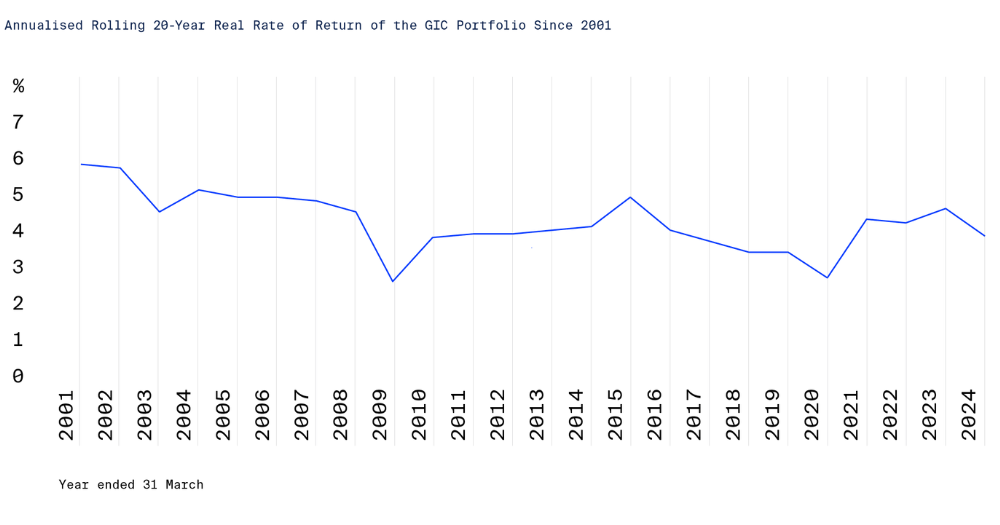

For the 20-year period ending Mar. 31, 2024, GIC's annualised real rate of return was 3.9 per cent, after taking into account global inflation.

This was a decrease of 0.7 percentage points from 2023's rate of 4.6 per cent, the sovereign wealth fund said in its annual report released on Jul. 24, 2024.

The annualised U.S. dollar nominal return was 5.8 per cent, meaning if US$1 million were invested with GIC in 2004, it would have grown to approximately US$3.1 million in 2024.

Photo via GIC

Photo via GIC

GIC's primary metric for evaluating its investment performance is the rolling 20-year real rate of return, which aligns with its mandate to preserve and enhance the reserves' international purchasing power to achieve good long-term returns over global inflation.

One of the reasons GIC cited for the drop in real return this year is that the financial year of 2003/2004 is no longer in the 20-year period used to calculate the rate.

That financial year saw the equity markets stage a strong recovery from the dot-com crash.

"That exceptional year contrasted starkly with the lower returns of recent years due to weak returns in fixed income and global equities, particularly in emerging markets," said GIC.

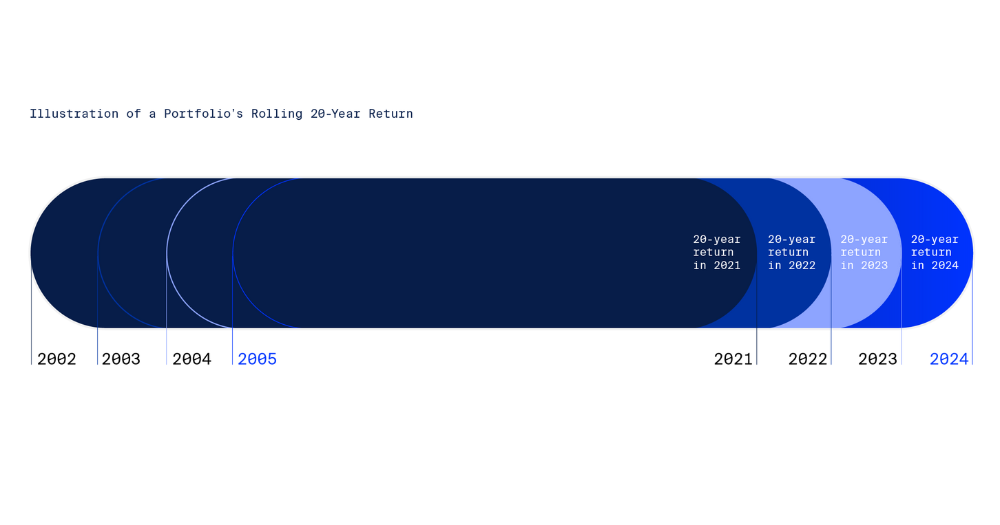

Here is a visual of how this average time-weighted portfolio return is calculated from year to year:

Photo via GIC

Photo via GIC

Investment outlook

The GIC report pointed out that the global investment environment remains challenging due to factors such as tight monetary policy settings in the U.S., macroeconomic challenges in China related to its property market, and continued heightened geopolitical tensions.

It also noted that medium-term return prospects remain low, and risk-reward is less favourable, given the elevated valuations across many risk assets.

"Investors are now in uncertain terrain and must rely on their purpose and unique strengths. In GIC's case, our purpose – to preserve and enhance Singapore's foreign reserves for the long term – means staying disciplined and diversified," said chief executive officer of GIC Lim Chow Kiat.

Lim talked about "profound uncertainty" which would "continue to weigh on returns", and said GIC would have to "play to [its] strengths and seize new opportunities".

GIC's actions in challenging times

In its report, GIC explained the challenges posed by growing geopolitical risks, higher inflation and interest rates, and slower growth in emerging economies, and said these factors would likely result in weakened returns in the coming years.

GIC explained that geopolitical uncertainty fuels "rising economic nationalism", as nations are working to control their own resources and markets, going against the post-Cold War trend of economic integration.

Covid-19 also pushed businesses and countries to seek to increase supply chain resiliency, GIC said, and pointed out that this would "inevitably increase costs", leading to higher inflation.

Other factors contributing to inflation include greater investment in the transition to a net-zero economy, and wage pressures as populations age.

GIC's report said many emerging economies would be impacted by deglobalisation and resource competition, though it pointed to others being "well-positioned for strong growth". This diverging outlook across emerging economies will require a fire-grained approach to investing across markets, GIC said.

GIC said it would tap on its advantages — including its long investment horizon, commitment to partnerships, diversified portfolio, and active investing capabilities — to deliver on its mandate.

GIC added:

"With the investment environment becoming more challenging, we must remain guided by our core investing principles of playing to our strengths as a global, long-term investor. By unearthing more granular opportunities with good risk-reward, continuing to emphasise collaboration and using more technology, we strive to continue to generate good real returns to safeguard Singapore's financial future."

Generative AI

In 2023, GIC pointed to generative Artificial Intelligence (AI) as something that could disrupt the global economy, and said it could also transform how GIC does its work.

This year, GIC said in its report that it has established an "AI Council" to explore the use of AI in its investment decision-making process, and to enhance operational efficiency.

GIC said generative AI could help detect anomalies in data and automate analysis of "large and diverse" data sets, but pointed to the need for safeguards when it came to proprietary or sensitive data, such as using an AI engine that is not connected to the internet.

As for investment opportunities, a GIC spokesperson pointed to GIC's recent involvement in leading a Series C funding round for AI startup Atlan in May 2024, as well as its participation in a funding round for data and AI company Databricks in September 2023.

GIC had previously noted in July 2023 that AI had potential to transform industries and businesses, but said then that it would exercise discretion as it might be too early to "identify the winners" in the industry.

Top photo via GIC

MORE STORIES