The United States Federal Reserve cut interest rates on Sep. 19 (U.S. time) for the first time in four years, dialling back its aggressive bid to reduce inflation by cooling the world’s largest economy.

The Fed announced a cut of 50 basis points and lowered its key rate to roughly 4.8 per cent, Associated Press (AP) reported.

This is down from a two-decade high of 5.3 per cent, where it had stood for 14 months, as it struggled to curb the worst inflation streak in four decades.

Inflation has tumbled from a peak of 9.1 per cent in mid-2022 to a three-year low of 2.5 per cent in August, not far above the Fed’s 2 per cent target.

The central bank had made 5.25 percentage points of increases between March 2022 and July 2023.

This latest cut is the first and biggest cut since March 2020 when Covid-19 was hammering the economy.

More cuts to come

Policymakers at the Fed also expect to cut rates by an additional 50 basis points before 2024 is up, according to projections.

The projected decline will see the interest rate reach the 2.75 per cent to 3 per per cent range in 2026.

The Fed now sees its benchmark rate falling by another half of a percentage point by the end of 2024, another full percentage point in 2025, and by a final half of a percentage point in 2026.

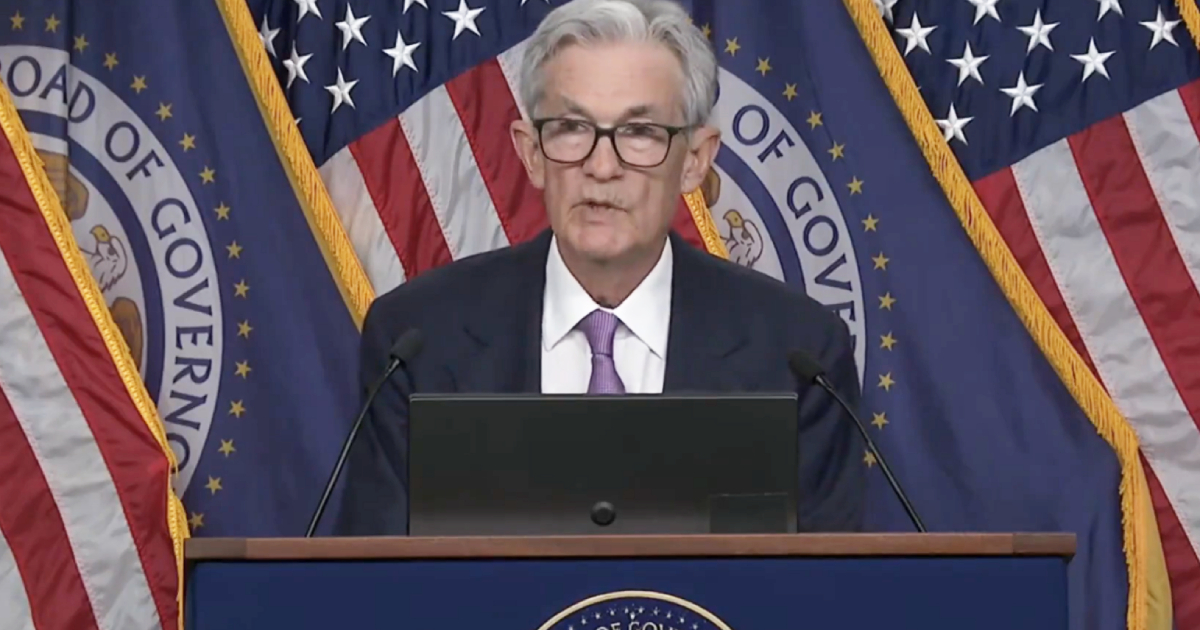

US job market weakening

“This decision reflects our growing confidence that with an appropriate recallibration of our policy stance, strength in the labour market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 per cent,” Fed chairman Jerome Powell said at a press conference following the meeting.

The pivot comes in the wake of fading inflation for months now, and it is meant to prevent the economy from slowing and the job market to weaken.

This latest big rate cut can be explained as the Fed taking out insurance against a bigger employment slowdown, given the recent uptick in the unemployment rate.

The U.S. economy so far has averted a recession, referred to as a "hard landing".

Hiring and wage growth, which remained robust during rate hikes, have slowed.

Lower interest rates are aimed at easing those trends by making it less expensive for businesses and households to borrow and spend more freely.

Low rates of the past aren't coming back

Fed policymakers have said that they do not see the policy rate returning to the sub-2 per cent levels that prevailed for more than a decade before 2022, Reuters reported.

That era's low mortgage rates, often under 4 per cent, are not coming back any time soon.

Fed has no preset course

Even though inflation “remains somewhat elevated”, the Fed’s latest statement said policymakers chose to cut the overnight rate “in light of the progress on inflation and the balance of risks”.

The worry has been that the more aggressive rate cut risks could ignite inflation again.

However, the central bank said it “would be prepared to adjust the stance of monetary policy" and Powell said the Fed is not on a "preset course".

Next big thing: US presidential election

The Fed’s policy meeting this week was its last before voters go to the polls for the U.S. presidential election on Nov. 5.

The central bank’s next two-day policy meeting begins a day after the U.S. election.

Top photo via The Recount X

MORE STORIES