I brought my fiancé & family out for a well-deserved break & it was rewarding

Because who doesn’t want to be brought out for a date?

My fiancé and I are in the thick of wedding preparations right now.

Don’t get me started on the details, but am glad that my fiancé and our families have been so considerate and accommodating about everything.

With so many to-dos, I thought it’ll be good for all of us to take a breather.

How? By going on “dates” planned by yours truly.

The family

First up, brunch at Refuel Cafe.

My family typically does not eat out unless it is for a special occasion.

Plus, my sister had moved out recently, so gathering the whole family was a rare but precious moment.

Photo by Alena Khoo

Photo by Alena Khoo

Food was good, and I spent a total of S$95 for the five of us.

Now, all the wedding planning has made me more aware of how I’m spending my money, but more importantly, to maximise my spendings.

As far as lunch goes, leaving the spot with our tummies feeling happy was good but earning UNI$ rewards that can later be used to redeem rewards by paying with my UOB Lady’s Credit Card made it even better.

While we’re on the topic of making things better, here’s how you can get more UNI$ for your spendings.

Accelerating rewards & maximising spends

The UOB Lady’s Credit Card allows you to earn 10X UNI$ per S$5 spent (equivalent to 4 miles per S$1) on up to two preferred rewards categories from a total of seven.

- Dining

- Travel

- Fashion

- Beauty & Wellness

- Family

- Transport

- Entertainment

If you own the UOB Lady’s Card, you can choose one preferred rewards category, while owning the Lady’s Solitaire Card allows you to choose two preferred rewards categories.

As for me, I selected “Dining” as my rewards category, so I unlocked the 10x multiplier under the bonus UNI$ rewards, bringing me to a total of 190 UNI$.

But hey, we’re not stopping at 190 UNI$.

The OTP

By OTP, I meant “one true pairing”, not “one-time password”. And no, I wasn’t just referring to my fiancé and I.

I was referring to the UOB Lady’s Credit Card and the UOB Lady’s Savings Account.

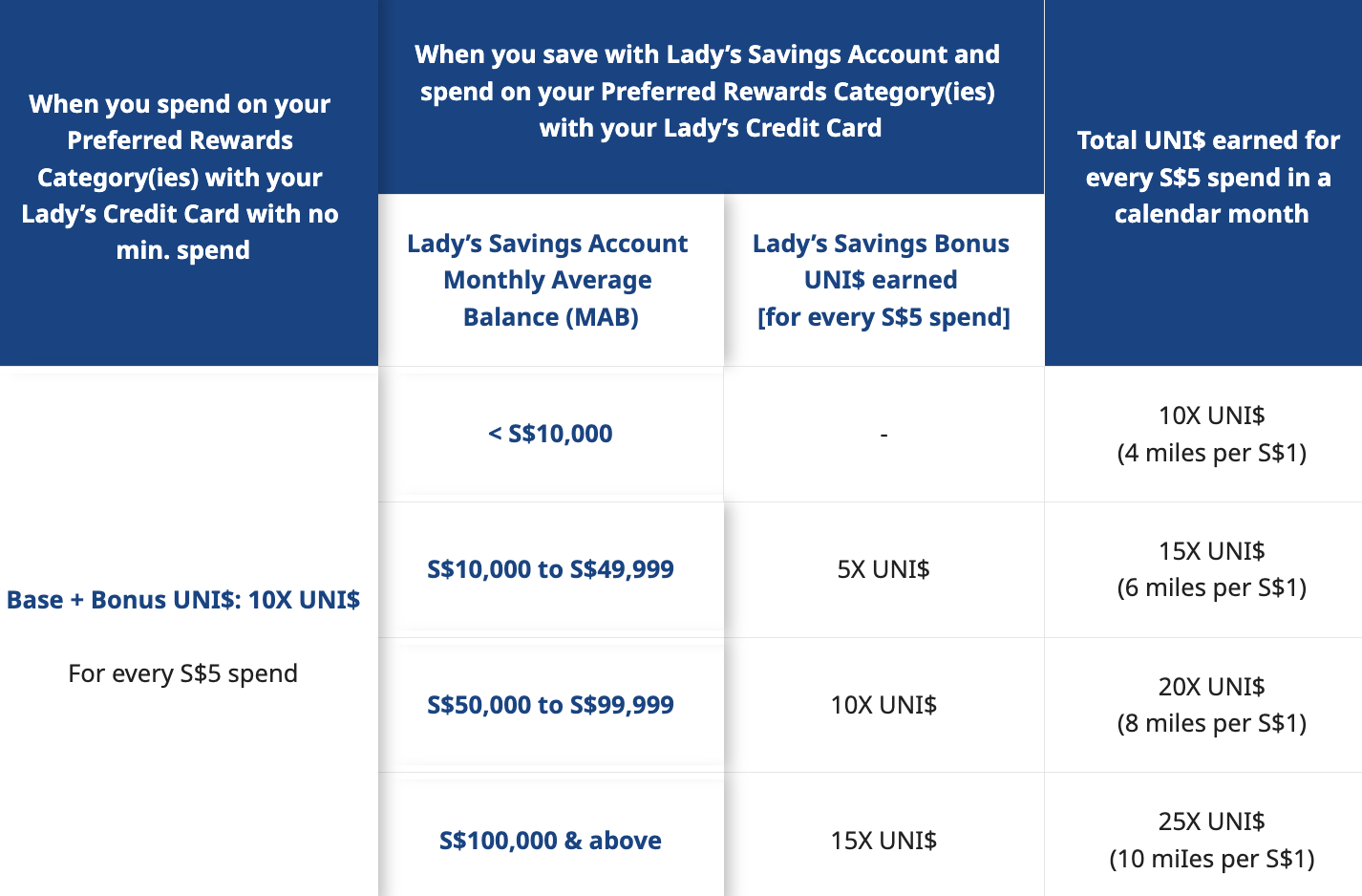

If you pair the two together, you get to stack up to another 15x UNI$ (equivalent to 6 miles per S$1), depending on your account’s monthly average balance (MAB).

Screenshot via UOB

Screenshot via UOB

In an ideal world where my bank account sees over S$100,000 as my MAB, my base reward would see the 25x multiplier (equivalent to 10 miles per S$1).

Realistically, my MAB falls within the S$10,000 to S$49,999 range.

That would mean my base reward of 19 UNI$ will be stacked with a 15x multiplier, bringing me to a total reward of 285 UNI$.

The breakdown of the multiplier?

- 10x UNI$ for spending under your preferred rewards category(ies)

- Additional 5x UNI$ for having S$10,000 – S$49,999 MAB in a UOB Lady’s Savings Account

And if you’re more of a miles-person, we’re looking at 570 miles for this meal alone.

Neat, here’s to clocking more miles for our honeymoon trip.

The fiancé

Back to the date that I’ve lined up for my family, it’s time for a cosy dinner with my fiancé amidst the wedding planning.

We headed to Watami Japanese Dining and ordered a main, along with some sides to share between the two of us.

Photo by Alena Khoo

Photo by Alena Khoo

Overall wallet damage? S$75

Bonus rewards (15x multiplier)? 225 UNI$ = 450 miles.

The fiancée

Obviously, I had to treat myself to some self-care too.

The thing about wedding prep is that you’re always running errands and trying to balance the 1 million to-dos on your plate.

The best break for me? Doing absolutely nothing.

Which is exactly what I got when I purchased a S$300 credit package from my beauty clinic.

The joy of leaving a place looking refreshed when all you did was simply to lie down is always amazing.

Now think along with me, if I hold a Lady’s Solitaire Card and selected an additional reward category, “Beauty & Wellness”, my low-effort break would also earn me a total of 900 UNI$ too, which equals 1,800 miles.

The reward

Being able to bring my loved ones out (myself included), amidst the wedding planning has been rewarding.

Having time to enjoy each other's presence reminded us that there’s more to life than having a bunch of to-dos.

The practical reward is being able to maximise returns while bringing my loved ones out for dates.

Just to entertain my calculations and potential rewards, my spending would earn me a total of 1,410 UNI$ which also meant 2,820 miles.

If I were to multiply this by 12, that would mean earning a total of 33,840 miles in a year.

I’ve obviously still got quite a bit to go but it’s still exciting to think about all the miles I can get.

The card

UOB Lady’s Credit Card is both versatile and flexible in its own rights.

Besides being able to pick up to two out of seven categories, you could also choose to change your preferred rewards categories on a quarterly basis.

If you're like me, and are going through different phases of your life, you could change your categories based on your needs.

If you are a beauty junkie and homebody, and your main expenditures are on facials and groceries, you could potentially pick “Family” and “Beauty & Wellness” to earn the 10x UNI$ rewards.

If you’re a parent who’s always on the lookout for fun activities or overseas vacation to bring your children to, you could pick “Entertainment” and “Travel” to maximise your rewards.

The card can essentially be anything you want it to be… let that sink in. You don’t need to hold multiple cards in your wallet!

The sign-up privileges

If you don’t have the UOB Lady’s Savings Account yet, here’s another piece of good news for you. From now till Mar. 31, 2025, you can get up to S$268 cash credit if you apply online*.

Apply for the UOB Lady’s Credit Card online here, or find out more here.

*T&Cs apply. Insured up to S$100k by SDIC.

This sponsored article by UOB got this writer all riled up about maximising her rewards so she can have enough miles to bring her parents overseas.

Cover photos from Alena Khoo.

MORE STORIES