Man, 25, loses entire life savings in a job scam. 4 years on, he’s still reeling from the impact.

He initially thought he could outsmart scammers.

As a tech-savvy youth, Patrick (not his real name) thought he was sharp enough to avoid scams.

It was one of the first few things Patrick wanted me to know as he shared with me his personal experience.

Patrick has seen anti-scam advisories before. He had also seen news of people getting scammed and losing their hard-earned savings.

That was why he never thought he would become a scam victim at the age of 21.

“There was a real person behind this.”

There was a hint of lingering pain as Patrick recounted the incident to me.

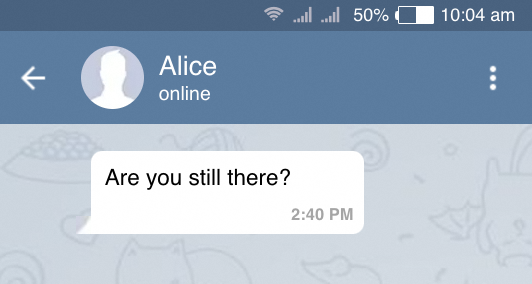

It all started with a Telegram message he received on a random afternoon.

Image for re-enactment purposes.

Image for re-enactment purposes.

“I’ve seen a lot of stuff like this before when an unknown number texts you. Confirm scam, right?”

So like other well-informed citizens, Patrick ignored the text and went about his day.

Patrick would have forgotten about the text if the same person hadn’t texted him again a few days later.

Image for reenactment purposes.

Image for reenactment purposes.

The follow-up text was what prompted Patrick to reply.

“That’s what intrigued me. [I realised] there was a real person behind this,” he told me.

“Okay, then let’s talk to the scammer, find [out] what’s going on.”

“I felt I was smart enough to block [any scam].”

It was curiosity that prompted Patrick to start a conversation with the scammer.

The Telegram user, Alice (not their real name), didn’t try to engage Patrick in small talk— she went straight to the point and started introducing him to a “money-earning programme”.

“They say it’s like an incentive programme. All you need to do is just press a button, and call it a day.”

Intrigued, Patrick wanted to find out more about how the whole operation worked and where the money was coming from.

“I felt I was smart enough to block [any scam]. I can stop whenever.”

As the conversation continued, Patrick was eventually added to a WhatsApp group with around 16 people inside.

These people were already engaging in a conversation— appreciative texts for the programme, congratulating each other for gaining profits from the programme, and screenshots of them withdrawing money from the programme, among other things.

“I still don’t believe it,” Patrick told me. “I even Googled the company to check if they’re a legitimate company.”

Patrick said he did find a website for the company. It was decorated with stock images and generic phrases, but there was enough to convince him there was indeed an organisation operating the programme.

A ‘simple’ programme

Less doubtful, Patrick was then given a link to a website where he had to sign up for an account by filling in his personal information, such as his name and personal email.

He didn’t have to link his bank account to the website.

The programme operates simply:

A user would have to top-up their account by transferring cash to a PayNow number provided by the website.

Once transferred, the amount would show up in their account, which would be used to participate in the programme.

On the programme website was a wheel spinner filled with movie titles that were showing in the cinema at that time.

A user would need to spin the wheel, which would land on a movie title.

After this, a pop-up will appear to prompt a user to buy multiple movie tickets he or she wanted for that movie.

The money used to purchase these tickets would be deducted from the money inside their account.

A user will earn a commission from buying these tickets. Patrick forgot the exact margin of profit, but he remembered it was a substantial amount enough to entice him who “needed [money] at that time”.

Made 150 per cent profit

Trying to stay on the err of caution, Patrick deposited S$10 to the account on the website.

He proceeded to purchase his first movie tickets and managed to increase the cash on his account to S$25— meaning, he made a 150 per cent profit.

Still testing the waters, Patrick was able to withdraw the amount back to his bank account.

That was when Patrick felt that the programme might be legitimate.

One could only withdraw their cash every 20 rounds, but having experienced his first taste of profit, Patrick thought he had nothing to lose and everything to gain.

“I was desperate,” Patrick told me.

At the time of the incident, Patrick was serving the National Service and had “money struggles”.

“I didn’t know what future I [would] have,” he said. “So I was like, scared. I was panicking.”

“If this works out, that’s okay. What’s the worst that can happen?” He asked.

“I mean, [I] could withdraw [the money]. There was money back. It was kind of safe.”

Far too deep to abandon everything

So Patrick deposited S$100 into his account.

Patrick went on several rounds in the same rhythm— using the money on his account to purchase movie tickets, topping up cash to his account by sending money to a PayNow number— which interestingly, Patrick said, was a different number every round.

The amount he needed to spend to purchase movie tickets increased every round, forcing him to transfer more money to his account to keep playing the game.

However, Patrick didn’t question the illogicality of the mechanism. He continued topping up his account until eventually, his savings ran out.

But at round 14, Patrick was far too deep to abandon everything.

To get to round 20, Patrick ended up borrowing money from his friends— about S$4,000 in total, until he finally reached the 18th round.

But the amount for the next two rounds jolted him out from the never-ending cycle of the programme.

“The next round was S$9,000, and the last round was S$10,000. I can’t afford that. I really can’t afford that.”

“At this point, I lost about S$7,000. That’s a lot [of money] for an NS boy.”

When I asked Patrick how he felt at that point of time, he told me he “didn’t want to believe it was a scam.”

“I just wanted to believe I lost some money, that’s all.”

But a few days later, the WhatsApp group Patrick was added to was deleted and he realised he couldn’t find the website where he had deposited his money.

That’s when reality hits that he had been scammed.

“I feel worse than hopeless,” he revealed. “But there was no one else to blame but myself.”

Just wanted “to find solutions, whatever I can”

Patrick immediately reported the incident to the police.

The police tried to help Patrick as much as they could. They tried to find more information about the incident and retrieved receipts from Patrick for the monetary transactions.

“I told them I didn’t expect my money back,” Patrick said.

He had read enough articles and tales to know that the chances of retrieving the stolen money was like finding a needle in a haystack.

But in the midst of uncertainties, Patrick just wanted “to find solutions, whatever I can.”

And reporting the scam, Patrick told me, made him feel better as he “had done all he could”.

Lingering impact

The entire incident from replying to Alice's text to losing his money on the website took less than eight hours.

But the impact of the incident continued to affect his life for the next three to four years.

He had to return the money he owed his friends— in instalments— for over three years. He skipped lunch and ate rice with egg tofu for most meals.

He didn’t tell his friends what happened as he was "embarrassed" for falling victim to a scam.

Patrick shared it was only last year that everything began to stabilise.

But even then, it wasn’t without any lingering scars— Patrick said his heart still skipped a beat when he received a text or a call from a random number.

But he no longer entertains these texts or calls. Instead, he reports and blocks these numbers.

“Don’t entertain them”

Now at 25 years old, looking back at the past was still difficult for Patrick.

“That’s the hard part. You grew up with the internet, and somehow you still get scammed over the most ridiculous thing ever.”

With an increasing number of anti-scam campaigns, Patrick is optimistic that the public will be able to guard themselves against scams.

Nevertheless, he acknowledges that scammers are getting smarter, and scams are getting more and more intricate.

Remember to stay vigilant

Staying vigilant is the best way to avoid falling victim to scams.

Real jobs will never require you to fork out money to do the work, use your personal bank accounts to transfer money, or provide your Singpass credentials.

Being a digital native and having confidence in spotting scams is not enough, as we may have our blind sides and scams are ever-evolving.

Remember to ACT (Add, Check, Tell) – take protective measures to shore up our defence against scams.

1. ADD the ScamShield app

Add the ScamShield App to protect yourself from scam calls and SMSes. You should also enhance privacy settings to your messaging apps to avoid being added into unknown chatgroups and enable Two-Factor Authentication (2FA) and multifactor Authentication for banks and e-wallets.

2. CHECK for any scam signs

Check the authenticity of job offers directly with the company and with someone you trust about the offer. When in doubt, call and check with the 24/7 ScamShield Helpline at 1799.

TELL authorities, family and friends about scams

Call your bank and make a police report if you suspect you have been scammed.

Report and block suspected scam accounts/chat groups. In addition, warn friends and families about this scam encounter.

Just as Patrick said, “Don’t respond. Don’t entertain them. Just straight up block and report them.”

This branded content was brought to you by the Singapore Police Force.

Top image via Canva

MORE STORIES