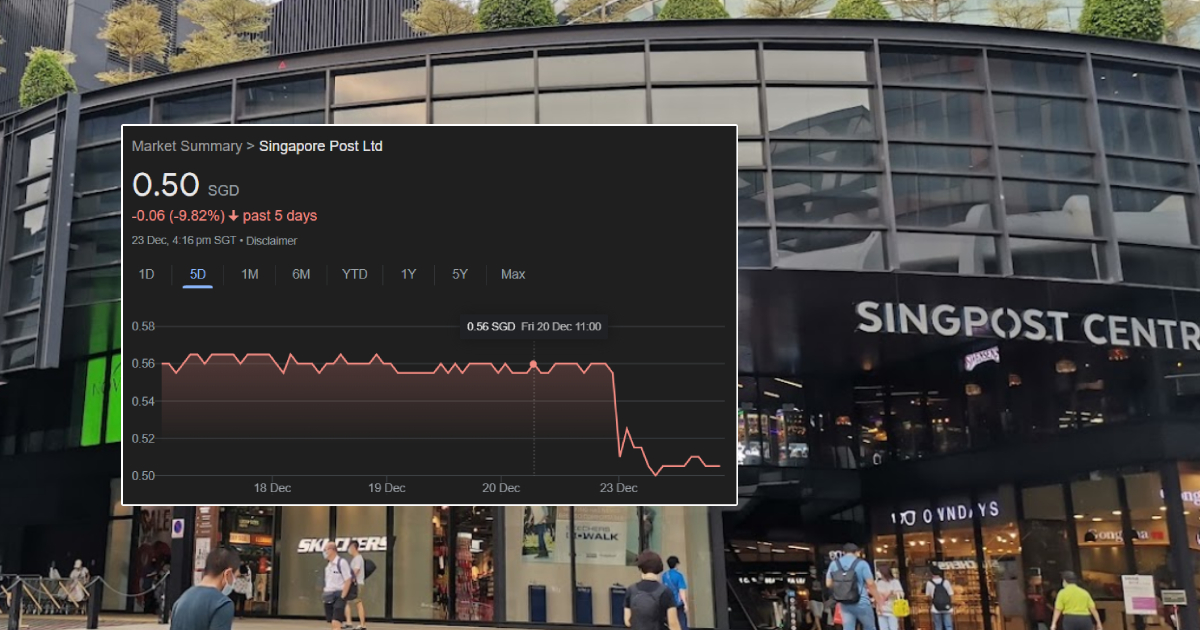

The share price of Singapore Post (SingPost) plunged more than 10 per cent on Monday, Dec. 23, after the Singapore market opened for trading at the start of the short Christmas week.

This was following the company revealing on Sunday, Dec. 22 that it had fired its chief executive and two other senior executives after an internal investigation found they had mishandled whistleblower allegations about misconduct by company employees, according to Reuters.

SingPost share price was S$0.51 earlier on Monday morning, down by about 9.8 per cent, before proceeding lower as the trading day was about to close.

Year of share price volatility

The share price slump was the most in over four years, marking its biggest intraday loss since March 2020 when the effects of the pandemic on the markets were felt.

The correction marks a year of volatility for the company's share price.

SingPost shares traded at about S$0.38 in March 2024 before surging to a high of S0.60 in early December.

It is still up about 7.5 per cent year-to-date.

Background

Chief executive officer (CEO) Vincent Phang, chief financial officer (CFO) Vincent Yik, and chief of the company's international business unit Li Yu, were dismissed after the company found they had been "negligent" in handling the case and misrepresented it before an audit committee, SingPost said.

Chair Simon Israel will oversee senior management of Singapore Post in the interim.

The company said it planned to announce a new CEO in due course.

Phang and Yik have indicated they will "vigorously contest the termination of his employment, both on merits and on the grounds of procedural unfairness," the duo said in a statement to the media.

Top photos via Google & Google Maps

MORE STORIES