Are we done with the goodies from Budget 2024 announcement? Not yet.

A detailed checklist on the goodies from Budget 2024.

Are you one of those who like to make new year resolutions?

Perhaps, refreshing your memory on some of the recent government initiatives and keeping a tab on the benefits that you are eligible for is a good place to start.

The 2024’s Budget announcement includes not just payouts and rebates to cope with costs of living but also incentives and initiatives to help Singaporeans pick up new skills, and plan for retirement.

It’s a lot to remember, and not all goodies have been distributed yet.

Here’s a recap, so that you can plan ahead better.

This is for everyone.

2024 hasn’t been an easy year, we know.

Thankfully, it was announced at the Budget 2024 that Community Development Council (CDC) vouchers, Cost-of-Living Special Payment, and numerous rebates would be distributed to help ease financial pressures faced by Singaporean households and individuals.

- Community Development Council (CDC) vouchers

From April 2024 to March 2025, all Singaporean households would have received a total of S$600 CDC vouchers. You’ve probably already claimed the first S$300 in June 2024, as well as the remaining S$300 which was disbursed this month.

These vouchers will not only help with daily household expenses, but also allow Singaporeans to support participating heartland merchants and hawkers when spent at their shops.

- Cost-of-Living Special Payment

Singaporean citizens aged 21 and above got a nice little boost to their wallets as they were given a one-off Cost-of-Living Special Payment between S$200 and S$400 in cash in September 2024.

Plus, another S$200 to S$600 in cash was given to about 2.9 million Singaporeans aged 21 and above in 2025 in December 2024.

- U-Save

Measures were also taken to help Singaporeans living in HDB flats.

Up to S$950 of U-Save was disbursed to eligible Housing and Development Board (HDB) households to help offset their utilities expenses in April, July, October 2024, as well as January 2025.

The amount received varies depending on the HDB flat type, and the amount received can be found here.

- S&CC rebates

Up to four months of Service and Conservancy Charges (S&CC) rebate was also given out in April, July, October 2024, as well as January 2025, to offset monthly estate maintenance bills for eligible HDB households.

So yes, keep a look out for the U-Save and S&CC rebates this month!

- Personal Income Tax (PIT) Rebate

A Personal Income Tax (PIT) Rebate of 50 per cent of tax payable was granted to all tax resident individuals for the Year of Assessment 2024, helping each taxpayer to save up to S$200.

Thank you, national servicemen.

A special thank you was also given to the national servicemen who safeguard our nation.

Past and present national servicemen, including those who have enlisted by Dec. 31, 2024, would have received S$200 in LifeSG credits in November 2024.

Don’t stop learning, guys.

Looking to upgrade your skills, pursue new qualifications, or get more support to stay competitive in the workforce? Read on.

- SkillsFuture Level-Up Programme

Singaporeans, aged 40 and above, would have received a SkillsFuture Credit (Mid-Career) top-up of S$4,000 from May 2024. Time to pick up new skills or dive deeper into your current field?

For those thinking of pursuing further education—look no further. Starting from Academic Year 2025, you’ll receive a government subsidy to pursue another full-time diploma at polytechnics, ITE, or arts institutions.

Those diving into selected full-time courses can also get a monthly training allowance of up to S$3,000 to keep things rolling.

- ITE Progression Award (IPA)

For those aged 30 and below who graduated from ITE and are thinking about enrolling in a diploma programme, there’s a new ITE Progression Award just for you.

The award is eligible to all Singaporeans who pursue a diploma qualification issued by a MOE-funded institution from 2024.

If you fulfil the above criteria, you’re eligible for a S$5,000 top-up to your Post-Secondary Education Account (PSEA).

Even better: you’ll also get a S$10,000 top-up to your CPF Ordinary Accounts (CPF-OA) upon finishing your diploma.

The IPA will automatically be credited to your PSEA or CPF-OA upon meeting the respective milestones.

Salarymen, we got your back.

Working is tough. Worrying about not getting a job or losing a job is worse.

But help is available to tide you through this tough period and hopefully 2025 will be sweeter for you with these measures.

- SkillsFuture Jobseeker Support scheme

Under the SkillsFuture Jobseeker Support scheme, lower- and middle-income Singaporeans, aged 21 and above, who are involuntarily unemployed and actively looking for a job, will get up to S$6,000 over six months.

It will apply to Singapore Citizens from April 2025 and Permanent Residents (PRs) from Q1 2026.

- Local Qualifying Salary

Schemes have also been put into place to support lower-wage workers.

For instance, the Local Qualifying Salary—which is the minimum salary firms hiring foreign workers will have to pay their full-time local workers—increased from S$1,400 to S$1,600 per month in July 2024.

- Workfare Income Supplement (WIS) scheme

From January 2025, the Workfare Income Supplement (WIS) scheme payouts will also increase to a maximum of S$4,900 per year, and raise the qualifying income cap to S$3,000.

For eligible employees, the WIS gives you CPF payments to help you save for retirement, as well as cash payments to supplement your income.

- Progressive Wage Credit Scheme (PWCS)

Plus, the Progressive Wage Credit Scheme (PWCS) gets a boost.

The scheme aims to support employers in uplifting resident lower-wage employees, by co-funding the wage increases of lower-wage workers. This is done by having the government match a percentage of the wage increase — the higher the increase, the more the government will co-fund.

In 2024, the government has enhanced PWCS co-funding support to a maximum of 50 per cent. This means the government will be matching half of the wage increase.

The gross monthly wage ceiling for PWCS co-funding will also increase from S$2,500 to S$3,000 in 2025 and 2026—meaning more workers will be eligible and benefit from the scheme.

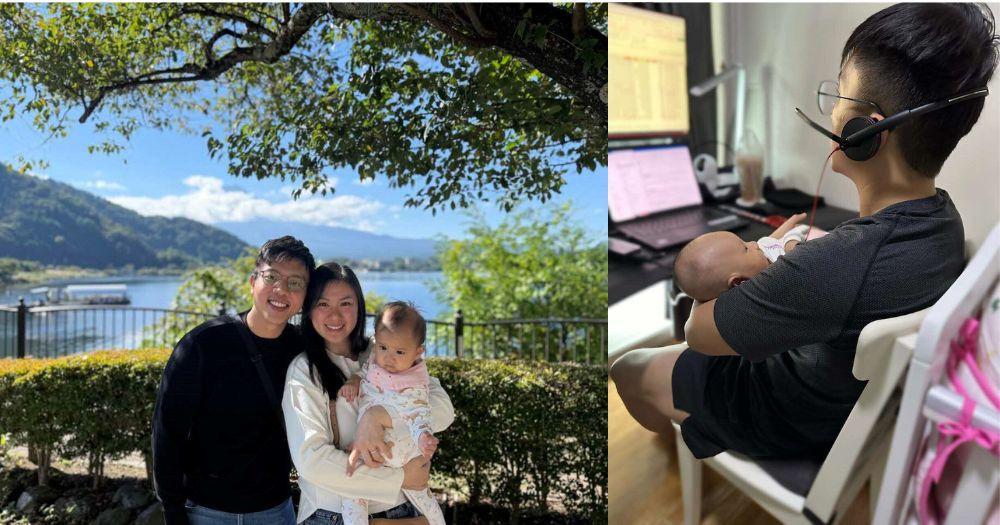

Parents, this is for you.

From affordable housing to enhanced support for education and employment, here’s some support for families at every stage of their journey.

- Parenthood Provisional Housing Scheme (Open Market) Voucher

Here’s a voucher for the families on the move: the Parenthood Provisional Housing Scheme (Open Market) Voucher is a one-year voucher that supports eligible families who rent an HDB flat or bedroom in the open market.

The temporary housing option HDB provides for families waiting for their new flats to be completed is effective for one year from July 2024.

Families who qualify will be reimbursed S$300 per month for each full month of tenancy, starting from Jul. 1, 2024 to Jun. 30, 2025.

- ComLink+ Progress Packages

Lower-income families with young children are also better supported with the ComLink+ Progress Packages.

Through such packages, lower-income families with young children were supported in areas such as preschool education, employment, and financial stability.

For instance, eligible adults from lower-income families will receive financial top-ups ranging from S$450 to S$550 per quarter, through a combination of cash and CPF payouts.

- Raised annual income threshold for all dependant-related tax reliefs

Not forgetting to mention, the annual income threshold for dependant-related Personal Income Tax reliefs will also be raised from S$4,000 to S$8,000 from the Year of Assessment 2025.

- Childcare and Special Needs

Young parents to note: monthly full-day childcare fee caps will be lowered to S$640 for anchor operators and S$680 for partner operators in 2025.

In short, childcare centres will not be able to charge fees exceeding these caps, and when coupled with means-tested subsidies, eligible families will enjoy savings for their children's overall childcare expenses.

From mid-2025, the maximum monthly fees at Special Education schools will be reduced to S$90.

All these add up to some relief to the financial stress that parents may feel.

Worried about retirement or your parents’ retirement? Read on.

Seniors in Singapore, rest assured that you are taken care of too.

- Age Well SG

In the 2024 Budget announcement, S$3.5 billion was committed to Age Well SG – a national programme to support active aging.

Under Age Well SG, seniors can look forward to more Active Ageing Centres and senior-friendly home fittings and commuter infrastructure in the future making it easier for seniors to get around or live independently.

- Silver Support Scheme

Seniors, aged 65 and above, with low incomes during their working years and now have less in retirement, can benefit from the quarterly cash supplements under the Silver Support Scheme.

Quarterly payments from the scheme were increased by 20 per cent, and the qualifying per capita household income threshold was raised to S$2,300 to keep pace with inflation.

The amount received depends on the applicant’s monthly household income per person and the type of HDB flat they live in. More information can be found here.

- Matched Retirement Savings Scheme

In addition to the Silver Support Scheme, the Matched Retirement Savings Scheme (MRSS) can help seniors with lower retirement savings by matching the cash top-ups they make to their CPF Retirement Accounts (RA).

From Jan. 1, 2025 onwards, the scheme has been expanded to cover Singaporeans aged 55 and above. The annual matching cap has also been increased to S$2,000, with a lifetime matching cap of S$20,000.

- CPF Enhanced Retirement Sum

Basic Retirement Sum (BRS) and Full Retirement Sum (FRS) are meant to provide one with monthly payouts to cover basic living needs in Singapore in retirement.

That said, some seniors may wish to contribute more to their CPF Retirement Account (RA) to accrue interest and enjoy higher payouts later on in life.

Enter the Enhanced Retirement Sum (ERS).

The ERS will be raised from three to four times of the BRS on Jan. 1, 2025. This means seniors aged 55 and above can top up more to their RA to receive higher monthly payouts at 65.

- Property Tax Help

For eligible retirees aged 65 and above, the government has extended the interest-free GIRO instalment plan for residential Property Tax bills to 24 months. You can check if you are eligible for the scheme here.

Majulah Package

For Singaporeans born in 1973 or earlier, the Majulah Package is here to provide an additional boost for retirement.

- Earn and Save Bonus

Those born in 1973 or earlier will be getting a little boost to their CPF pockets.

Eligible Singaporeans who work and earn up to S$6,000 per month will get a S$400 to S$1,000 annual bonus to their CPF Retirement or Special Account starting from March 2025.

- Retirement Savings Bonus

Not quite at the 2023 BRS of S$99,400? You don’t have to stress about that.

You would have received a S$1,000 or S$1,500 one-off bonus to your CPF Retirement or Special Account in December 2024, if you are eligible.

- MediSave Bonus

All Singaporeans born in 1973 or earlier would have also received a S$1,250 or S$2,000 one-off bonus to his/her CPF MediSave Account in December 2024.

The MediSave Bonus, which aims to supplement the medical savings of seniors, will vary depending on your age, the annual value of your residence, and the number of properties you own.

Younger seniors and younger, younger seniors? Read this.

Just missed out on the Majulah Package by a few years? You’re still in for something.

All Singaporeans born from 1974 to 2003 would also have received a one-time MediSave Bonus of up to S$500 to their CPF MediSave Account in December 2024.

The Singapore government also raised the monthly per capita household income thresholds for healthcare and social support subsidies from Oct. 1, 2024, with increases ranging from S$100 to S$800.

This means more people are now able to enjoy higher subsidies on healthcare.

How many more? Up to 1.1 million Singapore residents are expected to benefit from this revision.

Businesses

The government has set aside S$1.3 billion for the Enterprise Support Package to help businesses thrive and grow.

An enhanced Enterprise Financing Scheme gives you more opportunities to access financing support at each stage of your business growth.

More about the eligibility and types of loans under the scheme can be found here.

The SkillsFuture Enterprise Credit has been extended until June 2025, meaning more time for employers to submit final claims for training courses or programmes they have completed. Eligible employers for the programme have already been informed, meaning more chances to invest in the capabilities of your employees through the one-off S$10,000 SkillsFuture Enterprise Credit (SFEC).

All companies also get a 50 per cent Corporate Income Tax Rebate, capped at S$40,000, in the year of assessment 2024, under the new Enterprise Support Package.

Companies that hire at least one local employee in 2023 will get a minimum benefit of S$2,000 in cash payouts.

Learn more at the Budget website

If you want to know more about the different support measures, more information can be found on the Budget website.

This sponsored article by MOF made this writer want to check everything she is eligible for.

Cover photo via Canva

MORE STORIES